Company Snapshot

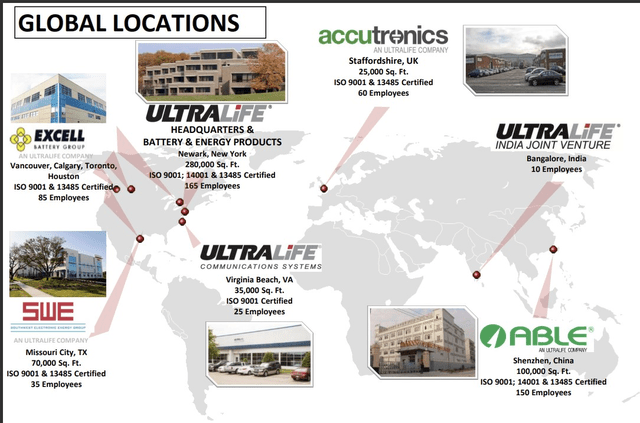

Ultralife Corporation (NASDAQ:ULBI) is a designer and manufacturer of portable power solutions, and communication and electronic systems, which are primarily used by the government, defense, and commercial industries. The company reports under two segments- a) Battery and Energy Products (85% of group revenue), and b) Communication Systems (15% of group revenue). Whilst ULBI exports its products across the globe, its main manufacturing centers are in North America, UK, and China.

Investor Presentation

ULBI- What’s To Like

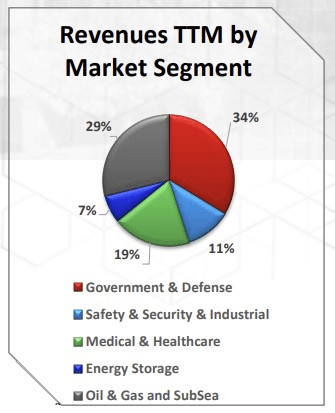

Firstly, we like that ULBI is exposed to quite a few markets whose fortunes are not closely linked to each other. This brings a useful degree of resilience to the business model to withstand various cyclical hues that may beset different industries at different points in time. The government and healthcare exposure helps bring some stability, whilst the other cyclical sectors such as industrial and oil and gas enable the company to prosper when there is general buoyancy in the economic environment.

Investor Presentation

Within the various market segments, note that government & defense contribute the largest chunk of business (over a third), and to qualify for consideration here takes some doing, given the stringent fulfillment requirements and the difficult environmental conditions that ULBI’s communication equipment (both standalone and integrated devices) are tested under.

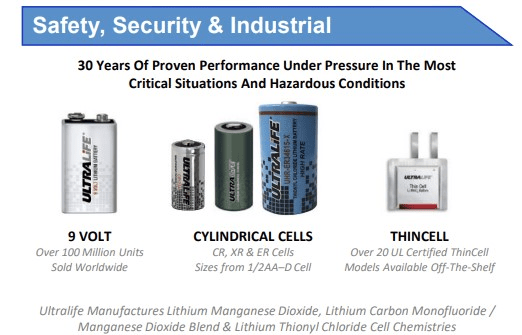

Then, when it comes to the industrial and safety markets, we think ULBI’s brand of Lithium batteries have an edge over other non-rechargeable battery tech alternatives. The well-noted advantages are typically in areas of higher energy density or operating duration (or even their lightweight nature). However, what’s also crucial to note is that quite unlike the alkaline-based competing battery tech that typically tends to have sloping voltage profiles, ULBI’s brand of non-rechargeable batteries have flat voltage profiles, which inherently make them more reliable.

Investor Presentation

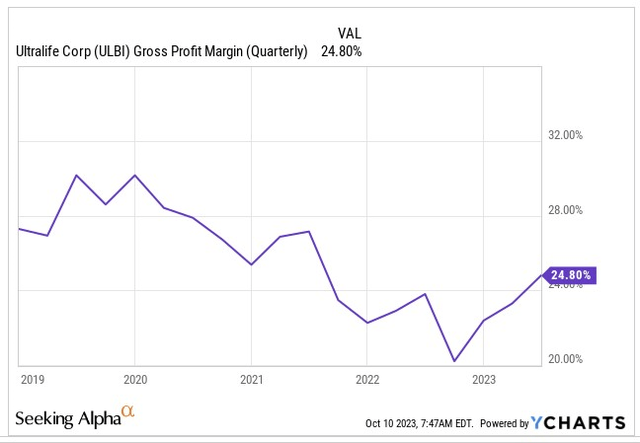

We’re also enthused to note some of the gross margin (GM) progress that ULBI management is looking to engender and it’s something that certainly has legs. Already we’ve seen some evidence of that recently (in Q2, the GMs rose by 100bps YoY and 150bps QOQ) with management stating that they expect to see “ improvement throughout this year and into 2024”.

YCharts

For further clarity, note that previously, ULBI was facing challenges on this front, as there was a lag between the frequency with which it faced input cost increases (typically on a weekly basis) and the alacrity with which it could pass this on to clients. Recently, they have made arrangements to tweak the frequency of price increases to keep it more in tandem with cost increases.

Separately, last year in order to meet the tight shipment schedules of their defense and medical contracts, ULBI was at the mercy of middlemen who levied high brokerage costs which ended up upending the cost base. Going forward, ULBI will now ask its customers to fund all or a large portion of these incremental costs as and when they take place.

Besides these developments, ULBI is also benefitting from a resilient order backlog which provides strong revenue visibility, which in turn enables the company to order parts well in advance, thus limiting the high expedition fees that were a dominant theme last year.

Financial Outlook And Valuation

Gauging ULBI’s valuation quotient is a bit tricky, as different metrics provide different perspectives. Nonetheless, here’s a summary of things.

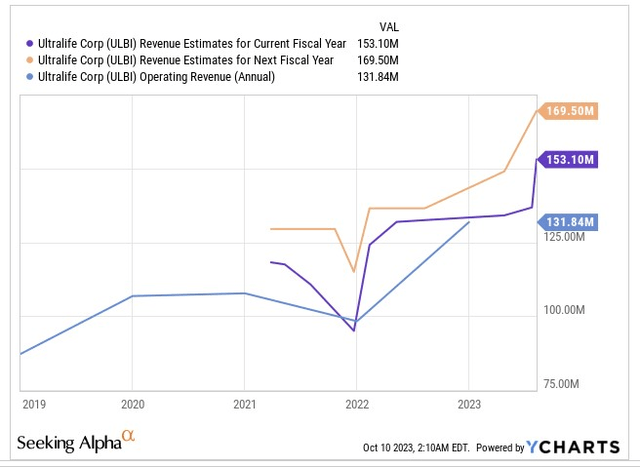

On the top line, note that whilst ULBI is currently growing at an impressive pace of 32% YoY, consensus estimates show that the revenue CAGR rate through FY25 will come in at a lower rate of 13%, implying a slower pace of growth in FY24. With 48% of group sales linked to non-dollar sales, it’s also worth noting that the appreciation of the dollar (currently at around 11-month highs) could make their products less price competitive in the foreign markets.

YCharts

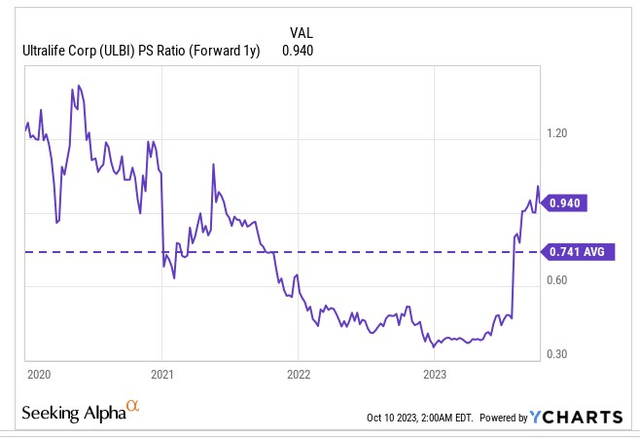

Meanwhile, the stock is now close to hitting 1x Price to sales, with the current multiple representing a 27% premium over the stock’s 5-year average multiple of 0.74x.

YCharts

Then, ULBI wasn’t able to generate any positive bottom line figures over the past two fiscals, but based on consensus estimates, it appears that this could change by the end of the year, with the company now poised to generate positive EPS of $0.45 (even though the Q1 EPS was still negative at -$0.02). EPS expansion will largely be driven by a step up in production and operating leverage, as the company looks set to fulfil at least 70% of its record backlog figure of $110.9m, before the end of the year.

Note that even next year, the EPS will expand again by an impressive rate of 50% ($0.68), resulting in a business priced at 14.5x forward P/E. Those numbers also imply that from a PEG (Price to earnings growth) angle, you’re getting pretty tremendous value at the current price, with an implied PEG ratio of just 0.28x

Closing Thoughts- Technical Considerations

If we switch our attention to the charts, we’re afraid the current risk reward does not look too enticing.

The image below provides some clarity on ULBI’s strength versus its peers from the broad industrial universe. Even as recently as June, one could’ve said that ULBI looked rather oversold and could benefit from some rotational interest, but now the ratio is hardly a breath away from the mid-point of its long-term range, dampening the long case.

Stockcharts

Then on ULBI’s long-term chart, it is evident that there’s a certain range in play.

Investing

Usually, when the stock drops to the $3-$4 levels, one witnesses a spike in buying and a pivot in the price action, and when it gets closer to the $11-$12 levels, we see additional supply come on board, preventing further upside. We’ve seen this happen twice before in 2019 and 2021, and it looks like this pattern may well play out yet again. Thus, we’d advise investors to wait on the sidelines and get in only after you see a pullback in the price action.

Read the full article here