Two days ago, comments from a chief executive for Medicare and Retirement Tim Noel set off the stock’s largest sell-off in UnitedHealth (NYSE:UNH) since 2020 when he mentioned that many Medicare patients are getting surgeries they had previously put off. Of course, this means that the medical loss ratio will likely be at or over the high-end or previous projections.

However, I think this recent stock sell-off is an opportunity, especially for dividend seekers, given that there is now more prospect for an upside in the stock price to complement the healthy dividend. I think this is a prime opportunity to add to the stock if you have it in a dividend portfolio or if you need a new healthcare dividend aristocrat as the odds of recession rise.

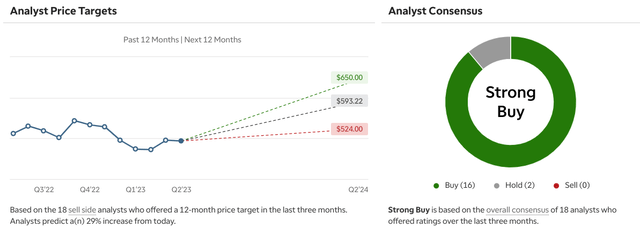

But given that the current price is even far below the lower end of price target ranges and the likely pullback in high-beta areas coming up, I think there’s more margin of safety in the stock for those with a long-time horizon than is normally available.

TD Ameritrade/Tipranks

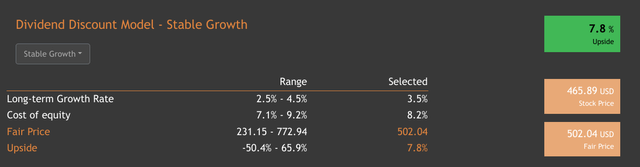

UnitedHealth is a really great stock to have in your portfolio. I’ve noticed that because of its competitive advantage in a highly regulated industry with very high barriers to entry, it is usually overvalued. The massive run-up in growth has kept investors focused elsewhere over the past few months, and I think scooping up some of the stock at these levels would be wise. I’m relieved that there is finally a good entry point, and the stock looks undervalued.

valueinvestor.io

Of course, this may not be the most exciting stock to some. In some ways, it is the exact opposite of an exciting stock. It is the largest health insurance player in the market and is a sprawling empire that is, in many ways, emblematic of the dysfunctional industry in which it is dominant.

However, the bad sides of healthcare are also a massive opportunity for shareholders who have the time to let progress play out. The status quo in the health industry looks like it will remain largely in place, as the Republican Party has given up trying to replace Obamacare.

Still, there are also emerging opportunities for profitability above consensus expectations in healthcare, particularly the data-intensive insurance segment, that artificial intelligence may unlock.

Aite Group

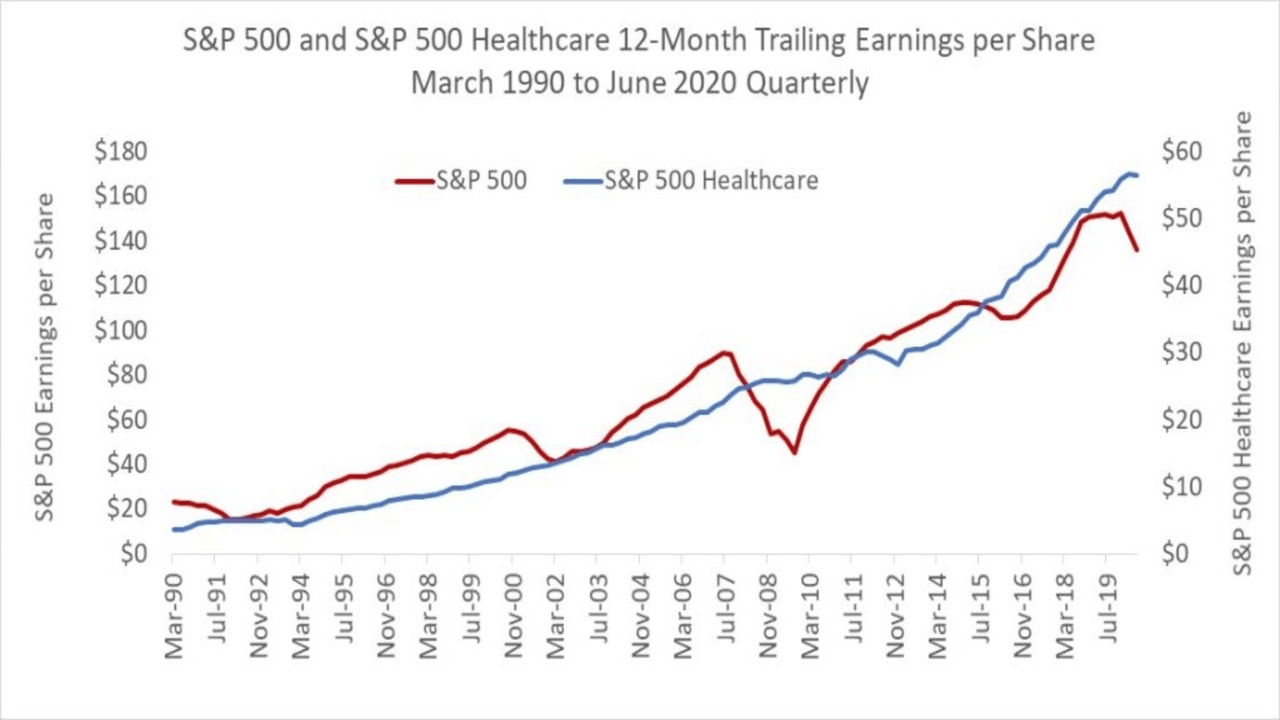

Healthcare is, of course, a naturally countercyclical industry, given that spending is largely driven by factors exogenous to the economic cycle. So, as the odds of a recession are increasing, I think there’s a very solid case for adding some UnitedHealth to the portfolio. I also think there are some long-term positive catalysts that will reward patient investors.

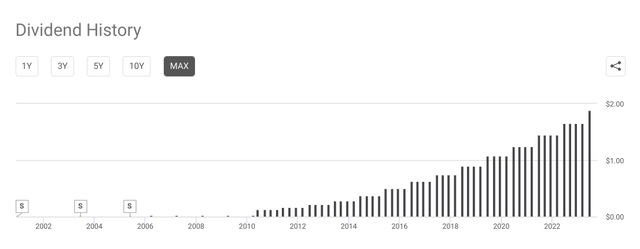

UnitedHealth Dividend Remains Safe

Dividend investors are, by their nature, long-term investors. The price tends to move in a way that discourages stock renters from benefitting from dividends. You have to own it for the long term to get the benefits of compounding. But yield isn’t everything, as tempting as it may be to use a screen and concentrate only on the highest-yielding stocks.

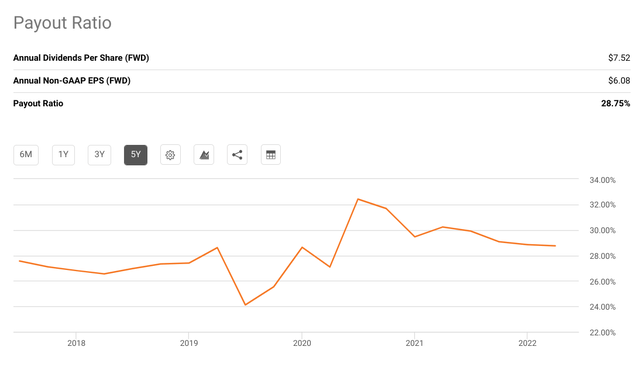

The highest yields are also often the least certain. With industry-leading dividend growth and a comfortable payout ratio, I’m highly confident that this is a great opportunity for dividend hounds to let UnitedHealth start compounding. The technological effects of AI are likely to make the dividend safer, since creative destruction that displaces incumbents is highly unlikely in the US Healthcare sector. So the technology will likely benefit incumbents like UNH.

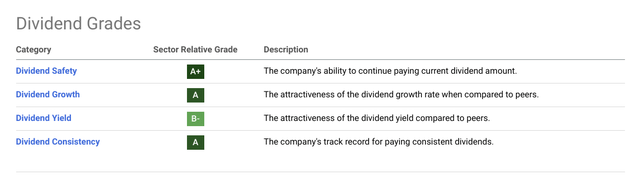

Seeking Alpha

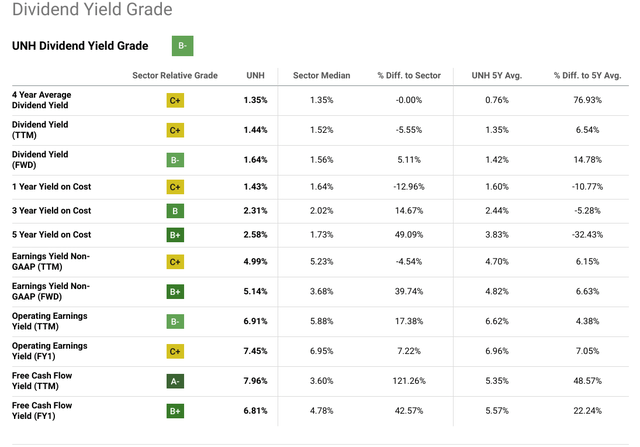

You have to understand a business just as much to understand the safety of its dividend as its earnings potential. Just like that old adage that analysts got As but CEOs got Cs and B minuses, I think the dividend grade of UnitedHealth is actually a badge of honor. It shows the company has room to grow, and that the payout ratio is supported by current conditions.

Seeking Alpha

Healthcare is one service that virtually everyone must consume, and the incentives are very perverse and divorced from the interests of the consumer. It’s the commercial entity you have to interact with while your loved ones are dying. The Health Care sector can be frustrating, hard to understand, and infuriating from a personal perspective.

Invesco

Luckily, from a shareholder’s perspective, it’s pretty solid and has no drama. The heavy regulation and the government being the primary consumer means that returns are very steady and countercyclical, as you can see above.

Political risk is still present, particularly in today’s climate, but I also think it’s less than many might think. The status quo is unlikely to change, which largely is to the benefit of this stock, the industry’s largest and very entrenched incumbent. Compared to more functional times in recent history, the risk of legislation that is a major cost for the industry seems diminished.

Seeking Alpha

I like to think you can take some of the sting out of being a healthcare consumer by buying a quality healthcare company that will compound for you over time, like UnitedHealth. When you’re on the phone contesting charges, you can remember that at least you have a commercial stake in the ungainly Leviathan that vexes you.

Seeking Alpha

As you can see, the only subpar grade for UnitedHealth on dividends is the yield itself. But I would say this typical shortcoming can be mitigated by entering the stock at an attractive level, like the current price. I think right now, when everyone is feverish about growth, is the perfect time to add to this time-tested dividend grower and likely future aristocrat.

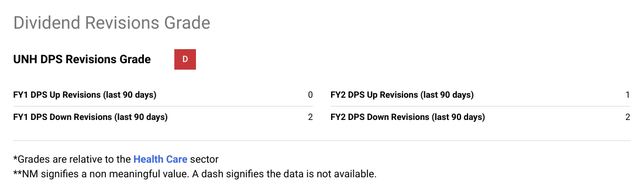

Risks and Where I Could Be Wrong

Look, there are a number of risks that could potentially interrupt the dividend payment from UnitedHealth, but most of them are so severe that you’d likely be worried about things other than stocks. The costs shouldn’t be overlooked in the short-term and could result in more price weakness around earnings, but again, for dividend investors, this price weakness can be seen as a gift.

It is highly unlikely that any spike in costs will be large enough to interrupt the dividend or compromise share price gains more than in the short term. Still, the company’s earnings have been revised down only slightly, and if costs prove worse than currently anticipated, there could be a nasty earnings surprise and price drop again.

Seeking Alpha

Remember in March 2020 when the future of human civilization was being questioned in the face of an unprecedented pandemic? I don’t think you were worried about your UnitedHealth Dividend, but if you were, you’d have been pleasantly surprised since they kept paying it through that incredible event.

But one of the main assets of the company, the fact that strict regulation helps insulate it from major competition, can also be a death knell if the system stresses the consumers it depends on too much. If healthy folks drop out of the health system or if adverse selection occurs, it can always dramatically dampen the prospects of insurers if either or both occur in sufficient volumes.

Conclusion

I had a really colorful teacher who always stuck out because of his rhetorical dexterity. He was, after all, a healthcare lobbyist. He said his mother had been proud of him back when he played piano in a whorehouse, but had disowned him when he’d descended into the bowels of the American political machine by becoming a healthcare lobbyist. He also told me something I have always remembered since.

You have to think about the healthcare industry in a different way, he told us. He said if you tried to design a commercial system with the intent of making it as convoluted as possible, with the most perverse incentives possible, you probably couldn’t beat the good old US Healthcare System in those lamentable attributes.

So UnitedHealth is inefficient in many ways, and it can also infuriate customers by being disconnected from accountability. The system we have is strange and inefficient, but it favors incumbents like UnitedHealth. Technological developments and a lack of potential for a major transformational change in healthcare legislation make me believe fortune favors the upside over the long term for UNH and the sector it dominates, both in terms of share price and dividend growth and safety.

Read the full article here