Universal Corporation (NYSE:UVV) supplies leaf tobacco to companies that manufacture and sell tobacco products, as well as other products and services in the agricultural industry. The company has had a very good amount of growth in recent quarters compared to a long-term growth near zero, but as margins have fell from historical levels, the company’s earnings have continued to stay quite stable. With a valuation that fairly reflects the low-ESG industry, I have a hold-rating for the stock.

The Company

Universal Corporation operates in three segments – Universal Leaf, Universal Ingredients, and Universal Enterprises. The main segment, Universal Leaf, purchases, and processes tobacco leaves from farmers globally, along with helping the tobacco farmers with support, research, and financing. Essentially, the company works as a middleman between tobacco farmers and tobacco product manufacturers. Quite similarly, Universal Ingredients purchases and processes vegetable and fruit ingredients, being a support throughout the supply chain.

Universal Enterprises, the company’s third segment, provides the agricultural industry with multiple products and services, such as liquid nicotine, and software that tracks crops:

Universal Enterprises’ Offering (www.universalcorp.com/UniversalEnterprises)

In ten years, the company’s stock price has decreased by 8%:

10-Year Stock Chart (Seeking Alpha)

This doesn’t correspond to a negative return for the period, though – Universal Corporation has a high dividend yield of 6.70%, with a slow long-term dividend growth.

Financials

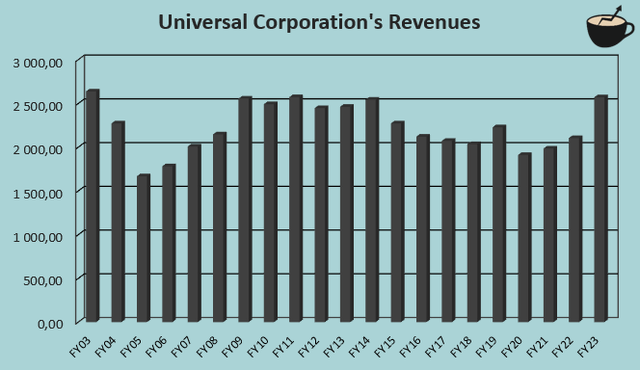

In the company’s long-term, Universal has had stable revenues – the company’s revenues for FY2023 are around the same as for FY2003:

Author’s Calculation Using TIKR Data

The company has had quite minimal acquisitions in the past, with a divestiture in FY07 that exceeds the combined acquisitions in size. The company has recently had growth that’s well above the historical rate – in Q1 of FY2024, Universal had a growth of 20.5% in revenues, after a FY2023 growth of 22.2%. Also, in Universal’s Q1 earnings call, CFO Johan Kroner told that the company’s looking to expand its capacity in calendar year 2024 – it seems that some growth efforts could be more long-lasting.

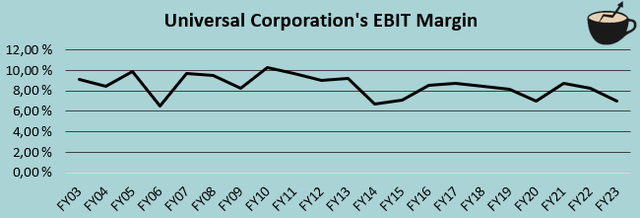

Universal has had a mostly stable EBIT margin throughout the company’s history:

Author’s Calculation Using TIKR Data

The margin has been lower in the latest quarters, with a significant margin decrease in Q1/FY2024 – the company’s gross margin was 1.8 percentage points below the previous year’s period. The company did manage to have a lower SG&A level as a percentage of revenues, though, resulting in a margin compression of a percentage point. As with the revenues, I believe the margin is a temporary result of slow demand, and the margin should recover at least partially. From FY2003 to FY2023, Universal’s margin has been 8.5% on average.

The company leverages a large amount of debt. The company has almost a billion dollars of interest-bearing debt – with a market capitalization of $1.2 billion, the amount seems excessive. Of the debt, $360 million is in short-term borrowings and $617 million in long-term debt. Universal does have quite stable cash flows though, lowering the risk of the debt in my eyes.

Valuation

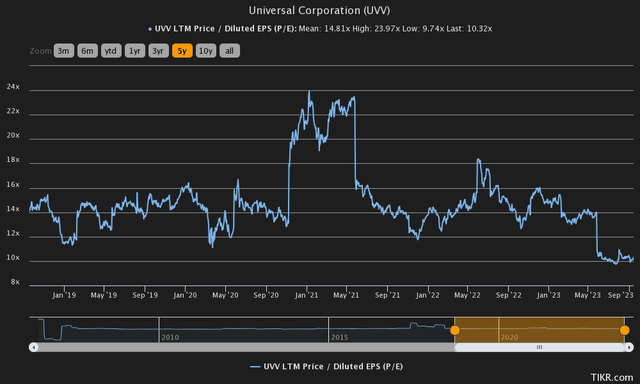

Currently, Universal trades at a trailing price-to-earnings ratio of 10.3, well below the five-year average of 14.8:

Historical P/E (TIKR)

The modest ratio is quite typical for tobacco companies – the industry currently has a price-to-earnings ratio of 14.8 according to CSIMarket, well below the S&P 500’s ratio of 25.4. I believe the lower valuation is based on concerns about a changing regulatory environment as well as the low-ESG nature of the business.

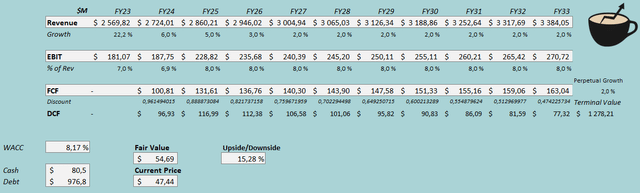

To further analyze the valuation, I constructed a discounted cash flow model as usual. In the model, I estimate a growth of 6% for FY2024 – the estimate is well below the growth achieved in recent quarters, but as in the company’s latest earnings call CFO Kroner pointed out a soft demand, I believe the estimated growth is a fair assumption. Going forward, I estimate small growth as the company expands capacity – the model has growth rates of 5% and 3% for FY2025 and FY2026 respectively, after which the growth reaches a perpetual rate of 2%.

For Universal’s EBIT margin, I estimate that the margin falls by 0.1 percentage points in FY2024 as a result of softer demand. Going forward, I estimate a margin of 8.0%, around the company’s long-term margin. The mentioned estimates along with a cost of capital of 8.17% constructs the following DCF model scenario with an estimated fair value of $54.69, around 15% above the price at the time of writing:

DCF Model (Author’s Calculation)

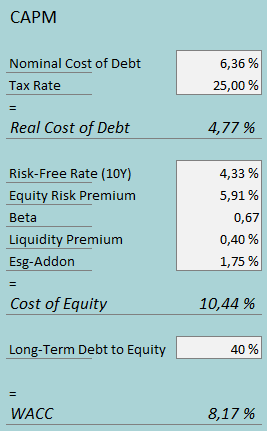

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1/FY2024, Universal had $15.5 million in interest expenses – with the company’s interest-bearing debt base, the company’s interest rate comes up to 6.36%. Universal Corporation has leveraged a large amount of debt in its history, as well as having a large debt balance as of now – I estimate Universal’s long-term debt-to-equity ratio to be 40%.

On the cost of equity side, I use the United States’ 10-year bond yield of 4.33% as the risk-free rate. The equity risk premium estimate of 5.91% is Professor Aswath Damodaran’s latest approximate. Tikr estimates Universal’s beta to be 0.67, quite low as demand for tobacco stays very stable throughout different economic situations. Finally, I add a liquidity premium of 0.4% and an ESG-addon of 1.75% into the cost of equity, crafting a cost of equity of 10.44% and a WACC of 8.17%

Takeaway

At the current price, Universal Corporation seems like fair investment. The company has a modest risk profile even though Universal holds a very significant amount of debt – Tikr still estimates the beta to be 0.67 as demand for tobacco products is very stable. My DCF model estimates an upside of around 15% for the stock – although slightly undervalued, I don’t believe the model facilitates a buy-rating; I have a hold-rating for the time being.

Read the full article here