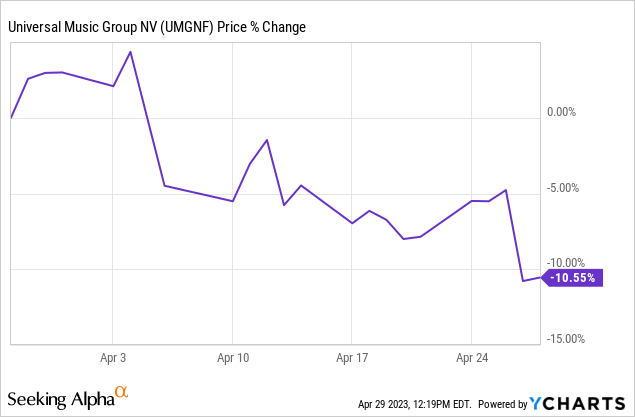

Universal Music Group (OTCPK:UMGNF) (OTCPK:UNVGY) announced its Q1-23 results, reporting a revenue increase of 11.5% and an adjusted EBITDA increase of 14.7%, compared to the prior year period. Despite the impressive numbers, a non-recurring expense and investor fear of potential AI disruption sent the stock to a 15.0% selloff. As UMG now trades at a 16.5 forward EV/EBITDA multiple, I find the current price an extremely attractive opportunity to buy the best business in the music industry. I reaffirm my Strong Buy rating and estimate a 29.0% upside.

Background

Two months ago, I started covering UMG on Seeking Alpha, with a Strong Buy rating. I published two articles covering the company. In the first article, I described the company’s business model in detail. Specifically, I explained its complex revenue streams, the legal framework in which UMG operates, the company’s segments, and its main growth drivers which include the continued adoption and expansion of digital music services, as well as constant price increases as the price of a music subscription barely changed since 2014, the year streaming businesses started to gain traction.

In my second article, I covered the company’s FY22 results and focused on the introduction of its employee stock option plan, which is still extremely relevant in order to understand the opportunity that arose after the Q1-23 selloff.

Unfortunately, the stock has significantly underperformed the market in the last two months. However, I believe the recent selloff is caused by misinformation and immaterial risks. Thus, I find UMG’s current price an attractive opportunity to buy a long-term compounder, which possesses one of the strongest moats in the market, as UMG holds the rights to monetize generational music of artists like Rihanna, The Beatles, Taylor Swift, Drake, Queen, Kendrick Lamar, Guns N’ Roses, Justin Bieber, Aerosmith, BTS, The Weekend, Ariana Grande, and many more.

Unlike most TV shows and movies, a good song is consumed by fans over and over again. Songs that were created 50 years ago are still generating huge amounts of money, and artists need the backing of large stable music labels now more than ever. In essence, buying a share of Universal Music Group is buying a share in assets like The Beatles’ White Album, Queen’s A Night At The Opera, or Kendrick Lamar’s Damn.

Despite all that, as investors, we can’t ignore the market. It can’t all be perfect if the stock dropped 15% in less than a month. So, let’s start by explaining the recent selloff.

Explaining The Selloff – The AI Scare & The EBITDA Decline

After reaching the $25.7 price per share mark, UMG’s stock began to decline. As the company’s results show no sign of deterioration, it was two other major concerns that caused this selloff.

The AI Scare

It started on April 5th, when an analyst that covers the stock downgraded his rating, stating that AI could be an existential threat to major labels like UMG. That has started a flux of headlines regarding the AI monster, which reached a climax after an AI-generated song that uses Drake’s voice became popular on TikTok.

The generative AI trend which was first started by ChatGPT, has now reached the music industry. Even Sir Lucian Grainge, UMG’s Chairman and CEO, addressed this issue in his opening remarks in the Q1-23 call, and it felt like this was the only concern on analysts’ minds throughout the call.

The recent explosive development in generative AI will, if left unchecked, both increase the flood of unwanted content hosted on platforms and create rights issues with respect to existing copyright law in the US and other countries as well as laws governing trademark, name and likeness, voice impersonation and the right of publicity. Further, we have provisions in our commercial contracts that provide additional protections. Unlike its predecessors, much of the latest generative AI is trained on copyrighted material, which clearly violates artists’ and labels’ rights and will put platforms completely at odds with the partnerships with us and our artists and the ones that drive success.

— Sir Lucian Grainge – Chairman and CEO, Q1-23 Earnings Call

As an old-fashioned guy who still collects physical vinyl, I personally find this AI scare to be overblown, to say the least. I advise investors to go and find an AI-generated song with a known artist’s voice, and see for themselves if it comes anything close to the real thing.

Putting my personal opinion aside, UMG and its artists are legally fortified against infringement of their rights, including unauthorized use of artists’ voices. Additionally, music services like Spotify and Apple Music are bound by contract to protect UMG’s rights against third parties. Moreover, customer experience on such platforms will deteriorate materially if a flood of bad and fake content will take place. Already today, these platforms hold millions of songs that aren’t consumed at all.

Here’s an example from one music platform’s own publicity disclosed data. Of the 9 million content uploaders on that platform, yes, 9 million, 8.3 million, more than 92% of them have fewer than 1,000 monthly listeners and only 2% are professional or professionally aspiring artists.

— Sir Lucian Grainge – Chairman and CEO, Q1-23 Earnings Call

To conclude the AI point, I believe this “monster” will be put to rest very quickly. Music services like YouTube and Deezer are working actively to take such content off their platforms, and until this will be sorted in a way that allows the creation of AI-generated songs in a legal, non-infringing way, I believe we won’t see any significant effect on UMG’s business.

The EBITDA Decline

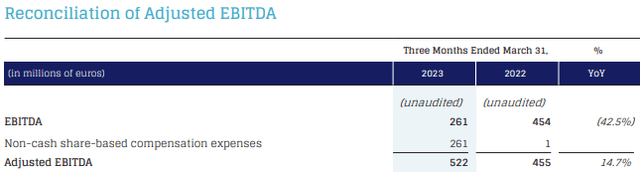

For Q1-23, UMG reported revenues of €2.5B and adjusted EBITDA of €522M, representing 11.5% and 14.7% increases from the prior year period. Meanwhile, the group reported a 43% decline in regular EBITDA which came at €261M.

Before explaining the EBITDA decline, it’s important to understand that as a European company, UMG does not report full financial statements on a quarterly basis. Instead, it provides partial financial data every Q1 and Q3, and full reports only on a semi-annual basis. On its quarterly reports, UMG provides investors with the following figures – Revenue, EBITDA, and Adjusted EBITDA.

The difference between EBITDA and Adjusted EBITDA, regarding UMG, is only one single account, which is share-based compensation:

Universal Music Group Q1-23 Earning Release

Many companies exclude share-based compensation from their adjusted figures because they can, and they do so to mislead investors. Terry Smith devoted an extensive section of his 2022 annual letter to shareholders to address this phenomenon, and I advise you to read it.

However, UMG’s case is different. In my last article, I wrote the following:

Unlike most companies on the market, UMG went public without an already established equity plan for employees. Investors were worried the equity plan will be too aggressive in terms of dilution and waited for the company to resolve this matter. Well, now we know there is nothing to be scared about. The group plans to reward employees via share-based compensation (SBC) at an annual run rate of approximately €200M. This will impact EBITDA by approximately €100M per year in the future. However, for 2023, due to IFRS accounting, the company expects a non-recurring transition expense to the amount of €442M. Overall, the net EBITDA impact for 2023 is expected to be €550M.

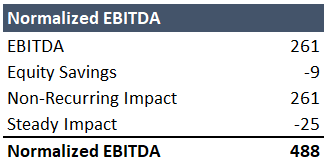

In short, the stock-based compensation plan will amount to approximately €100M per year on a steady state. However, the fact that UMG initiated the plan as a public company and transformed some old plans into the new one, will result in a total non-recurring €550M expense. Therefore, the adjustment UMG is making aims to address the non-recurring nature of the expense and not the fact that this is a stock-based expense. However, the adjusted EBITDA figure is also somewhat misleading, as €25M of the expense is recurring (a quarter of the steady €100M per year). Additionally, it includes benefits from non-recurring items to the amount of €9M.

To sum it all up, this is how the normalized EBITDA, which only excludes non-recurring items, should look like:

Created and calculated by the author using data from UMG’s reports and information provided on the company’s earning calls

The normalized EBITDA reflects a 19.9% margin, which is a decrease from the 20.6% in the prior year, as the company is yet to reach a balance between SBC and salaries. Adjusting for SBC, margins actually improved to 20.9%. As we can see, the EBITDA decline doesn’t paint a true picture of UMG’s operations, and in 2024, these complex adjustments won’t be necessary. When we reach that point, I believe investors who exploited the current selloff will be significantly rewarded.

UMG’s management has guided investors in advance for this expense, and it was known. Despite being expected, notable financial websites disregarded the non-recurring nature of the expense. For example, Reuters came up with a headline stating “Universal Music reiterates AI concerns as quarterly profit slumps”. Of course, in the article itself, the writer mentions that earnings beat expectations.

When investing in European companies, investors must take into account the fact there will be worse analyst coverage and less information about the company. Similar to small caps, this is both good and bad, as it provides thorough investors with the opportunity to invest in companies that are destroying analysts’ expectations. But, it could also result in major selloffs with no apparent explanation.

In my view, this UMG selloff is providing us with an attractive opportunity.

Other Q1-23 Highlights

Although it was overshadowed by the above, Universal Music Group and its artists had another amazing quarter. For the first time in the 56-year history of Billboard’s 200 chart, a single label, Republic (owned by UMG), had seven of the top 10 albums. So far, this year in the US, UMG has had five of the six most consumed albums with releases by Drake, Metro Boomin, Taylor Swift, and Morgan Wallen who had two. UMG’s publishing division became the first publisher to hold a greater than 30% market share in three consecutive quarters since tracking began in 2014.

The Artist-Centric Approach

UMG continued with the deployment of its artist-centric approach, which aims to incentivize music platforms to focus on rewarding deep artist-fan relationships and improve the user experience on their platforms by reducing inferior content and highlighting the artists and the music that customers care about most. In simple words, UMG will charge lower fees from platforms that support its artists, whereas platforms that try to sway their customers into the 92% non-professional content will be charged more. This initiative shouldn’t be taken lightly. Platforms like Spotify are allocating a lot of resources to reducing their dependency on UMG, as it’s almost impossible for them to generate profits from music due to the high portion of revenues UMG takes. If it succeeds, the artistic-centric approach could reduce the conflict of interest between UMG and the music streamers, without UMG giving up profits.

Advertising Market

UMG reported a 2% decline in ad-supported revenues. As companies like Meta (META) and Alphabet (GOOG) (GOOGL) see slower growth and declines in their ad businesses, UMG is no exception. It’s important to note that the decline is a result of ad prices decreasing, as opposed to lower consumption of ad-supported music streams. Thus, when the ad market improves, this part of the business should return to high single-digit growth as well. Management expects such recovery as early as the second half of the year.

Merchandising

Merchandising revenues declined by 4% in the quarter, as a result of tough comparisons to 2022. In the prior year, the post-Covid rebound resulted in very strong touring and retailing. In the future, this segment of the business should continue to see some cyclicality, but over the long term, merchandising revenues are projected to grow, as UMG expands the number of artists it represents for merchandising purposes, which currently amounts to 200.

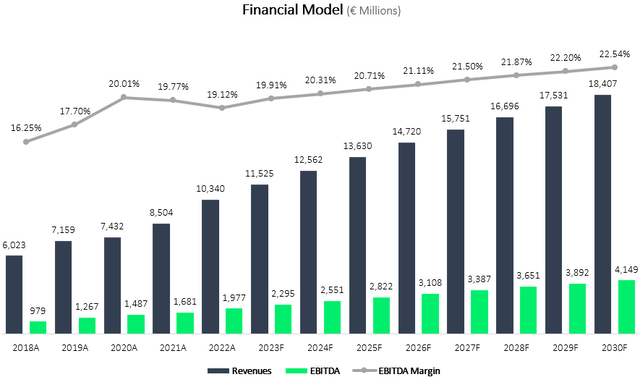

Updated Financial Model

I use a discounted cash flow methodology to evaluate UMG’s fair value. I expect UMG to grow revenues at a CAGR of 7.5% between 2023-2030, which is in line with the management’s long-term guidance of high single-digit growth. I estimate revenues will grow at this pace due to price increases of streaming services, an increase in total global subscribers, and the improvement of monetization in social media (mainly TikTok). In addition, I believe advertising budgets will recover in the near future. Regarding price increases, management mentioned the price increases from Amazon (AMZN) and Apple (AAPL), which have both increased their music services prices by 10.0%. Management expects the full effect of those increases to be shown in the company’s 2023 results.

Regarding EBITDA, I project margins to increase incrementally up to 22.5% in 2030, Which is below the management’s guidance for mid-twenties EBITDA margins. I believe margins will improve due to a better mix between physical and digital consumption, as well as a lower percentage of merchandising revenues.

Created by the author based on data from UMG’s financial reports and the author’s projections

Taking a WACC of 8.3%, I estimate UMG’s fair value at €46.5B, or €25.6 per share, which represents a 29.0% upside compared to its market value on the day of writing. Converting those numbers to the U.S listed ADR, I estimate its fair value at $28.5, based on the current EUR / USD rate.

An important clarification to make, I increased the WACC and decreased my EBITDA margin projection. Naturally, this results in a lower fair value than my previous article. I prefer to be more conservative after the last quarter, as I am a little discouraged by the time it takes UMG to reach a steady accounting state, after going public almost a year and a half ago. I am still extremely bullish on UMG’s business, and I expect the company’s reports in 2024 and beyond will be much smoother.

Near-Term Projections

In my previous article, I provided the following projections:

For Q1-2023 and H1-2023, I expect revenues of €2.5B and €5.3B, respectively, and net EBITDA of €404M and €877M, respectively.

As we can see, my revenue projection was spot on, and my EBITDA projection came a little lower compared to the company’s normalized EBITDA. Thus, I reaffirm my H1-23 revenue guidance and update my normalized EBITDA projection to €1.0B. We’ll meet here after the H1-23 results, and see if I need to update my assumptions.

Conclusion

Universal Music Group, the leader of the music industry which represents the most successful artists in the world, is growing and should continue to grow at a double-digit pace. Despite that, the stock is now trading at a 16.5 forward EV/EBITDA multiple, thanks to a misinformed selloff and what I find as an immaterial AI scare. With 14.7% EBITDA growth, UMG provides an extremely rare opportunity to buy a long-term compounder at a multiple that equals its growth rate. I reiterate my Strong Buy rating and estimate a 29.0% upside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here