Upstart Holdings, Inc. (NASDAQ:UPST) investors have seen its stock consolidate constructively over the past two months. I last updated Upstart investors in August, suggesting I was ready to buy its steep plunge from its early August highs. While UPST pulled back further toward its early October lows, downside volatility in UPST has reduced significantly, suggesting selling pressure seems to have abated.

With Upstart scheduled to report its third-quarter or FQ3 earnings results on November 7, I believe it’s timely to update investors on whether the current opportunity is still apt to add exposure.

Before that, investors need to know that the macroeconomic conditions have been mixed. While consumer spending has remained robust, bond yields have surged higher as market participants are positioned for a higher-for-longer rate environment.

As such, some Fed officials are reportedly looking to hold rates steady between 5.25% and 5% at the upcoming 2-day FOMC meeting starting on October 31, in line with its previous hawkish pause at the last meeting. However, it’s also important to note that the surge in the 10Y Treasury yield (US10Y) has also intensified concerns about a possible credit crunch, leading to a hard landing. Therefore, I believe the downside risks to the US economy are expected to worsen, justifying why investors battered UPST as it topped out in August, falling nearly 66% toward its early October lows.

As such, the critical question facing investors is whether further downside is anticipated, even as Upstart’s operating performance could have bottomed out in the second quarter.

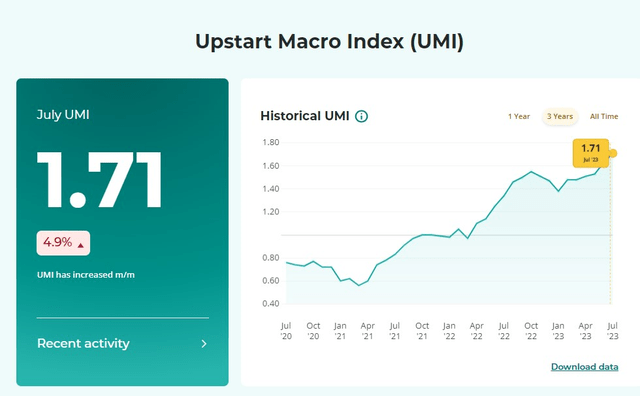

UMI (July 2023) (Upstart filings)

Based on the Upstart Macro Index or UMI’s most updated reading, the metric worsened MoM in July, posting a reading of 1.71. Investors should note that Upstart shared its proprietary UMI model to provide deeper insights into its assessment of credit risks relative to the prevailing macroeconomic conditions. While it’s backward-looking, it suggests that macro risks rose as of July, resulting in even higher default rates than its long-run average.

As such, the higher-for-longer worry has likely dampened investor optimism in UPST over the past two months since its FQ2 earnings release. The surge in bond yields could weaken Upstart’s conversion further, potentially pricing out more borrowers. In addition, a worsening macroeconomic outlook leading to a hard landing would hit Upstart harder, given its reliance on funding from institutional and banking partners. While Upstart has made progress in obtaining long-term committed funding, the developments are still nascent and far from reaching its 50% long-term target. As such, if bond yields continue to surge higher, it could put more selling pressure on UPST moving ahead.

Notwithstanding that caution, recent results from the big banks suggest they don’t anticipate a hard landing, even as they prepare for higher capital requirements and potentially higher loan losses. As such, the mixed signals need to be carefully monitored by investors, as Upstart isn’t immune to external funding and conversion challenges.

UPST price chart (weekly) (TradingView)

UPST seems to have weathered the broad market weakness in September/October relatively well, holding the critical support level of $25. That level is also aligned with UPST’s 50-week moving average or MA (blue line) and must be defended stoutly by dip-buyers.

Losing that line could open up a steeper fall toward the gap between the $12 and $25 level before a firmer consolidation. Given Upstart’s no-moat business model with an “F” profitability grade (assigned by Seeking Alpha’s Quant), I assessed UPST as suitable only as a speculative setup. As such, investors are urged to consider appropriate risk management strategies if the $25 level is decisively breached.

Rating: Maintain Speculative Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here