It is unrealistic to expect that the growing energy needs of the world will be met only by conventional energy and/or renewable energy sources while sticking to emissions targets. Development of a country is closely tied to its fossil energy use.

I have been a long-time investor in the Uranium Sector, and for many long-time believers, the wait seems to have been forever. After undergoing a deep bear market for much of the last decade, the sector showed signs of life towards the end of that decade, and for long-time bulls, it felt like a validation of a thesis that was taking forever to play out. The thesis was simple:

1. The world had underestimated the role of nuclear energy in mitigating climate change;

2. Nuclear Energy was the only source of energy that could provide baseload power efficiently while having no carbon emissions;

3. The demand for Nuclear energy would take off when the world realizes that it is the only practical long-term solution;

4. While Uranium as a resource is abundant there was simply not enough new development that could meet the demand;

5. When the supply comes up short, a confluence of the above factors would finally provide the commodity sector the mega rally that would benefit the investors.

But after gaining more than 250% in one year in 2021, the excitement surrounding the Sprott Uranium Miners ETF (NYSEARCA:URNM) started to fade as all price rise factors were unmet. It fell more than 45% from the highs established in 2021, and it was mostly consolidating in the last two years in that range. In the last 6 months, URNM has gained more than 50%, and could this be the onset of another mega rally that would surpass the highs of 2021? What are the catalysts that are driving the latest surge? Where do we go from here?

Getting the right Uranium Exposure

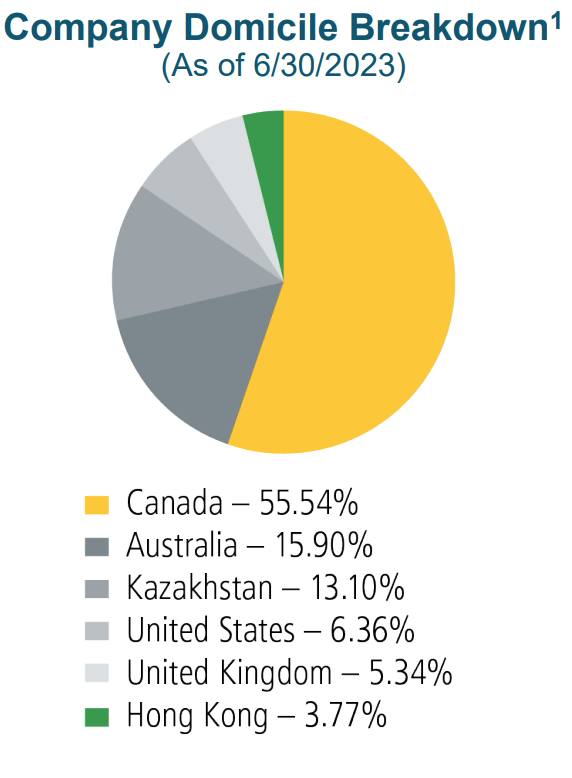

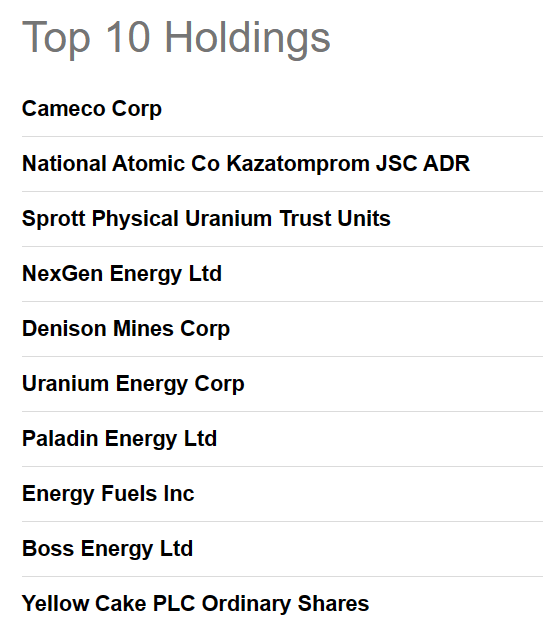

Buying the Sprott Uranium Miners ETF would provide the investor with most of the required exposure to the Uranium mining industry. URNM aims to track the performance of the North Shore Global Uranium Mining Index, which consists of global companies engaged in uranium mining and exploration. The ETF has 37 issuers, with more than 50% of the companies in the small market cap category and almost 17% in Physical Uranium. The majority of the names in the ETF are also based in Canada. The management fee for the ETF is 0.83%

Sprott Seeking Alpha

The Catalysts

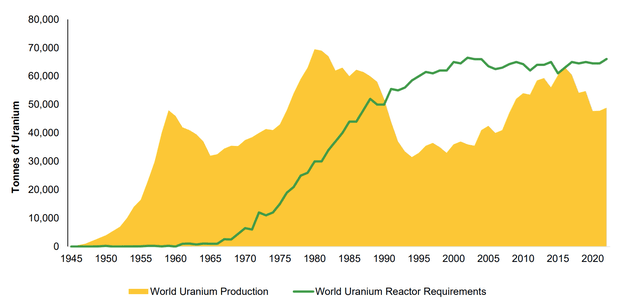

The Uranium sector has had multiple bull markets and each bull market had its own catalysts. The latest set of catalysts started off with the COVID-19 supply cuts, major nations committing to Carbon neutrality, the sentiment gradually turning in favor of nuclear energy, and the world waking up to the fact that the industry has been running on a deficit for some duration.

Requirements versus supply (Sprott ETF Presentation)

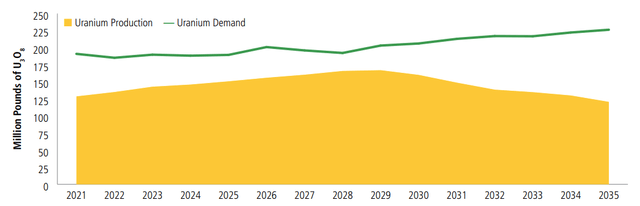

Recent and Projected Production versus Demand (Sprott ETF Presentation)

While the deficits were largely met with inventories and secondary supplies, going forward, the fear is that we are close to a point where we will be exhausting all existing inventories and secondary supplies and there is simply not enough new production that can be brought forward in a short duration. Discovery and development is an exhaustingly slow process and could take decades before production comes to the market. On the supply side, this is what we have seen recently that could act as positive catalysts:

1. Geopolitical tensions, exemplified by the recent coup in Niger, have created significant disruptions in the global uranium supply chain. This coup resulted in international sanctions against the ruling military junta, causing logistics challenges and forcing companies like Orano SA to suspend uranium processing. Furthermore, Global Atomic Corp. has indicated that these circumstances might lead to a delay of six to 12 months in the inauguration of its Dasa Project. Niger, which contributes 4% of the world’s uranium production, plays a crucial role in the uranium supply chain. The concentration of uranium production in geographically sensitive regions has exacerbated vulnerabilities in the supply chain, making it more susceptible to disruptions.

2. More geopolitical risks compounded by concerns about Russian supply. Western utilities have been cautious, implementing self-sanctions by accepting deliveries of uranium under existing contracts but avoiding new agreements. Additionally, legislative efforts to relocate the U.S. nuclear supply chain away from Russia have gained momentum, exemplified by the Nuclear Security Act, which played a pivotal role in initiating the recent uranium rally as of July 31, 2023.

3. Problems at Cameco’s McArthur River Mine and Cigar Lake Mine have led Cameco to revise their production estimates and the company is already looking at buying Uranium from the market to meet its obligations to its customers.

On the demand side, we are seeing many positive developments as well.

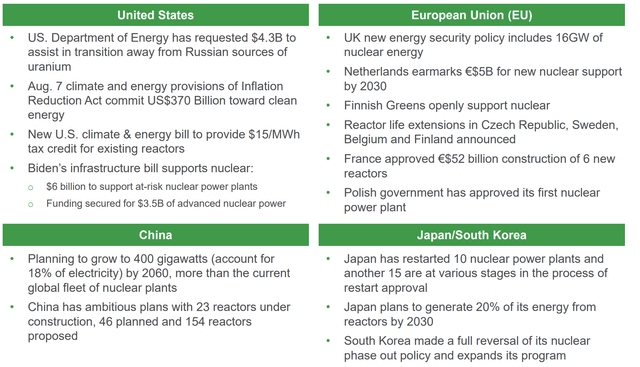

An unprecedented number of announcements for nuclear power plant restarts, life extensions, and new builds are coming from different countries. While India, China, and parts of the EU are looking at new builds, life extensions are coming from the U.S. and plant restarts are coming from Japan. Outside of Germany being the most prominent voice against nuclear power, most countries are seeing positive changes in sentiment and accordingly taking action.

Positive developments on the demand side (Sprott)

Overall, there are 435 operational reactors, 58 are under construction and 104 are planned! This represents more than a 35% increase in the coming decades with more proposals on the way.

The upside to investing in Miners

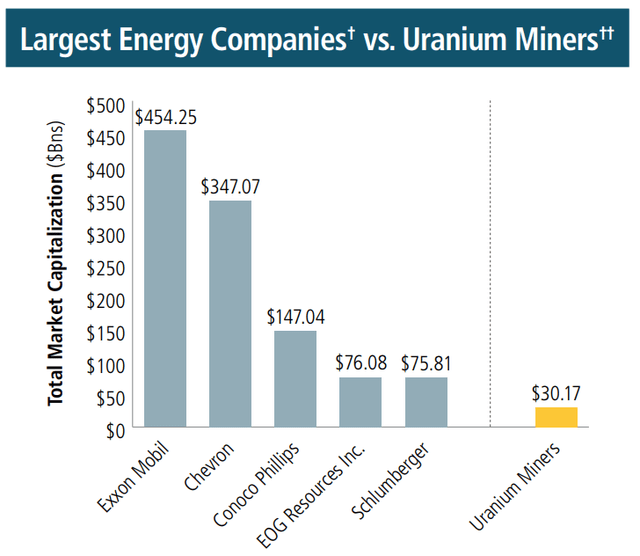

1. Nuclear energy generates 10% of the world’s electricity and more than 50% of zero carbon emissions electricity but the market capitalization of miners is still low compared to the largest energy companies. As this sees more momentum and we go deeper into this energy transition, the upside potential could be big.

Sprott Whitepaper

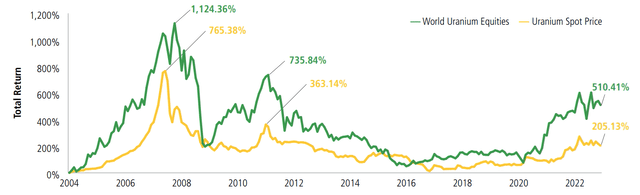

2. Miners tend to outperform during physical uranium bull markets and recent price action also lends further credence to this fact.

Returns of Uranium Equities versus Uranium Spot Price (Sprott White Paper)

Risks to this thesis

The last time an existential risk faced by this sector was the Fukushima disaster which caused many nations to completely change their sentiment towards nuclear energy (e.g. Germany). The sector entered a deep bear market following this incident and it took almost a decade for the world to realize that the benefits of nuclear energy far outweigh the risks posed by it. Another incident even on a much smaller scale would cause the voice against nuclear power to be loud again. But I have argued in my previous takes that it’s hard to have the cake and eat it too (It is unrealistic to expect that the growing energy needs of the world will be met only by conventional energy and/or renewable energy sources while sticking to emissions targets and its undeniable that the development of a country is tied to its use of fossil fuels).

This realization limits the worst-case scenario for this industry in my opinion, but we would still have to bear with the fallout from another short-term change in the sentiment. This is why position sizing is important in a portfolio and should be exercised in this investment as well.

Wrapping up

I am already long with a few individual names in this industry (For the interested reader, my latest take on an individual name can be seen here). The benefit of being long individual names is avoiding the expense ratio but it requires continuous monitoring of your holdings in addition to the monitoring of the sector itself. For the investor just warming up to the sector, I would recommend the ETF and as you get more familiar with the industry you can reevaluate your position and start thinking of individual names.

Read the full article here