Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

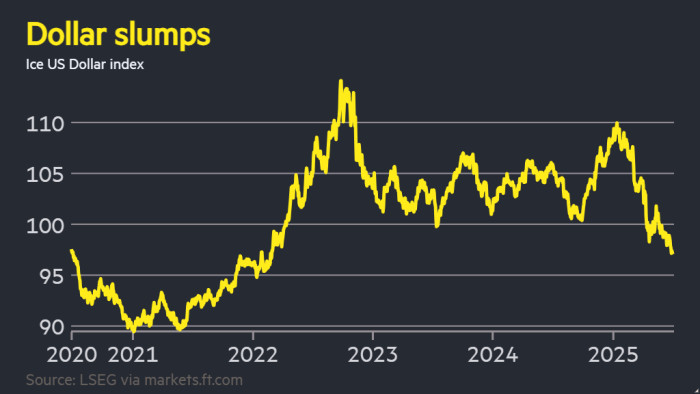

The US dollar has suffered its worst first half of the year since 1973, as Donald Trump’s trade and economic policies prompt global investors to rethink their exposure to the world’s dominant currency.

The dollar index, which measures the currency’s strength against a basket of six others including the pound, euro and yen, has slumped more than 10 per cent so far in 2025, the worst start to the year since the end of the gold-backed Bretton Woods system.

“The dollar has become the whipping boy of Trump 2.0’s erratic policies,” said Francesco Pesole, an FX strategist at ING.

The president’s stop-start tariff war, the US’s vast borrowing needs and worries about the independence of the Federal Reserve had undermined the appeal of the dollar as a safe haven for investors, he added.

The currency was down 0.2 per cent on Monday as the US Senate prepared to begin voting on amendments to Trump’s “big, beautiful” tax bill.

The landmark legislation is expected to add $3.2tn to the US debt pile over the coming decade and has fuelled concerns over the sustainability of Washington’s borrowings, sparking an exodus from the US Treasury market.

The dollar’s sharp decline puts it on course for its worst first half of the year since a 15 per cent loss in 1973 and the weakest showing over any six-month period since 2009.

The currency’s slide has confounded widespread predictions at the start of the year that Trump’s trade war would do greater damage to economies outside the US while fuelling American inflation, strengthening the currency against its rivals.

Instead, the euro, which several Wall Street banks were predicting would fall to parity with the dollar this year, has risen 13 per cent to above $1.17 as investors have focused on growth risks in the world’s biggest economy — while demand has risen for safe assets elsewhere, such as German bonds.

“You had a shock in terms of liberation day, in terms of the US policy framework,” said Andrew Balls, chief investment officer for global fixed income at bond giant Pimco, referring to Trump’s “reciprocal tariffs” announcement in April.

There was no significant threat to the dollar’s status as the world’s de facto reserve currency, Balls argued. But that “doesn’t mean that you can’t have a significant weakening in the US dollar”, he added, highlighting a shift among global investors to hedge more of their dollar exposure, activity which itself drives the greenback lower.

Also pushing the dollar lower this year have been rising expectations that the Fed will cut rates more aggressively to support the US economy — urged on by Trump — with at least five quarter-point cuts expected by the end of next year, according to levels implied by futures contracts.

Bets on lower rates have helped US stocks to shake off trade war concerns and conflict in the Middle East to reach record highs. But the weaker dollar means the S&P 500 continues to lag far behind rivals in Europe when the returns are measured in the same currency.

Big investors from pension funds to central bank reserve managers have stated their desire to reduce their exposure to the dollar and US assets, and questioned whether the currency is still providing a haven from market swings.

“Foreign investors are requiring greater FX hedging for dollar-denominated assets, and that has been another factor preventing the dollar from following the US equity rebound,” said ING’s Pesole.

Gold has also hit record highs this year on continued buying by central banks and other investors worried about devaluation of their dollar assets.

The dollar slump has taken it to its weakest level against rival currencies in more than three years. Given the speed of the decline, and the popularity of bearish dollar bets, some analysts expect the currency to stabilise.

“A weaker dollar has become a crowded trade and I suspect the pace of decline will slow.” said Guy Miller, chief market strategist at insurance group Zurich.

Read the full article here