Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

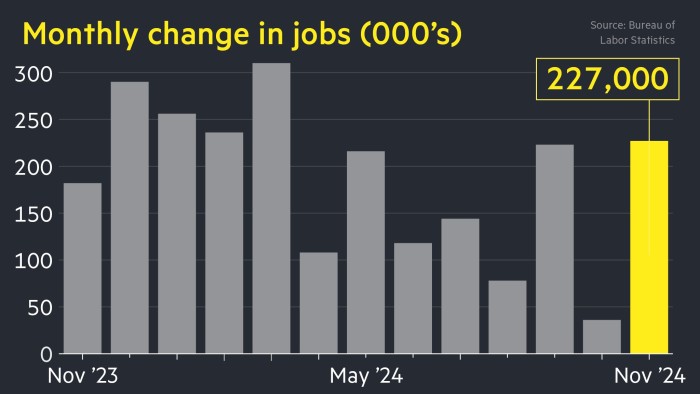

The US economy added 227,000 jobs in November, a sharp rebound after the previous month’s total was dragged down by hurricanes and the Boeing strike.

Friday’s number, published by the Bureau of Labor Statistics, beat a consensus forecast of 200,000 by economists surveyed by Reuters.

It marked a jump from the downwardly distorted figure of 12,000 new positions initially recorded for October. That figure was revised higher to 36,000 in Friday’s data release.

The unemployment rate rose incrementally to 4.2 per cent.

The jobs report is one of the final big data releases before the Federal Reserve’s December 17-18 meeting, at which it will decide whether to proceed with a third consecutive interest rate cut.

Although Friday’s figures beat forecasts, analysts said they were not sufficiently strong to undermine the case for a final rate reduction this year.

“Nothing within this release will prevent the FOMC from cutting [this month],” said Ian Lyngen, head of US rates strategy at BMO.

Gregory Daco, chief economist at EY, added: “From a Fed perspective, we are seeing a gentle deceleration in labour market momentum, and there is still not much inflationary pressure coming from the labour market.”

“Therefore I think they will proceed with an additional rate cut,” he added.

Treasury yields fell as investors bet that a Federal Reserve rate cut this month was now slightly more likely. Interest rate futures implied an 85 per cent likelihood of a cut, up from a 70 per cent chance immediately before the data release.

The two-year yield, which reflects interest rate expectations, declined 0.06 percentage points, to a five-week low of 4.09 per cent.

The S&P 500 rose 0.3% in early trading.

Recent data has suggested that the US economy remains strong and inflation at risk of settling above the Fed’s 2 per cent target, making policymakers wary about moving too quickly on lowering rates.

Fed chair Jay Powell said this week that the Fed could “afford to be a little more cautious” on reducing rates because the US economy was in “remarkably good shape” and inflation had come in a little higher than earlier anticipated.

His fellow governor Christopher Waller warned that progress on getting inflation down “may be stalling”, although he added he supported a December cut.

A quarter-point reduction this month would lower the target range of the federal funds rate to 4.25 to 4.5 per cent.

Friday’s jobs figures contrast with October’s total, which was by far the worst such report of the Biden administration, as two deadly hurricanes in the south-east and the Boeing strike took their toll on survey responses and the real economy.

On Tuesday, data showed that job openings rose to 7.7mn as lay-offs decreased to their lowest level since June. The number of Americans quitting their jobs rose to the highest point since May.

The figures suggested that the labour market was stabilising, assuaging officials’ earlier fears that it was weakening too quickly.

Over the past year, the US economy has created an average of 186,000 jobs each month. In November, healthcare, leisure and hospitality and the government were among the sectors reporting the biggest gains.

Employment in transportation manufacturing rose by 32,000, helped by the end of the Boeing strike.

The retail sector lost 28,000 posts in November. Job gains were flat for the construction industry, as well as for financial activities and professional and business services.

Read the full article here