Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

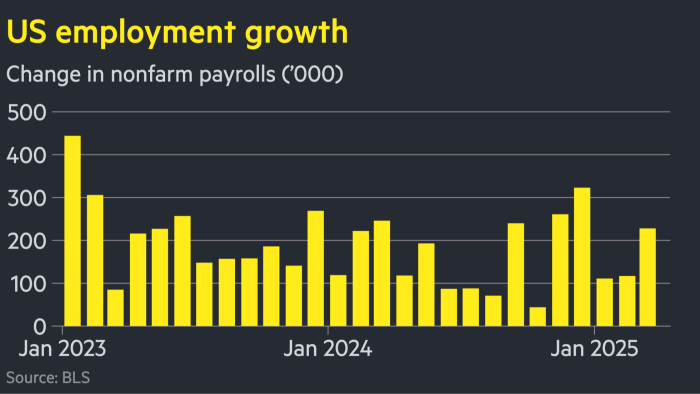

The US economy added 228,000 jobs in March, surpassing expectations, in a sign of resilience despite the Trump administration’s sweeping cuts to the federal workforce.

Friday’s figure from the Bureau of Labor Statistics far exceeded both February’s increase of 151,000 posts and the 135,000 predicted by economists polled by Reuters.

The unemployment rate rose by 0.1 percentage point to 4.2 per cent.

The data provoked only a subdued market reaction, as investors focused instead on the economic fallout from the sweeping tariffs announced by US President Donald Trump this week.

S&P 500 futures were largely unchanged following the data, down 3 per cent on the day.

Bond yields remained sharply lower, with the two-year Treasury yield, which moves inversely to prices, 0.18 percentage points lower at 3.56 per cent amid a flight to safety.

The better than expected labour market figure will help ease concerns that the US economy was already slowing down before the full burst of Trump’s tariffs was announced this week.

But, given the breadth of the levies to be imposed by the White House on the largest US trading partners in the coming days, the data may be superseded by rapidly escalating risks to the global economy.

Global markets have lurched downwards following Trump’s announcement of steep levies on the US’s trading partners on Wednesday, wiping out about $2.5tn of Wall Street market value and erasing the dollar’s post-election gains.

“Given the market turmoil that we’re facing, it’s going to be largely overlooked because this is now ancient history,” said James Knightley, chief international economist at ING.

Torsten Slok, chief economist at Apollo, added: “The markets’ reaction is telling you that the markets are looking through this.”

But he added that the strong employment figure was still “good news, that the economy is still producing jobs”.

On Friday, Trump posted on his Truth Social platform: “GREAT JOB NUMBERS, FAR BETTER THAN EXPECTED. IT’S ALREADY WORKING. HANG TOUGH, WE CAN’T LOSE!!!”

The figures come as the Federal Reserve had already been considering how to respond to the twin threats of lacklustre growth and persistent inflation.

The so-called Department of Government Efficiency has led Trump’s charge to axe tens of thousands of positions in an aggressive effort to slim down the federal bureaucracy.

Read the full article here