Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

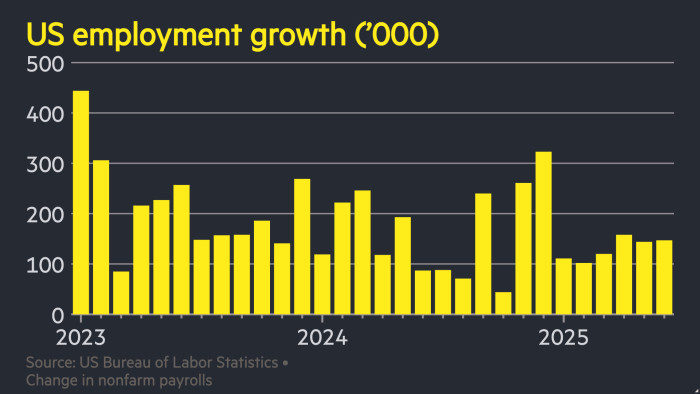

The US economy added 147,000 jobs in June, breaking through expectations and leading investors to scale back their bets on interest rate cuts.

Despite uncertainty over Donald Trump’s trade and immigration policies, Thursday’s figure from the Bureau of Labor Statistics surpassed both the upwardly revised 144,000 posts added in May and the 110,000 predicted by economists polled by Bloomberg.

The unemployment rate fell slightly to 4.1 per cent.

The unexpectedly strong figures will ease pressure on the US Federal Reserve to cut interest rates, despite the US president’s repeated calls for the central bank to do so.

The dollar climbed after the data publication as investors bet the Fed will lower rates more slowly than previously thought. The currency was up 0.5 per cent against a basket of rivals.

Traders are now betting that there is a roughly 5 per cent chance of the US central bank lowering borrowing costs this month, compared with about 25 per cent before the jobs data.

Fed chair Jay Powell said this week a July cut was not “off the table”, in an apparent reversal on his previous position that borrowing costs should be kept on hold until the autumn.

The two-year Treasury yield, which moves with interest rate expectations and inversely to prices, increased 0.09 percentage points on Thursday morning to 3.87 per cent.

US stock futures also rose, with contracts tracking the S&P 500 up 0.2 per cent ahead of the New York open.

This is a developing story

Read the full article here