Stay informed with free updates

Simply sign up to the US inflation myFT Digest — delivered directly to your inbox.

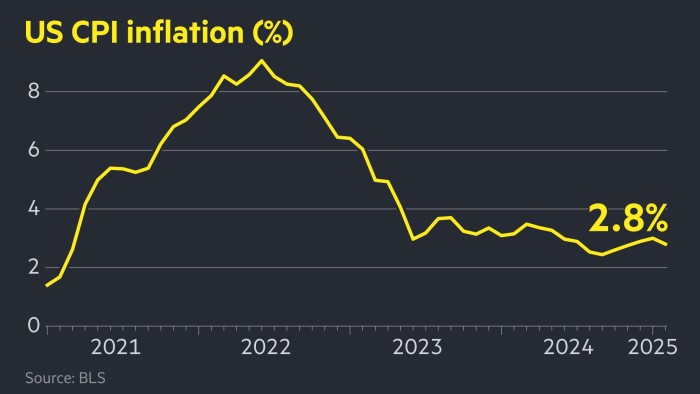

US inflation fell more than expected to 2.8 per cent in February, bolstering the case for the Federal Reserve to cut interest rates amid signs of slowing growth in the world’s largest economy.

Wednesday’s annual consumer price index figure was below both January’s 3 per cent and the 2.9 per cent expected by economists, according to a Reuters poll.

Stock futures extended gains on Wednesday. S&P 500 futures were up 1.1 per cent, compared with 0.8 per cent before the figures.

Futures markets are pricing in two rate cuts this year with a roughly 85 per cent chance of a third — up marginally from before the data release.

The US central bank faces a difficult balancing act as it tries to restrain inflation without triggering a recession, amid intensifying fears that President Donald Trump’s aggressive economic agenda is hampering growth.

Businesses and financial markets have been rattled by the chaotic rollout of Trump’s tariffs on the US’s biggest trading partners, which has been marked by a series of sudden escalations and U-turns.

Wednesday’s figures showed that core inflation rose 3.1 per cent, falling short of expectations of a 3.2 per cent increase.

“Underlying inflation is slowing before we get to those upside risks of tariffs, which will come later in the spring, so that’s positive for the Fed,” said Veronica Clark, an economist at Citi. “That will make them less worried about planning cuts later in the year.”

Last week, Fed chair Jay Powell played down concerns over the health of the US economy after all of the S&P 500 index’s post-election gains were wiped out following the release of disappointing employment figures for February.

Powell suggested that he expected the central bank to hold interest rates at their current range of between 4.25 per cent and 4.5 per cent at its meeting next week, saying the Fed was in no “hurry” to cut and was “focused on separating the signal from the noise as the outlook evolves”.

Sectors registering the biggest price increases included medical care and used cars, while air fares and new cars were among those where costs declined.

Egg prices, a significant contributor to January’s strong reading, were higher again in February, rising a further 10 per cent on the month for an annual increase of 59 per cent.

“It’s good news, for sure, but I do think we don’t want to overstate this,” said Ryan Sweet, chief US economist at Oxford Economics. “Only the tariffs on China had gone into effect in February and it may be a bit too soon to be captured in this round of data.”

Read the full article here