Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

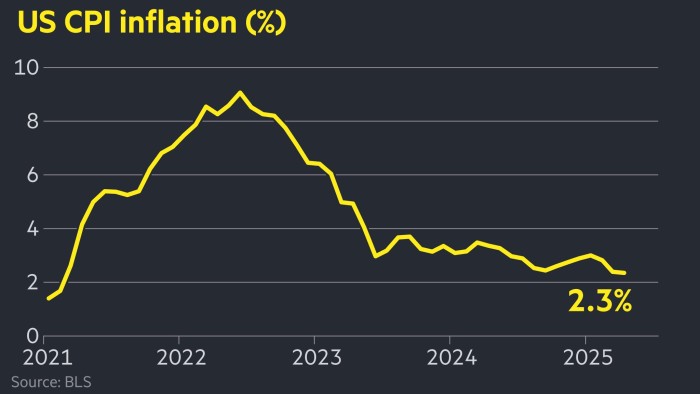

US inflation fell to 2.3 per cent in April, the month Donald Trump imposed his global tariffs, as the US president maintains pressure on the Federal Reserve to cut interest rates.

Tuesday’s annual consumer price index figure from the Bureau of Labor Statistics was below the expectations of analysts surveyed by Bloomberg that inflation would remain at March’s 2.4 per cent rate.

Although Trump has cut back many of the tariffs he announced on April 2 — including this week with China — economists caution that most of the impact of the import duties has yet to be felt, with Fed officials anticipating further increases in price pressures.

The Yale Budget Lab, a university research organisation, said on Monday that, because of the tariffs, the average US consumer would pay $2,800 more for products this year than in 2024.

The Fed, which has kept rates in the 4.25 per cent to 4.5 per cent range for six months, next meets in June.

Trump has heaped pressure on Jay Powell to cut borrowing costs, adding last week that dealing with the Fed chair was like “talking to a wall”.

Following the data release, US stock futures edged higher, with contracts tracking the S&P 500 up 0.2 per cent. Yields on Treasuries were little changed after the figures.

The core inflation rate, which excludes changes in the price of food and energy products, remained at 2.8 per cent in April, the BLS said.

The Fed’s preferred inflation target is not CPI but the Personal Consumption Expenditures, which fell to 2.3 per cent in March but remained above the central bank’s 2 per cent goal.

Read the full article here