Stay informed with free updates

Simply sign up to the US inflation myFT Digest — delivered directly to your inbox.

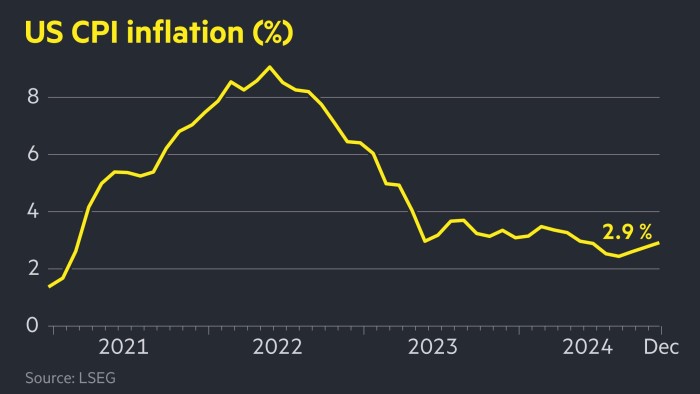

US inflation rose to 2.9 per cent in December, in line with expectations, prompting investors to increase bets on rates cuts this year.

Wednesday’s data from the Bureau of Labor Statistics matched the prediction of economists polled by Reuters and was above November’s figure of 2.7 per cent.

Core inflation, which strips out food and energy prices, was 3.2 per cent in December compared with 3.3 per cent in November.

US stock futures and government bonds rallied immediately while the dollar fell after the release of the latest inflation data. Contracts tracking the S&P 500 equity gauge added 1.5 per cent, while those tracking the tech-heavy Nasdaq 100 rose 1.8 per cent.

In government bond markets, the policy-sensitive two-year Treasury yield fell 0.08 percentage points to 4.29 per cent, while the 10-year yield — a benchmark for global borrowing costs — slipped 0.09 percentage points to 4.7 per cent per cent. Yields fall as prices rise

A gauge of the dollar against six other currencies slipped 0.5 per cent.

Fed officials have signalled that they plan to take a “careful approach” to rate cuts amid growing concerns that inflation may not quickly come down to the central bank’s 2 per cent target.

Investors are now betting that the Fed will cut rates by July – compared with September before the data was published.

Future markets now imply a 60 per cent likelihood of a second cut this year, up from 20 per cent earlier on Wednesday.

Most investors and analysts believe the Fed will not lower rates again at its next policy meeting later this month. US central bankers have signalled in their own projections that they will only cut rates by a further 50 basis points this year.

President-elect Donald Trump, who takes office on Monday, has laid out aggressive plans to impose tariffs on a vast swath of imports, implement a huge crackdown on undocumented immigrants and enact sweeping tax cuts.

Economists have warned such plans could boost inflation further.

Read the full article here