Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

The US Treasury secretary has defended Donald Trump’s push for an agreement with Ukraine to develop its natural resources and critical minerals, saying the plan would fuel postwar growth in the country and did not involve any coercive economic pressure.

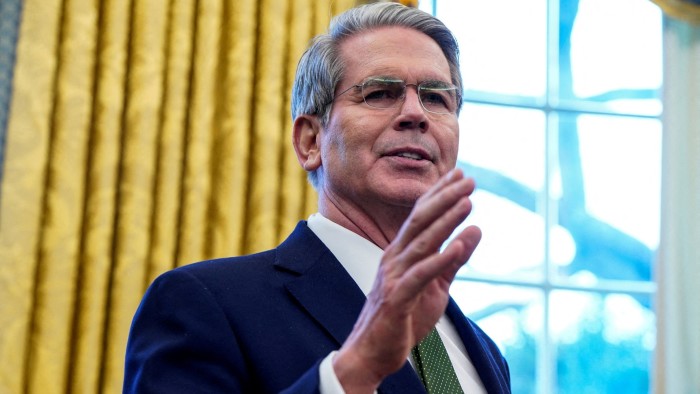

Scott Bessent’s comments in an op-ed for the Financial Times come as Trump administration officials are trying to clinch what they claim is an economic partnership with Kyiv as part of their broader diplomatic push to broker a peace deal between Russia and Ukraine.

Ukrainian officials have so far rejected US demands for such an agreement, but US officials are applying intense pressure on Kyiv in their push for a deal.

Officials in Kyiv believe that Trump’s onslaught against Ukrainian President Volodymyr Zelenskyy this week, describing him as a dictator and suggesting Ukraine, not Russia, had started the war, are ways of strong-arming Kyiv into a mineral deal.

In the op-ed, Bessent laid out some of the details of the US proposal. He said Ukraine’s revenue from “natural resources, infrastructure and other assets” would be “allocated to a fund focused on the long-term reconstruction and development of Ukraine where the United States will have economic and governance rights in those future investments”.

However, Bessent did not say how much of the proceeds from mineral extraction would be allocated to the fund or how much would be paid out to the US. Trump has presented the mineral deal as a way of ensuring Ukraine pays back previous US military aid.

An earlier draft of the agreement reported by Ukrainian media, which Ukrainian officials said was accurate, stated the fund would be set up “with the encumbrance (legal claim) of such revenues in favour of the United States”.

It also said that the US would decide how much of the fund would be paid out for reconstruction projects.

In his op-ed, Bessent said that the agreement would include “high standards of transparency, accountability, corporate governance, and legal frameworks necessary to attract the robust private investment for postwar growth in Ukraine” and America’s involvement “would leave no room for corruption and insider deals”.

The US Treasury secretary travelled to Ukraine earlier this month on his first international trip to pitch the deal to Volodymyr Zelenskyy, the president.

While US officials including Mike Waltz, Trump’s national security adviser, have said they believe a deal is close, Ukrainian officials are more guarded.

“The draft on the table now needs more work,” said a person involved in negotiations. “We see there many obligations of Ukraine and very weak things [offered] from the American side, so the draft, as for today, is not ready to be accepted on the president’s level.”

Negotiations went early into the morning for the third day and will continue on Saturday and probably into Sunday.

Zelenskyy has said that Bessent’s original proposal was not in Ukraine’s interest, as it demanded 50 per cent of the rights to the country’s rare earth and critical minerals in exchange for past military assistance, and did not contain any offers of future assistance.

Senior Ukrainians officials said they had spent the past week drawing up a counterproposal, which they discussed with the US special envoy for Ukraine, Keith Kellogg, in Kyiv on Thursday and Friday.

Zelenskyy wants the Trump administration to provide security guarantees in a new proposal before they agree to sign on.

In the op-ed, Bessent said the terms of the deal would “ensure that countries that did not contribute to the defence of Ukraine’s sovereignty will not be able to benefit from its reconstruction or these investments”.

Bessent also suggested the US was not trying to seize control of Ukraine’s natural resources coercively. “Let’s also be clear as to what this is not. The United States would not be taking ownership of physical assets in Ukraine. Nor would it be saddling Ukraine with more debt. This type of economic pressure, while deployed by other global actors, would not advance American nor Ukrainian interests,” he wrote.

Read the full article here