Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

Donald Trump’s bid to upend the international trading order with huge tariffs has wiped $5.4tn from US stocks in two days, as China hit back with its own levies, deepening fears of recession in the global economy.

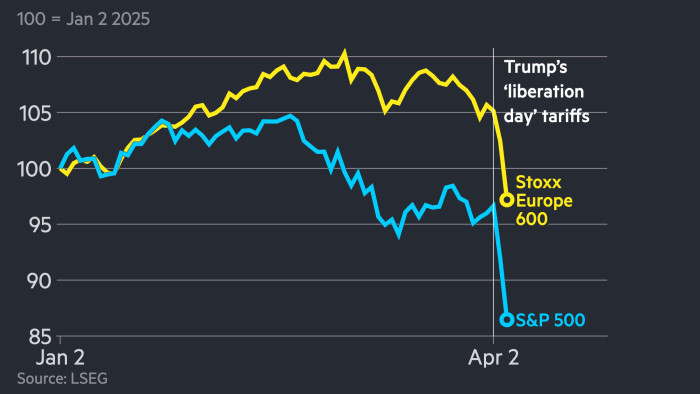

The S&P 500 index tumbled 6 per cent on Friday, following a 4.8 per cent drop the previous day, shedding $5.38tn in market value, in the wake of the US president’s “liberation day” announcement on Wednesday, according to Financial Times calculations based on FactSet data.

The blue-chip index’s 9.1 per cent fall for the week was the biggest since the onset of the pandemic five years ago.

Tech stocks, including behemoths such as Apple and Amazon, retreated, pushing the Nasdaq Composite down more than 20 per cent from its mid-December peak, tipping the gauge into “bear market” territory. Across the Atlantic, Europe’s Stoxx 600 shed 8.4 per cent on the week, while the UK’s FTSE 100 fell 7 per cent. MSCI’s Asia index fell 4.5 per cent.

The turmoil underscores how Trump’s plans to enact a 10 per cent universal tariff and hit many countries with bigger “reciprocal” duties within days has shaken investor confidence and triggered fears of a slowdown in the world’s biggest economy.

China, the world’s biggest exporter, added to the sense of gloom on Friday when it announced duties of 34 per cent on all US imports.

“If the reciprocal tariffs are not walked back by April 9, which I don’t think they will be, you will probably be looking at a recession in the United States and the European Union,” said Ajay Rajadhyaksha, global chair of research at Barclays. “Unless there is a very quick end to this global trade war, we think we get a US recession this year.”

Federal Reserve chair Jay Powell also warned on Friday that Trump’s tariffs would cause “higher inflation and slower growth”.

“It is now becoming clear that the tariff increases will be significantly larger than expected. The same is likely to be true of the economic effects,” Powell said.

Ahead of Powell’s speech, Trump had called on the Fed chief to lower borrowing costs, saying on his social media platform that “this would be a PERFECT time” to cut interest rates.

He also said China had “PANICKED — THE ONE THING THEY CANNOT AFFORD TO DO”, in a reference to Beijing’s plan to retaliate against US tariffs with steep duties of their own.

But the comments from the US president did little to calm equity markets amid wider fears of further deterioration in the economic outlook.

JPMorgan analysts raised the risk of a global recession this year to 60 per cent, from their previous estimate of 40 per cent.

The bearish sentiment was enough to supersede a strong employment report for March, released on Friday morning, which showed the US added more jobs than expected.

“Risk markets are hitting the panic button on China retaliation,” said Ladislav Jankovic, a JPMorgan strategist.

In a sign of deepening anxiety across markets, investors fled lowly rated US corporate bonds and other risky assets as they rushed for shelter in havens such as Treasury bonds.

The sell-off gained momentum as banks hit hedge fund clients with demands to stump up extra cash as portfolios were knocked by the market turbulence, while several companies including fintech company Klarna froze plans for initial public offerings.

The Vix index, a measure of expected volatility in US stocks often called Wall Street’s “fear gauge”, soared 15.1 points to 45.1, the highest level since 2020.

The rout extended to commodity markets, with international oil benchmark Brent on Friday sliding 6.5 per cent to settle at $65.58 a barrel, its lowest point in three years. US oil marker WTI fell 7.4 per cent on the day to settle at $61.99 a barrel, below the price many shale producers need to break even.

The price of copper, often considered a proxy for traders’ view of the health of global industry, were down about 9 per cent in the UK evening.

US Treasury bonds have been the primary beneficiary of the sell-off in stocks, with the 10-year Treasury yield — a rate closely tied to growth expectations — falling to 3.86 per cent, its lowest level since before Trump’s election.

Read the full article here