Recently, I have been advocating investors take a barbell approach to their investment portfolio by holding megacap companies with funds like the Invesco S&P 500 Top 50 ETF (XLG) and cash via floating rate funds like the WisdomTree Floating Rate Treasury Fund ETF (NYSEARCA:USFR).

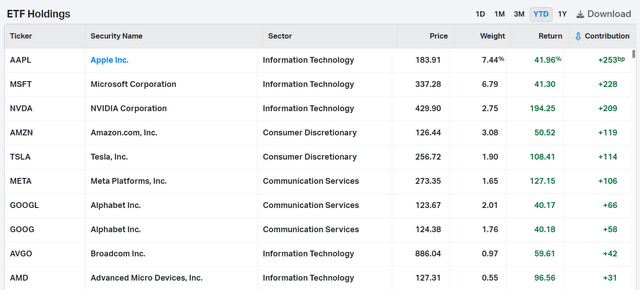

I believe this allocation makes sense in an uncertain macro environment, as stock indices continue to rally on narrowing breadth, with the top stocks accounting for the vast majority of index performance YTD (Figure 1).

Figure 1 – 10 stocks account for 83% of S&P 500’s 14.8% rally YTD to June 14 (SPY ETF return attribution from Koyfin.com)

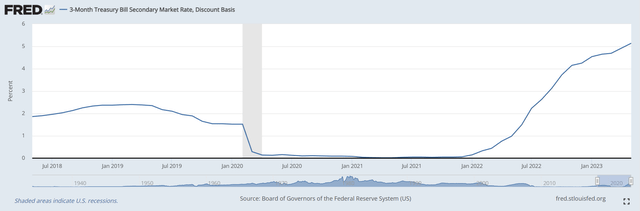

The allocation to cash-like investments like the USFR ETF provides investors with principal preservation as well as a decent yield, with short-term interest rates now above 5%.

Brief Fund Overview

First, before we proceed further in our discussions, let me briefly go over the USFR ETF for those not familiar.

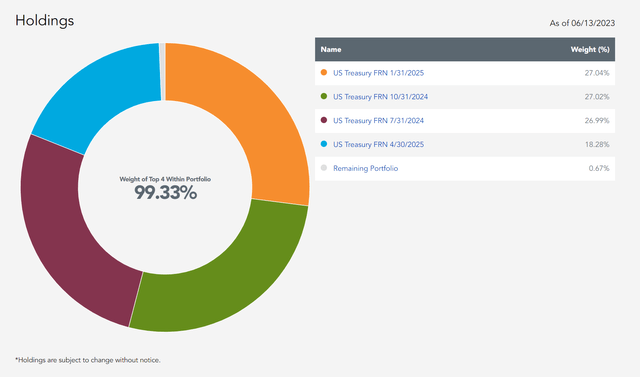

The USFR ETF owns floating rate treasury notes with various maturity dates. These bonds earn interest that are based on the prevailing 3-Month treasury yields that are reset quarterly (Figure 2). The USFR ETF has $16 billion in assets and charges a relatively inexpensive 0.15% expense ratio.

Figure 2 – USFR portfolio holdings (wisdomtree.com)

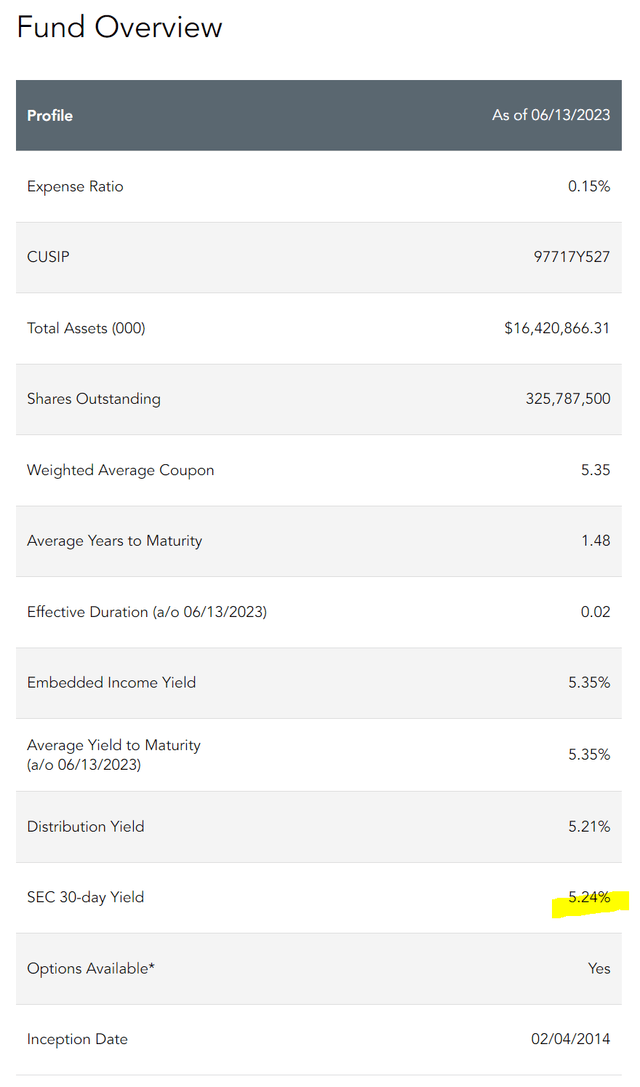

Currently, the USFR ETF has a 30-Day SEC yield of 5.2% and its most recent monthly distribution of $0.219 / share annualizes to 5.2% (Figure 3).

Figure 3 – USFR portfolio overview (wisdomtree.com)

Readers who wish to learn more about the USFR ETF should consult my initiation article and the fund’s website.

While earning over 5% distribution yield is great, one question that is often asked is how long will high short-term interest rates last? Having suffered a decade of the Federal Reserve’s Zero Interest Rate Policies (“ZIRP”), investors are understandably wary of an imminent return to low interest rates.

FOMC Meeting Over; Hawkish Pause?

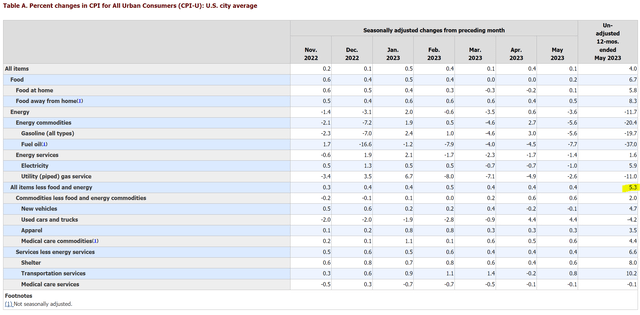

If we take the Federal Reserve at their word, the current phase of ‘restrictive policy rate’ will last for quite a while, as the Fed has yet to tame the inflation monster with the latest CPI reading for May still showing a hot 5.3% YoY core inflation rate (Figure 4).

Figure 4 – Core CPI not showing much progress despite a year of interest rate hikes (BLS)

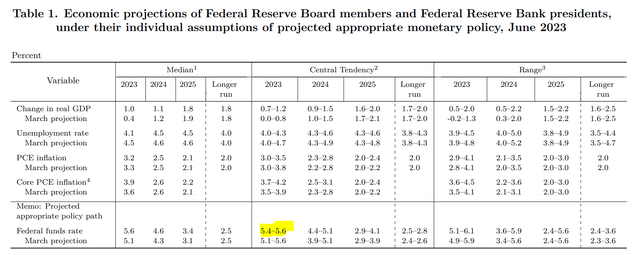

In fact, reading the latest Summary of Economic Projections (“SEP”) by the FOMC participants, although the FOMC committee agreed to pause interest rate increases at the recent June meeting, the median Fed Funds rate projection for the end of 2023 is at 5.4-5.6% compared to 5.00% currently and 5.1-5.6% at the March SEP (Figure 5).

Figure 5 – Summary of Economic Projections suggest more rate hikes to come (Federal Reserve)

My interpretation of the latest SEP is that although the Fed paused at the June meeting, they are still on a tightening path, with expectations for one or two additional interest rate hikes between now and year-end if the economy continues to develop as the Fed expects.

Pausing And Restarting Is Not Without Precedent

While some traders may believe the Fed have stopped raising interest rates for good this cycle, I would like to point out that pausing and restarting is not without precedent. For example, the Bank of Canada recently raised its main policy rate by 25 bps after ‘pausing’ since January.

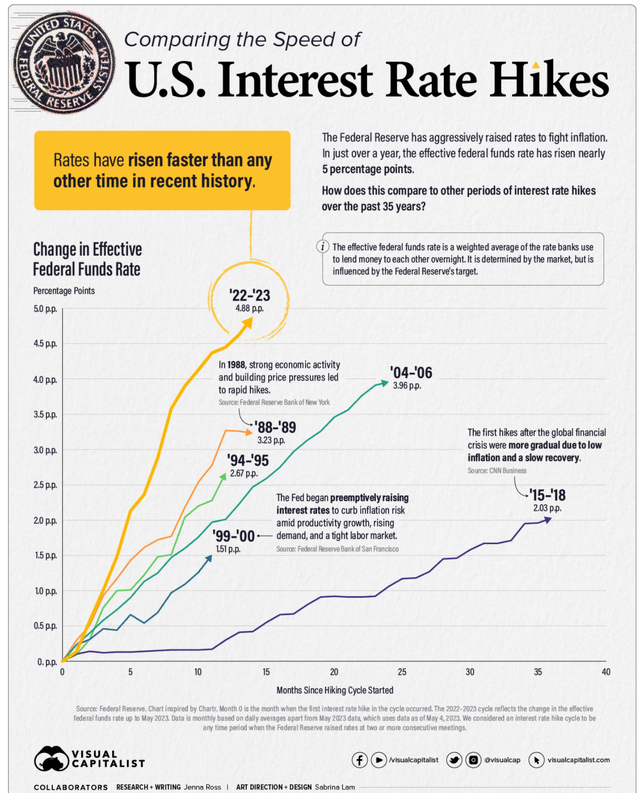

In fact, prior to the current interest rate cycle, the Federal Reserve itself had often taken a slow and steady approach to interest rate increases, with the 2015-2018 cycle seeing multiple ‘pauses’ as the Fed waited for the impact of higher interest rates to flow through to the economy (Figure 6).

Figure 6 – Comparing the speed of interest rate hikes (Visual Capitalist)

Treasury Yields Expected To Stay Elevated

For funds that earn floating rate treasury yields like the USFR ETF, this means that not only are the high short-term yields expected to stay elevated for the next few quarters, it may even increase if the Federal Reserve raises interest rates in the coming FOMC meetings (Figure 7).

Figure 7 – 3M Treasury Yields (St. Louis Fed)

Cash As A Real Option

Another way to think about a high cash allocation is as a real option that has positive carry.

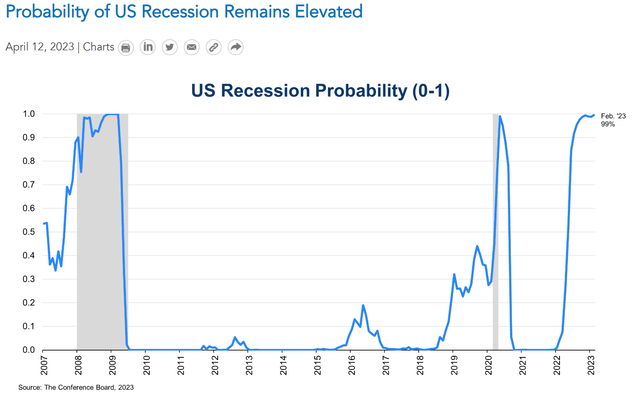

Notice from Figure 5 above, the Fed expects real GDP growth to be below trend for the next few years. In fact, the Fed may be optimistic, as many private sector economists are projecting an imminent recession (Figure 8).

Figure 8 – Elevated probability of a recession (Conference Board)

If the economy does slip into a recession, having high cash allocation will protect investors’ principal and may allow them to take advantage of discounted valuations to buy cheap assets.

Conclusion

The latest Summary of Economic Projections give me comfort to continue holding cash in the form of floating rate ETFs like the USFR. Although the Fed paused their interest rate hikes at the recent June FOMC meeting, the FOMC committee still projects 1-2 additional rate increases before year-end 2023. This means high short-term yields should persist.

Furthermore, if the Fed does end up cutting interest rates prematurely, that will be in response to a recession, in which case investors would be glad to have ample amounts of cash.

I continue to rate USFR a buy.

Read the full article here