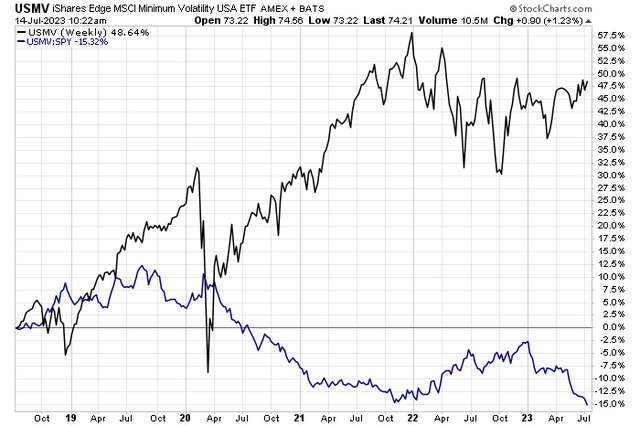

Playing it safe has been a losing strategy since the calendar flipped. The iShares MSCI USA Min Vol Factor ETF (BATS:USMV) is in fact notching fresh all-time lows compared to the S&P 500 on the weekly performance chart. While USMV is well off its October 2022 nadir, there’s been severe relative weakness, and it has been an opportunity cost to be overweight USMV.

I have a hold rating on the fund as I like the product’s cost and its absolute chart situation, but its valuation and relative performance trends are too much to overcome.

USMV: Probing Rebound Highs, But At All-Time Lows Versus SPX

Stockcharts.com

According to the issuer, USMV seeks to track the investment results of an index composed of U.S. equities that, in the aggregate, have lower volatility characteristics relative to the broader U.S. equity market. The fund offers investors exposure to U.S. stocks with potentially less risk and USMV has declined less than the market during market downturns, according to iShares.

With a low 0.15% annual expense ratio and more than $29 billion in assets under management, USMV has high tradeability and is commonly seen as a place to be overweight during periods of market volatility, hence it has underperformed this year after posting solid alpha in 2022. This factor fund features a tight 30-day median bid/ask spread of just a single basis point while typical volume is near 2.2 million shares (30-day average as of July 13, 2022).

USMV holds 171 individual stocks, and the ETF yields 1.72% on a trailing basis. Modest volatility is indeed seen in the portfolio’s 3-year average standard deviation of 14.9%, but it is not a cheap fund. iShares notes that the current forward P/E ratio is 22.5 – that’s a steep premium to the broader market earnings multiple. So, it appears it’ll cost you a tidy sum if you want to pay for safety today.

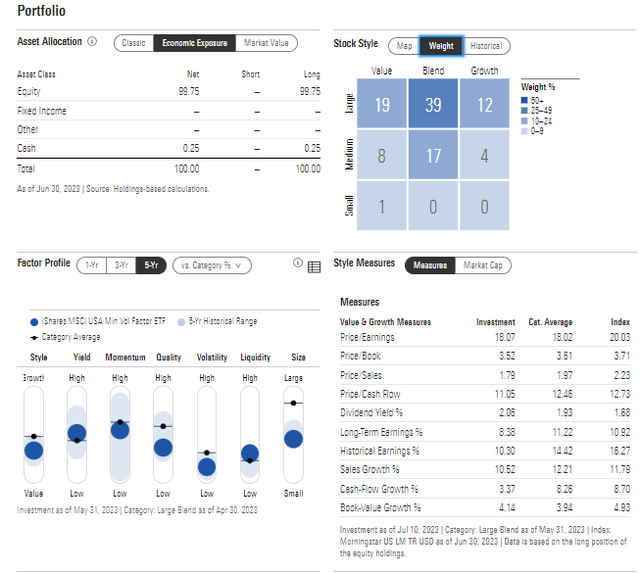

Digging into the portfolio, the top seven positions are companies in the Information Technology sector, though the fund’s modified equal weight construct means USMV will never be too top-heavy. As it stands, about 80% of the ETF is considered large cap in the size factor, according to Morningstar, and there is a solid mix between value and growth. Momentum is lukewarm right now, but the basket of stocks together features low risk, high liquidity, and the fund itself is cheap to own long-term.

USMV: Portfolio & Factor Profiles

Morningstar

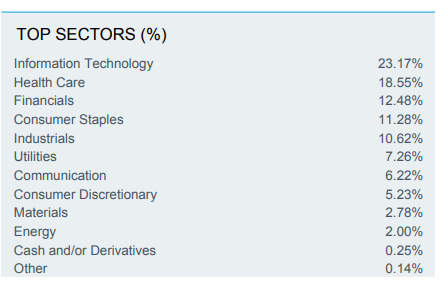

USMV is attractive to me in this light – the sector breakdown is a healthy mix for investors to diversify somewhat, while not taking major sector bets. With 23% in the I.T. space, that is materially less than what the S&P 500 features and the value sectors are close to the S&P 500’s current position.

USMV: Sector Exposure

iShares

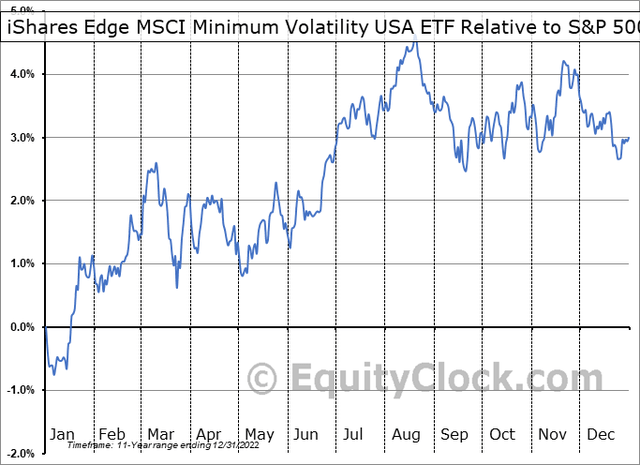

Seasonally, the USMV portfolio tends to simply tread water compared to the S&P this time of year, according to data from Equity Clock. Namely, the mid-August through early January stretch can feature some modest negative alpha, so we are encroaching on a non-favorable period to be overweight USMV.

USMV: Sideways Relative Performance Trends In the Second Half

Equity Clock

The Technical Take

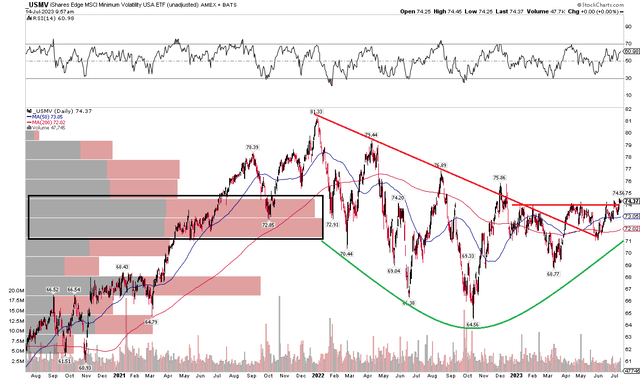

As you might have presumed, USMV did not feature as big of a drawdown as so many other equity ETFs. Notice in the chart below that shares are currently working on a bearish to bullish reversal. This rounded bottom pattern has resistance at a few points, so there is not an “all clear” breakout point until the fund notches a new all-time high above the late 2021 high of $81.33.

Near-term, the $74 to $75 zone has been problematic, but a rally through there would lead to further upside, in my opinion. Also take a look at the high volume by price situation in the $71 to $74 zone – that means any near-term pullbacks should be met with some accumulation, offering a layer of important support. With a flat to slightly positive long-term 200-day moving average, the bulls appear to be regaining control.

Overall, long here with a stop under $71 make sense as we near the sometimes-volatile September and October stretch.

USMV: Bullish Reversal, But Big-Time Negative Alpha

Stockcharts.com

The Bottom Line

While the technical setup appears better than in quarters past, USMV’s high valuation and lackluster seasonal trends, along with dismal relative strength make me too hesitant to recommend an overweight play. Thus, I have a hold rating on this low-cost fund.

Read the full article here