Strategic Analysis of Ventyx Biosciences’ Clinical Pipeline

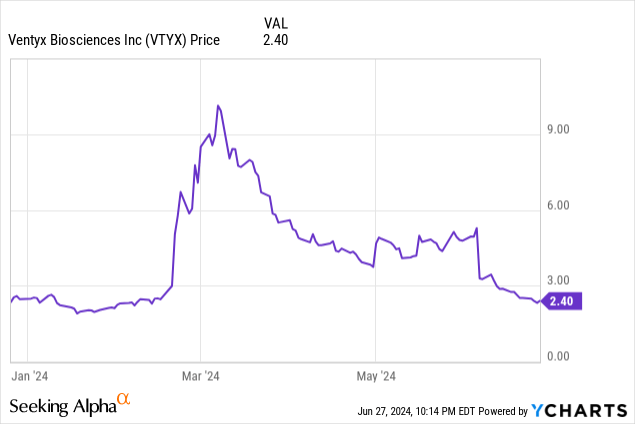

Ventyx Biosciences, Inc. (NASDAQ:VTYX) has been in the news lately due to its pivot to obesity, but its stock has plummeted 72% since my last look in March. The company previously disclosed preclinical data (primarily pharmacokinetic supporting once-daily administration) for their brain-penetrant NLRP3 inhibitor, VTX3232. This followed preclinical data from another NLRP3 inhibitor, NT-0796, which demonstrated comparable efficacy to Wegovy in obese mice. So we have a novel, albeit speculative, mechanism of action that is in its early stages for a considerable and competitive indication. I gave Ventyx a hold rating and made the following observations:

This is a very volatile and risky prospect. Investors interested in Ventyx should be prepared to either lose their entire investment or see multiples in return. Given the nature of biotechnology, the former is far more likely.

So, it appears that this has occurred, and it would require the stock to triple to recoup its losses.

Such is the risk of investing in a stock that is driven by sentiment and optimism. Let us set aside the volatility of the company’s stock and revisit the fundamentals.

Ventyx continues to advance VTX3232 in obesity and Parkinson’s disease (PD). The company plans to launch a Phase 2 clinical trial in patients with early Parkinson’s disease in the second half of 2024.

In June, Ventyx presented preclinical data for VTX3232 in diet-induced obese mice. VTX3232 showed

“reductions in body weight, body fat content, food consumption, liver triglycerides, and liver fat deposits, as well as improvements in insulin resistance, cardiometabolic parameters, and biomarkers of systemic inflammation.”

When VTX3232 was combined with a GLP-1 medication, the effects became more pronounced.

Ventyx is also looking into VTX3232 for Parkinson’s. Notably, there is conflicting evidence about whether NLRP3 is involved in Parkinson’s disease development and progression. In a Phase 1/2a clinical trial, NodThera’s NLRP3 inhibitor, NT-0796, which is further advanced in development than Ventyx, reduced “key neuroinflammatory and inflammatory biomarkers in Parkinson’s disease patients to levels found in healthy elderly controls over 28 days.” Given the devastating impact of Parkinson’s disease and the lack of disease-modifying therapies, almost anything is worth a trial. However, one should be aware of the low chances of clinical success here. It is similar to taking a shot in the dark. Drugs in development for neurology, chronic, high-prevalence diseases, and novel molecular entities have lower clinical success rates. So, despite a market for PD expected to eclipse $8 billion in 2027, very little value should be assigned to 3232 in Parkinson’s at this early stage.

The same can be said of its prospects for obesity. In fact, this pursuit may be more daunting, especially since the advent of GLP-1s like Wegovy. Moreover, several companies are further ahead in clinical development with far more experience and resources.

I feel comfortable assigning clinical success odds of < 3% in both PD and obesity. The odds of clinical and market success are likely to be < 1%.

Ventyx’s most advanced drug is a S1P1R modulator, VTX002, for the treatment of ulcerative colitis. However, there are two existing S1P1R modulators on the ulcerative colitis market. Zeposia, marketed by Bristol-Myers Squibb (BMY), was approved in 2021. Judging from the data, VTX002 does not at all appear to be differentiated from others in its class following Phase 2 data. So, while the odds of clinical success are decent, the market landscape is quite unfavorable. Ventyx intends to partner up ahead of Phase 3 clinical trials.

Finally, Ventyx is developing VTX958, a TK2 inhibitor, to treat Crohn’s disease. Although this is a more targeted approach than previous attempts with less-selective Janus kinase inhibitors (JAKis), BMY’s own TK2 inhibitor, deucravacitinib, failed a Phase 2 trial in Crohn’s, missing the primary efficacy endpoint of clinical remission after 12 weeks, indicating that TK2 inhibitors may be ineffective in Crohn’s despite success in other autoimmune conditions, such as psoriasis. Interestingly, Ventyx changed the trial’s primary endpoint from remission to “change from baseline in mean Crohn’s disease activity index (CDAI) score.” The change was made to “streamline trial design and accelerate the potential detection of an efficacy signal.”

Financial Health

Looking at Ventyx’s balance sheet, as of March 31, cash and cash equivalents stand at $141.898 million and marketable securities equal $160.684 million. Current assets are $319.759 million, while current liabilities are just $14.534. So, this is quite a comfortable balance sheet for clinical-stage biotechnology.

Because the company is not yet profitable, I will estimate the cash runway. If we divide their cash and marketable securities by their cash burn ($41.768 OpEx in Q1), this suggests a runway into 2026. This estimate is limited as it is based on historical figures and does not account for any changes in revenue or operating expenses. Investors should anticipate that operating expenses will increase as the company pushes forward in later trials.

Risk/Reward Evaluation and Investment Recommendation

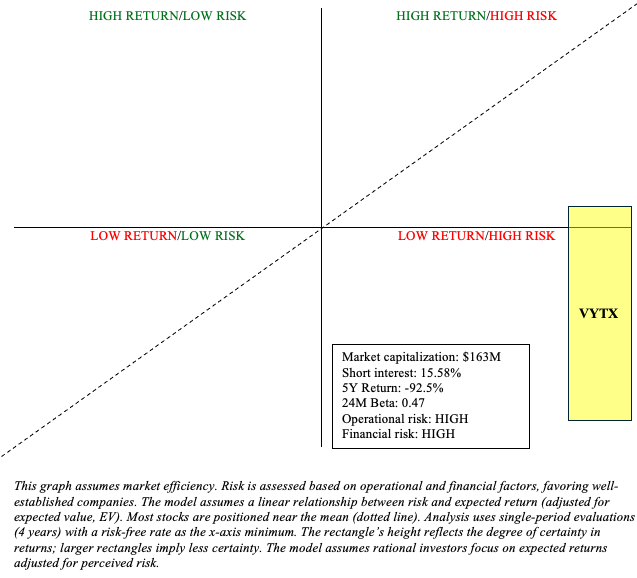

Ventyx remains a high-risk investment, despite having an enterprise value of less than zero. Most of their expensive projects are likely to have a negative net present value. Not understanding this is a common mistake I see among biotechnology investors. Remember, Ventyx is valued based on the sum of its future cash flows, which the market estimates to be negative, and this is not an unreasonable assumption. Ventyx appears destined to fail, whether in terms of clinical success in obesity, Parkinson’s, and Crohn’s disease, or market success in ulcerative colitis.

Author

Ventyx is a microcap stock, so investors should be aware of the risks that come with microcap investing, such as high volatility, low liquidity, dilution, and information asymmetry. Although its stock is down 92.5% within the past five years, do not underestimate a similar result in the next five years. An investment in Ventyx could reasonably result in a total loss. On the flip side, Ventyx has a few targets in a number of large indications. So, if something hits, it could really impact the stock. Moreover, a strategic partnership could reinvigorate the company’s operational and financial outlook. However, I’m inclined to think of the chances of something hitting as minimal. Therefore, I view the recent stock prices as an opportunity to sell. In summation, Ventyx’s shots in the dark amidst a high cash burn are not worth speculating on.

Read the full article here