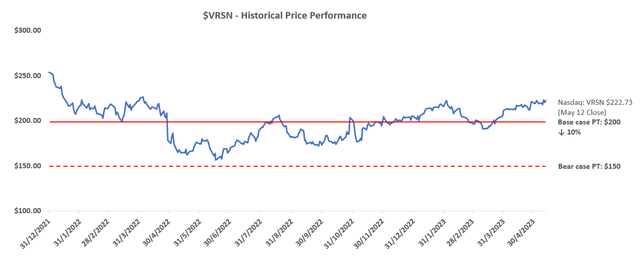

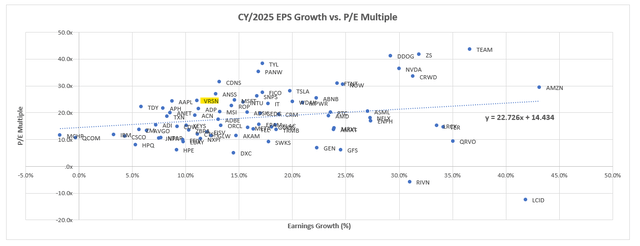

VeriSign (NASDAQ:VRSN) is currently one of the most expensive stocks relative to both its IT peers and the broader market. Yet, despite its lofty valuation multiple relative to peers, VeriSign’s stock has still slightly underperformed the Nasdaq 100 this year, with only half the caliber of the tech-heavy gauge’s 20%+ gains over the same period, underscoring signs of resilience and resistance to volatility amid the uncertain market climate.

VeriSign’s underlying business has continued to exhibit durable fundamentals, buoyed by its mission-critical role in the provision and maintenance of domain infrastructure to support IoT demands, despite mounting macroeconomic uncertainties. The company’s generous share repurchase program has also been key to keeping the stock’s resilience amid fragile market conditions. However, the stock’s increasingly lofty valuation relative to peers far exceeds the premium attributable to the appeal of its fundamental durability, especially considering the deteriorating macroeconomic conditions ahead that will weigh on the underlying business’ near-term growth prospects. Specifically, the company’s ballooning market value at current levels is diverging further from its earnings power. Despite VeriSign’s robust balance sheet, attractive margin profile, and generous shareholder returns, we believe the stock’s lofty valuation at current levels remains susceptible to near-term downside risks in the market that could make way for a better risk-reward entry set-up.

1. Durability of Underlying Fundamentals

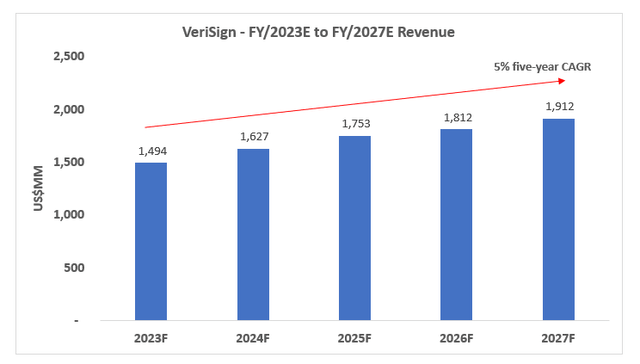

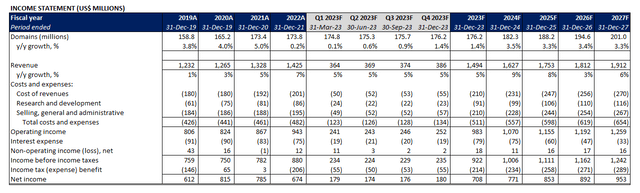

What We Like About VeriSign’s Fundamental Prospects: VeriSign’s mission-critical role in the provision of critical domain infrastructure to support the IoT era continues to be a key competitive advantage in ensuring durability to its growth and profitability profile. The company is expected to grow at a five-year CAGR of more than 5% despite near-term macroeconomic uncertainties, which remains in line with its historical pace of expansion. And the recent price increases to both .net (effective February 1, 2023) and .com domains (effective September 1, 2023) will be key to ensuring durability to the company’s consistent pace of growth, and offset some of the near-term cyclical headwinds facing its end-market demand environment (discussed in a later section) – particularly on the normalization of the pandemic-era boom in e-commerce and weakening digital advertising demand, two of VeriSign’s biggest end-market demand drivers.

The number of domain names registered is largely driven by continued growth in online advertising, e-commerce, and the number of internet users, which is partially driven by greater availability of internet access, as well as marketing activities carried out by us and our registrars.

Source: VeriSign 2022 10-K Filing

VeriSign FY’23E to FY’27E Revenue Forecast (Author)

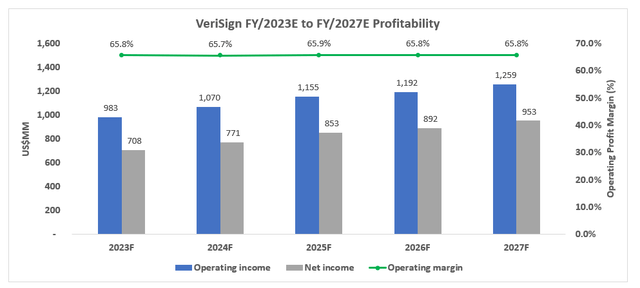

Meanwhile, profitability is expected to expand at a durable pace equivalent to a 6% five-year CAGR as the underlying business continues to scale. This will largely be driven by the inelastic nature of VeriSign’s demand environment in the IoT era, which has been critical to sustaining the company’s scalability, as observed by its high margin business model.

VeriSign FY’23E to FY’27E Earnings Forecast (Author) VeriSign Financial Forecast (Author)

VeriSign_-_Forecasted_Financial_Information.pdf

Specifically, VeriSign currently operates two of only 13 “global internet root servers”, which are critical to serving the information required for a domain to launch on user browsers; the root servers are essentially the roadmaps that “translate domain names into IP addresses” needed to land a specific webpage. VeriSign also provides domain registration services critical to ensuring industry operations in the IoT era. The inelastic business model plays a key role in preserving profit margins at VeriSign, which, inadvertently, is also bolstering the company’s ability in generating free cash flows – a core focus area for investors in the stock. In addition to underpinning the bulk of VeriSign’s current market valuation premium, which reflects a growing investor preference for profitability and cash flow generation over “growth at all costs” amid tightening financial conditions. The company’s robust free cash flows also remain critical to supporting its historically generous shareholder returns distributed through its repurchase program.

What We Dislike About VeriSign’s Fundamental Prospects: While the company’s business model allows for durable fundamental expansion, the heavily regulated nature of VeriSign’s business also means certain limitations to both its top- and bottom-line expansion roadmap. Although VeriSign’s mission-critical role as the operator of two of 13 internet root servers and provider of domain registration services safeguards its demand environment, regulatory bodies such as the Internet Corporation for Assigned Names and Numbers (ICANN) limit the extent to which the company can increase prices charged.

Specifically, VeriSign has Registry Agreements with ICANN that limits annual price increases to 7% for .com domains (exercisable only in the “final four years of each six-year period”), and 10% for .net domains. While VeriSign’s recently announced price increase to its .net and .com domains this year will help to offset some of its exposure to macro-sensitive end-markets (further discussed in later sections), its current .net Registry Agreement is due for renewal in July 2023. This keeps us incrementally cautious as pricing terms related to .net domain registration services could potentially change post-renewal of the Registry Agreement, and weigh on the company’s already subdued, though consistent, pace of single-digit growth. This is further corroborated by weak revenue growth between 2019 and 2020, given the price freeze on .com domains after the related six-year Registry Agreement was renewed on October 26, 2018.

2. Shareholder Returns

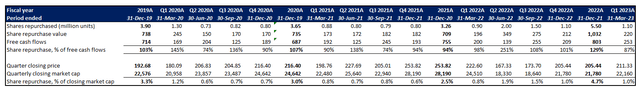

What We Like About VeriSign’s Shareholder Returns: As discussed in the earlier section, VeriSign currently boasts one of the most active share repurchase programs in the broader tech sector, buoyed primarily by its durable business model’s ability to keep up with free cash flow generation. The company has repurchased more than one million shares during the first quarter of the year, valued at $220 million, with more than $639 million remaining in its authorized buyback program without expiration.

And over the past several years, VeriSign has maintained a buyback yield – which measures the extent of repurchases – averaging more than 3%. The value of annual share repurchases has also exceeded full year free cash flows in previous years, and represented 3.4% on average of the company’s year-end closing market cap, underscoring the critical role they play in bolstering gains and/or recouping losses – particularly in 2022 – for investors in the VeriSign stock.

VeriSign Share Repurchase Trends (Data from VeriSign SEC Filings)

Under current market conditions, blighted by elevated interest rates that have dulled the appeal of growth stocks, as well as a weakening consumer end-market that risks weighing on company fundamentals – the broader tech industry is expected to incur a 15% decline in profits on average this year, while the broader S&P 500 is expected to experience an 8% decline – alongside brewing risks in the banking sector, VeriSign’s generous shareholder returns and robust free cash flows make it a durable haven tech stock, which explains some of its resilience in recent months.

What We Dislike About VeriSign’s Shareholder Returns: But despite VeriSign’s generous shareholder returns distributed via share buybacks, its balance sheet continues to show negative shareholders’ equity, which implies liabilities that far outweigh its assets. A deeper dive into the company’s balance sheet history would reveal that its negative shareholders’ equity balance is primarily driven by a few items:

- Deferred revenues: Deferred revenues represent a substantial portion of the company’s total liabilities. The balance is primarily due to the nature of VeriSign’s heavily contracted business, whereby payments are typically billed and received in advance of the company’s delivery of related domain registration services. Most of the company’s deferred revenues are realizable within one year, while only a small portion is recognized over a long-term period of “up to ten years”.

- Senior notes: The company currently carries a significant debt burden relative to the book value of its assets, totaling almost $1.8 billion in recent years. Despite its highly profitable business model, much of the related debt outstanding has been secured at a fixed rate prior to the most recent monetary policy tightening, which mitigates VeriSign’s exposure to rising costs of capital.

- Accumulated deficit: We view VeriSign’s longstanding accumulated deficit balance as a key driver to its negative shareholders’ equity balance. The company reported more than $14 billion in accumulated deficit in the latest quarter, far exceeding the $12.4 billion in shareholders’ equity generated from common stocks and additional paid-in capital, which does not quite align with the company’s robust profit margins exhibited in recent years. Digging back to VeriSign’s historical filings, we have found that much of the accumulated deficit balance was generated in 2002 and 2003 following the change in accounting policy that resulted in the substantial write-off of goodwill and other intangible assets related to past acquisitions.

Despite VeriSign’s robust profit margins, aided by its highly scalable business model, in recent years, the company has yet to reverse the accumulated deficit balance. Although relatively immaterial, the annual share repurchases have also weighed on VeriSign’s lofty stockholders’ deficit. Eventually, we’d like this number to come down to further bolster the appeal of VeriSign’s robust balance sheet. In the meantime, keeping up with shareholder returns distributed through its repurchase program will be critical to mitigating risks pertaining to its negative net worth.

3. Cyclical Exposure

What We Like About VeriSign’s Business Model: The company’s ability to raise domain registration and renewal prices by as much as 10% per year remains a competitive advantage in mitigating some of the cyclical weaknesses currently experienced by its core end-market verticals. Aside from substantial infrastructure capex spend (in the 2% to 3% range of total annual revenues, in line with observations at peers), recurring costs of operations have also demonstrated high scalability, which, taken together with consistent top-line growth, helps to preserve VeriSign’s profitability profile and offset some of the near-term inflationary impacts.

Specifically, the fees VeriSign pays to ICANN on an annual basis ranges from $0.75 to $1 per domain, while it is permitted to charge $9.59 for each new and renewal .com domain name registration effective September 1, and $9.92 for each new and renewal .net domain name registration since early February. Stock-based compensation has also stayed relative stable as a percentage of revenue, while total opex has also stayed largely in line with the company’s durable growth prospects in recent years, despite cyclical ups and downs.

What We Dislike About VeriSign’s Business Model: Despite the highly contracted nature of VeriSign’s business model, as well as its mission-critical role in the provision of key IoT infrastructure and domain registration services, the company is not immune to cyclical headwinds currently experienced by some of its core end-market verticals. Specifically, the advent of digital advertising and e-commerce have emerged as key drivers of domain registration and server traffic demand for VeriSign. Yet, the inherently macro-sensitive nature of the two verticals has, nonetheless, weighed on the company’s growth in recent quarters, which is corroborated by the subdued expansion in the company’s total domain count.

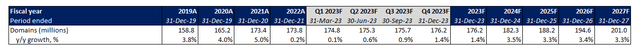

VeriSign FY’23E to FY’27E Domain Growth Forecast (Author)

Specifically, digital ad demand has stayed subdued over the past two years relative to the pandemic-era boom, as advertisers tighten budgets and stay cautious on spending amid deteriorating economic conditions that have weighed on consumer sentiment. Meanwhile, mounting macroeconomic uncertainties and persistent inflationary pressures have also slowed e-commerce expansion – although more than 80% of commerce remains offline, which makes strong secular tailwinds for VeriSign, transient macroeconomic headwinds have challenged the pace of related TAM expansion, while the growing appeal of online marketplaces and social media has also increased competition and diminished VeriSign’s market share prospects.

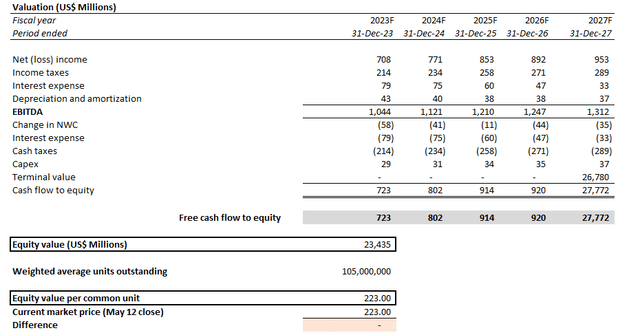

Valuation Analysis

VeriSign Valuation Analysis (Author)

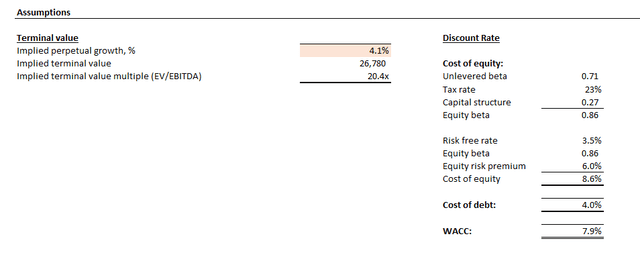

Considering VeriSign’s valuation premium relative to its tech peers, there is little consideration to the downside risks facing its fundamental prospects. Taking VeriSign’s projected free cash flows over a five-year discrete period in conjunction with our fundamental analysis in the foregoing discussion, discounted at a WACC of about 8% based on the company’s risk profile and capital structure, would imply a perpetual growth rate north of 4% at its current share price of about $223. This prices in substantial top-line expansion prospects over the longer term despite VeriSign’s relatively mature, though consistent, growth profile, underscoring bull-case level optimism on the company’s prospects.

VeriSign currently trades at an implied perpetual growth rate of more than 4% (Author) VeriSign implied perpetual growth computation (Author)

i. Base Case Scenario

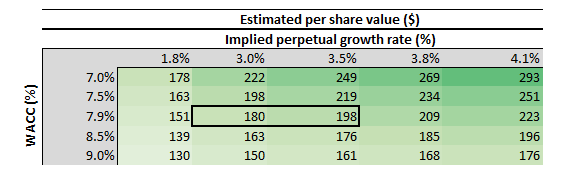

Even at an implied perpetual growth rate of 3% to 3.5%, which is more in line with the rate of economic expansion at VeriSign’s core operating regions (namely, the U.S., EMEA, and China), the stock should trade closer to the sub-$200 range per share, which we view as a reasonable base case PT range.

VeriSign should trade closer to the sub-$200 range under a conservative implied perpetual growth assumption in line with its mature business model. (Author)

ii. Bear Case Scenario

This is further corroborated by the stock’s estimated intrinsic value under the steady-state and future value creation premium method. The steady-state valuation method reflects the worth of a company’s cash flows that can be sustained indefinitely regardless of whether incremental capital investments are made, and can be denoted under two methods:

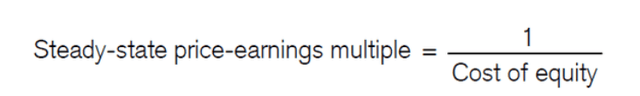

- The steady-state P/E multiple, which is equivalent to one divided by the cost of capital:

Steady-state P/E computation (Valuation Theory)

A company can continue to grow earnings as it invests at the cost of capital. It will just fail to create value, and hence should trade at its steady-state worth. We can readily translate from the steady-state value to a steady-state price-earnings multiple, which is the reciprocal of the cost of [capital].

Source: Credit Suisse

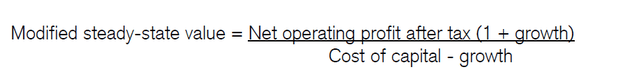

- The Gordon growth model, with the key assumption being the pace of economic growth in the company’s core operating regions. Specifically, growth companies are typically valued at an implied perpetual growth rate closer to the anticipated pace of GDP increase across their core operating regions to reflect their leading role in driving economic expansion.

Gordon Growth Model (Valuation Theory)

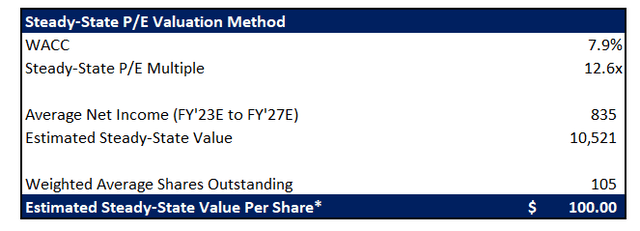

In the case of VeriSign, a WACC of about 8% would yield a steady-state P/E of about 12.6x. Applying this multiple to VeriSign’s average annual net income over the five-year forecast period would reflect an estimated steady-state value of about $100 per share.

VeriSign estimated steady-state value under the P/E method (Author)

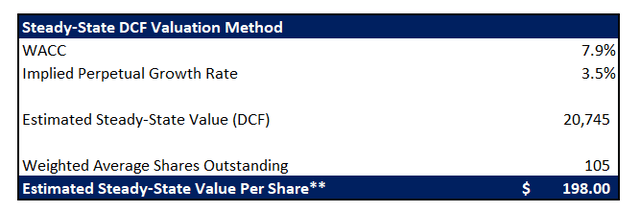

Meanwhile, we view VeriSign’s business model as relatively stable, with the ensuing growth prospect leaning on the mature side. This leaves its underlying free cash flows being the substantial value accretive factor, making VeriSign more of a value rather than growth pick. Thus, under the Gordon growth model, even if a generous 3.5% implied perpetual growth rate – typically reflective of a growth company’s prospects, and in line with the anticipated economic expansion of VeriSign’s core operating regions – is applied to its underlying business’ projected cash flows, the stock should trade closer to about $200 apiece as discussed in the earlier section.

VeriSign estimated steady-state value under the Gordon growth method (Author)

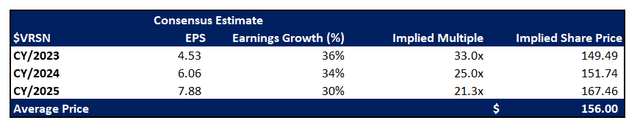

Averaging the two outcomes, VeriSign’s estimated steady-state value nears the $150-range per share, which we view as a reasonable bear case scenario for the stock. Recall that the steady-state value measures a company’s worth under the scenario of indefinitely sustained cash flows regardless of whether incremental capital investments are injected into the business, thus reflective of the most conservative growth prospect attributable to the company and reasonably representative of the bear case for VeriSign’s relatively resilient business model.

VeriSign estimated steady-state growth value (Author)

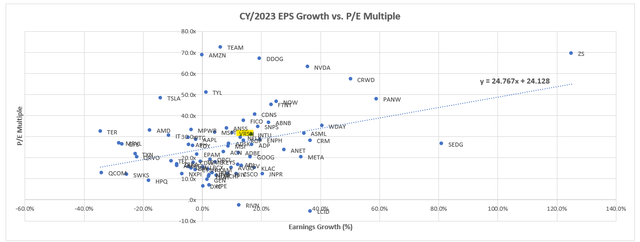

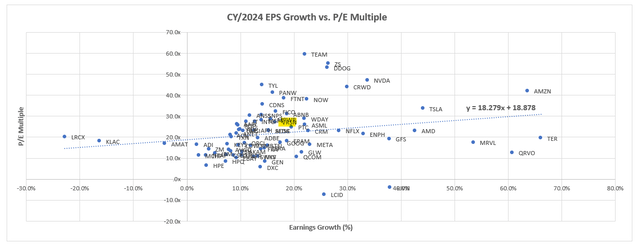

The bear case $150 level is also consistent with where VeriSign should trade at relative to its tech peers based on its earnings prospects, without consideration for any incremental premium attributable to the company’s robust free cash flows and generous shareholder returns, which are relatively favourable to its higher growth though more capital-intensive tech peers under currently fragile market conditions.

VeriSign FY/2023 Earnings Peer Comp (Data from Seeking Alpha) VeriSign FY/2024 Earnings Peer Comp (Data from Seeking Alpha) VeriSign FY/2025 Earnings Peer Comp (Data from Seeking Alpha) VeriSign’s estimated relative valuation to the broader tech sector (Author)

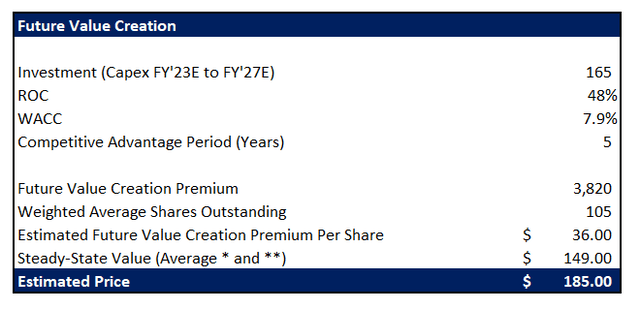

Moving on the future value creation premium, which accounts for the incremental value that additional investments at the cost of capital would generate for the company (i.e., return of capital), and takes into consideration the timeframe in which this value-creation opportunity would last (i.e., competitive advantage period).

Future value creation premium computation (Valuation Theory)

The future value creation premium is essentially reflective of a company’s value incremental to its steady-state worth, and typically explains the additional “outperformance observed in certain stocks relative to their peers and/or the broader market”. To gauge VeriSign’s future value creation premium, we have applied a WACC of about 8% consistent with the company’s risk profile and capital structure, and a ROC of about 48% reflective of its forecast annual net income over the five-year forecast period and estimated investment outlay. Taken together with a competitive advantage period of about five years, in line with the forecast period, VeriSign yields an estimated future value creation premium of about $36 per share. Paired with the estimated steady-state value in the $150-range, we expect the stock to trade closer to the $185 level, in line with our base case PT in the sub-$200 range discussed in the earlier DCF analysis.

VeriSign’s estimated intrinsic value per share under the steady-state value and future value creation premium method (Author)

The Bottom Line

Despite VeriSign’s negative shareholder equity balance incurred from impairment charges more than a decade ago, the company has demonstrated consistency in preserving margins and growth at a durable pace. This has been critical to sustaining the company’s robust free cash flows, a key driver of its generous share repurchase program that has supported the stock’s relative resilience to peers even amid the uncertain market climate.

However, trading at more than 15x sales and 30x earnings – which outperforms many of its higher growth and more profitable peers in the tech sector, as well as the tech-heavy Nasdaq 100 index – while market conditions remain fragile ahead of lingering macroeconomic uncertainties (e.g., inflation, monetary policy tightening, financial sector weakness, recession, etc.), the stock’s lofty valuation at current levels has not sufficiently de-risked for substantial market risks that remain skewed to the downside, nor is it reflective of VeriSign’s normalizing growth and profitability profile. Although the underlying business’ fundamental durability is appealing and supportive of sustained shareholder returns into the longer term, the burgeoning disconnect between its stock valuation at current levels and the company’s financial prospects provides little downside protection, while also leaving room for little upside potential realization.

Read the full article here