Verizon Communications Inc. (NYSE:VZ) is suffering a new period of stock price weakness which, in my view, is a compelling opportunity, particularly for passive income investors, to gobble up some shares for their portfolios.

Verizon just fell through its 50-day moving average line and some investors are having doubts, unjustifiably, about the company’s dividend sustainability.

Taking into account that Verizon managed to cover its dividend with free cash flow in the second quarter, as opposed to the first quarter, and that the telecommunications company just handed shareholders a 2% raise, I think the odds are in favor of Verizon delivering stable dividend pay-outs moving forward.

The valuation is also quite compelling, in my view, and I consider the chart picture to help make the case for a contrarian entry into the stock.

Free Cash Flow Rebound Reduced Risk Of Dividend Cut

The first quarter is typically not a good one for telecommunications companies in terms of free cash flow generation. In 1Q-23, Verizon produced $2.3 billion in free cash flow while being on the hook for $2.7 billion in dividend payments.

In the second quarter, however, the free cash flow situation reversed and improved as Verizon generated $5.7 billion in free cash flow, which translated into a dividend coverage ratio of 204%. In the first six months of the year, Verizon’s dividend coverage ratio was 145%.

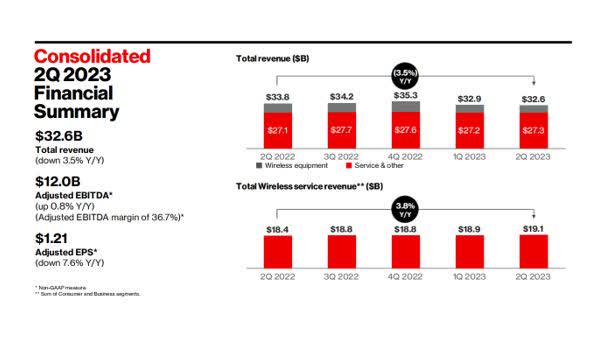

Verizon achieved these results despite pressure on its sales, which is the result of fierce competition among carriers. Verizon’s sales declined 3.5% YoY in the second quarter to $32.6 billion, while the company generated positive growth in its wireless services segment.

2Q-23 Financial Summary (Verizon Communications)

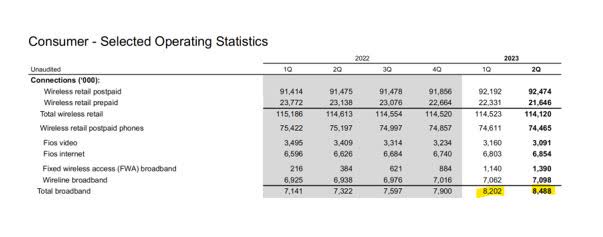

Despite QoQ sales declines in 2Q-23, Verizon’s broadband operations are doing well, and they continued to see a robust number of quarterly net additions.

Verizon had a total of 8.5 million broadband connections at the end of the second quarter, up 16% YoY. Ongoing momentum in broadband coupled with an accelerating debt repayment scheme and solid free cash flow make Verizon, despite its challenged sales situation, a potential recovery play, not only for passive income investors, but for investors with a contrarian bent.

Consumer – Selected Operating Statistics (Verizon Communications)

Postpaid Net Adds, Churn And Competition

Though broadband is a positive standout segment in terms of growth, the picture for postpaid phones looks a bit different. Verizon reported only 8K postpaid phone net additions in the second quarter and achieved positive growth exclusively due to growth in its business group. This group had 144K net adds compared to 227K net adds in the second quarter a year ago. The consumer group, however, had 136K net losses in the second quarter, meaning Verizon’s business is weak in consumer and slowing in business.

The consumer business overall remains challenged as it also reported 304K wireless retail prepaid net losses in the second quarter, but losses were lower than in the first quarter, which was when Verizon lost 351K accounts.

AT&T Inc. (T), on the other hand, reported 326K postpaid phone net adds in the second quarter as well as 123K prepaid phone net adds. In a postpaid and prepaid direct comparison, AT&T has the stronger momentum, and AT&T also reported a historically low churn rate in 2Q-23.

AT&T’s postpaid phone churn was 0.75%, compared to a retail postpaid phone churn of 0.83% for Verizon. In terms of growth and churn, AT&T has an advantage over Verizon.

However, the advantage is not big enough for me to definitely choose AT&T over Verizon. Verizon is raising prices which could potentially offset weaker growth. Only future quarters will show to what extent the price increase will affect the churn rate.

Though AT&T has momentum, I think that Verizon’s $17 billion free cash flow forecast (which is $1 billion more than AT&T expects to earn) is sufficiently compelling to justify a Buy classification for the stock.

Verizon Sends Clear Signal That The Dividend Is Safe

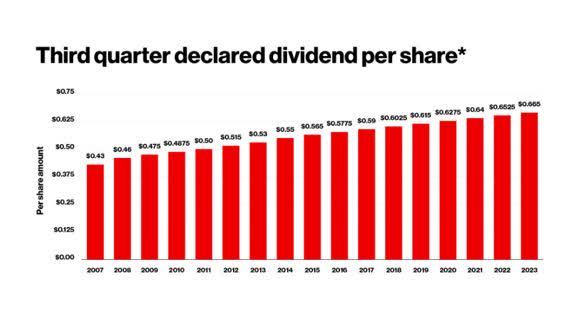

The clearest sign that Verizon’s dividend is not at risk of getting slashed was given by the company itself at the beginning of September, when it handed shareholders a raise of 2%.

The telecommunications company raised its dividend from $0.6525 to $0.6650 which results in a leading dividend yield of 8%. It was the 17th annual dividend increase for Verizon. And this dividend is solidly backed by free cash flow as well: Verizon expects to earn $17 billion in free cash flow in 2023 which implies a dividend pay-out ratio of 66% (on a run-rate basis).

Third Quarter Dividend Per Share (Verizon Communications)

Technical Analysis

Verizon’s stock has fallen into a short-term down channel lately, and it just broke through the 50-day moving average line, a bearish signal.

Verizon also failed to recapture the 200-day moving average line in July, and both developments together indicate a short-term bearish setup that may result in new lows in the short-term.

However, considering that the company reaffirmed its free cash flow guidance for 2023 and just delivered its 17th annual dividend increase for the benefit of shareholders, Verizon, in my view, is a compelling investment for contrarians.

Moving Averages (Stockcharts.com)

Why Verizon Communications Might See A Lower/Higher Valuation

Verizon Communications, just like AT&T Inc. (T), has a major issue that could hold the stock price back for longer: The company owns a boatload of debt, and it will require a lot of free cash flow to rectify the situation moving forward.

At the end of the second quarter, Verizon owed $137.87 billion in long-term debt, which compares to equity capital of $96.5 billion and a market value of all outstanding shares of $140.0 billion. Put simply, for every dollar in market value, the company owns one dollar in debt. This is a lot, and Verizon would be best advised to repay as much of its debt as it can moving forward.

Verizon’s failure to address investor concern about leverage would likely prevent the stock to stage a rebound, even if the dividend itself is solidly covered by free cash flow.

Verizon Is Undervalued

Analysts expect Verizon to produce $4.69 per share in profits next year, which reflects a bargain-basement 7.1x earnings multiple. AT&T, as an example, is forecast to earn $2.48 per share, which implies an earnings multiple of 6.1x.

Both companies can be considered balance sheet restructuring plays, as AT&T is also weighed down by a considerable amount of financial debt. Taking into account that Verizon expects an average of $4.25 billion in free cash flow per quarter in 2023, I think that Verizon is hugely undervalued, as is AT&T.

Earnings Estimate (Yahoo Finance)

My Conclusion

As far as I am concerned, Verizon Communications’ dividend is safe for a number of reasons.

First, the company raised its dividend pay-out in September by 2% and, second, Verizon’s free cash flow rebound in the second quarter resulted in drastically improved dividend coverage. The safest dividend for passive income investors is the one that has just been raised.

Furthermore, the technical picture of Verizon should look appealing to passive income investors with a contrarian bent. The stock recently broke through the 50-day moving average line, indicating a short-term bearish setup that based on fundamentals is not justified, in my view.

Since VZ is cheap based on earnings and the company expects to rake in a solid amount of free cash flow this year, Verizon is a top income play with an 8% yield.

Read the full article here