The Telecom Investment Thesis Is Still More Than Decent

We have previously covered Verizon Communications Inc. (NYSE:VZ) in January 2023 here, discussing its prospects with the launch of the high-speed 5G Ultra-Wideband by FQ1’23 and increased industrial/ automotive partnerships ahead.

For this article, we will be focusing on its FQ1’23 earnings call, with VZ achieving its 10Y highest net adds for broadband at 437K (+5% QoQ/ +90.8% YoY). This is on top of a still moderate phone churn at 0.9% (+0.01 points QoQ/ +0.07 YoY) at the same time.

Due to the notable moderation in its operating expenses to $25.32B in the latest quarter (-9.6% QoQ/ -1.6% YoY), it is no wonder that the telecom has reported improved profitability with a net income of $5.01B (-25.1% QoQ/ +6.3% YoY).

This cadence is significantly aided by VZ’s moderation in the cost of wireless equipment at the same time, despite offering free devices in exchange for signing up for their new unlimited data plans.

By FQ1’23, the sum has continued to decline moderately to $6.42B (-25.1% QoQ/ -9.8% YoY), comprising a smaller ratio of its operating expenses at 25.3% (-5.3 points QoQ/ -2.3 YoY).

As a result, it is unsurprising that the telecom has beaten the consensus EPS estimates at $1.17 (-25% QoQ/ +7.3% QoQ) while generating excellent Free Cash Flow of $2.33B (+37% QoQ/ +133% YoY) by the latest quarter, easily trumping AT&T Inc. (NYSE:T) at the same time.

The latter reported adj. EPS of $0.60 (-1.6% QoQ/ -4.7% YoY), with a lumpy FCF generation of $1B (-83.6% QoQ/ +42.8% YoY) at the same time.

Therefore, while VZ may have engaged in increased promotional activities to boost its subscriber growth and net adds, naturally impacting its revenue of $32.91B (-6.6% QoQ/-1.9% YoY) in FQ1’23, we are not concerned yet for now. This is because its consumer postpaid Average Revenue Per Account [ARPA] has continued to expand to $130.06 (+1.5% QoQ/ +4.9% YoY) at the same time.

On the one hand, it is important to note that the telecom still records eye-watering long-term debts of $140.77B (inline QoQ/ +0.5% YoY) by the latest quarter, with rising annualized interest expenses of up to $4.82B (+33.51% YoY).

The latter is naturally attributed to the elevated interest rate environment, thanks to the Fed’s hike thus far, with market analysts already anticipating another 25 basis point hike in May 2023.

On the other hand, most of VZ’s debts are well-laddered through 2040, with only $12.08B due within the year. We believe its prospects remain more than decent, for so long that it continues to record exemplary EBITDA ahead.

So, Is VZ Stock A Buy, Sell, or Hold?

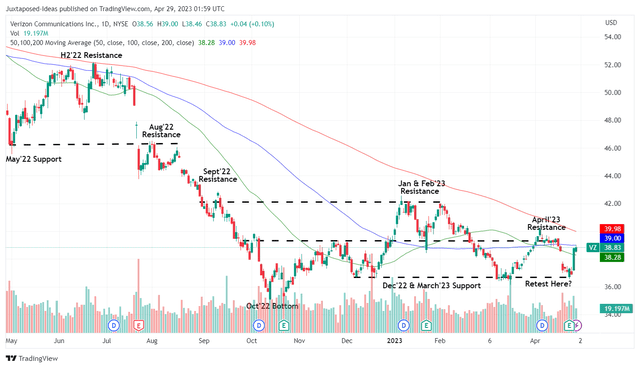

VZ 1Y Stock Price

Trading View

Despite the excellent execution thus far, VZ continues to trade sideways, though successfully rebounding from its December 2022 and March 2023 support levels.

While that phenomenon may usually be upsetting, we suppose long-term income investors may welcome the chance to DRIP and dollar-cost-average accordingly. These levels may also trigger improved forward dividend yields of 6.73%, compared to its 4Y average of 4.85% and sector median of 3.29%, based on its annualized dividends of $2.61.

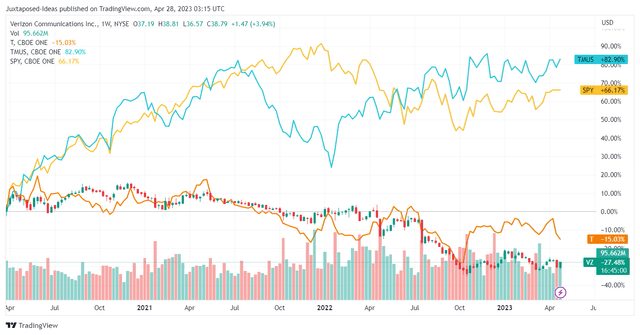

VZ Stock 3Y Stock Performance Compared To Its Peers

Trading View

Nonetheless, we must also highlight that the VZ stock has continued to underperform compared to its telecom peers over the past three years, with the stock losing -27.41% of its value, compared to T at -14.75%, T-Mobile’s (NASDAQ:TMUS) at +75.53%, and SPY at +67.59%.

When adjusted for dividends, VZ underachieved as well at -14.64%, against T at +6.05% and SPY at +75.44%. Therefore, while current levels may look attractive for new investors, its prospects appear mixed in the near term, only made somewhat attractive by its dividends.

In addition, with VZ’s choice of growing its dividends payout at a CAGR of 1.61% over the past five years, we believe

its debt levels may remain elevated over the next few years, worsened by its stagnant top and bottom line growth ahead. Market analysts only expect a revenue CAGR of 0.6% and an EPS CAGR of -2.5% through FY2025, suggesting its potential underperformance.

On the other hand, the stock has the extra benefit of being “overly sold” at these levels, in our opinion, and therefore, may be less volatile during the uncertain macroeconomic outlook over the next few quarters.

In addition, the telecom has guided an excellent FY2023 adj EBITDA of $47.75B at the midpoint (inline YoY), with an EPS of $4.70 (-9.2% YoY) balanced by the lower capital spending of $18.75B (-18.7% YoY). These numbers may trigger an improved Free Cash Flow generation of up to $17B (+20.9% YoY), implying the safety of its dividends ahead.

As a result, we continue to rate the VZ stock as a Buy for income investors, with the caveat that the portfolio be sized appropriately according to their risk tolerance, due to the increased likelihood of a mild recession in H2’23 and a recovery only by 2025.

Read the full article here