Greenlight threw the towel

Hedge fund manager David Einhorn’s Greenlight Capital built its position in Victoria’s Secret & Co. (NYSE:VSCO) in Q4 2021. The hedge fund decided to exit its holdings in Victoria’s Secret in Q1 2023. The stock went down 45% from a year ago and now trades at $24.1 per share at a P/E ratio of 5.05x and a P/S ratio of 0.32x.

The stressed valuation of the company is attributed to its underperformance in 2022. Comparing the figures, the company experienced a decline in revenue from $6.7 billion in 2021 to $6.3 billion in 2023. Moreover, its gross margin decreased from 40% to 36%, and operating income dropped from $870 million to $478 million. Unlike some other brands that possess pricing power and can counter weaknesses by raising prices, VSCO failed to do so. Recognizing the highly competitive market, the management anticipated heightened promotional activity in the first quarter. This pessimistic outlook may have influenced Greenlight Capital’s choice to sell their holdings after a 24-month investment period.

However, VSCO is anticipated to announce its financial results for the first quarter on May 31. The management has indicated an expectation of a revenue decline in Q1, albeit at an accelerated pace compared to Q4 2022, and a mid-single digit increase in revenue for the full year. The operating margin is projected to remain at the same level as in 2022, standing at 8.9%. The company foresees early signs of recovery emerging in late Q2, with a stronger market presence during the autumn season. This positive trend in VSCO’s financial performance throughout 2023 is likely to serve as a favorable catalyst for the company’s stock in the upcoming one or two quarters. We find these dynamics to be interesting. Now, let’s delve into the recent progress of VSCO.

Victoria’s Secret’s rise and fall

Victoria’s Secret & Co. was founded in 1977 and is an American fashion company famous for its lingerie, sleepwear, and beauty products. Victoria’s Secret announced its plan to undergo a rebranding strategy, focusing on inclusivity, body positivity, and celebrating all women. This transformation includes a shift in their marketing approach and the discontinuation of their famous fashion show in 2019. The decision to stop the fashion show came after the event faced declining viewership and criticism regarding its lack of inclusivity and outdated portrayal of beauty standards.

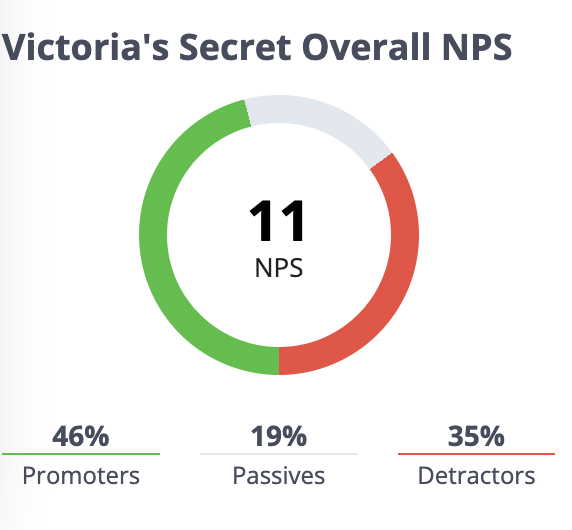

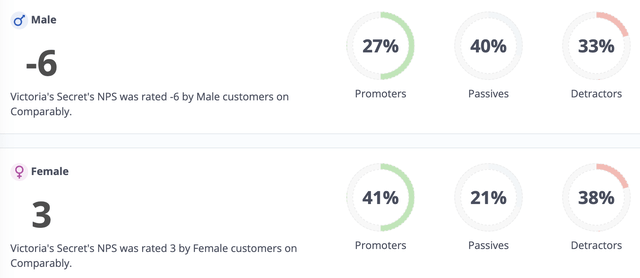

According to Comparably, VSCO received a poor Net Promoter Score from consumers, with a significantly lower NPS among males compared to females.

NPS score (Comparably)

NPS by male and female (Comparably)

One possible explanation for this discrepancy could be the design of VSCO’s old store format, which primarily catered to female shoppers. The dim lighting and secretive ambiance, with limited windows, often made men feel uncomfortable when entering and shopping. Furthermore, a more profound reason could be changing consumer preferences. Victoria’s Secret, as a gift, might not be as popular as it once was, as there is a growing trend towards prioritizing comfortable intimate wear over solely focusing on appearance. VSCO’s products were commonly chosen as gifts by men. However, if men begin to notice that their gifts are not received as warmly as before, coupled with the negative shopping experiences mentioned earlier, it can significantly affect their perception of the brand.

Nowadays, women are increasingly prioritizing their own preferences and spending more on products they personally need, rather than solely relying on what men want to gift them. We believe this shift in demand could be attributed to the increasing empowerment and financial independence of women.

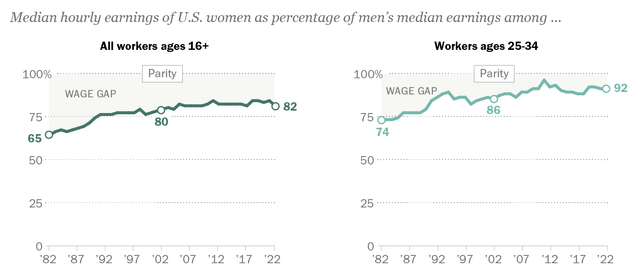

This trend is supported by Pew Research’s findings on the narrowing wage gap between women and men in the United States. Notably, younger women have experienced a significant improvement in earnings. As a result, changes in consumer preferences have greatly affected VSCO’s pricing power. Female consumers now prioritize comfort, while male consumers are less likely to pay a premium for the products as gifts. Consequently, Victoria’s Secret’s U.S. business has faced considerable challenges, losing a significant share of the premium market it once held.

Earnings gap in U.S. (Pew Research)

International market has different landscape

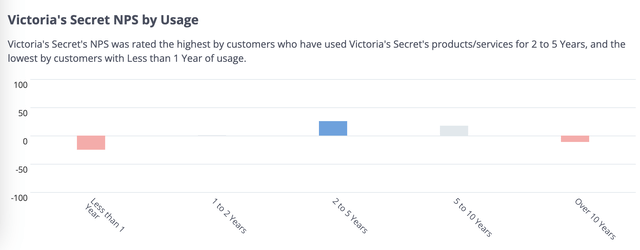

Despite challenges, we believe there is still fundamental demand for VSCO’s products in the United States. According to a survey conducted by Comparably, consumers who had been using VSCO’s products for 2–5 years reported a higher NPS. This indicates that VSCO has the capability to offer quality products and maintain a loyal customer base.

NPS by usage year (Comparably)

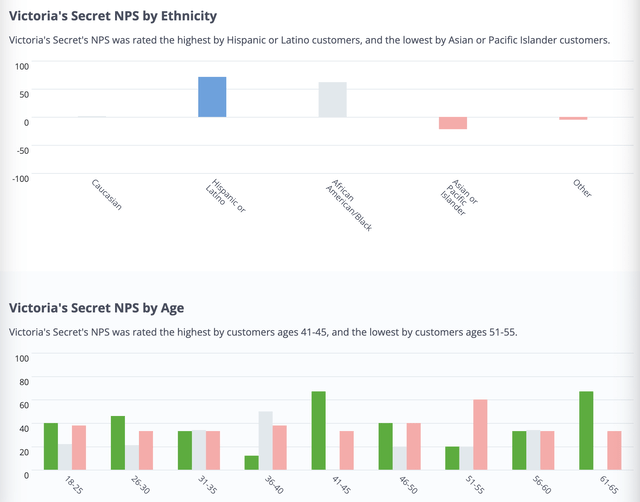

Moreover, VSCO has observed significantly higher NPS among Hispanic, Latino, and African American consumers. This can be attributed to factors such as income disparities and the brand’s continued relevance to these specific groups. The income gap may influence the purchasing power and perception of value among different demographics, while the brand’s image retains its appeal and resonance within these communities.

NPS by ethnicity (Comparably)

This trend is further exemplified by VSCO’s expansion into international markets. The company established its presence in countries such as Mexico, China, Canada, the UK, and more. Notably, its international revenues experienced significant growth, with a 24% increase in 2022 and a 21% increase in 2021. In 2022, VSCO’s sales outside of the United States reached $830 million, representing approximately one-seventh of its overall business in the U.S.

Consumer behaviors and values in international markets can vary significantly from those in the United States. According to the United Nations, the global average gender pay gap is 23%, which suggests that countries outside the U.S. may have even higher gaps. For instance, Korea holds the unfortunate distinction of having the largest gender pay gap in the world at 31.5%, while Belgium boasts one of the smallest gaps at 3.4%.

Recognizing the need for inclusivity, VSCO has initiated efforts to broaden its target audience and expand its product offerings. We believe this strategic move positions the company to tap into the diverse cultures and consumer behaviors prevalent worldwide, presenting ample growth opportunities in international markets.

With $6 billion in revenue generated in 2022 and a reported 20% market share, VSCO holds a strong position in the industry. This advantageous standing affords the company significant bargaining power with suppliers, resulting in cost advantages that facilitate its expansion into international markets.

In the first quarter, VSCO expects its international business to experience low double-digit growth. According to the management, the company’s international segment has consistently delivered profitability and remains a strong performer, prompting plans for further expansion in terms of new stores and entry into additional countries.

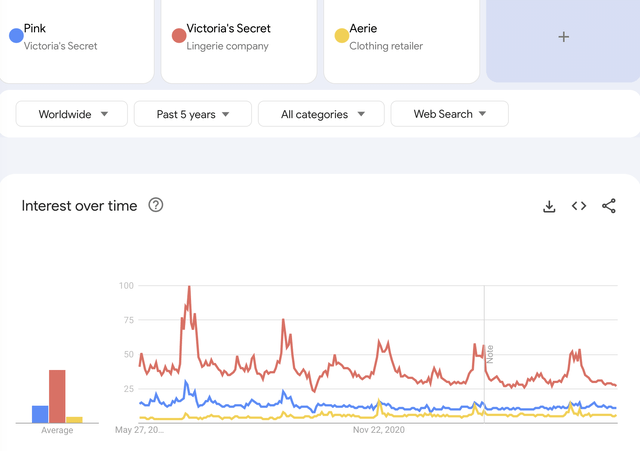

In addition, despite facing strong competition from peers like Aerie, the brand of American Eagle, VSCO maintained a global awareness advantage over Aerie.

Google search (Google trend)

Adapting to changing shopping behaviors with new store format

In fact, VSCO has been actively working towards revitalizing its U.S. business by strategically exiting mall locations and engaging in brand acquisition and nurturing.

We believe the decision to exit malls proved to be a prudent one, considering shifting consumer behaviors. Recognizing the rise of online shopping, the company opted to launch smaller stores, including those situated in travel retail locations like airports. This adaptation caters to the convenience-oriented preferences of modern consumers, offering easy self-pickup and return options. Furthermore, VSCO has capitalized on the recent surge in travel by expanding its presence in travel retail locations. While the long-term sustainability of travel demand remains uncertain, we anticipate the trend to persist in the short to mid-term due to factors such as high inflation in the U.S. and Europe because consumers are increasingly inclined to travel to countries with lower living costs. This can be beneficial for VSCO.

From a player to a coach

Though, VSCO, in its pursuit of becoming a more inclusive brand that values and represents everyone, has not abandoned its core business. The company forecast a single-digit revenue increase in 2023, but expected flat growth from Victoria’s Secret and Pink and held high expectations for the acquisition of Adore Me. They anticipate mid-teens growth from Adore Me, which is projected to contribute a 4 to 4.5-point increase in the company’s overall growth.

Adore Me rose to prominence in the early 2010s, was founded in 2011. It quickly established itself in the lingerie industry by offering affordable and fashionable lingerie options through an online-only subscription model. However, Adore Me faced challenges with shipping delays, resulting in a low NPS, according to Comparably. With VSCO taking over, the company is likely to address this issue by leveraging its robust supply chain and distribution network. Notably, Adore Me recently entered into a partnership with Walmart, with the Adored collection becoming available in 1,900 Walmart locations and on its website. This presents a significant growth opportunity for VSCO and demonstrates its capability to nurture emerging brands.

Furthermore, VSCO has launched a digital platform called VS&Co-Lab, dedicated to showcasing third-party brands, particularly women-led up-and-comers. Out of the 19 featured brands on the platform, 75 percent are founded, owned, or led by women, with some being black-owned. These brands’ products are sold alongside Victoria’s Secret’s core ranges, including intimates, lifestyle, swimwear, beauty, and Pink. We tend to be optimistic about this strategy, which effectively diversifies VSCO’s brand portfolio and optimally leverages its leadership position for growth.

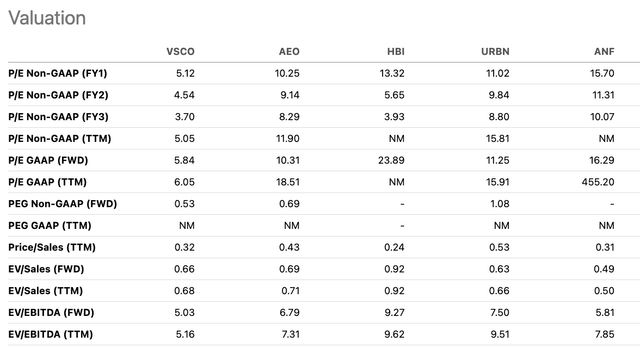

Stressed valuation multiple and potential catalyst

When compared to its peers, VSCO’s stock stands out with a significantly lower forward P/E ratio of 5.84x, in contrast to American Eagle Outfitters, Inc., (NYSE:AEO) at 10.3x and Hanesbrands Inc., (HBI) at 23.8x. This discrepancy can be attributed to market expectations of VSCO’s U.S. market continuing to decline due to shifting consumer behaviors and an uncertain macroeconomic environment. Furthermore, the market perceived VSCO’s weak pricing power based on the promotional environment mentioned by management in Q1. Our bearish case suggests a scenario in which VSCO fails to strengthen its core business in the premium segment and is at risk of being viewed as a seller of intimate wear commodities. Although VSCO has acknowledged the need to tap into the low-end market, as exemplified by its partnership with Walmart, the market’s pessimism appears excessive given that stocks of Hanesbrands and American Eagle, both commodity-like intimate wear players, trade at a significant premium to VSCO.

Valuation multiple (Seeking Alpha) Margin (Seeking Alpha)

DCF suggests fair value

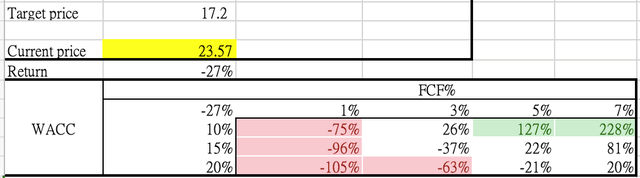

Our DCF model uses management’s projection for 2023. (5% revenue growth and FCF margin 4.7%)

Along with the following assumptions:

- WACC: 20%

- Terminal growth rate: 3%

- Net debt:492 million (Q42022 data)

- Shares outstanding: 82.2 million (Q42022 data)

Through the DCF model, we arrived at a 1.4 billion equity value ($17.2 per share), which is -27% below the current price.

Based on the sensitivity test below, the stock is likely undervalued if the company can improve its free cash flow margin to above 5% or its WACC falls below 15%. If the company fails to grow or has a lower margin than expected, the stock is likely to fall another 30%.

Sensitivity analysis (LEL Investment)

One valuable insight for investors when utilizing the DCF model is to leverage sensitivity analysis wisely. The key to the DCF model is not the precision of the assumptions, as 80% of the valuation is often determined by the terminal growth assumption, which can be volatile. As a matter of fact, fund managers employ the DCF model with reasonable assumptions and stress testing through sensitivity analysis to aid in decision-making. Therefore, the margin of safety is particularly important. In this case, even though the DCF model indicates a -27% return, we typically consider a margin of safety of 50%. Hence, a -27% return is not excessively concerning, considering our conservative assumptions of a 4.7% FCF margin and a 20% WACC.

Summary

While we agree with the market’s expectation of headwinds for VSCO’s U.S. business, we see VSCO still playing a role in the space and having multiple ways to stabilize its business.

We believe there is an attractive entry point for investors, particularly in the first half of the year. This optimism stems from management’s guidance of a return to growth in 2023, driven by international expansion and the emergence of brands such as Adore Me. While remaining cautious about the company’s long-term outlook, we see favorable upside potential for short- to mid-term returns. We can live with the downside risk of the stock and like the upside potential. Hence, we rate VSCO stock as a “Buy”.

Thank you for reading!

Read the full article here