Investment Thesis

Victory Capital Management (NASDAQ:VCTR) has performed strongly this year, both in terms of stock performance and in their financial results and AUM growth. Despite these positives, the stock still looks undervalued relative to peers, and we can see bullish signals based on analyst recommendations, institutional shareholder analysis, and the sentiment of the options market.

Company Summary

Victory Capital is a diversified global asset management firm that operates as a holding company for 12 investment franchises. VCTR pursues an interesting hybrid model, that aims to offer the best of both worlds – specialist, boutique-style investment management for traditional and alternative strategies, whilst benefitting from the synergies of running a centralized operating model and an integrated sales & marketing distribution platform across the various franchises. This allows investors a broad selection of products and services whilst maintaining a more simplified interaction in terms of operational dealings, risk management, and commercial touch points. As a result, VCTR has the breadth of strategies to cater for many different investor types and satisfy their various needs when it comes to diversifying across different investment strategies, from equities, to fixed income, and even alternatives.

There is a growing trend across both public and private managers that is leading to the consolidation of smaller and mid-sized firms and/or acquisitions of the latter by larger players in order to create “one-stop shops” for investors, moving away from single-strategy firms to multi-strategy asset managers. From an investor perspective, this offers multiple advantages. They gain better access to an expanded list of strategies/sub-managers, whilst avoiding the complexity of having multiple communications and commitments to separate firms or funds, and receiving consolidated reporting and valuations for all of their investments. As a result, a lot of players in the sector are scrambling to pursue M&A activity to fill the gaps in their offerings. Victory Capital appears to be ahead of the curve in that they already have an advanced and complete product offering across the investment spectrum.

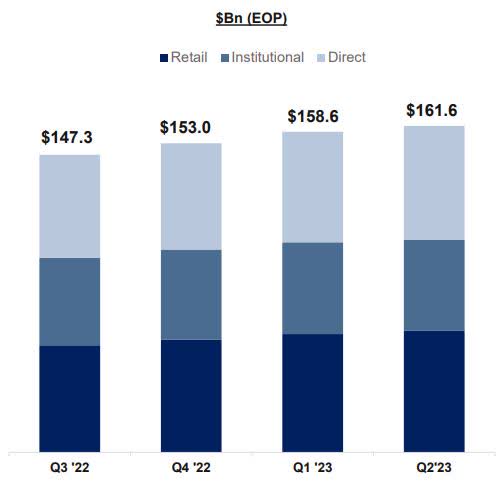

As per the recent quarterly presentation, VCTR has done a fantastic job of developing a well-diversified client base and distribution channels across different investor types. This results in a more stable revenue base to earn management fees from and improve the firm’s revenues.

AUM Client Breakdown (Victory Capital)

The commercial strategy described above is reaping rewards in the form of increased assets under management (AUM). As of July 2023, AUM hit ~$166 billion, a notable increase from the $153 billion in December 2022. At the same time, the company’s positive prospects can also be seen in the stock’s performance so far this year. YTD, VCTR is up nearly 28%, despite the difficult environment for financial stocks, and significantly outperforming the S&P 500 Financial Index. This outperformance may possibly have more room to run to the upside, as the stock still looks undervalued relative to peers, to be discussed below.

VCTR, S&P 500 Financials Index (Bloomberg)

Strong Financial Performance

VCTR reported Q2 23 earnings at the start of August and the results were positive. Net Revenues hit $191.3 million, up from $188.6 million the prior quarter, whilst Net Income was $60.1 million, up ~48% on a year-on-year basis. Earnings Per Share also increased significantly to 0.88, compared to 0.56 in Q2 22. A key highlight has been the consistent increase in operating margin % during the last year. VCTR’s strategy of a centralized distribution and administrative platform appear to be doing a good job to drive cost efficiencies and keep margins high. At the same time, the firm benefitted from both an increase in the average fee rate to 52.1 basis points, whilst also seeing total expenses decline 7% from Q1 23.

Looking forward, the market consensus is bullish, as the positive earnings trend is expected to continue. For Q4 23, Revenues are forecasted to increase to ~$215 million, with Net Income hitting ~$78 million, and EPS expected to rise significantly to 1.19. Despite the tough economic environment, the prospects for VCTR are looking attractive, which could possibly lead to further outperformance in the stock.

Financial Analysis (Bloomberg)

Valuation & Income

From a Relative Valuation perspective, VCTR is trading at a significant discount despite the positive performance discussed above. This is clear to see in the chart below, using the Blended Forward P/E Ratio, which uses a time weighted average of fiscal year 1 and fiscal year 2 forward estimates.

P/E Ratio Analysis (Bloomberg)

P/E Ratios Peers (Bloomberg)

Focusing specifically on Fiscal Year 2023 estimates within the investment management peer group in the US, we obtain a median comp P/E ratio of 13.23x. If we apply the consensus estimate for VCTR’s EPS GAAP for FY 23 of 3.68, we obtain a target price of $48.69. This would represent a significant possible uplift from the current stock price, but I would look to haircut to a notable extent, in order to account for the valuation gap that has been sustained persistently for quite some time between VCTR and peers, as per the above chart. Nevertheless, there is a clear undervaluation based on both realized and forward-looking PE ratios. If VCTR is able to tighten this divergence from the median and average peer multiple, we could possibly see further upside in their stock performance.

P/E Relative Valuation (Bloomberg)

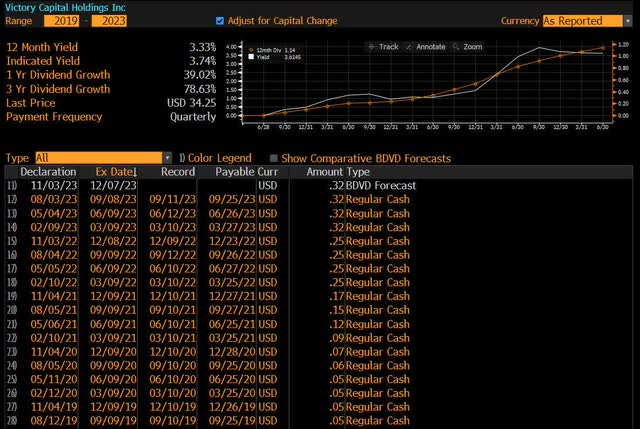

It is also worth highlighting the income characteristics of VCTR, as the company has made incredible steps in growing their dividend policy. The 3 year dividend growth is ~79%, and this year has seen the quarterly dividend jump up to 32 cents per share, versus the 25 cents paid per quarter last year. The current annualized dividend yield is 3.74%, compared to the median dividend yield of peers at 2.72%, and the average of peers at 2.97%. Given the dramatic increase in pay out growth from the tiny 0.05 cents in 2019, it is clear that growing the dividend programme is a top priority for VCTR management, and if performance continues in the right direction, we could possibly expect further dividend increases in 2024. This provides an additional positive factor to my bullish thesis on this stock.

Dividend Summary (Bloomberg)

Positive Analyst Recommendations

Looking at the sell-side recommendations on the stock, we can see a positive picture. Based on the equity research analysts covering VCTR, ~91% issued either “BUY” or “HOLD” recommendations, with only 1 analyst issuing a “SELL” recommendation. Based on the 12 month consensus target price of $37.50, there is also a possible return potential of ~10%. This helps affirm my bullish view on the stock.

Analyst Recommendations (Bloomberg)

Shareholder Analysis

I also look to analyze the movements of top shareholders in recent quarters to gauge sentiment and spot persistent buying or selling trends. Based on the Historical Holdings page on Bloomberg, we see a positively skewed picture. There is some significant selling by the top 2 shareholders, but looking beyond that there are key names such as Vanguard, BlackRock, and Dimensional that have notably increased their stakes in the last year. Beyond the Top 10, we see a pretty clear wave of consistent buying and increased positions from those shareholders. This gives me confidence that a large list of key institutional shareholders may also have a bullish view on the stock and possibly see it as good value for a long-term trade, or else they would either be maintaining or selling their position.

Shareholder Analysis Top 20 (Bloomberg)

Bullish Options Sentiment

A final technical indicator that I like to check from the options market that can signal bullish or bearish sentiment on the stock is the Put/Call Ratio, which compares the current open interest for put options versus call options. A value below 1 indicates that there is a greater amount of open interest in call options versus puts. The current value of 0.36 indicates that there is strong positioning in the market to take advantage of upward moves in the stock through call options, despite the already notable rise in the stock price this year of ~28%. If there were broad concerns on the stock being overbought, there would be a greater proportion of open interest and demand in put options to either protect or speculatively profit from an expected fall in the stock.

Put/Call Ratio Open Interest (Bloomberg)

Risks To The Thesis

VCTR has experienced AUM growth due to increased investor interest and good performance from existing assets. If the funds’ performance were to deteriorate, management fees and performance fees would be at risk of falling, negatively impacting the company’s top line revenues. This is also a highly competitive sector as there is a broad wealth of public and private market managers and investors may pull their commitments to shop around for better performance. In addition, VCTR’s products have a greater focus on small and mid-cap equity strategies, which have historically demonstrated greater volatility and drawdown periods than large-cap strategies.

An additional risk revolves around deal making, as VCTR has grown a broad platform by acquiring smaller, specialist managers. In a tougher acquisition market, this strategy does not operate as smoothly. There is also the risk that the breadth and complexity of the offering starts to bite in a negative way, as diminishing returns and lower margins could result from excessive administrative burden of the centralized operating and distribution model that VCTR pursues. Finally, there could also be a cannibalization of similar strategies if there isn’t a clear plan to provide sufficient differentiation between the sub-managers within the VCTR group.

In Conclusion

Overall, VCTR’s strategy to build a hybrid model of offering their clientele a broad platform of niche managers and strategies under one umbrella company whilst keeping operating and distribution costs low, has been a successful endeavor so far. This pursuit is well-aligned with the industry trends around manager consolidation and offering investors a one-stop shop platform. As a result, we can see strong financial performance in VCTR’s recent results which partly explains the good stock performance year-to-date. Based on the relative under valuation and bullish signals from the sell-side and institutional investors, I believe there is further run way for this stock to continue rising.

Read the full article here