Welcome to the “Viewing from Space” analysis series, where I delve into companies – through the lens of commercial space – that operate outside or not primarily in the space technology sector, to examine how these companies can tap into the advantages presented by the new era of space economy from space exploration to applications.

Analyst’s note: The company we’re covering today operates in the military and defense sector. As a professional ESG investor, the investment recommendations are strictly based on the financial performance and the potentials in the space industry.

I personally refrain from investing in companies that do not align with responsible investment principles.

The first coverage is Northrop Grumman (NYSE:NOC), a prominent defense company with a rich legacy U.S. space exploration history, from the Apollo Program that landed the first man on the moon, to NASA’s largest and most powerful space science telescope, the James Webb Space Telescope.

The company operates in four main sectors: Aeronautics Systems, Defense Systems, Mission Systems, and Space Systems that by itself accounts for 31.7% of the total revenue in 2022.

Thesis

While the space economy and budget in space technologies have grown significantly, traditional defense companies like Northrop Grumman benefit more than the other new players – both because of their familiarity and experience in doing business with matters of national security. Space is a strategic sector, under the new space race between superpowers.

Fundamentally speaking, Northrop Grumman has solid financial fundamentals and fair valuation, while the business is growing every year. Therefore, I expect that space technologies will become an important driver for the company and enhance long-term prospects. Therefore, a Buy rating is given.

Space-for-Space and Space-for-Earth

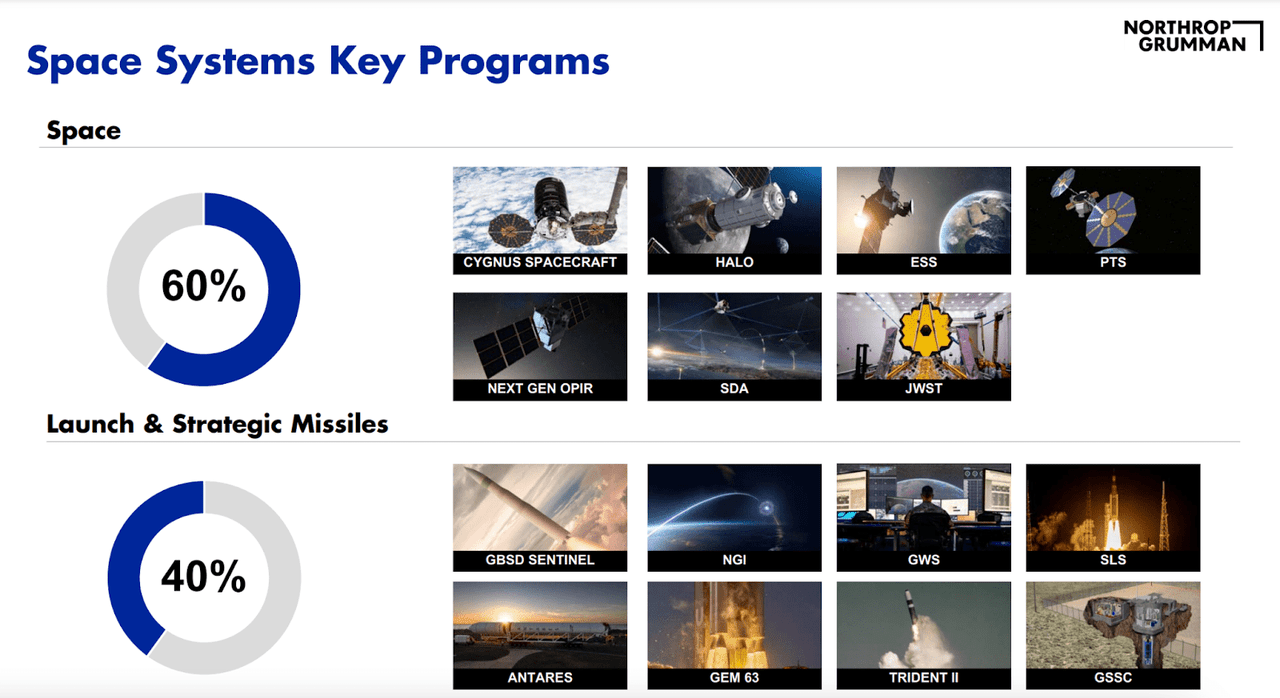

Northrop Grumman’s space systems business can be categorized into two areas:

-

Discovery in Space: Developing space technologies for exploration in space that play vital roles in the quest to discover the origins of our universe, to explore beyond our own planet, and pioneer new technologies. This includes developing of the James Webb Space Telescope and supporting in the Artemis Program to return astronauts to the lunar surface.

-

Security on Earth: The company, with its expertise in defense, specializes in strategic deterrence, secure communications, missile warning and missile defense, space security, and advanced technologies to protect the nation and its allies.

Company’s Presentation

In recent years, we have witnessed rapid growth in both the quantity and capability of emerging commercial space players. However, despite the thriving new space landscape, Northrop Grumman, amongst other esteemed “legacy space players” who have been critical to support NASA and the Space Force over the years, continues to be the top pick for contracts tied to national security imperatives.

This has allowed the company to harness the business potential of a developing space economy, against the backdrop of the new international and commercial space race.

The Space Force’s Proliferated Warfighter Space Architecture (PWSA) is the best case in point. PWSA represents a strategically important constellation of communication satellites, designed to provide warfighter information and timely communication of missiles. Under this program, Northrop Grumman has been awarded contracts totaling approximately $2 billion for the production of a total of 92 satellites, with the first batch set to be delivered by September 2024.

What is particularly noteworthy, yet intriguing, is that Northrop Grumman secured one of these contracts and replaced SpaceX’s original role in the same program. While the specific reasons behind this decision have not been disclosed, it is reasonable to assume that the government is seeking to diversify its military satellite providers, moving away from SpaceX’s predominant role, especially in the Ukraine war.

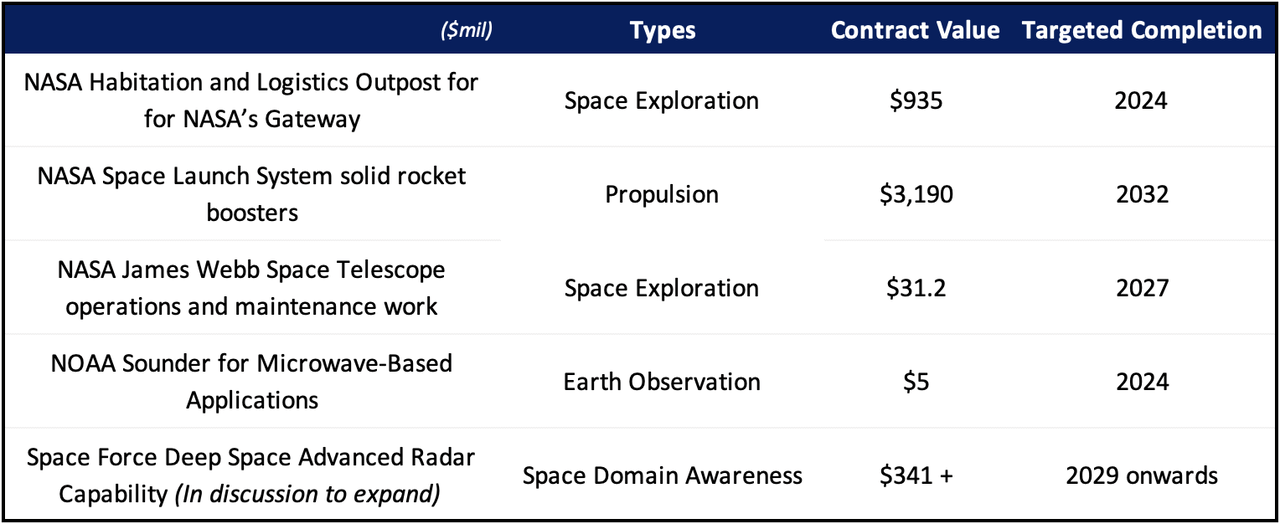

Meanwhile, Northrop Grumman is not short of other high-profile contracts that position the company as a leader in the field of space systems, including:

Analyst’s Research

The Growing Space Segment in Numbers

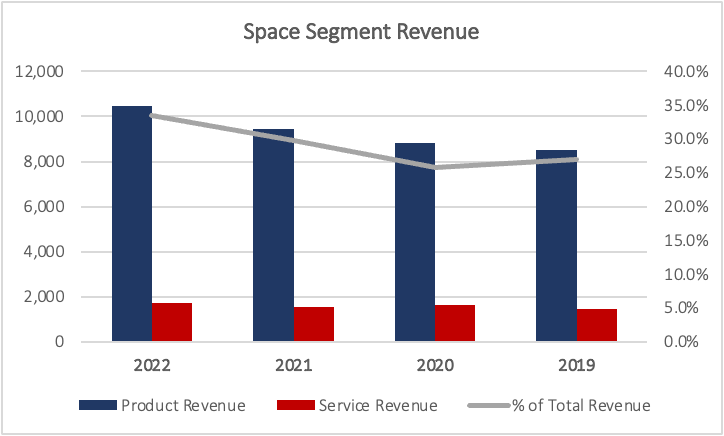

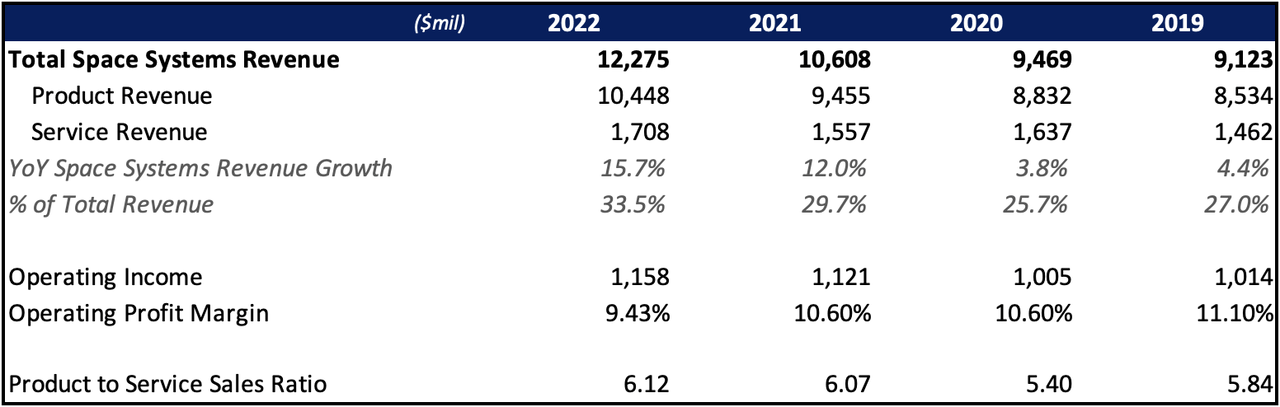

The following analysis provides a comprehensive examination of Northrop Grumman’s financial performance within its Space Segment over recent years. Northrop Grumman’s space segment demonstrates robust growth both in revenue and profit as evidenced by Year-over-Year Growth and Operating Profit Margin.

The consistent upswing in sales from 2019 to 2022 underscores the segment’s expanding footprint in the space industry. The predominance of product sales over service sales implies the company’s capability to tailor and deliver a diverse range of products, from satellites to space exploration, based on the company’s expertise and superiority in technologies.

Company 10-K

While the operating profit margins experienced a slight dip in 2022, they remain resilient, reflecting efficient operations. This data bodes well for potential investors and reaffirms Northrop Grumman’s promising position in the space sector.

Company 10-K

A Fundamentally Strong Company

Balance Sheet: An Anchor in Turbulent Waters

When examining liquidity, Northrop Grumman emerges with commendable stability. A current ratio of 1.20 might slightly trail Lockheed Martin (LMT), but it notably outstrips both L3Harris (LHX) and Boeing (BA). Furthermore, while its debt-to-equity ratio of 112.64% does signal leverage, it is essential to recognize that Northrop Grumman remains more insulated than Lockheed. Importantly, when juxtaposing the company’s Debt/Free Cash Flow with Boeing’s towering 16.09, Northrop Grumman’s financial prudence becomes evident.

Valuation Musings: Northrop Grumman and the Competitive Landscape

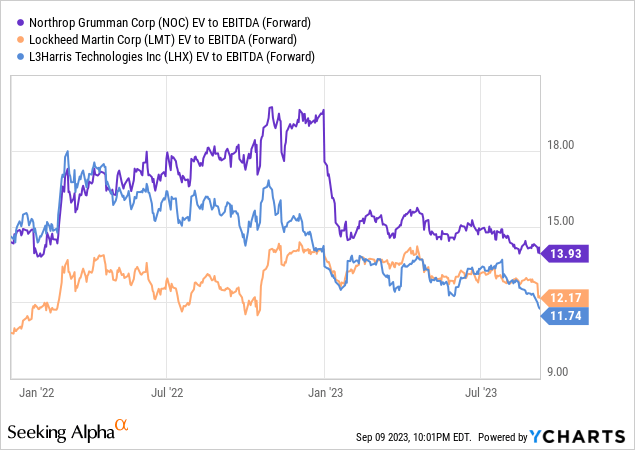

Looking at the company’s value, its forward EV/EBITDA stands at 14.79, which might seem a bit higher compared to Lockheed and L3Harris. However, when we compare it to Boeing’s much higher 51.83, Northrop Grumman’s valuation looks more attractive. Its trailing EV/EBITDA also remains competitive among its peers.

Considering the company’s year-over-year revenue growth of 8.36%, it outperforms both Lockheed and L3Harris. Looking at profitability, Northrop Grumman boasts a strong Gross Profit Margin of 20.24% and an EBITDA Margin of 19.12%, highlighting its operational efficiency.

However, in early 2023 the company has seen a decline in its traditional defense and military segment, which has led to a major revaluation of its valuation. However, I believe that, in the medium term, the company will grow its business and share price back to the pre-2023 level at EV/EBITDA of around 16 (implying a share price level of above $500), contributed by the rising space systems segment.

Therefore, it is important to consider the growing space segment as a new value driver. With nations and private companies venturing into space exploration and defense, Northrop Grumman’s involvement in this sector could drive significant growth. And for long-term investors, Northrop Grumman’s stock performance over the past decade speaks to its enduring value.

Investment Comments:

In the interplay of the aerospace, defense, and space industries, Northrop Grumman emerges as a captivating narrative. The company’s strong financial footing, combined with impressive profitability and a promising position in the space sector, makes it distinctive. Our analysis is not focused on whether the company can outperform its peers. Rather, we think Northrop Grumman and its legacy space players will benefit from the expanding space industry, both from the angle of space-for-space exploration and space-for-earth security perspectives.

Despite this, one should be careful of the underlying investment risks:

- New entrants working on different technologies are threatening Northrop Grumman’s space systems business. There are companies working on rockets (SpaceX, Rocket Lab), on satellite buses (Terran Orbital), on space exploration (Intuitive Machines). The company is literally facing competition on all fronts.

- Budget approvers like NASA and Space Force are trying to get rid of the old ways of contract awards to their closest suppliers in the defense sector, which might affect Northrop Grumman’s contract volume.

- The whole “Space Race” play is, to some extent, built upon the intensifying geopolitical environment. Even Northrop Grumman is calling out “threats” on the Moon. This is questionable not just because they are benefiting from conflicts, but if things are defused, the company’s growth assumptions will be gone.

Read the full article here