Introduction

Vista Energy (NYSE:VIST) is a Mexican-based energy company that was incorporated in 2017. Notwithstanding the volatile nature of the oil and gas industry, this Mexican company’s financial statements and strategic production expansions pave the way for higher growth and achievements in the future.

Vista financials and business outlooks

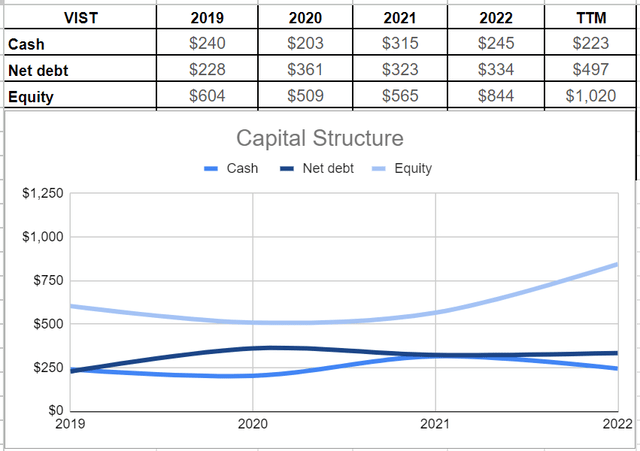

During the second quarter of 2023, the company focused on increasing its good inventory and securing more evacuation capacity for its 2026 plan, thereby leading to a 22% lower revenue year over year. The lower revenue of $231 million in 2Q 2023 was driven by higher oil inventory and lower prices versus at the same time in 2022. Meanwhile, their total production improved by 4% year over year. Vista Energy is on strategic development plans to expand its productions in the following years. In doing so, their capital expenditures surged to approximately $596 million in TTM versus circa $480 million at the end of 2022. Note that these capital spending included the drilling of 10 wells and the completion of five wells in the recent quarter. As a result, higher CapEx led to a free cash outflow of $85 million. However, their balance sheet is strong enough to support the company’s strategic plan. During the last years, Vista Energy’s accelerating production plans brought higher debt for the company, with their net debt level sitting at $497 million in TTM versus $334 million at the end of 2022, 48% up, however, their equity level inclined and reached $1,020 million in TTM. Thankfully, their net debt is well beneath the equity level, which shows that notwithstanding lower revenues and adjusted EBITDA in the recent quarter versus the same time in 2022, the company’s healthy balance sheet may pave the way for more profitable growth acceleration beyond their current plan (see Figure 1).

Figure 1 – VIST’s capital structure (in millions)

Author

Regarding their production developments, it is worth noting that the management assured investors they are on track, with their wells in Palo Oeste-18 and Palo Oeste-19 being completed in Q3 and Q4 2023, respectively. Moreover, by upgrading their oil treatment plan, they can increase their treatment capacity by 70,000 barrels of oil per day, which addresses the company to the production plan through 2026. Note, Vista Energy do not pay dividend yet and is focusing on its production expansions. As a result, free cash outflows are not likely to bring serious concerns for the company since free cash flow is normally a source of financing debt levels and shareholders’ returns. However, these expansions will be over one day, thereby providing an opportunity for the company to pay dividends to its investors.

As long as we are talking about their capability of paying back their debt levels, it is worth noting that although their net debt has improved, the management could reach a very competitive interest rate by accessing the local debt market in Argentina. As a result, they have been able to reduce their average cost of debt to 3% in 2Q 2023 and pre-finance their CapEx increases. In addition, focusing on decelerating cross-border debt from 54% of their total debt in 2020 to 22% of the debt at the end of the second quarter will reduce their probability of exposure to international risks like higher interest rates and economic constraints.

Overall, Vista Energy’s progress in drilling and completion activities will lead to the tie-in of 12 wells by the end of the third quarter of 2023. These wells will accelerate the production and thus lead to higher adjusted EBITDA by the end of 2023. Furthermore, the management asserted:

“We have secured midstream and export evacuation capacity to deliver well above our 2026 production target. Based on our current capacity and the contract we have in place, we forecast to have 100,000 barrels of oil per day of pre-evacuation capacity by the end of 2025.”

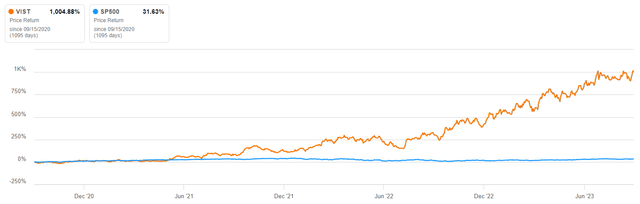

As Figure 2 illustrates, during recent years, Vista Energy has performed astonishingly and reached over 1000% price return, which is far higher than the return of approximately 31% of the S&P 500. I believe that the company’s performance in production expansion in the following years makes it still a profitable investment decision even if oil prices decline.

Figure 2 –

Seeking Alpha

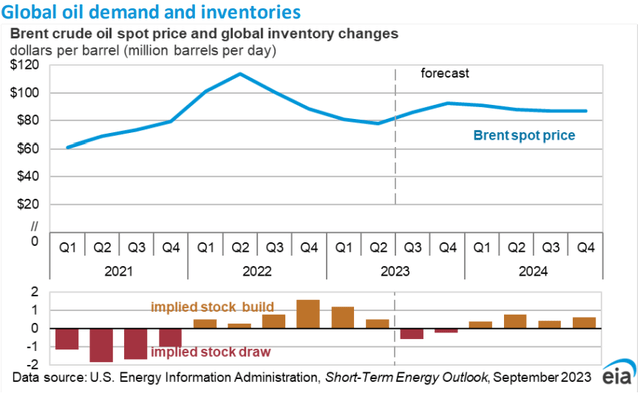

Following the recent decision of OPEC+ countries for further oil production cut per day by the end of this year, oil prices are expected to accelerate and reach $93 per barrel by the end of the fourth quarter of 2023 due to the lower global oil inventories. However, the prices are about to decline to $88/b on average during 2024 due to the higher-than-average oil inventories, the end of the OPEC+ production cut agreement, and lower oil demand growth. As a result, it is expected that oil prices will remain above $90/b by next year, which is still higher than recent prices of $86/b on average (see Figure 3). Thus, Vista Energy’s production expansions in the following year are likely to cater to higher income and adjusted EBITDA based on favorable oil prices.

Figure 3 –

EIA

Risks related to Vista Energy’s investments

The company’s operations and performance are significantly related to long-term capital investments and expenditures. Therefore, if the management becomes unsuccessful in accessing local market debt at competitive interest rates, their cost of debt will surge and significantly impact their profitability and ability to compete in the market. Moreover, Vista Energy’s properties and productions are mostly concentrated in Argentina. As a result, the company’s developments and new plans are more exposed to social and economic uncertainties in comparison with companies in more established areas.

Conclusion

Vista Energy has provided a great return during the recent years as compared with the S&P 500 return. Based on the company’s production plan and strong capital structure, I believe VIST stock is still undervalued and capable of higher growth in the coming years.

Read the full article here