This analysis supports a Buy rating for shares of Vizsla Silver Corp. (NYSE:VZLA) which should not be implemented soon, but after shares have pulled back significantly from current levels.

The Precious Metal Could Be the Protagonist of Another Intense Bull Market as the Risk of a Recession Becomes Increasingly Important

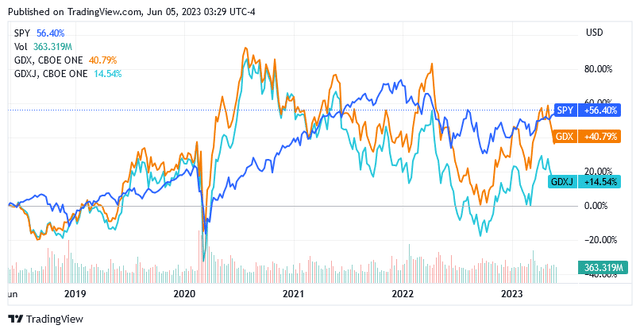

The past five years suggest gold and silver stocks were held to benefit from the positive effects of the surge in the demand for precious metals in response to the following events: the outbreak of the Covid-19 virus pandemic [Q1 2020], the start of interest rate hikes to stem high inflation coupled with the Russian invasion of Ukraine [Q1 2022], and the start of the US regional banking crisis [from mid-March 2023 to April 2023].

Source: Seeking Alpha

In these very short intervals of time, the precious metal was considered a safe haven investment, and mining stocks outperformed the US stock market.

In my opinion, investors should try to take advantage of gold and silver miners’ ability to appreciate significantly when demand rushes towards the precious metal to hedge against the headwinds of uncertainty.

In the coming months, gold and silver could be the protagonists of a new intense bull market as the risk of the economy slipping into recession remains. In this case, the precious metal will be in high demand because it will be again believed to protect the real value of wealth from the fall in the prices of the securities that may result from a negative trend in the business cycle when investors’ investment appetite typically declines.

Vizsla Silver Corp. is a Good Candidate to Profit from the Bull Market in Precious Metals

Vizsla Silver Corp. is a stock that I think could be suitable for the above strategy as the market price of its shares is very sensitive to changes in the price of the precious metal.

Vizsla Silver Corp. based in Vancouver, Canada, acquires, explores, and develops gold, silver and base metal deposits. Their flagship project is the Panuco-Copala Silver-Gold District in Sinaloa Province, Mexico.

Vizsla Silver Corp.’s stock price is strongly influenced by changes in the price of the precious metal. In fact, the stock price grows much more (or much less) as the metal rises (or falls). This can be observed through an analysis that places the price of Vizsla Silver’s stock in a linear relationship to the precious metal, with the weekly return on the stock representing the output and the weekly return on the metal representing the input. The analysis says that the securities are positively correlated with VZLA amplifying gold price fluctuations on average 2.5 times and VZLA amplifying silver price fluctuations 1.2 times on average. Vizsla Silver Corp’s gold beta is 2.5x, while Vizsla Silver Corp’s silver beta is 1.2x.

Shares in Vizsla Silver Corp could very well be used in a strategy aimed at taking advantage of a possible rise in commodity prices, which would be prompted by fears of an economic recession. From which, if gold and silver trade higher, based on the results of the analysis, this stock should in theory generate substantial capital gains.

I think that the high volatility of Vizsla Silver compared to the fluctuations of precious metals is due to the characteristics of this stock, which is not yet a producer but a company that today has a very ambitious goal. The goal is to become one of the most important producers in the Panuco district of Mexico.

About Vizsla Silver Corp.

Panuco emerges as a high-grade silver-gold project and one of the world’s most important silver discoveries.

Vizsla’s wholly owned Panuco silver-gold project in Sinaloa, Western Mexico, lies along a prolific silver trend in Western Mexico that already houses another mine, the San Dimas mine which is the flagship mineral asset in the portfolio of First Majestic Silver Corp. (AG). As an indication of what Panuco may look like in the future, San Dimas is targeting a total production of 12.5 million to 14 million silver equivalent ounces in 2023 [6.4 million to 7.2 million ounces of silver plus 72,000 to 81,000 ounces of gold] at an all-in sustaining cost of $13.02 to $13.91 per ounce sold. San Dimas has measured and reported mineral resources as follows: 59.4 million ounces of silver plus 738,000 ounces of gold.

Vizsla currently has an Indicated Mineral Resource of 7.5 million tons grading 243 grams per ton [g/t] of silver and 2.12 g/t gold or 437 g/t silver equivalent. These resources include 58.3 million ounces of silver and 508,000 ounces of gold, or 104.8 million silver equivalent ounces.

So far, Vizsla has focused its exploration activities on the newly consolidated Panuco silver-gold project, for which it has committed approximately $42 million. The company has no outstanding debts. The company has drilled over 250,000 meters in the project area, which covers 68 square kilometers, and plans to complete additional drilling activity totaling 90,000 meters as it aims to issue a resource update by the end of 2023. The latter can also boost the stock price.

Panuco remains largely unexplored. The exploration team has identified 158 targets but only 43 have been explored to date and two structures, in particular, the Copala and Cristiano structures, offer amazing upside potential.

The Stock Valuation

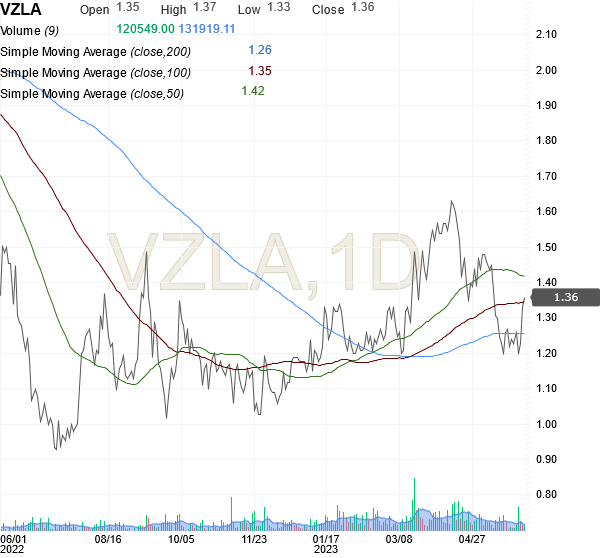

At the time of this writing, Vizsla Silver Corp. shares are trading at $1.36 per unit, giving it a market cap of approximately $282.529 million.

Vizsla Silver Corp is almost on par with the 100-day simple moving average of $1.36 and above the 200-day simple moving average of $1.26. The share price is significantly below the 50-day simple moving average line, as it appears from the Investing.com chart.

Source: Investing.com

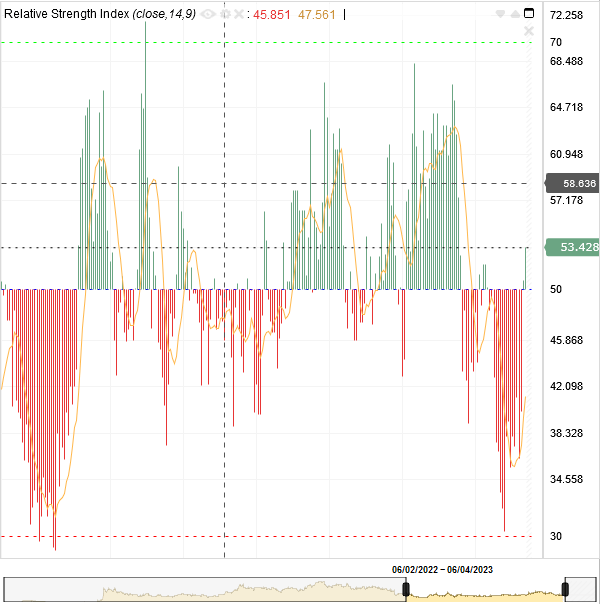

Another chart from Investing.com, which plots the patterns of the 14-day relative strength indicator over the past year, suggests that shares of Vizsla Silver Corp. are neither overbought nor oversold and that bullish sentiment is currently driving the stock price higher.

Source: Investing.com

This stock has shown over the past 52 weeks that it can rally as high as $1.65, which was reached intraday on April 18 as the precious metal was approximately at its yearly highs amid the US regional banking crisis. The lower boundary of the 52-week range came in at $0.91 instead.

Vizsla Silver Corp. (TSXV:VZLA:CA) is also traded on the Toronto Venture Exchange [TSX-V] and the share price, at the time of this writing, is C$1.77 for a market capitalization of C$376.01 million. The 52-week range is between CAD$1.19 and CAD$2.24. The 50-day moving average was CAD 1.9196 and the 200-day moving average was CAD$1.6938.

The Risk of Buying VZLA Now

However, the 52-week high is 21% above current levels, but in my opinion it’s not a reason to buy just yet, as shares carry the risk that they can fall significantly from current levels due to the following factors.

Assuming that VZLA continues to track the precious metal’s performance, investors need to be aware that gold and silver could come under severe downward pressure over the next few weeks as economic indicators and some Federal Reserve governors point to the possibility of further rate hikes to curb inflation. Rising interest rates increase the opportunity cost of holding gold rather than fixed-income securities like bonds, leading investors to prefer bonds to gold.

The unexpected rise in job vacancies in the US paves the way for another rate hike by the US Federal Reserve. Fed Chair Jerome Powell has always pointed out that the weakening of labor market conditions is a good indicator for deciding whether to change monetary policy. However, the latest reading points to a continued tightening of labor market conditions.

Philadelphia Federal Reserve President Patrick Harker has not ruled out further rate hikes. Federal Reserve Governor Philip Jefferson (US President Biden’s nominee for Vice Chairman of the Fed Board of Governors) appears to believe that the monetary policy cycle of rate hikes has yet to peak. Fed Governor Patrick Harker is a dovish policymaker and voter in 2023, while Fed Governor Philip Jefferson is a moderate policymaker (neither truly dovish nor truly restrictive) and a voter in 2023.

In addition, Dallas Fed President Lorie Logan believes it is normal to continue raising interest rates. Fed Governor Logan is moderately dovish and a voter in 2023.

Further tightening of the cost of money to combat persistent inflation due to a resilient labor market will act badly on the precious metal’s price and generate headwinds for VZLA’s share price.

As such, I would wait for a lower price to form before buying VZLA stock. But the economic recession remains on the horizon and a possible extension of the tightening – not to mention that not every rate hike already had an impact on the economy – could exacerbate the negative cycle more than what we currently expect for it.

I think this will be enough to create a new bull market in precious metals prices. Since VZLA is high beta gold and high beta silver, the stock price should pick up significant momentum.

A higher price for the metals will make it possible to view VZLA’s projects in an even better light and assume a higher chance of establishing a profitable production of silver and gold.

Conclusion

Vizsla Silver Corp. is a good candidate to profit from the next bull market in precious metals that is likely to take place as the economy slides into recession.

A resilient labor market ensures persistent inflation and, in response, an extension of monetary tightening paves the way for a recession.

Vizsla Silver Corp. stock price is strongly and positively linked to the price of gold and silver, whose demand as a safe haven against fears of recession should then increase sharply.

However, I believe Vizsla Silver Corp could take a significant hit initially as further interest rate hikes increase the opportunity cost of holding gold/silver and not bonds. Therefore, investors should wait for lower levels and not buy the stock today.

Read the full article here