Thesis

We have written about Agency MBS before, assigning Buy ratings on a couple of occasions:

It seems that the JPMorgan asset strategy team has read our pieces, with the bank now recommending the Agency MBS asset class as a Buy as well:

Recession remained our base case,” Bob Michele, chief investment officer and head of the Global Fixed Income, Currency & Commodities Group at J.P. Morgan Asset Management, said in a note. “While the central banks are committed to bringing inflation down to 2% and willing to sacrifice the economy to get to that level, the group appreciated that it is taking longer to work through several years of accumulated policy stimulus.” Nevertheless, leading indicators continue to see a recession as the most likely outcome.

Taking into consideration the outlook for more central bank rate hikes and the inverted yield curve, “agency mortgage-backed were our top pick,” Michele said. “While the technicals of Fed balance sheet runoff, FDIC selling, and lower bank demand are challenging, valuations are at their cheapest level since the height of the global financial crisis.

In essence Agency MBS are AAA rated, but offer higher yields than Treasuries with an equal duration. The mREIT sub-sector is a known market niche that ends up leveraging up this asset class anywhere from 4x to 9x to juice up returns. Unfortunately mREITs are extremely volatile (the likes of NLY, CIM and AGNC), so a retail investor might be better served by an outright, unleveraged position in this asset class at this stage of the economic cycle.

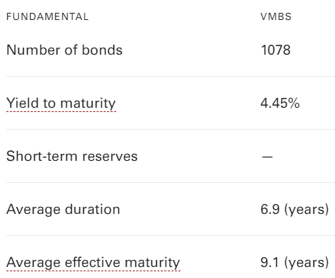

The Vanguard Mortgage-Backed Securities Index Fund ETF (NASDAQ:VMBS) is an exchange traded fund focused on the Agency MBS asset class. The fund seeks to track the performance of the Bloomberg U.S. MBS Float Adjusted Index, which offers a diversified exposure to intermediate-term U.S. agency mortgage-backed pass-through securities issued by Ginnie Mae (GNMA), Fannie Mae (OTCQB:FNMA), and Freddie Mac (FHLMC). In effect VMBS contains a diversified portfolio of Agency MBS bonds with an average duration of 6.9 years. The assets are AAA, so the only consideration to be had here are rates.

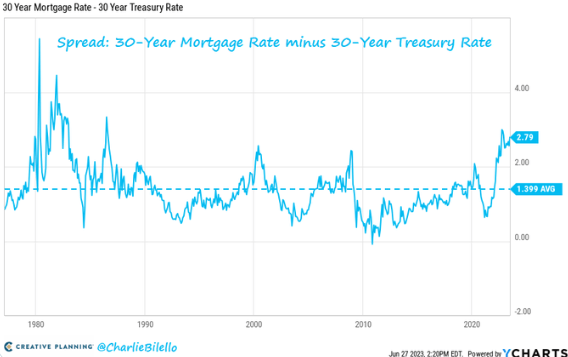

The Agency MBS asset class has become interesting because spreads on Agency MBS bonds are now trading at historic wide levels versus Treasuries, especially on the long side of the curve:

MBS Spreads (Creative Planning)

The above graph illustrates the spread of 30-year Agency MBS bonds versus 30-year Treasuries. The higher the spread, the higher the yield on MBS bonds versus equivalent Treasuries. We can notice how the spread is correlated with monetary policy – during the low rates environment exhibited in 2020/2021, the spread was very low.

Ultimately MBS bonds have question marks around their actual maturity date, due to pre-payments. Historically this feature has forced the asset class to pay wider spreads to Treasuries. We feel the low CPR rates are now priced in, and for the same duration an investor is better served by buying into Agency MBS bonds.

Performance

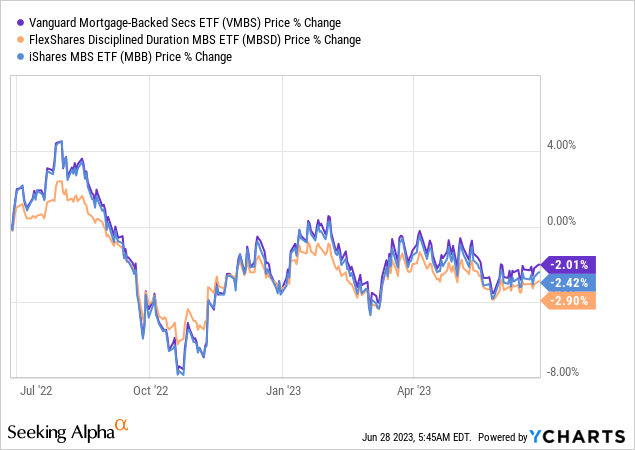

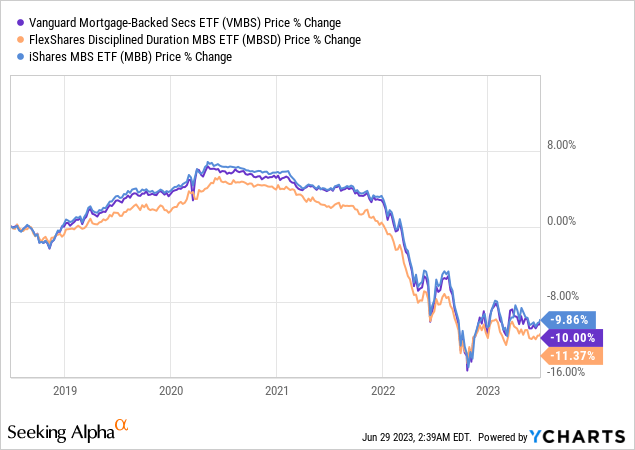

VMBS has largely performed in line with other unleveraged MBS products:

We are comparing the fund here with a cohort formed from the iShares MBS ETF (MBB) and the FlexShares Disciplined Duration MBS ETF (MBSD). Since the start of the monetary tightening cycle, all funds have experienced deep drawdowns:

Holdings

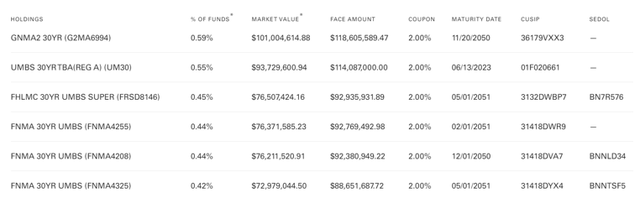

The fund contains over 1,000 MBS bonds with an intermediate duration:

Holdings (Fund Web)

The asset class here is AAA, so there are no consideration for credit risk. The largest risk factor is represented by rates and prepayments. Prepayments affect the duration of the underlying MBS bonds, by increasing or decreasing the average life of the collateral. We are currently in a high mortgage rate environment, with fewer people able to move due to the fact that they have locked in low rates on their mortgages. This translates into lower pre-payments and a higher duration for the MBS bonds, which is now already priced in.

The fund does not take any concentration risk either, with most names below a 2% portfolio weighting:

Top Holdings (fund website)

The above represent the fund’s top holdings as of now.

Conclusion

VMBS is an exchange traded fund. The vehicle aims to follow the Bloomberg U.S. MBS Float Adjusted Index by investing in a portfolio of unleveraged agency MBS bonds with an intermediate duration. The fund had a deep drawdown in 2022 due to higher rates, but is set to outperform going forward. Agency MBS now have almost historic wide spreads when compared to equal duration Treasuries, making them an attractive asset class. VMBS only contains AAA assets, thus the main risk factor here is rates, followed by spreads to treasuries. As per the forward SOFR curve, we expect a 1% cut in rates by the end of next year (extrapolated for the 7 year curve point), implying a 10% plus return for VMBS in the next 18 months given its duration profile and current dividend yield.

Read the full article here