Introduction

I have a love-hate relationship with the Vanguard Real Estate ETF (NYSEARCA:VNQ) – although I would replace hate with somewhat dislike.

As most of my readers know, I do not usually buy ETFs. I prefer to buy single stocks, as it’s way more fun. I also believe that I can outperform most benchmark ETFs.

Having said that, I often use the VNQ ETF as a benchmark in REIT-focused articles, as it’s the biggest real estate ETF in the world.

In this article, we’ll dive into the details and alternatives for investors to beat the ETF with similar income.

What Is VNQ?

Incepted in 2004, this Vanguard-managed ETF tracks the investment performance of the MSCI US Investable Market Real Estate 25/50 Index.

With more than $30 billion in assets under management, this ETF aims to:

- Provide high-income and moderate long-term capital by

- Investing in stocks issued by commercial REITs.

The ETF currently yields 4.7%, which is the highest yield since the Great Financial Crisis. Over the past ten years, the dividend has been hiked by 4.3% per year, which is decent, as it beats the average inflation rate.

Rising rates and high inflation have made REITs a bit unattractive, as investors prefer investments with lower debt and better pricing power. Almost all REITs rely on affordable financing to expand and/or maintain their balance sheets, while most REITs have long-term contracts with CPI-tied pricing.

Sometimes these contracts are capped, making above-average inflation an issue.

The VNQ ETF currently trades 21% below its 52-week high and is down 3.4% year-to-date, which explains why the yield has increased to almost 5%.

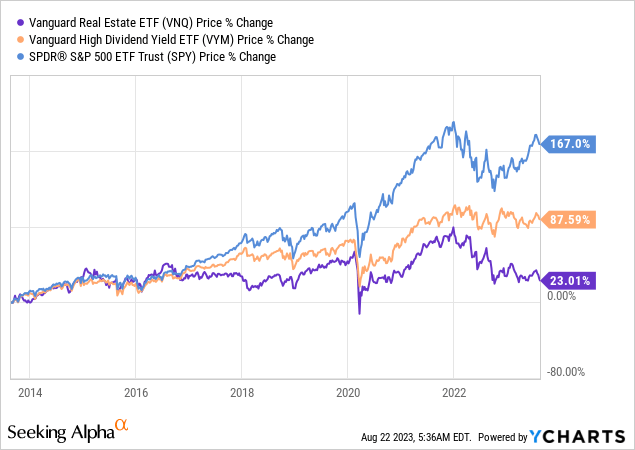

Speaking of its performance, VNQ has returned just 23% over the past ten years, including dividends.

This performance is poor. Even the Vanguard High Dividend Yield ETF (VYM) – currently yielding 3.1% – has returned 88%.

With that in mind, VNQ is well-diversified. Thanks to its passive management approach, it has an expense ratio of 0.12%, which is fair.

The ETF has 164 holdings with a median market cap of $25 billion. All of its holdings are based in the United States.

Its largest sectors are:

- Industrial (12.7%)

- Retail (12.6%)

- Telecom Towers (12.1%)

- Multi-Family Residential (8.8%)

- Data Centers (8.3%)

- Health Care (8.1%)

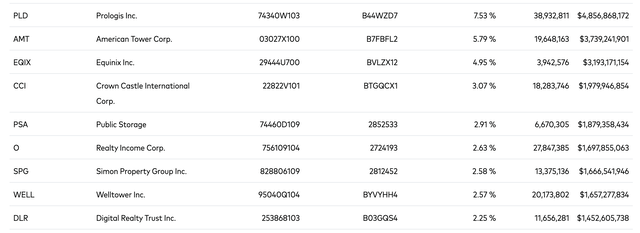

Its largest holdings can be seen below. None of its REITs have a weighting of more than 8%, which is good for diversification.

Vanguard

Having said all of this, I do not hate VNQ. It’s a well-diversified ETF with an attractive expense ratio, a juicy yield, and steady dividend growth.

If I were to own this, I wouldn’t lose sleep.

However, I wouldn’t be happy either, as I believe that it’s not impossible to build a REIT portfolio with a better performance.

Building My Own VNQ

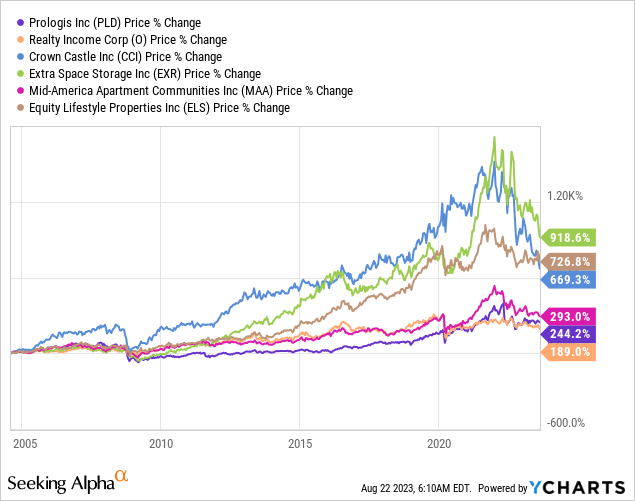

Now, let me introduce you to a simple but well-diversified six-stock REIT portfolio.

This portfolio covers six REITs in an equal-weight portfolio. I went with some of the stocks on my watchlist. All of them are mature REITs with decent yields, dividend growth, and financial health.

| Name | Type | Dividend Yield | Dividend 5Y CAGR | Credit Rating |

| Prologis (PLD) | Semi-cyclical industrial | 2.9% | 12.5% | A- |

| Realty Income (O) | Semi-cyclical retail | 5.5% | 3.7% | A- |

| Crown Castle (CCI) | Non-cyclical cell tower | 6.3% | 8.5% | BBB+ |

| Extra Space Storage (EXR) | Cyclical self-storage | 5.0% | 17.8% | BBB+ |

| Mid-America Apartment Communities (MAA) | Non-cyclical apartments | 3.9% | 8.4% | A- |

| Equity LifeStyle Properties (ELS) | Non-cyclical manufactured housing communities | 2.0% | 4.7% | N/A |

- Average dividend yield: 4.2%

- Average (unweighted) dividend growth rate: 9.3%

Please note that I did not go with an average weighted dividend growth rate, as EXR would significantly skew the result. Also, I believe that EXR’s dividend growth will slow in the next few years.

- With regard to these picks, I included Prologis because it owns the world’s best industrial properties. This includes warehouses that are leased to the biggest transportation and supply chain firms in the world.

- Realty Income is a staple with top-tier tenants in the U.S. and abroad and a well-covered 5.5% monthly dividend.

- Crown Castle offers a decent yield and a wide moat portfolio consisting of cell towers. This business is anti-cyclical.

- Extra Space Storage is my largest REIT holding, as it has excelled at building top-tier self-storage assets with high margins, high occupancy rates, and outperforming growth.

- Mid-America Apartments owns Sunbelt apartments with high occupancy rates, well-diversified tenants, and long-term demand growth.

- Equity LifeStyle Properties owns manufactured housing communities, RV communities, and marinas. It benefits from an aging population, cost benefits of MH communities, supply headwinds in the marina space, and a low-expense structure.

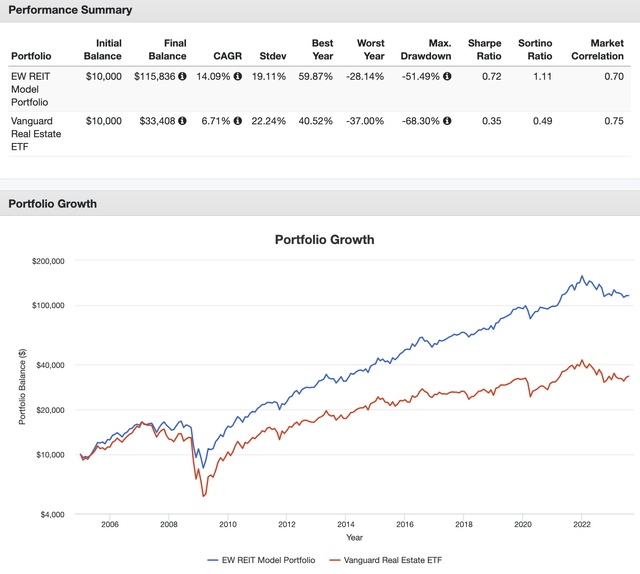

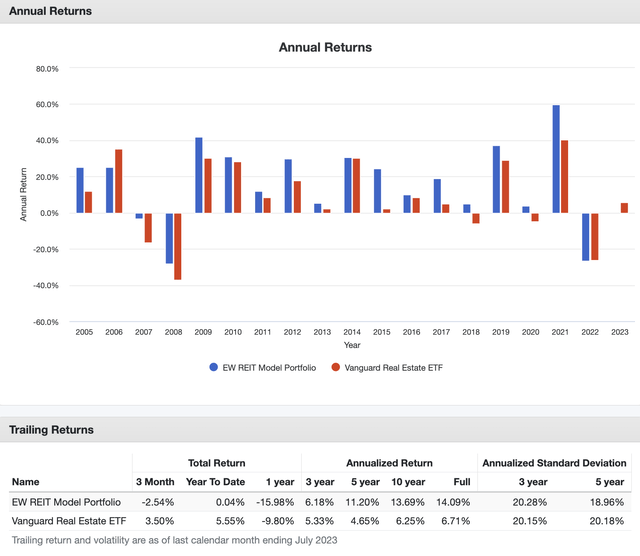

Since 2005, this six-stock basket has returned 14.1% per year, beating the VNQ ETF by a wide margin.

The S&P 500 returned 9.5% per year during this period.

Furthermore, despite the fact that this basket holds just six stocks, it has a standard deviation that was LOWER than the VNQ standard deviation since 2005.

Also, the max drawdown during the Great Financial Crisis was just 52%. VNQ fell by 68%.

Portfolio Visualizer

Even better, this performance has been consistent.

This equal-weight basket has beaten VNQ almost every single year since 2005. Over the past five years, for example, it has returned 11.2% per year, beating the 4.7% return of the VNQ ETF. The standard deviation of the basket was lower.

Portfolio Visualizer

With all of this in mind, I’m not making the case that everyone needs to own these six stocks – although I like all of them.

My point here is that it’s not impossible to build a diversified basket of REIT stocks with decent income and dividend growth without having to take on bigger risks.

Going forward, I believe that these stocks will continue to outperform the VNQ ETF. I also believe that these investments offer attractive buying opportunities if rising rates continue to pressure REIT stock prices.

So far, I only own Extra Space Storage and Public Storage. However, I’m increasingly looking to expand my REIT portfolio.

All stocks mentioned in this article are on my watchlist.

And, just to be clear, if you own VNQ, do not let me force you into single stocks. Some people are better off buying ETFs, as stock picking comes with additional risks.

Takeaway

While VNQ has its advantages, I’ve built a diversified selection that has consistently outperformed the ETF.

Embracing Prologis for its world-class industrial properties, Realty Income for its robust tenant base and monthly dividend, Crown Castle for its anti-cyclical cell tower portfolio, Extra Space Storage for its exceptional self-storage assets, Mid-America Apartment Communities for its strong Sunbelt apartments, and Equity LifeStyle Properties for its unique housing communities, this portfolio has excelled year after year.

Since 2005, it has achieved a remarkable annual return of 14.1%, leaving VNQ in the dust.

This outcome is backed by a lower standard deviation, highlighting its resilience during market turbulence.

The performance consistency further supports its credibility.

While these specific stocks might not be for everyone, the core message is: crafting a REIT portfolio tailored to your preferences can indeed beat VNQ’s performance without the need for elevated risk.

Read the full article here