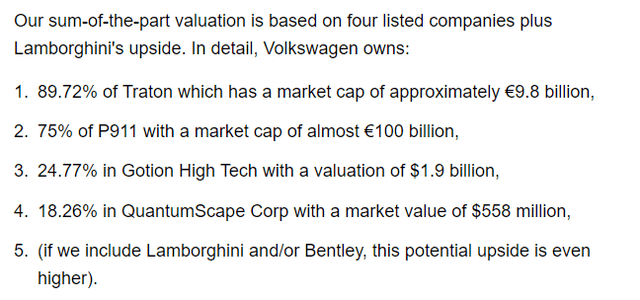

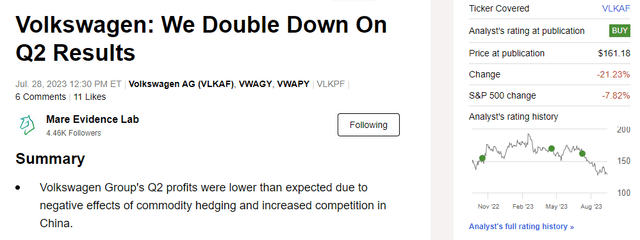

Here at the Lab, we continue to believe that Volkswagen (OTCPK:VLKAF)(OTCPK:VWAGY) is ‘The Most Discounted Auto Stock‘. Despite our double-down investments following the H1 results and Mare Ev. Lab supportive sum-of-the-part valuation (Fig 1), the company’s stock price further declined (Fig 2). We are incredibly disappointed, and today, rather than looking at the financials, we focus on the latest MACRO changes and new strategic developments within the company. Given the inventory development and resilient expectations in 2024, we note valuation anomalies on the current market cap (P911 equity stake at €60 billion > VW market cap at €58 billion). Our internal team continues to overweight the company, and we are still confident that Volkswagen offers an attractive entry point at the current valuation.

Past SOTP Valuation

Fig 1

Mare Past Analysis

Fig 2

EU supports

Last week, the European Commission announced an investigation into Chinese electric car imports. Here at the Lab, we anticipate this is crucial for the sector. Reporting Ursula von der Leyen words: “The global markets are now flooded with cheaper Chinese electric cars. And their price is kept artificially low by huge state subsidies.” In our risk section paragraphs, Chinese-made electric cars represent the most significant risk for European car manufacturers. According to Allianz Trade, unless government authorities intervene, this might cost almost €7 billion per year in terms of lost earnings between now and 2030. In 2022, three of the EU’s best-selling electric vehicles were imported from China. Chinese car brands recorded total sales of 147,000 units in Europe, a market share of around 2.25% (it was 0.19% in 2019). However, looking only at total electric vehicles, the market share of battery-powered cars went from 0.5% in 2019 to 8.2%, thanks to the sale of 86,000 BEVs. In particular, Saic Motor’s brand (MG) recorded total sales (ICE and electric) of 104,000 cars, almost doubling compared to the previous year, surpassing Mazda and Honda. To oppose this development, the EU President reported that “too often our companies are excluded from foreign markets or are subject to predatory practices and are often weakened by competitors who benefit from significant state aid.” Strengthening European competitiveness and supporting businesses in Europe is now a top priority. Von der Leyen decided to rely on Mario Draghi (former Italian Prime Minister and the ECB). We view Draghi’s appointment positively and believe he will support European auto competitiveness. Following this news, we might forecast higher duties on cars imported from China to protect EU car manufacturers. The current European standard rate on car imports is at an advantageous 10% vs. an import US duty at 27.5%. To better assess the current environment, we should also report that European car manufacturers pay tariffs between 15% and 25% to be able to export cars to China. Therefore, a Chinese retaliation seems unfair considering this fact.

Volkswagen Latest Update

Last week, Volkswagen disclosed the Trinity project, which had already been postponed several times. The industrial facility chosen was the Zwickau plant, which will be dedicated to electric cars. In addition, the German newspaper Handelsblatt revealed the hiring of Sanjay Lal for Cariad. Sanjay is a former manager at Tesla (TSLA), Cisco (CSCO), and Google (GOOG) (GOOGL). Cariad is betting on the newcomer to eliminate the ongoing difficulties and delays that have slowed the launch of new and crucial models. Sanjay Lal recently developed a new software platform for Rivian (RIVN) and should start in November. Last week, the supervisory board allocated production plans until 2028, setting up its industrial sites to ensure profitable use of production capacity and achieve the expected economic results in the coming years. By setting up the future production network in Germany, Volkswagen aims to achieve the most efficient model allocation and simultaneously increase productivity, two critical aspects outlined on the capital market day. What is important to emphasize is that Volkswagen is now more open to management changes and external cooperation. Discussing the ability of the company to change triggers skepticism among investors; however, we should recall Blume’s track record in Porsche. The company needs to change, and there is a need to make difficult decisions such as cost reduction and lower headcount. Change in management’s attitude from insularity toward shared investment with cooperation and partnerships will pay off. Volkswagen’s competitiveness is at risk, and the CEO is aware of that.

Why are we still supportive?

After a substantial build-up in 2022, inventories increased marginally in 2023 H1 as delivery bottlenecks were released. In light of this, auto companies have, on average, approximately 2.5 months of sales, which is an optimal level for the industry. Here at the Lab, we forecast a significant reduction in inventories starting in H2. Therefore, we expect a reversal effect in 2024 working capital effect with a boost in Volkswagen’s cash on the balance sheet. Confirming an absolute value of EBIT at €24.9 billion for the next year with a group core operating profit margin of 7.7%, we are raising FCF development to €15 billion. Therefore, even if we are not chasing a dividend yield (which we believe will be confirmed and the company is yielding at 8%), Volkswagen trades at an FCF yield of almost 25%. On a current P/E of 3.5x, we think Wall Street is not pricing the company with its long-term potential, and we reaffirmed our previous valuation. Volkswagen’s last two years have been harsh, from no uplift in P911’s IPO valuation, disappointing EV shares, and losing Chinese leadership. In a nutshell, we can say that “what could go wrong at the company has gone wrong.” Having said that, Volkswagen’s market valuation is not justified considering its quality portfolio. MACRO support from the European Union and visible change in management, we are still confident in VW’s future stock price appreciation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here