Introduction

As my August article says, Volvo Car Group (OTCPK:VLVOF) (OTCPK:VLVCY) is working on improving battery electric vehicle (“BEV”) margins. Since the time of that article, we see the numbers confirming these efforts as the 3Q23 presentation shows BEV gross margins improved from 3% for 2Q23 up to 9% for 3Q23:

Volvo Car Group BEV margins (3Q23 presentation)

My thesis is that the EX30 BEV from Volvo Car is an intriguing new model. It is expected to have gross margins of 15 to 20% and be the first proof point of BEVs reaching cost parity.

At the time of this writing, SEK 1,000 is about $89.51.

The Numbers

One of the reasons customers should be excited about the new EX30 BEV model is because Volvo Car Group has a history of taking electrification seriously with their XC40 BEVs and their C40 BEVs. The 3Q23 report breaks down sales by model type and we see the XC40 BEV jumped from 6,500 units in 3Q22 up to 14,500 units for 3Q23 while the C40 BEV increased from 3,700 units in 3Q22 up to 6,900 units for 3Q23:

Volvo Car Group retail sales by model (3Q23 report)

I like to visualize the above numbers in a tree map graph where we see the importance of the two existing BEV models on the right:

Volvo BEVs – XC40 and C40 (Author’s spreadsheet)

The new EX30 SUV BEV was revealed in June and pre-orders have been higher than expected. Per ArenaEV, this small SUV uses the sustainable experience architecture (“SEA”) platform from Geely (OTCPK:GELYY) which is the same as the Zeekr X and the Smart #1 from Mercedes (OTCPK:MBGAF). The EX30 model has already won several industry awards and production started in 3Q23 with the first deliveries expected in 4Q23. Production and deliveries will ramp up in 2024 per the 3Q23 report (emphasis added):

We announced our plan to expand production of the EX30 and also build it at our Ghent plant in Belgium from 2025. This decision reflects the strong demand for the EX30, supports our strategy to produce where we sell, and boosts production capacity for the car in Europe as well as for global export. It has indeed proven to be a small car with a big opportunity and has already won several industry awards.

Valuation

One area of concern from a valuation standpoint is the fact that management keeps saying BEVs are the future yet the number of BEVs sold fell from 1Q23 to 2Q23 and again from 2Q23 to 3Q23 per the 3Q23 report:

Volvo Cars Recharge sales (3Q23 report)

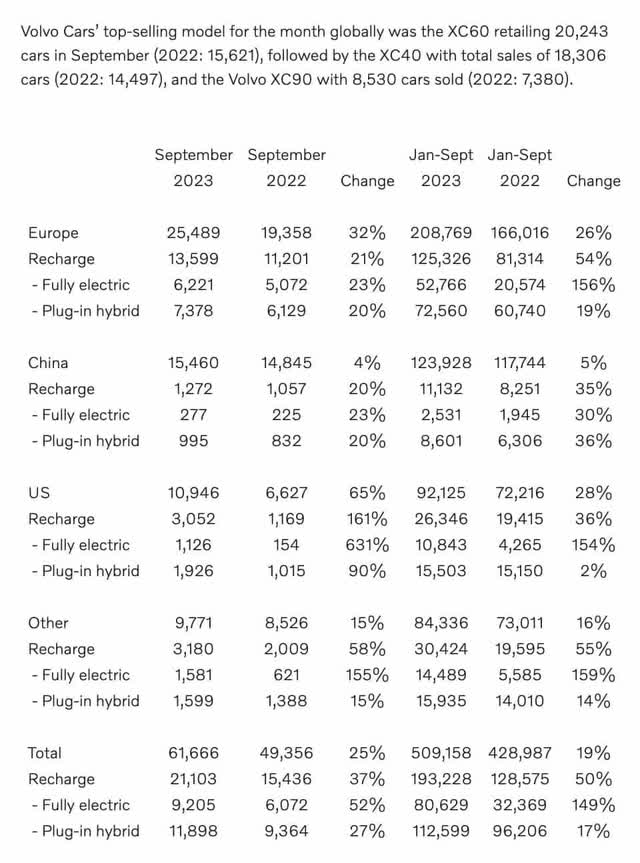

In the 3Q23 livestream, management said BEV units should pop back up with new models but we know the EX30 won’t be widely available until 1Q24. Despite the recent slowdown of overall BEV levels, the September release shows BEVs growing nicely in the US. The prodigious US BEV growth of 631% from September 2022 to September 2023 really stands out and I believe the US market will be a big part of Volvo Car Group’s valuation in the future:

Itemized September sales (September release)

Delays with the EX90 BEV hurt Volvo Car’s valuation. Per a July Automotive News article by Urvaksh Karkaria, one area of anxiety with the new EX90 BEV is the lidar system. Deliveries are now expected to be pushed back half a year to 3Q24 because of the complexity of the software code around the lidar system. One has to wonder if Tesla (TSLA) CEO Elon Musk was prescient when he decided to leave this out of their vehicles. The delay is worrisome but Automotive News says the safety benefits are substantial:

Self-driving car sensor startup Luminar Technologies will supply Volvo with its Iris lidar and Sentinel software, which will be integrated with Volvo software in the EX90. The lidar system, which Volvo said can detect pedestrians up to 820 feet away, even at highway speeds, is part of the EX90’s road-monitoring system, which includes cameras, radars and ultrasonic sensors.

“The difference lidar can make for real-life safety is remarkable,” Rowan said earlier. “Research indicates that adding lidar to a car can reduce accidents with severe outcomes by up to 20 percent, and overall crash avoidance can be improved by up to 9 percent.”

Per the 3Q23 livestream, the EX90 should sell well on the East Coast of the US and the West Coast of the US where customers are moving to BEVs faster than in the interior of the country. Per the 3Q23 report, Volvo Car’s facility outside Charleston South Carolina is preparing for production of the new EX90 flagship BEV and the Polestar (PSNY) 3 SUV. An August article from Automotive News talks about the way Volvo Car can counteract the Tariff Act of 1789 with respect to EX30 BEV imports from China (emphasis added):

Volvo plans to use duty drawback – a provision originally from George Washington’s first term and modernized in 2016 – which allows the refunding of tariffs, duties and certain fees on imported merchandise. Under the law’s substitution provision, an export to countries not in the United States-Mexico-Canada Agreement can be matched to an import with the same tariff classification number. And because the drawback program is retroactive, automakers can recoup duties paid on already imported vehicles. Volvo Cars and EV startup Polestar plan to use this provision to recoup the duties and 25 percent tariff on the Chinese-built Volvo EX30 crossover and Polestar 2 sedan using its exports of the U.S.-built EX90 and Polestar 3 crossovers.

Like any company, Volvo Car is worth the amount of cash that can be pulled out from now until judgment day. EBIT gives us a closer approximation to this cash than gross profit and CEO Jim Rowan talks about the way EBIT margins can improve even if gross margins stay at the 20% level. Citing the understanding of key tech components like batteries, motors, inverters and software, CEO Rowan says EBIT margins for BEVs can improve over time. He says Volvo Car already does much of the work themselves with motors and inverters and they’re aiming to take on more responsibilities with batteries as well.

Per the 3Q23 report and the 2022 annual report, trailing twelve month (“TTM”) EBIT excluding share of income in JVs and associates was SEK 22.8 billion or SEK 18.9 billion + SEK 17.9 billion – SEK 14 billion. This comes from TTM revenue of SEK 391.1 billion or SEK 289.9 billion + SEK 330.1 billion – SEK 224.9 billion. TTM EBIT is equivalent to roughly $2 billion and I think this part of the business is worth 6 to 8x this amount which is a range of $12 to $16 billion. In addition to this, Volvo Car owns nearly half of Polestar whose market cap is above $4 billion. Adding this consideration, my valuation range for Volvo Car is about $14 to $18 billion.

The October 31st share price of VLVCY is $6.68 and the ratio for this instrument is 2:1 so we divide the 2,980,681,371 weighted average diluted shares from the 3Q23 report in half and multiply by the share price to arrive at a market cap of $10 billion.

Another way I like to think about valuation is with respect to other companies. Rivian (RIVN) delivered 36,150 BEVs from January to September and their common equity plus convertible debt comes out to a consideration of more than $15 billion. Volvo Car Group sold 80,629 BEVs from January to September and Polestar delivered 41,700 BEVs during the period. If we exclude enterprise value considerations due to Rivian burning through cash then the market is saying Rivian is worth more than 1.5 times as much as Volvo Car Group and this is hard to fathom.

The market cap for Volvo Car is below my valuation range, and I think the stock is a buy for long-term investors.

Forward-looking investors should pay close attention to reviews as EX30 BEV deliveries take place in the months ahead.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here