Note:

I have covered VOXX International Corporation (NASDAQ:VOXX) previously, so investors should view this as an update to my earlier articles on the company.

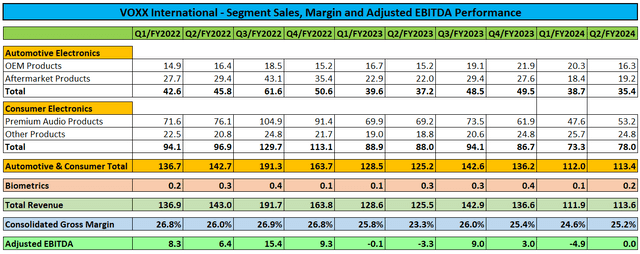

Earlier this week, VOXX International Corporation or “VOXX” reported sequentially improved Q2/FY2024 results with increased gross margins and Adjusted EBITDA back to break-even levels.

Regulatory Filings

For the second half of FY2024, management expects a return to year-over-year revenue growth and profitability:

We saw modest improvements in our business sequentially and expect to generate year-over-year growth and profitability in the second half of our Fiscal year. The extent of our growth will be very much dependent on the state of the car markets, especially now with the UAW strike, as well as consumer spending during the upcoming holiday selling season. To combat market softness, we took significant steps during the quarter to restructure our business and have reduced our operating expenses significantly. We expect restructuring and realignment initiatives to also generate higher gross margins in the second half, with more improvements planned as we move into next year. New products and programs across each of our business segments are driving our optimism, though we remain very conservative in our outlook given the state of the global economies.

During the quarter, the company repurchased 267,831 shares at an average price of $10.67.

Unfortunately, VOXX continues to grapple with a large arbitration award against the company that has been confirmed by the United States District Court in July.

While the company has appealed the decision, I would expect former supplier Seaguard Electronics, LLC (“Seaguard”) to ultimately prevail in the ongoing court proceedings. As of the end of Q2, the company had accrued $46.0 related to the award.

Last month, the court extended the stay of execution on the judgement until October 16 to allow VOXX to file a supersedeas bond in the amount of 52.5 million.

The company ended the quarter with $5.9 million in cash and cash equivalents and $42.8 million in outstanding debt principal under its various credit facilities.

Availability under the company’s up to $165 million asset-backed revolving credit facility amounted to $72.3 million at the end of Q2.

However, the biggest news in Tuesday’s earnings release was the announcement of automotive supplier Gentex Corporation or “Gentex” (GNTX) purchasing a substantial stake in the company from president Beat Kahli (emphasis added by author):

On October 5, 2023, Avalon Park International LLC and Avalon Park Group Holding AG, as Sellers, and Gentex Corporation, as the Purchaser, entered into a Stock Purchase Agreement whereby Mr. Beat Kahli has agreed to sell 50% of APG’s total holdings in VOXX International Corporation in two separate tranches. The first tranche of 1.57 million shares closed on Friday, October 6, 2023 at $10 per share, representing a 32.5% premium to the Company’s current share price as of market close on October 5, 2023.The second tranche of 1.57 million shares is scheduled to close on January 5, 2024 and the stock price will be based on a formula in the Stock Purchase Agreement at (a) a 25% premium if the volume weighted average price (VWAP) for the 20 days prior to the closing is between $7 and $8; or (b) if the 20 day VWAP is at least $8.00 but less than $10, the purchase price will be $10 per share; or (c) if the 20 day VWAP is greater than $10, the purchase price will be the market price.

As noted in its Form 4 filing with the Securities and Exchange Commission on August 21, 2023, Gentex Corporation previously owned 173,808 shares of VOXX International’s Class A Common Stock. With this most recent transaction and the one planned for January 2024, Gentex will own approximately 15.1% of the Company’s total Class A Common Stock Outstanding, becoming one of the Company’s largest shareholders, along with the Company’s Founder and Chairman, John Shalam and the two Avalon Park entities.

On the conference call, management provided additional insights on Gentex’ strategic investment (emphasis added by author):

With Gentex, we have found a great partner as we are collaborating with them in both our Biometric and Automotive segments on current projects, while concurrently looking to drive innovation in our offerings to grow our joint businesses and market share. Steve Downing, who serves as CEO and President of Gentex, also sits on our Board, and this alliance is one that we believe holds great promise for our company and our shareholders.

While I do not expect any near-term impact on the company’s business, VOXX gaining a financially strong strategic investor is certainly good news, particularly when considering the company’s current challenges.

Bottom Line

VOXX International Corporation reported sequentially improved Q2/FY2024 results with management projecting a return to year-over-year revenue growth and profitability for the second half of the company’s fiscal year.

On the flip side, VOXX is unlikely to succeed in its efforts to vacate a material arbitration award against the company which would result in liquidity taking a major hit.

But with leading automotive supplier Gentex Corporation having stepped up to the plate, I am upgrading VOXX International Corporation’s shares from “Sell” to “Hold“.

Read the full article here