W. P. Carey (NYSE:WPC) decision to exit from office seems to be a good move to improve the company’s fundamentals over the long term, while in the short term its shares appear to be undervalued and will continue to be a high-dividend yielder following the dividend cut.

Business Overview

W. P. Carey is a Real Estate Investment Trust (REIT) specialized in investing in single-tenant commercial real estate, in the U.S. and Europe. Its current market value is about $11 billion, being therefore a mid-sized REIT by this measure.

The company was founded in 1973 and nowadays owns a diversified portfolio across real estate, including distribution, retail, industrial facilities, and offices. At the end of last June, WPC’s net lease portfolio consisted of some 1,475 properties, spread across almost 400 tenants, while its self-storage portfolio had 85 properties with more than 52,000 units.

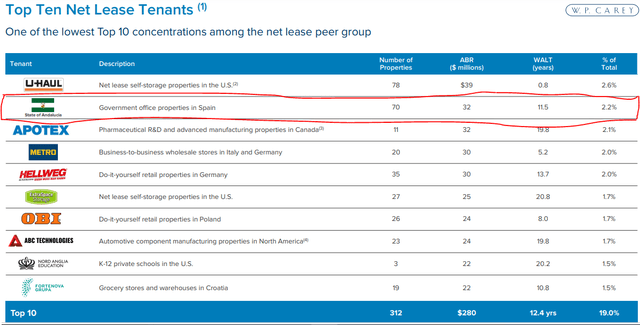

Its net lease portfolio is the company’s most important one, representing annual rental income of nearly $1.5 billion, with revenue being mainly generated in the U.S. (65%) and Europe (34%). Its weighted-average lease term was above eleven years, and its occupancy rate was above 99%, showing that its net lease portfolio has very good quality. The top ten tenants represent some 19% of annual rental income, thus WPC has a very good tenant diversification and is not heavily exposed to any single tenant.

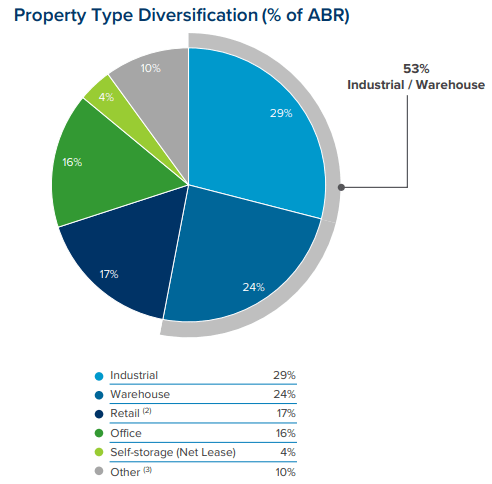

On the other hand, in its self-storage portfolio the occupancy rate is only 91.9%, thus there is significant vacant space that is not being used, even though this is not a big issue given that this segment only accounts for 4% of WPC’s annualized base rent. Its largest segment exposure is to industrial real estate, representing 29% of annualized base rent, followed by warehouses (24%), retail (17%), and office (16%).

Business diversification (WPC)

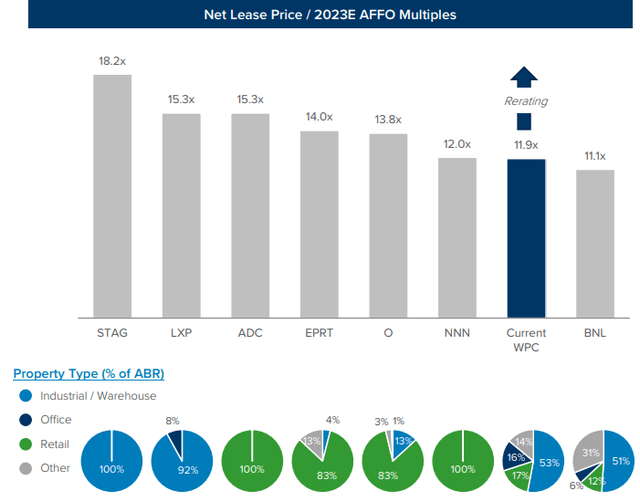

This means that WPC’s business model is somewhat different than most of its peers, given that usually REITs are more focused on just one real estate segment instead of having exposure to several segments.

While from an operational and diversification perspective this business approach can make sense, it can also make some distortions from a valuation perspective.

Regarding the operational perspective, by being exposed to several segments, WPC can withstand better downturns in a specific industry, like offices nowadays or retail during the pandemic, by being exposed to other segment that may be in a better operating momentum.

For instance, during the pandemic retail stores and shopping malls were hit hard by COVID restrictions, while on the other hand the growth of e-commerce was good for logistics assets. Not surprisingly, by being exposed to both retail and warehouses, WPC’s revenues only dropped by 1.9% year-over-year (YoY) in 2020, while its peer Simon Property Group (SPG), which is heavily exposed to shopping malls and retail, posted a revenue drop of 20% in that year and are the business is still recovering from the pandemic hit, as I’ve covered in a recent article.

Another example is Prologis (PLD), which I’ve also covered recently, that is heavily exposed to warehouses and reported a revenue increase of 33% YoY in 2020, showing that the pandemic has a net positive effect on its business, even though its impressive growth was also boosted by some acquisitions.

Nevertheless, what is important to retain here, in my opinion, is that WPC’s business diversification is a positive factor that should, theoretically, enable it to have a recurring revenue and earnings profile over the long term and have lower financial volatility than its pure-play competitors.

Regarding valuation, the fact that WPC’s business is spread across different real estate sub-segments make it harder to value the whole business, especially in a relative value perspective. As the company has several peers for different segments, such as Prologis for warehouses or Realty Income (O) for retail, a peer comparison is trickier than for pure-plays. This can lead to some distortions as the market is likely to trade its shares at a discount to peers, due to added valuation complexity.

Additionally, from an absolute valuation perspective, due to the fact that its business is exposed to several segments with different risk-return profiles and cost of capital, the best approach is to use a sum-of-the-parts valuation and use the discounted cash flow model to value each business as a stand-alone company.

However, this also adds complexity because detailed financial figures for each segment may not be available and it may be hard to estimate the cost of capital for each segment, thus leading to a discounted valuation for the whole company given that, usually, investors and analysts tend to be conservative in their estimates.

Taking this background into account, WPC’s diversification strategy can be a double-edge sword, as it provides it with a better operating profile and stable financial performance over the long term, but it can also lead to undervaluation of its business when compared to the economic value of each segment.

This is a reason why usually large conglomerates and holding companies trade at a discount to its Net Asset Value (NAV), even for companies that only have investments in listed stocks. Acknowledging this backdrop, some companies choose to separate its business into different companies or list a small part of its operating entities, to ‘unlock’ value for the group as a whole.

A good example has been Volkswagen (OTCPK:VWAGY) in Europe, which beyond its main listing at the holding level (Volkswagen AG), has also listed in recent years its Porsche (OTCPK:POAHY) division and the Truck Division, Traton SE (OTCPK:TRATY), to better reflect the value of its assets beyond other business goals.

In WPC’s case, its business diversification and its exposure to offices, that is currently out of favor, has led to a discounted valuation of its shares. To address this issue its management has recently decided to go ahead with a new business strategy, with the company announcing its plan to exit from the office segment.

Office Spin-Off

The office segment is WPC’s fourth-largest, representing some 16% of its annualized base rent, and generally speaking seems to have good quality. Its largest tenant in this segment is the Spanish government, which represents about 2.2% of WPC’s overall annual base rent and has a weighted average lease term (WALT) above 11 years. No other tenant in the office segment is in WPC’s top ten tenants, as shown in the next graph.

Top tenants (WPC)

WPC’s strategy has been for many years to reduce its exposure to the office segment, which represented some 30% of its annual base rent back in 2015, as the company acknowledged that the outlook for this segment was not the best one. The pandemic only accelerated this trend, with the shift to remote work being another negative factor impacting greatly the office market.

The supply-demand situation in the office market is clearly not balanced, with supply currently exceeding demand both in the U.S. and Europe, leading to lower rents, higher vacancy (16.4% in the U.S. in Q2 2023), and consequently declining property valuations for this segment. The rising interest rate environment over the past eighteen months only adds more fuel to the fire, and the outlook for the office market is clearly negative and is not expected to change much over the coming years.

This happens because it’s difficult to overhaul office buildings to another use, for example residential units, thus it’s expected that vacancy rates will continue to increase in the office segment and new construction is likely to remain low until the market balances, which will certainly be a slow process that will take many years.

Taking into account this background, WPC has decided to exit the office segment by spinning-off the majority of its office portfolio into a listed REIT, to be called Net Lease Office Properties (NLOP), and to sell the remaining office properties that will remain on WPC’s balance sheet.

NLOP will have 59 net lease office properties and will be externally managed by WPC, aiming to generate value by its operating its existing assets and perform dispositions over time to repay debt and return capital to shareholders. Regarding the European office portfolio, WPC expects to sell it mostly until the end of this year and the Spanish office portfolio in January 2024.

This spin-off does not require shareholder approval and WPC is expected to close it by the beginning of next November, which means its full exit from the office segment is expected to be completed over the next three months and generate proceeds of some $800 million.

Current WPC’s shareholders will receive one NLOP share for each 15 shares currently owned, and from a valuation perspective, this should be relatively neutral assuming that the transaction and asset sales are performed close to WPC’s book value.

For WPC shareholders, they will receive new NLOP shares if they hold their current shares until next October 19, 2023, even if they don’t want to have exposure to a pure-play office REIT. Beyond that, WPC also had a strong dividend history, and following this transaction, it will cut its dividend to reflect its new dividend policy. Not surprisingly, investors reacted badly to these news, as investors got stuck into a new office REIT if they don’t decide to sell and WPC will perform a dividend cut in the short term, which is usually badly received by income investors.

Share price performance (Seeking Alpha)

Nonetheless, WPC’s business profile following this office spin-off is stronger in my opinion, as the company will be more exposed to industrial, warehouse, and retail assets, which have much stronger growth prospects over the medium to long term.

While WPC’s office portfolio have a good quality, this could turn to be problematic in the near future as the office market is expected to remain soft, and it’s also a positive step in streamlining WPC’s business profile and, eventually, lead to a higher valuation.

Regarding its dividend, WPC’s current quarterly dividend is $1.071 per share, or $4.28 annually, which was raised just before the company announced the office spin-off. Following the spin-off, WPC’s dividend policy is to distribute 70-75% of its Adjusted Funds From Operation (AFFO), which is expected to decline from $5.30 in 2023 to some $5.16 in 2024, according to analysts’ estimates.

This means its dividend is expected to be cut to $3.61-3.87 per share following the office spin-off, or a cut of 12.6% at the mid-point of its dividend range. As new NLOP share will be received as a ‘dividend’, WPC’s share price will decline to reflect this, thus following the office spin-off its share price should drop to about $51 per share, leading to a forward dividend yield reflecting its new dividend policy of about 7.3%.

This high-dividend yield is quite good for income investors as the company’s fundamentals will be stronger following the office spin-off, plus its leverage position is expected to remain good given that its net debt-to-EBITDA is expected to be in the mid to high 5 ratio, thus its dividend seems to be sustainable due to WPC’s conservative payout ratio and good financial flexibility.

Conclusion

W.P. Carey decision to exit its office segment was not well received by the market, but this seems to make sense both from an operational and valuation perspective. While income investors aren’t surely pleased with the dividend cut or having exposure to a pure-play office REIT, WPC will become a stronger company with a better long-term growth profile, which makes sensible its management’s decision to exit office.

Moreover, WPC is currently trading at a cheap valuation at some 11x FFO, much lower than its historical average of 15.6x over the past five years, and also at a significant discount to some of its peers, as shown in the next graph.

Valuation (WPC)

Therefore, following the office spin-off, WPC seems to be an interesting income and value play within the REIT sector, and personally I will add its shares to my income portfolio over the next few weeks.

Read the full article here