Co-authored with “Hidden Opportunities.”

Cash flow is a terminology that symbolizes the movement of money in and out of an entity. The entity can be a person or a company, the concept still holds. Positive cash flow occurs when the total cash inflow exceeds the total cash outflows. This is desired as it allows for coverage of expenses, and some savings, allowing for investing for future needs.

When we talk about expenses, the items mentioned include basics – food, clothing, shelter, healthcare, and lifestyle enhancements – entertainment, travel, and recreation. Investors should note that inflation and taxes are legitimate expenses that are often missed in the planning. Your income stream must be cash flow positive after all these expenses.

Short-term treasuries are extremely popular in the current market. These provide a false sense of cash flow because the investment constantly faces a losing battle against inflation.

“You are going to be exposed to inflation any time you lock your money up in a fixed-rate investment,” – Michael Foguth, founder of Foguth Financial Group.

When inflation is above-average, your yield must also be above-average. Short-term Treasuries, currently yielding about 5%, might provide temporary shelter, but their attractiveness will disappear once the Fed stops raising rates. And there are many big dividend-payers to choose from, with several raising payments in these uncertain markets.

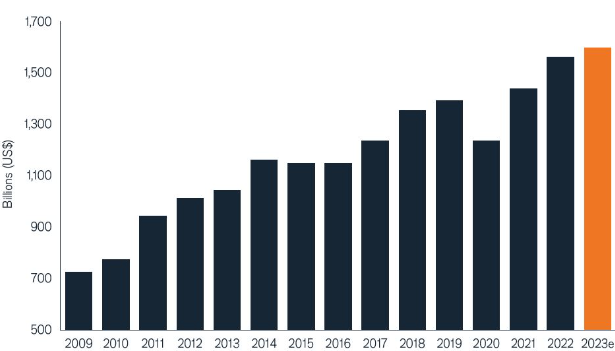

“Wake up and smell the roses / coffee” is an informal phrase used to help someone realize the truth about the situation or become aware of what is really happening. Global dividends set records in the 2022 bear market, and experts expect payments to edge higher in 2023. Source.

JanusHenderson

The best part is that many companies are significantly undervalued and present excellent long-term income opportunities. Let us examine two in more detail.

Pick #1: RNP – Yield 8.5%

Fixed-income securities (notably preferred stocks) and Real Estate Investment Trusts (“REIT”) have been most affected by the “interest rate risk,” a phenomenon where market rates adversely impact current earnings, future earnings or capital values.

Preferred stocks: While their trading prices experience volatility, dropping prices don’t indicate income risk or risk or loss of capital. When rates are lower, stronger issuers could redeem them at par value and reissue new preferreds at favorable coupons. It is rare to find investments that possess the combined virtues of manageable risk, rock-bottom prices, and good prospects for capital upside, all with high dividend yields. When the superfecta presents itself, we pounce!

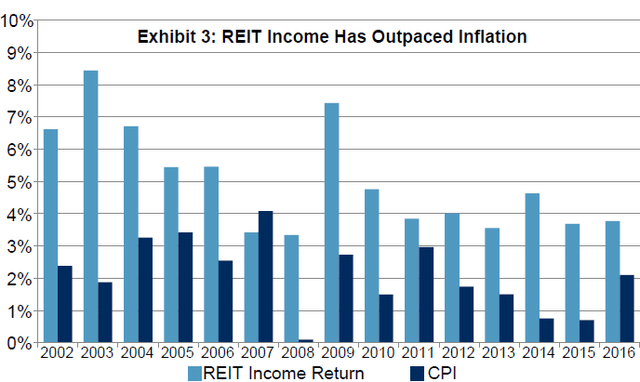

REITs: Believe it or not, REITs are one of the most robust industries when it comes to weathering the effects of inflation. They successfully produced inflation-beating income through bull and bear markets. Source.

S&P Global

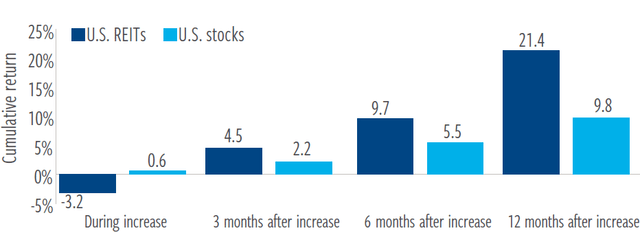

REITs with long-term lease agreements carry CPI escalators to raise rents regularly. Those with short leases can increase rents for new tenants. For REITs, rents matter more than interest rates, and history tells us that the U.S. REITs, despite temporary underperformance in the aftermath of rate increases, achieve equity-beating performance after the end of the rate cycle. Source.

Cohen and Steers

Cohen & Steers REIT & Preferred Income Fund (RNP) presents a unique combination of these two sectors that are poised to pay investors handsomely to wait for a substantial upside when we see the other side of the rate cycle.

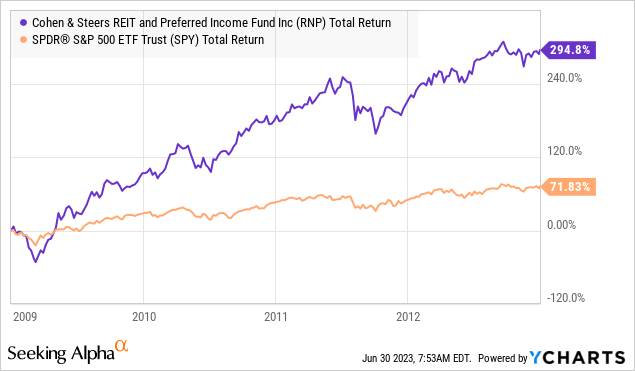

Don’t believe me? Let us examine the recovery years after the Great Financial Crisis. RNP blew the S&P 500 (SP500) out of the water while paying its shareholders a healthy waiting fee.

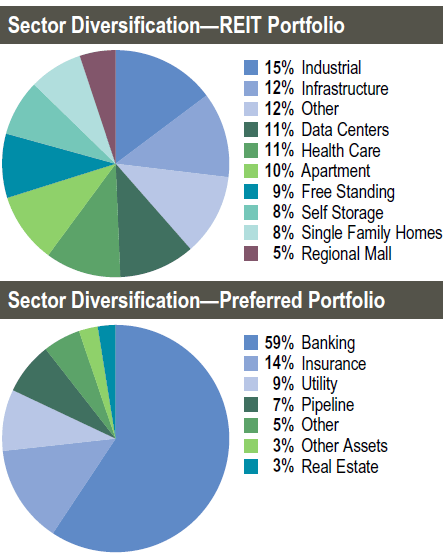

As of March 2023, RNP has a 51% fixed income and a 49% REIT equity allocation, the most beaten-up sectors of the market today. Source.

RNP March Fact Sheet

The closed-end fund (“CEF”) is diversified across 305 holdings, with some of the largest and dominant REITs representing ~31% of the fund.

RNP March Fact Sheet

RNP trades at a ~5% discount to NAV, presenting a meaningful opportunity to buy or add to your position. This monthly distribution payer yields 8.5% annualized. RNP is modestly leveraged at 32%, but 81% of its debt is fixed with a weighted average interest rate of 2.1% and a weighted average term of 3.3 years. RNP’s net debt has a 2.8% weighted average cost of financing.

RNP’s REIT-preferred dynamic duo makes it an income powerhouse. The exposure to REITs makes it a strong defense against long-term inflation, and its composition of preferreds increases its income stability and safety. RNP at current prices, sector discount, and yield levels makes an excellent fit for our rate-agnostic strategy.

Pick #2: ESGR Preferred Shares – Up to 7.7% Yields

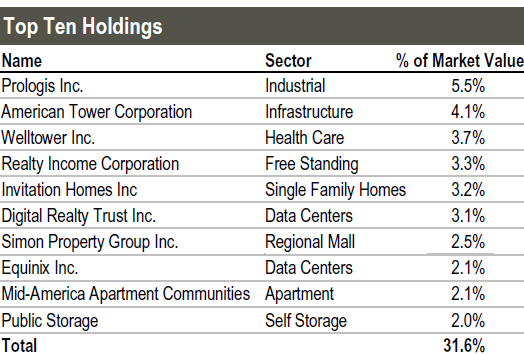

Enstar Group Limited (ESGR) is a specialty insurance company headquartered in Bermuda. ESGR is a global leader in run-off insurance, a policy provision that covers claims made against companies that have been acquired, merged, or ceased operations.

ESGR dominates the run-off insurance segment, with over 117 deals made since its inception. While ESGR does not pay dividends, the company reinvests its profits toward long-term growth. Its common stock has gained 2,300% since its IPO in 1997.

ESGR is rapidly growing, with an impressive 15.7% CAGR in its book value. The company ended FY 2022 with an estimated solvency capital ratio above 200%. Moreover, ESGR ended Q1 2023 with $828 million in cash and cash equivalents. Overall, the insurance firm is comfortable in terms of liquidity and capital resources.

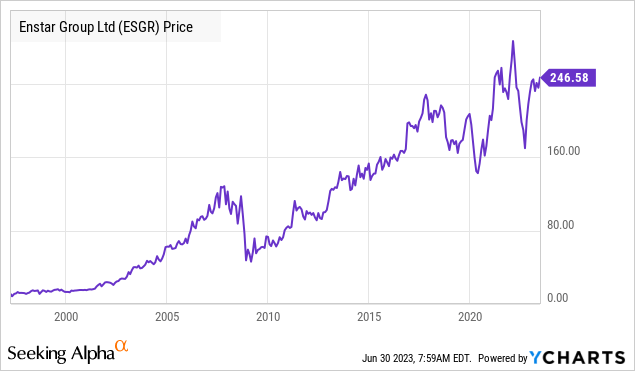

ESGR secured a long-term issuer rating of BBB+ from Fitch and maintained an average investment portfolio rating of A+ as of December 2022. Well-managed insurance firms are benefiting from higher interest rates as they don’t have to take much risk to achieve returns from the insurance float. The insurance firm is also very comfortable with its borrowings, with $1.8 billion in fixed-rate debt with staggered maturities and none due until 2029. It is safe to say that ESGR won’t have any difficulty navigating the hawkish Fed policies.

Data Source: ESGR 10-Q

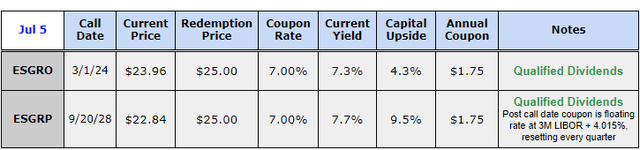

ESGR has two public preferred securities that present compelling bargains at this time. Both preferreds pay qualified dividends, providing favorable taxation for U.S.-based investors, and are rated investment-grade “BBB-” by Fitch as of March 2023.

Author’s Calculations

ESGRP is a rate-reset preferred that presents an impressive 7.7% current yield and 9% upside to par. The coupon floats at 3-month SOFR + 0.26% + 4.015% after September 2028, resetting every quarter. The adjustment has been made since LIBOR has been decommissioned and was replaced with SOFR.

ESGR repurchased $341 million worth of common stock as of March 2023, demonstrating its commitment to generate value for shareholders. During Q1, ESGR reported $424 million in net earnings attributed to common shareholders and spent $9 million on preferred dividends. ESGR spends $36 million annually on preferred dividends, a sum that was comfortably covered in FY 2022 through $257 million in net cash from operating activities.

ESGR preferreds present attractive income opportunities with lower risk to investors. This fearful market lets you lock in a qualified +7% yield from a global leader in a highly specialized and vital insurance segment.

Conclusion

When running a business, would you be ok if your employees sit idle or do just the bare minimum in their respective roles? It is unacceptable, right?

I feel the same about my investments. I need my capital to work hard; savings accounts and government-guaranteed instruments don’t cut it.

“How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” – Robert G. Allen, author of several Best-Selling finance books.

Guaranteed investments may provide the “fake comfort” of safe returns, but these give rise to negative cash flow after accounting for taxes and inflation, two very relevant expenses that we are stuck with till death do us part. If you are hiding from the bear market in money market funds, I encourage you to wake up and smell the cash flow.

If you smell insufficiency, your retirement planning just hit a brick wall, and you need to pivot before the Fed does. We are buying dividends with both hands while they are cheap.

Read the full article here