Listen below or on the go on Apple Podcasts and Spotify

Canada to subsidize Stellantis (STLA) battery plant with up to C$15B in incentives (00:32). Will June nonfarm payrolls cool enough for Fed’s liking? (01:53) PDD Holdings (PDD) sinks even as popular Temu shopping app expands abroad (03:02).

This is an abridged transcript of the podcast.

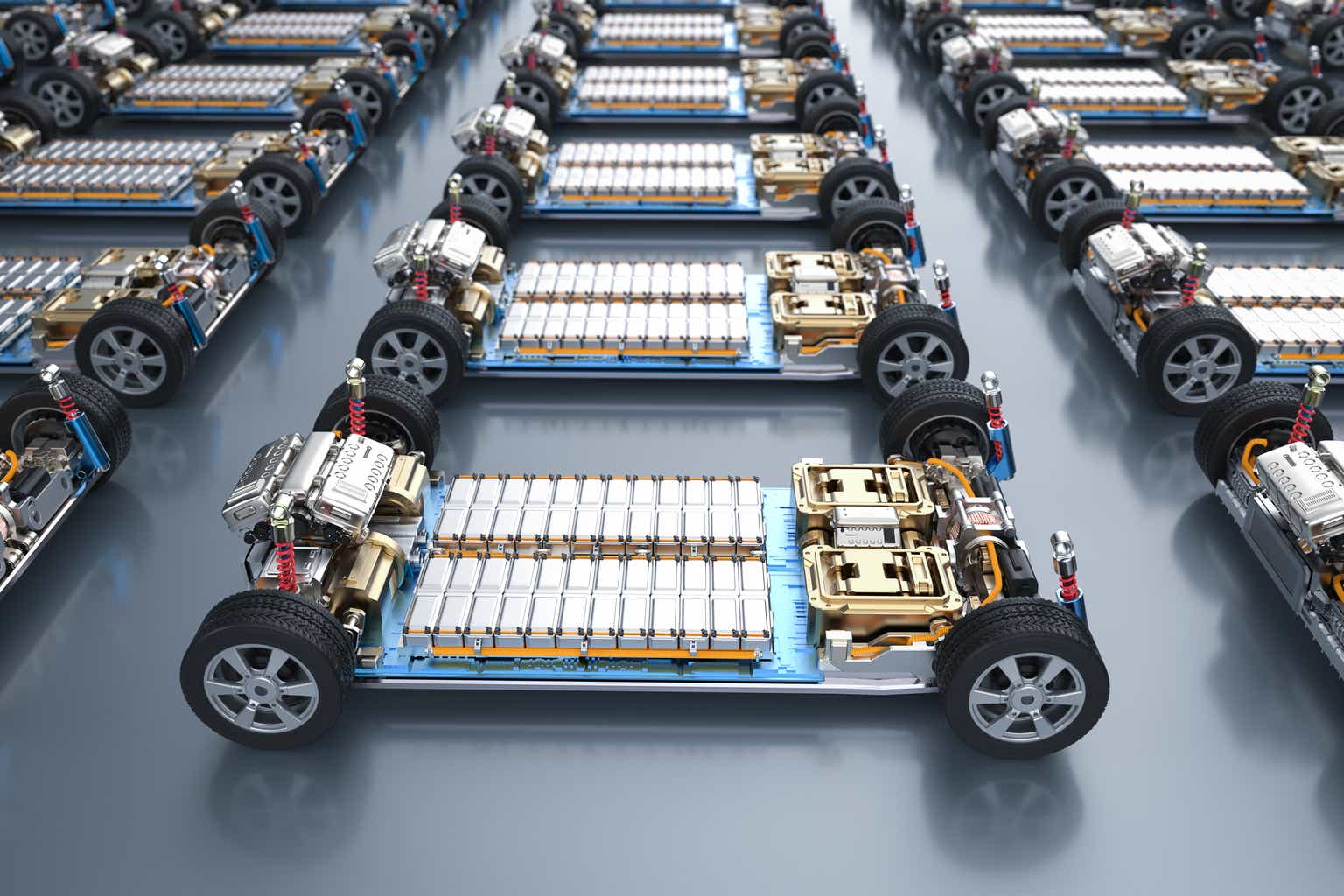

Canada’s government said Thursday it agreed to dole out as much as C$15B (~US$11.3B) in incentives to Stellantis (NYSE:STLA) for an electric vehicle battery plant.

This tops the C$13B in state aid previously offered to Volkswagen (OTCPK:VWAGY) for a similar plant.

According to Bloomberg, the Candaian government initially offered C$1B to Stellantis for capital costs.

The deal ended a standoff that began in May when the automaker stopped construction on the project.

They were demanding that Canada match support available in the U.S. under the Inflation Reduction Act.

The Stellantis (STLA) plant is being built in partnership with South Korea’s LG Energy. It will be located in Ontario.

Production at the Stellantis (STLA) plant is expected to begin in 2024, creating ~2,500 new jobs and targeting an annual production capacity of more than 45 GWh.

The deal’s performance incentives are contingent on and proportionate to the production and sale of batteries from each project, and could be canceled or reduced if incentives offered under the U.S. IRA are reduced or canceled.

Thursday on Wall Street lunch, our host Kim Khan told you about a hot jobs report from ADP for the private sector.

Well today we’re expecting numbers from the Department of Labor. The U.S. economy is expected to add fewer jobs in June vs. May but still stay at a relatively strong level.

Economists expect that 225K jobs were added in June, down from the 339K increase in May, and trailing the six-month average of 314K. For some context, May’s figure represented the second-strongest month for job creation so far this year.

Fed chief Jerome Powell made plain last month that the central bank’s inflation fight has yet to be resolved, as “this economy is very strong, and what’s driving it is a very strong labor market.”

Aside from the lingering labor shortage, the Fed will also keep an eye on wage growth. Average hourly earnings are expected to rise 0.3% M/M in June, unchanged from the prior month. On a Y/Y basis, AHE is seen ticking down to 4.2% from 4.3%.

PDD Holdings (NASDAQ:PDD) shares fell 5.78% on Thursday even as the company’s popular shopping app, Temu, confirmed its expansion plans.

Temu is now available in Japan, its first Asian country.

The popular app which is often among the top three apps on the App Store, is now available in 22 countries, including the U.S., where it launched this past September.

Temu, which bills itself as a place where its users can “shop like a billionaire,” sells low cost goods, including jewelry, home goods, pet care and more. Discounts on the platform can in some cases, reach 90%.

Several other U.S.-listed Chinese tech stocks were lower on Thursday including Alibaba (BABA), Baidu (BIDU) and Tencent (OTCPK:TCEHY).

Last month, it was reported that PDD-owned Temu was looking into hiring a compliance officer based in the U.S., following scrutiny by lawmakers over alleged lax practices, among other things.

Other headlines to look out for on Seeking Alpha:

Twitter threatens to sue Meta Platforms over Threads launch

Mallinckrodt delays $200M settlement payment again as it mulls bankruptcy

Biogen, Eisai win full FDA approval for Alzheimer’s drug Leqembi

Sandal maker Birkenstock looking at potential U.S. IPO – report

Tesla sacks some battery workers at Shanghai factory – report

On our catalyst watch for the day, Shareholders with GasLog Partners (GLOP) will vote on the acquisition offer from GasLog Ltd. to acquire all outstanding common units of the partnership it does not already own for $8.65 per unit. GasLog Partners ended Thursday’s trading at $8.64.

U.S. stocks on Thursday ended solidly lower, weighed down by a combination of rate concerns and mixed economic data on the jobs market.

The Nasdaq (COMP.IND) retreated 0.82% while the S&P 500 (SP500) fell 0.79% and the Dow (DJI) slipped 1.07%.

All 11 S&P sectors ended trading in the red, led by a nearly 2.5% drop in Energy, after crude oil prices dropped on demand concerns. Materials extended their losses from the day before after news that China was curbing exports of gallium and germanium, both used in chipmaking.

Treasury yields spiked as investors upped their bets that the Federal Reserve would have to further hike rates. The 10-year yield (US10Y) was up 9 basis points to 4.04% while the 2-year yield (US2Y) was up 4 basis points to 4.99%.

Now let’s take a look at the markets as of 6 am. Ahead of the opening bell today, Dow, S&P and Nasdaq futures are pointing lower. The Dow is down 0.08%, the S&P 500 is down 0.04% and the Nasdaq is down 0.1%. Crude oil is up 0.7% at more than $72 a barrel. Bitcoin is down 3.5% and is back below 31,000.

In the world markets, the FTSE 100 is down 0.4% and the DAX is up 0.15%.

On today’s economic calendar, at 830am the jobs report.

Read the full article here