Listen on the go! Subscribe to Wall Street Breakfast on Apple Podcasts and Spotify

This is an abridged transcript of the podcast.

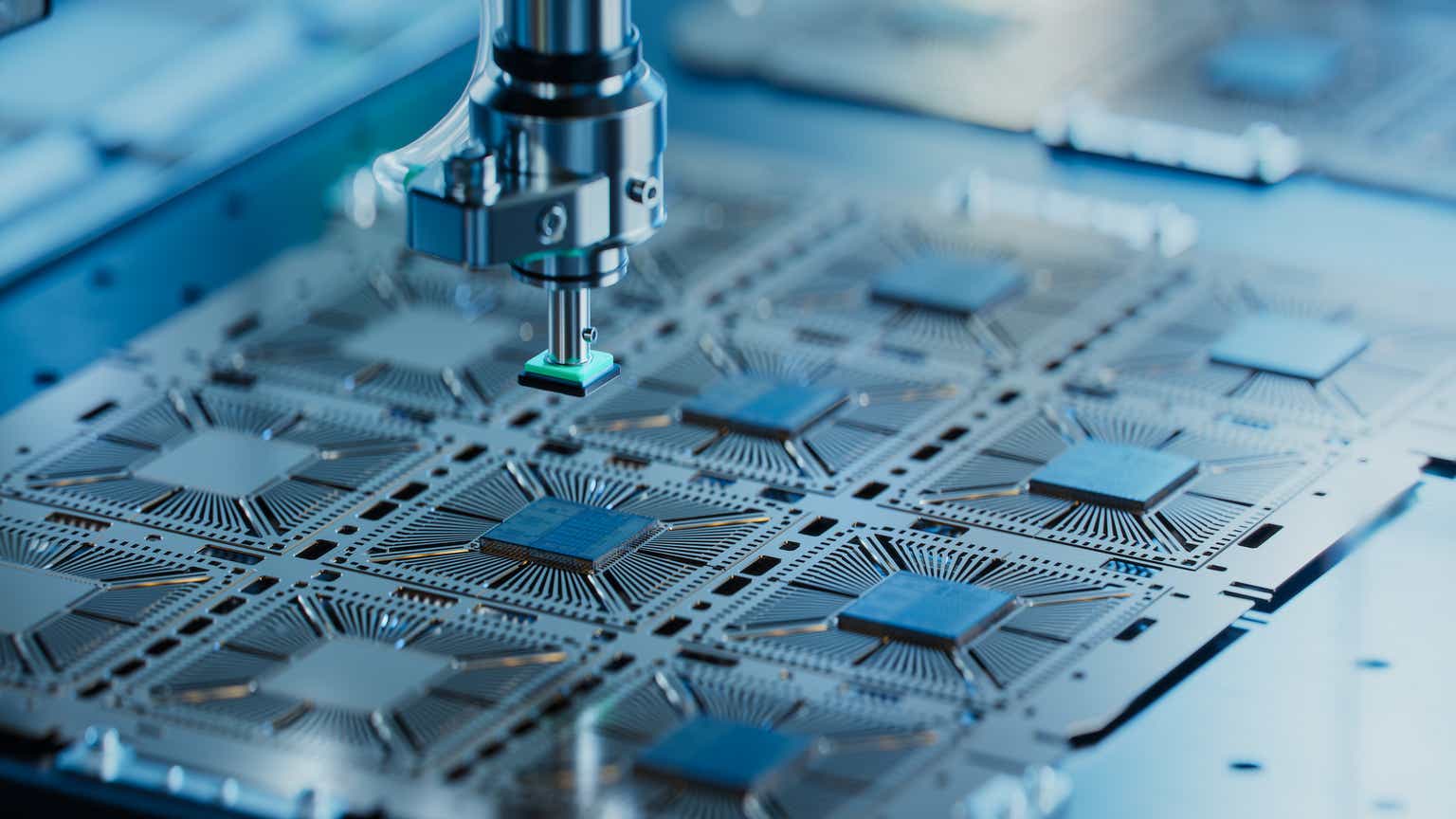

The U.S. Commerce Department says it’s expanding the eligibility for companies to receive funds from the U.S. CHIPs Act. It will now include those that make semiconductor equipment and chemicals used for chip making.

Secretary of Commerce Gina Raimondo said “the CHIPS and Science Act is a historic opportunity to ensure our microchip supply chain resilience.”

The eligibility, which had previously been available only for companies such as Intel (INTC) and Taiwan Semi (TSM), opens the fund to companies such as Applied Materials (AMAT), Lam Research (LRCX) and others.

The Commerce Department says nearly 400 companies are interested in receiving funding from the CHIPs Act.

Also in tech, the CEOs of Apple (AAPL), Google (GOOG) (GOOGL), AMD (AMD) and several other technology companies are slated to meet with President Biden to discuss, among other things, AI.

The tech execs are also scheduled to discuss manufacturing and innovation, the White House said.

In April, the Biden Administration laid out a formal request for comment to look into potential regulation for AI products and services.

Now, here’s a look at how trading is shaping up:

Stocks are moving lower, with growth lagging again despite a drop in rates. The S&P (SP500) is down more than half a percent, with the Nasdaq (COMP.IND) off more than 1%. The Dow (DJI) is faring better.

The 10-year Treasury yield (US10Y) is down to 3.73%.

An unexpected decline in the June manufacturing PMI is underscoring concerns about that vulnerable area of the economy. With continued manufacturing weakness a soft landing will be tough to orchestrate.

Oil (CL1:COM) is lower, but gold (XAUUSD:CUR) and bitcoin (BTC-USD) are higher.

Among stocks to watch, C3.ai (AI) is slumping after Deutsche Bank reiterated its Sell rating on the stock following the investor meeting. Analyst Brad Zelnick said the event “left a lot to be desired” as there were no details on financials, “limited” updates on the company’s operations and noted investors did not really attend the event.

GSK (GSK) gained some ground after the company reached a settlement in the U.S. for the first time over a lawsuit alleging that its discontinued heartburn medication Zantac causes cancer.

Smith & Wesson (SWBI) is increasing its dividend by 20%. The gunmaker also announced Q4 numbers that came in above expectations.

Other news of note, Cathie Wood’s ARK Investment scooped up more than 500,000 shares of Robinhood (HOOD) across three of its ETFs on Thursday, the same day that Robinhood agreed to acquire a company that will add a credit card to its business.

In the wake of the agreement to purchase X1 for an expected $95M, Robinhood shares dropped more than 3%, allowing Wood to buy on the dip.

Billionaire investor Ron Baron is bullish on Krispy Kreme (DNUT). Baron says he has purchased shares this past year, paying on average $14 or $15 per share.

Baron, well known for his Tesla (TSLA) investment, said on CNBC he sees the opportunity for Krispy Kreme to add an additional $2 billion in revenue for the stands it opens within retail stores like Walmart.

As of the end of March, Baron Capital owned 4.66 million shares of Krispy Kreme.

In the Wall Street Research Corner:

Hedge funds are starting to position for downside risk in U.S. stocks, adding to evidence that positioning is no longer a tailwind for equities, according to Goldman Sachs.

Hedge funds have net sold US equities in 9 of the past 10 trading sessions, driven by long-and-short sales at a ratio of 1.8 to 1.

Goldman says in cumulative notional terms, the recent bout of net selling in US equities is the largest over any 10-day period in the past year and ranks in the 99th percentile in the past five years.

Now, Goldman’s hedge fund prime book is Underweight North America vs. the MSCI world index by -5%, the most on record.

Meanwhile, Goldman’s equity team has noted a rebound in S&P return on equity after four quarters of declines.

Goldman rebalanced its ROE portfolio, with 25 new names entering the 50-stock basket.

New stocks include Meta (META), Humana (HUM), GE (GE) and F5 (FFIV).

Read the full article here