Stay informed with free updates

Simply sign up to the Technology sector myFT Digest — delivered directly to your inbox.

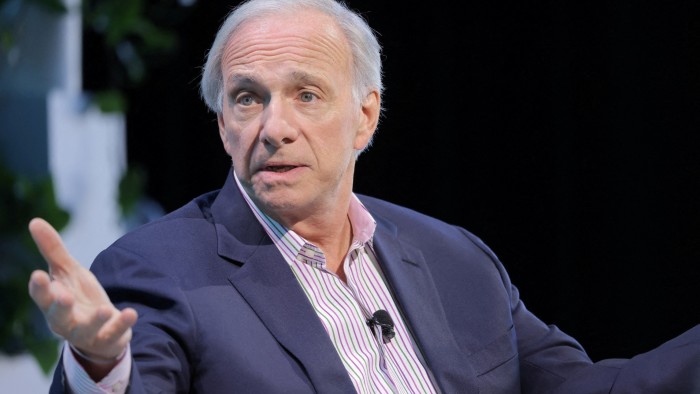

Investor exuberance over artificial intelligence has fuelled a “bubble” in US stocks that resembles the build-up to the dotcom bust at the turn of the millennium, billionaire investor Ray Dalio has warned.

Dalio told the Financial Times that “pricing has got to levels which are high at the same time as there’s an interest rate risk, and that combination could prick the bubble”.

The warning from Dalio, the founder of hedge fund Bridgewater Associates and one of the highest-profile figures on Wall Street, comes as concerns swirl over whether the boom in US AI stocks has gone too far. Investors also remain concerned about elevated borrowing costs, worries that sharpened after Federal Reserve officials in December trimmed their expectations for rate cuts this year.

“Where we are in the cycle right now is very similar to where we were between 1998 or 1999,” Dalio said. “In other words, there’s a major new technology that certainly will change the world and be successful. But some people are confusing that with the investments being successful.”

The late 1990s saw a run-up in tech valuations, powered in part by low interest rates and growing adoption of the internet, followed by a brutal correction that came as Alan Greenspan’s Fed tightened monetary policy.

The tech-heavy Nasdaq 100 index doubled in 1999, only to fall about 80 per cent by October 2002. The index has doubled since the beginning of 2023 as stocks such as AI-focused chipmaker Nvidia have powered higher.

Wall Street stocks slumped on Monday after DeepSeek, a Chinese AI company linked to a little-known hedge fund, published a paper claiming its newest AI model rivals those of OpenAI and Meta Platforms in performance, yet at a lower cost and with less sophisticated hardware. Nvidia shed nearly $600bn in market value on Monday.

DeepSeek’s apparent success calls into question the potential returns on hundreds of billions of dollars invested by Silicon Valley companies in AI data centres, and whether China has managed to find a way to compete despite restrictions on its ability to import high-end chips from the US.

OpenAI, backed by Microsoft, last week announced a plan to invest up to $500bn in AI infrastructure. The company’s ChatGPT was the top-rated free app on the Apple app store until it was displaced on Monday by DeepSeek’s AI assistant.

Dalio, who retired as chair of Bridgewater in 2021 but remains on the board, has long advocated economic engagement with China. He wrote last year that “the key question isn’t whether or not I should invest in China so much as how much”. He warned, however, that the stakes in AI are unusually high.

“The tech war between China and the US is far more important than profitability, not only for economic superiority, but for military superiority,” he told the FT.

“Those who are going to pay attention to profitability with sharp pencils are not going to win that race,” Dalio added.

Reinforcing the elusiveness of AI profit, OpenAI founder Sam Altman wrote on X this month that the company was losing money on its $200-per-month ChatGPT Pro plan because of unexpectedly heavy usage.

As US technology groups invest lavishly, President Donald Trump has pledged to support American AI in his second term.

China has offered financial assistance for its AI industry, including the launch of funds set up to support its embattled semiconductor industry. Meanwhile the US under former president Joe Biden extended billions of dollars of subsidies for groups to build chips on American soil.

Dalio conceded that state support for jockeying AI developers was inevitable given the importance of winning the global race, even it if came at the expense of profit.

“In our system, by and large, we are moving to a more industrial-complex- type of policy in which there is going to be government-mandated and government-influenced activity, because it is so important.”

“Capitalism alone — the profit motive alone — cannot win this battle.”

Read the full article here