I upgraded Warner Bros. Discovery, Inc., or Warner (NASDAQ:WBD) stock in late May, urging investors that it was time to “catch the falling knife.” That thesis played out remarkably well, as WBD bottomed out in early June 2023 before staging a spectacular reversal through its early August highs, up nearly 36% from its June lows.

As such, I consider the thesis as having played out accordingly. However, sellers returned in early August, knocking back the early summer optimism, as WBD fell steeply through last week, crumbling toward its early June lows.

With WBD back close to where I initiated my previous May article, I assessed it’s timely to update investors on whether the current levels are appropriate to buy more shares.

Warner reported its second-quarter or FQ2 earnings release in early August. Incidentally, WBD topped out at the week of Warner’s earnings release as investors reassessed the company’s opportunities in the second half.

Management updated that the advertising market was still underperforming, even though the company expects a second-half outlook. In addition, the company’s Studio segment is expected to improve, bolstered by the blockbuster release of Barbie recently. In addition, while the sequential subscriber loss in Warner’s direct-to-consumer or DTC wasn’t welcome, it should normalize moving ahead. Keen investors should recall that the company recently combined Discovery+ and HBO Max, resulting in a subscriber overlap between the services.

Notably, the company sees potential in its revamped Max streaming service as a launchpad in global markets. As such, the monetization opportunities for DTC are still expected to be in the earlier stages, as it reached approximately breakeven terms in adjusted EBITDA in the first half.

Therefore, considering the secular decline in its Networks business, it should provide investors with a more assured profitability ramp as the company channels its resources to underpin its DTC growth driver.

I believe the significant volatility in WBD last week could have been linked to the negotiations between Charter (CHTR) and Disney (DIS). The leading cable provider and the House of Mickey Mouse are engaged in a bitter dispute about content distribution and pricing. As such, Charter subscribers face the blackout of Disney’s content, as the company staked its negotiation as fundamental to the future of cable TV. As such, I believe the market is pricing in the potential of further disagreements in the Networks business that could also affect Disney and its peers, such as Warner.

However, I assessed that Warner’s management isn’t blindsided by such a potential standoff as TV continues its secular decline. It’s widely known and acknowledged that the future of the industry is moving into streaming. Despite that, significant profits in the Networks segment are at risk, hobbled by the ongoing writers’ and actors’ strikes.

As such, it has increased the execution risks for the company, even though management highlighted its confidence in achieving its $5B cost synergies target. Furthermore, Warner telegraphed its confidence in posting $1.7B in free cash flow or FCF for Q3 (broadly in line with Q2), suggesting it continues generating substantial FCF.

Notwithstanding its confidence, the company’s Monday morning (September 5) filing indicating that the ongoing strikes are expected to impact its adjusted EBITDA guidance by about $400M at the midpoint could cause near-term volatility. Despite that, it updated more robust FCF estimates against its previous $1.7B outlook for Q3, given Barbie’s breathtaking performance. As such, it anticipates full-year FCF of “at least” $5B, mitigating the impact on its lowered adjusted EBITDA outlook.

Moreover, I assessed that the market has already de-rated WBD’s valuation downward to reflect these significant headwinds, as the market is forward-looking. Seeking Alpha Quant’s “B+” valuation grade underscores my conviction. Notwithstanding the attractive valuation, it’s critical to observe robust buying support, suggesting investors don’t view WBD as a value trap, which could lead to a downward negative spiral.

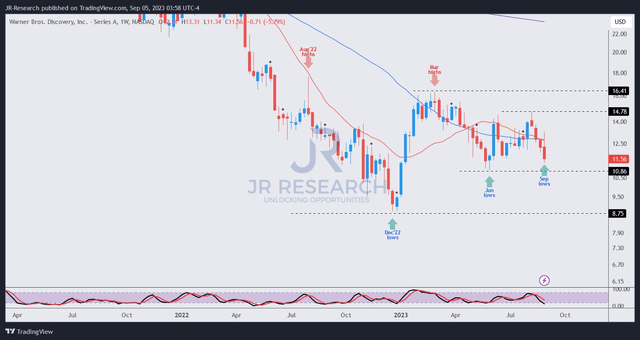

WBD price chart (weekly) (TradingView)

As seen above, WBD topped out in early August, falling steeply over the next three weeks and potentially re-testing its June lows.

I have yet to assess a validated bullish reversal at the current levels. As such, selling pressure could intensify over the next few weeks, forcing WBD down further before buyers are expected to return.

Despite that, I expect WBD’s June lows to hold robustly, corroborating that the worst (October 2022 lows) is likely over. However, there isn’t a sustained uptrend bias, suggesting WBD could continue consolidating in a range moving ahead. As such, investors should avoid adding on momentum surges but add on steep pullbacks close to a robust support level that could attract strong buying support.

More conservative investors can wait for a constructive potential re-test first. However, I believe the risk/reward remains favorable at the current levels for me to maintain my bullish thesis.

Rating: Maintain Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here