Investment Thesis

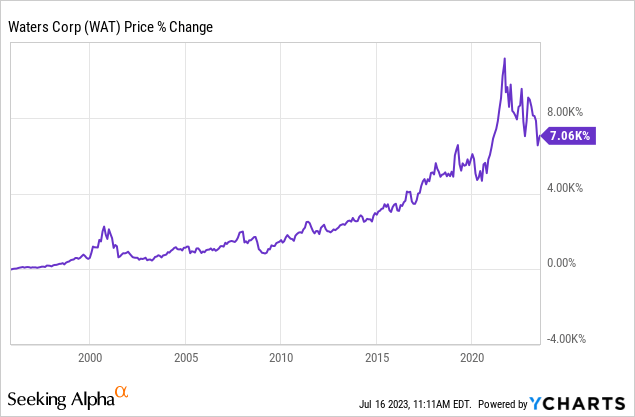

Waters Corporation (NYSE:WAT) has been a great compounder in the past two decades, but its recent performance has been underwhelming, currently down nearly 40% from its all-time high in 2021. The company is being pressured by the slowdown in the biotech and pharmaceutical industries amid rising interest rates and declining R&D funding. However, these impacts should be temporary and its fundamentals remain intact. I believe the current price should offer solid upside potential as the headwind eases in the future.

Strong Fundamentals

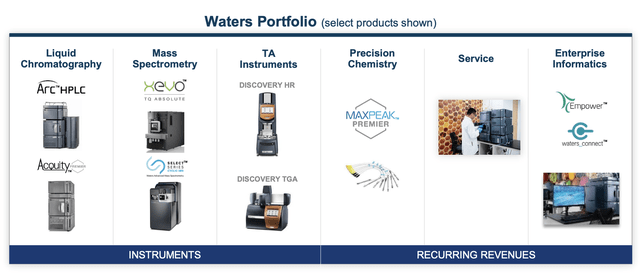

Waters Corporation is a Massachusetts-based life science company that provides instruments and services for chromatography, spectrometry, and thermal analysis. The company mostly serves pharmaceutical customers but also has some presence in the industrial and academic & government space. It currently operates in over 35 countries with 14 manufacturing sites globally.

Waters Corporation operates in what I believe is a highly attractive industry with favorable long-term tailwinds. According to the company, its market size in the pharmaceutical and clinical space is expected to grow at a long-term high-single-digit CAGR (compounded annual growth rate). For instance, the ongoing increase in the volume of drug manufacturing, disease testing, and the rising adoption of biologics are all major tailwinds for demand. The business model of the company seems also very compelling. Once an instrument is sold, its replacement becomes almost impossible as they are heavily embedded into the customer’s R&D workflow. Based on the 150,000+ installed base, it is able to then generate recurring revenue through chemistry solutions and other related services.

Waters Corporation

Temporary Headwinds

While Waters Corporation has great fundamentals, it has been facing some headwinds lately, especially in the biotech and pharmaceutical industry. During the pandemic, many companies in related industries pulled forward their spending amid rising demand and cheap capital. However, the trend has reversed quickly as COVID eases and interest rate rises sharply. Many did not expect the rapid shift and are stuck with elevated inventory levels. This alongside the uncertainty around the macro economy is making companies reluctant to spend.

According to Deloitte, R&D (research and development) expenses for the top 20 global pharmaceutical companies combined was $139 billion in 2022, down 2% compared to 2021. For example, AbbVie (ABBV) and Bristol-Myers Squibb (BMY) reduced their spending by 6% and 6.7% respectively. The decline is particularly evident among smaller and medium-sized companies, which are facing even greater financial constraints. This has been weighing on the company’s demand as many customers are cutting down their budget or pushing back their orders in order to save money.

While these headwinds may last through the remainder of the year, I believe they should be temporary and the company’s medium to long-term outlook remains favorable. With inflation continuing to ease rapidly, the Federal Reserve may choose to take a more dovish stance in the coming meetings, which could push interest rates back down. More importantly, pharmaceutical companies rely substantially on R&D to build their competitive advantage. Therefore I do not think they can afford to take their foot off the gas pedal for too long and spending should gradually rebound moving forward.

Udit Batra, on macro headwinds

While we have limited exposure to pre-commercial biotech, we have seen a pronounced scale back in demand from these customers as they have significantly reduced spending to conserve capital. And third, several of our large to medium-sized pharma customers delayed timing of instrument orders due to macroeconomic caution.

Soft Financials

Waters Corporation’s latest earnings were quite soft as headwinds continue to weigh on financials. The company reported revenue of $685 million down 1% YoY (year over year) compared to $691 million. On a constant currency basis, revenue was up 3% YoY. The decline was mostly attributed to the instruments revenue, which was down 7% from $325.2 million to $302.9 million. The segment was under pressure as many pharmaceutical customers are becoming more cautious in spending. This was partially offset by the strength in recurring revenue, which continues to be extremely resilient amid its stickiness. Service revenue grew 4% from $239.7 million to $248.2 million, while chemistry revenue grew 6% from $125.6 million to $133.5 million.

The bottom line was also weak amid higher spending. G&A expenses increased 15.6% from $157.5 million to $182 million, while R&D expenses increased from $40.5 million to $42.7 million. This resulted in the operating income down 10.9% YoY from $195.5 million to $174.2 million. The operating margin also contracted 290 basis points from 28.3% to 25.4%. The net income declined 11.8% from $159.8 million to $140.9 million. The diluted EPS was $2.38 compared to $2.62, down 9.2% YoY. Organic revenue growth is now expected to be between 3% to 5%, down from the previous range of 5% to 6.5%.

Valuation

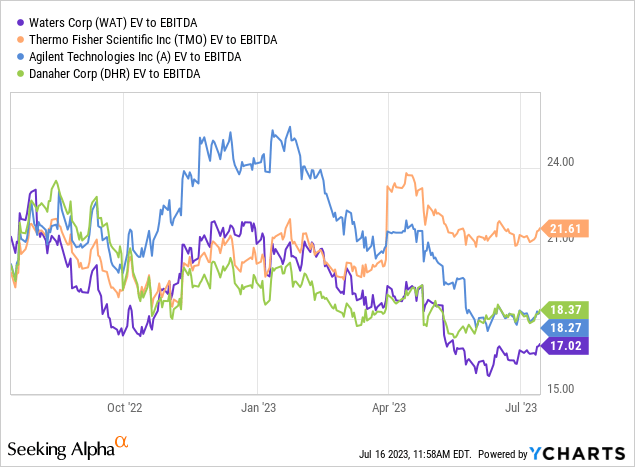

After the huge decline in share price, Waters Corporation’s valuation has dropped back to attractive territories. The company is trading at an EV/EBITDA ratio of 17x, which is discounted compared to both peers and its own historical average. As shown in the first chart below, the current multiple is lower than all other major life science companies including Thermo Fisher (TMO), Danaher (DHR), and Agilent Technologies (A). The peer group has an average EV/EBITDA ratio of 19.4x, which represents a premium of 14.1%.

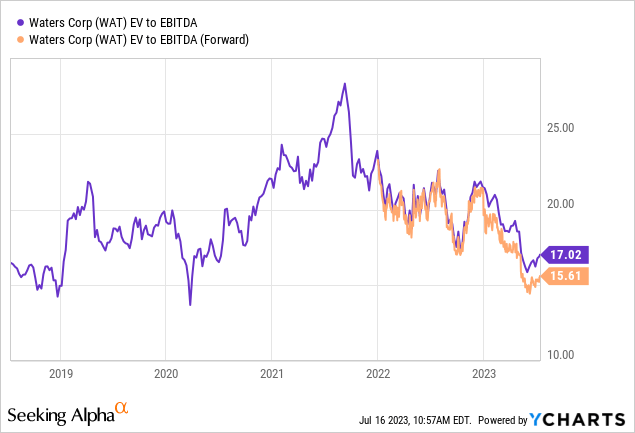

As shown in the second chart below, the multiple is now also near the low end of its historical range, representing a major discount of 15.5% compared to its 5-year average EV/EBITDA ratio of 20.1x. As the headwind eases and financials improve, I believe valuation should revert back to previous levels.

Investors Takeaway

I believe the recent decline in Waters Corporation presents a great entry point for the compounder. The recent weakness is mostly attributed to uncontrollable macro headwinds rather than company-specific issues. The long-term demand for pharmaceutical R&D remains intact and spending should recover moving forward. As shown in the last earnings, the recurring segment is also providing some support for the overall financials. I believe the discounted valuation should present compelling upside potential as headwinds improve. Therefore, I rate the company as a buy.

Read the full article here