Watts Water Technologies Inc. (NYSE:WTS) has experienced a surge in price due to strong earnings and guidance. I believe that Watts is currently a hold because although the company has an impressive ROIC, strong guidance, excellent balance sheet, and successful product innovation, Watts is far too overvalued to justify purchasing the stock now.

Business Overview

Watts Water Technologies, Inc. is an international provider of fluid and energy management goods and services for structures in different sectors. Backflow preventers, pressure regulators, valves, mixing valves, and leak detection equipment for plumbing and hot water systems are just a few of the flow control and safety devices the company provides for residential and commercial use. Boilers, water heaters, heating systems, and connectors for gas applications are just a few of the HVAC and gas goods that Watts offers. Along with items for filtration and conditioning water quality, the company also provides drainage and water reuse solutions. Wholesale distributors, dealers, OEMs, specialized distributors, and retail chains are just a few of the routes via which Watts distributes its goods.

Watts Water Technologies

Financials

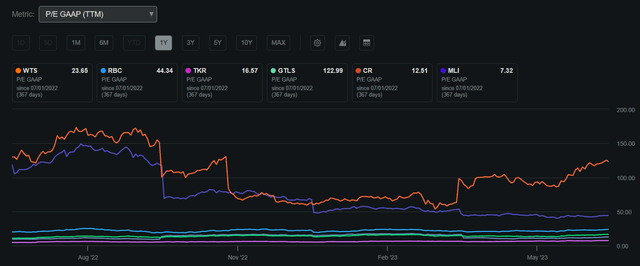

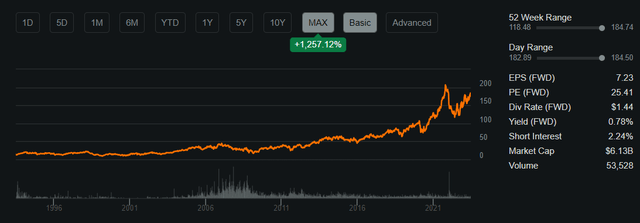

Watts currently holds a market capitalization of $6.13 billion and boasts a strong return on invested capital of 18%. Its stock price is currently sitting at $184.50, reaching its highest level in the past 52 weeks. However, with a GAAP P/E ratio of 23.65, Watts is trading at a higher valuation compared to many other companies in its industry. This suggests that the stock may be overvalued, as discussed in the valuation segment of this article.

Watts P/E GAAP Compared to Peers 1Y (Seeking Alpha) Share Performance (Seeking Alpha)

Watts also pays a dividend of 0.78% representing a payout ratio of 15.37. I believe that this dividend allows shareholders to receive small streams of income while also allowing the company to capitalize on its ROIC of 18% to scale its business and outperform peers. Once this growth begins to plateau, I believe that increasing the dividend such as the 20% rise in May, or repurchasing shares is likely to occur. With margins improving within the past few years, Watts has demonstrated that improving efficiencies can lead to strong growth in the long term.

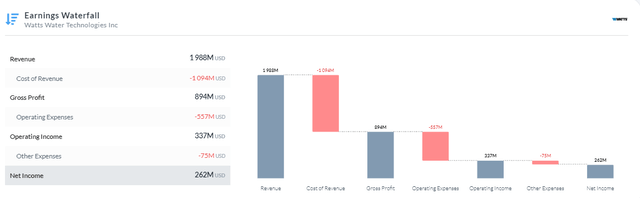

Annual Shares Outstanding (Trading View) Earnings Waterfall (Alpha Spread)

Earnings

Watts’ Q1 2023 performance showed a mixed outcome, with an EPS of $1.92, surpassing expectations by 17.32%, while revenues amounted to $471.7 million, slightly missing the projected figure by 0.34%. These results highlight Watts’ capacity to enhance profitability even in the face of challenging macroeconomic conditions, where business expansion becomes more challenging. Moreover, with optimistic earnings guidance for revenue and EPS growth until 2025, Watts has showcased its ability to further expand its core operations, building on substantial gains achieved in previous years.

Earnings Estimates (Seeking Alpha)

Outperforming the Broader Market

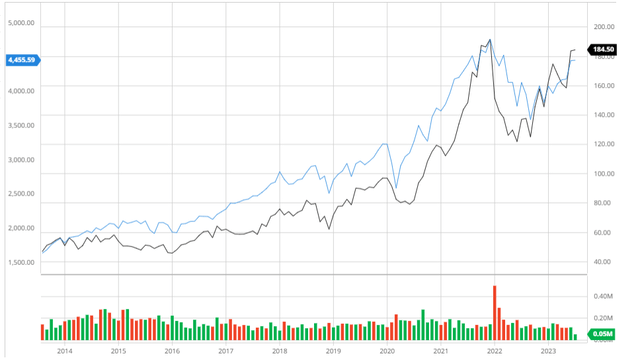

Over the past 10 years, Watts has outperformed the S&P 500 when adjusting for dividends. This exemplifies the company’s ability to allocate FCF and foster growth through various methods in order to achieve success.

Watts Compared to the S&P 500 10Y (Created by author using Alpha Spread)

Analyst Consensus

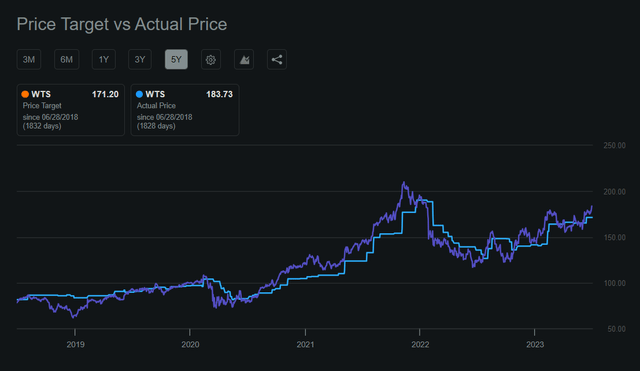

Watts is currently rated as a hold by analysts, with an average 1-year price estimate of $171.2, implying a potential downside of 7.21%. Given that analysts’ target price is in line with the current stock price, it is important to monitor if analysts revise their targets in response to the recent price surge. Keeping a close watch on any potential changes in analysts’ assessments will provide valuable insights for investors.

Analyst Consensus (Trading View) Watts Price Compared to Target 5Y (Seeking Alpha)

Balance Sheet

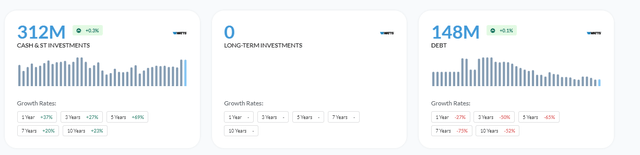

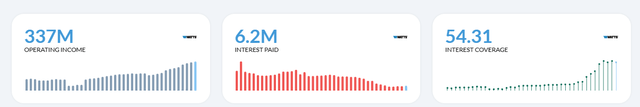

Watts currently holds an extremely strong balance sheet demonstrating its resiliency during headwinds. With quick growth through the company’s strong ROIC and a very defensive balance sheet, Watts has effectively balanced growth and safety within its core business model. The company’s debt has declined 75% over the last 7 years and interest coverage is at 54.31x showing the company’s ability to decrease debt through deleveraging while improving operating income and enhancing its cash flow through less interest paid. Lastly, Watts’ current ratio sits at 2.56 and Altman Z-Score at 7.31 demonstrating why the company has been around since 1874 and will maintain its presence for decades to come.

Financial Position (Alpha Spread) Interest Coverage (Alpha Spread) Solvency Ratios (Alpha Spread)

Valuation

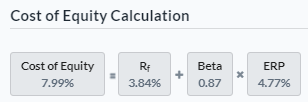

Before developing my hypotheses and performing a discounted cash flow analysis, it was essential for me to compute Watts’ Cost of Equity and Weighted Average Cost of Capital using the Capital Asset Pricing Model. Considering a risk-free rate of 3.84% derived from the 10-year treasury yield, my calculations indicated that Watts’ Cost of Equity stands at 7.99%. This figure represents the expected return that investors require to compensate for the risks associated with holding Watts’ equity.

Cost of Equity (Created by author using Alpha Spread)

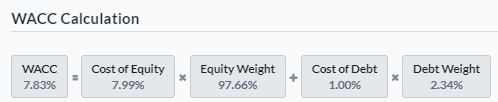

Using the aforementioned Cost of Equity as a starting point, I conducted a comprehensive analysis to ascertain Watts’ Weighted Average Cost of Capital. As a result, I calculated the WACC to be 7.83%, which falls below the industry average of 8.73%. This indicates that the company’s comprehensive cost of capital, encompassing both debt and equity, is comparatively lower when compared to other companies in the same industry.

WACC Calculation (Created by author using Alpha Spread)

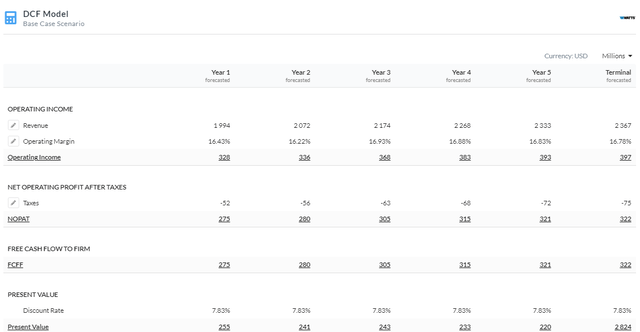

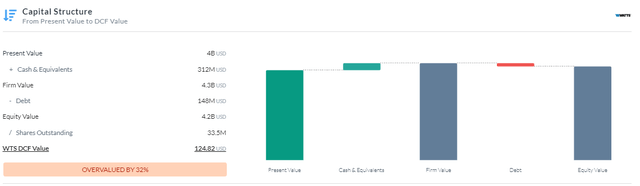

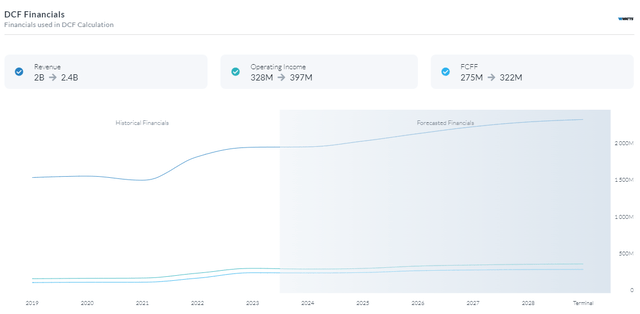

After conducting a detailed analysis using a Firm Model DCF approach, specifically focusing on Free Cash Flow to the Firm without Capital Expenditures, it has been concluded that Watts is currently overvalued by approximately 32% when compared to a fair value estimate of around $124.82. This evaluation was obtained by applying a discount rate of 7.83% over a 5-year time frame. Additionally, it is expected that revenues and margins will experience slight growth in accordance with the provided guidance.

5Y Firm Model DCF Using FCFF Without CapEX (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Product Innovation Fostering Growth

To meet the changing needs of its clients, Watts Water Technologies has been actively growing its product line. Smart water management solutions are one area where it has expanded its expertise to outperform competitors.

The Watts IntelliFlow Automatic Water Shutoff Valve, a component of their smart home water management system was launched to stop additional damage, this valve is built to recognize leaks and immediately turn off the water supply. It may be connected to a smartphone app for remote control and monitoring and makes use of cutting-edge technology and sensors to monitor water flow.

Watts Water Technologies has proven its dedication to offering cutting-edge solutions that improve water efficiency, reduce water damage, and support sustainable water management practices by entering the market for smart water management. With the addition of this product, the business is able to meet the market trend toward IoT solutions for water management and the rising demand for smart home technology.

I believe that this upgrade will enable Watts to achieve superior consumer satisfaction compared to its competitors enabling higher prices due to increased utility. This will expand revenues and margins allowing for the company to create compounding growth into the future with the improved cash flow.

Watts Connected Solutions (Watts Website)

Risks

Competitive Landscape: Other businesses in the same sector, including both long-established players and recent arrivals, compete with Watts. Strong competition may result in pricing pressures, a decline in market share, and a decline in Watts’ profitability.

Regulatory and Compliance Risks: Watts is a provider of goods for fluid and energy management, and as such, is obligated to comply with a number of legal regulations, industry standards, and compliance obligations. Penalties, legal problems, reputational harm, and operational difficulties may occur from non-compliance with certain regulations.

Conclusion

To summarize, I believe that Watts is currently a hold because although the company has an impressive ROIC, strong guidance, excellent balance sheet, and successful product innovation, Watts is far too overvalued to justify purchasing the stock now.

Read the full article here