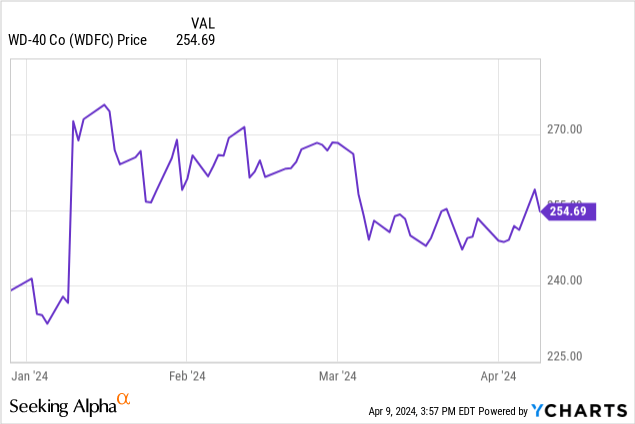

The WD-40 Company (NASDAQ:WDFC) stock is a long-term name we have continued to hold, one of our longest-held positions. In our last update, we continued to suggest holding shares are pricey based on valuations metrics. However, the stock has been consistently “overvalued” on many of these metrics. The stock, despite all the movement in the markets, has held in a tight range the last few months.

What we have here is a very slow-growing name, but one that delivers slow and consistent long-term returns. There is a reason we consider it “old faithful.” Along the way of these long-term gains, we have seen a dividend consistently paid, and one that is raised time and again. It has been a great name to own. If we see the stock pull back some 10%, we would suggest new money could add. We will likely need a market hiccup for this to occur.

The company just reported Q2 earnings, and nothing we are seeing in the results changes our resolve to hold this long term. Let us discuss.

Revenue growth continues

WD-40 company consistently and slowly grows sales. It enjoys ongoing demand, and internationally there is more room for the company to grow its geographic footprint. The company also enjoys pricing power for its products.

In fiscal Q2, WDFC sales were $139.1 million, up 7% from last year. We were expecting sales of around $140.0 million, so this was actually a slight miss against our expectations surprise. This also surpassed consensus by $1.15 million. We were looking for a high single-digit increases in the top line, and while sales came up a little short, it is mostly in line. Nothing to worry about here. We saw growth in all regions once again. Overall, net sales by location for fiscal Q2 were 46% in the Americas, 39% in EIMEA, and 15% in the Asia-Pacific region.

Regional breakdown – flattish sales in the Americas but strength internationally

Sales in the Americas only increased 1%. There was net sales growth of WD-40 Multi-Use products of $0.6 million, or 1%. That said, we saw increases of $1.1 million and $0.7 million, or 12% and 2%, in Latin America and the United States, respectively.

Turning to EIMEA, sales growth continues to be strong, rising 16%, and this was a result of both price increases and promotions put into place by the company. We saw strength in France, India, and Iberia. There was also a 23% increase in Specialist products in the region, along with a 17% increase in Multi-Use products. But pricing was only part of the equation, volume increased as well.

Asia-Pacific sales have been mixed the last few quarters, as the Asia distributor markets are volatile. Net sales rose 4% versus last year due to increases in the Asia distributor markets, which increased 7%. It is also worth noting the Australian market saw a 23% increase in homecare and cleaning product. Overall Multi-Use products crept up 3% in the region, while Specialist sales were flat.

Margin power

As a reminder, the WD-40 Company has a long-term 55% gross margin target. WD-40 has seen steady improvements in margin power of late. Gross margin in fiscal Q2 was 52.4% versus 50.8% a year ago. This increase is again a consequence of pricing increases, management cutting costs. This includes WD-40 purchasing its Brazilian distributor. We also learned in the release WD-40 will sell its lower-margin homecare and cleaning products in the United States and United Kingdom, which should boost profit margins. The company is getting closer and closer to its long-term target.

The work on general expenses has been beneficial, but selling, general, and administrative expenses were up 10% in the quarter. We would like to see better cost controls there. However, advertising spend was up 31% from last year, so the company is buying some of its own sales to a degree.

Despite the margin improvement, the lower sales than expected along with a 21% increase in advertising spend led to a decline in net income to $15.5 million, a decrease of 6% from the prior year fiscal quarter. Year-to-date, though, net income is up 8%. EPS fell to $1.14 from $1.21 a year ago, this was actually in line with our expectation and a $0.02 miss against consensus.

Forward view

Quarters come and they go. This was not the best quarter for the WD-40 Company, but it was not exactly a dud, either. The company is buying back shares and continues to boost its dividend.

As we look to the 2024 fiscal year, the company reiterated most of its outlook, with some improvements in the outlook. Despite EPS declining from last year, EPS for the fiscal year was boosted. While the company sees net sales growth of 6-12%, we see 8-11% as more likely. Margins were increased to 51.5% to 53%, up from 51.0% on the low end. You can expect net income of $67.7 million and $71.8 million, up from $65 to $70 million at our last coverage. And again, EPS was boosted.

Previously, EPS was seen at $4.78 and $5.15. It was upped to $5.00 to $5.30 per share. Oh, and this compares with our EPS expectation at the last update of $4.95 to $5.25, so expectations are now more aligned with our prior forecast.

At the midpoint, this is about 4% growth from last fiscal year. So, while WD-40 Company continues to grow year after year… valuation. At $250 per share, this is nearly 50X FWD earnings. That is expensive. However, if WDFC shares fall to the $225-$230 levels, we think new money can consider some buying. Shares are likely to be a bit volatile on this report, with news of sales of business lines and revisions to the outlook.

Read the full article here