“Anyone who isn’t confused really doesn’t understand the situation.” – Edward R Murrow

We’ve all seen the stories about how Americans have lost all trust in just about every facet of everyday life. We can start with politicians, then go to major US institutions, and from that point, the spotlight will hit the media. Health Officials and even religious leaders are being questioned these days. it seems everyone has an “agenda”.

None of us have a problem with some healthy skepticism, but the situation encountered in the investment world is especially confusing. We have trusted “‘reliable” sources proposing opposite but equally convincing viewpoints on a certain issue.

With regards to the market/economy, that’s exactly the type of situation investors face right now. The latest Fed commentary continues to remind us that inflation remains a major problem. Despite the initial decline, they remain concerned that we could see a rebound higher, and are not ready to say inflation is under control and ready to move to normal.

The Data is starting to tell a different story. There are plenty of data points that are telling a different story. For example, the Prices Paid and Prices Received components in the Fed surveys have been falling rapidly. I’ve mentioned how the commodity complex is struggling in a downtrend and that is also sending a message on inflation.

When I start to look at many aspects of the economy, I still see weaknesses. The usually reliable “Recession Playbook” that has correctly forecast economic downturns is being rendered useless. Leading Indicators and the yield curve are currently at levels that have been extremely reliable predictors of a looming recession in the past. If that’s the case, though, why are stocks trading to new reactionary highs? If I’ve seen one, I’ve seen a half dozen historical data patterns of market behavior lately, that would signal additional gains in the months ahead. If the economy is headed for a recession, why are stocks trending so positively? It sure looks like a wild disconnect.

However, as I have said in times like these, when the signals are mixed, an investor has to defer to the market. At this point, the stock market as measured by the S&P 500 has surpassed the highs from last August and looking at the intermediate term that breaks a series of LOWER highs. There are still plenty of obstacles to overcome on the technical side, and given the economic and interest rate backdrop, I’ve labeled this market rally “YES – BUT”.

Fundamentals Vs. Technicals

The fundamental picture is where I still see the most issues. It’s the biggest thing now holding me back from fully climbing aboard the bull train. I see a tug-of-war between the technical and fundamental sides. I have been doing this long enough to know that the market doesn’t have to make sense or align with MY interpretation of the fundamentals. The market is never “wrong,” though opinions often are.

It is also true that the stock market is a leading indicator that tends to turn before changes in the fundamentals become obvious. That said, stock prices can also temporarily disconnect from the fundamentals during emotionally-driven periods but these dislocations are ultimately remedied as the economic forces win out.”

That last paragraph is why investing and this market is so difficult. Either of these cases can be true and it’s a fine line to walk when we are left distinguishing which one is in force at any given time. While stocks keep going higher there is a contingent (myself included) that has kept saying “YES, BUT” – look at these reasons to be concerned.

Economic and fundamental hurdles remain that will need to be overcome. While the U.S. economy has so far managed to stave off an official economic recession, we are in the midst of an earnings recession. The S&P 500’s earnings have declined on a year-over-year basis in multiple quarters in a row and that is expected to continue at least for another quarter based on consensus analyst estimates (source: FactSet).

Meanwhile, more than 40% of the Russell 2000 companies are currently losing money. While I understand that cites the past rather than the future, the trend in earnings does appear to be down. Such an environment has also come at a time when the impact of higher interest rates has yet to be fully felt in the economy and while student loan payments have been paused. Both of these MACRO factors are now more likely to be headwinds in the months to come just as economic expectations for the future have become more optimistic.

Interest Rates And The Consumer

Last week we discussed how this entire interest rate hiking cycle has been discounted by the market. This is not the anomaly investors thought it was going to be, and history bears that out. YES, the S&P goes higher, BUT, I also noted the real issue is going to come from the “higher for longer” train the Fed is currently on. Fed Chair, Jerome Powell, noted that the primary reason behind their “pause” or “skip” at Wednesday’s meeting was the “lag effects” that higher rates have on the economy.

The Fed and other Central Bankers know that things are going in the right direction, but their rhetoric discloses their concern that if the restrictive monetary policies are lifted too soon, inflation would make a powerful comeback. That will take a huge bite out of the next growth stage in the economy and trap them into a more restrictive policy.

YES, the current mindset is a soft landing due in part to a resilient consumer, BUT the longer that rates remain high, the more pressure they will put on consumers, businesses, the government, and, by extension, the broad economy.

At the same time, student loan payments are expected to resume around September. The Supreme Court voted 6-3 to toss out the Administration’s student loan relief program that would eliminate student debt. This coming hit to consumers may be the biggest factor flying under radars right now. Based on various estimates I’ve seen, the average student loan payment could represent up to 5% of the current average monthly wage. So that’s effectively like many consumers taking a 5% pay cut, and, of course, it will disproportionately harm those who have benefited most from the three-year freeze on payments.

YES the housing market remains robust, BUT there is another issue no one is talking about; The cost of home ownership. Mortgage rates have tripled, while home prices have remained resilient. That adds up to a heft monthly bill that will impact discretionary spending. The average consumer will have to use more money for living expenses and will have to cut back on dining out and trips. As we noted recently, real wages have been in decline for months. Add it all up, and disposable income will be in decline.

None of these consumer issues is disastrous, and it’s doubtful they spike a huge economic decline by themselves. Instead, it will be more of a headwind that adds more pressure to the economy. That is one reason I stay grounded when I start to ascertain the MACRO fundamentals.

Irrational Exuberance

YES, we know all about the issues BUT the counterargument to these fundamental hurdles comes down to “artificial intelligence is going to fix it.” I am attempting to joke about this, but not really. The market by its price action is stating that. Optimism about AI appears to be one of the key drivers behind the stock market’s recent rise and why many are waving away the risks. I am certainly not dismissive of AI, and we’ve already noted it’s not so much of an “IF”, it is more about the “Time Frame” when this becomes a factor. There have been examples of early versions of AI being useful and it will continue to be transformative as the technology evolves. AI is not a “new” theme. It’s been a buzzword for years and we have already witnessed manifestations of it in the form of Siri, Alexa, and the ubiquitous chatbots that now function as “customer service.”

I scratch my head over the fact that all of a sudden this has become such a hot topic that so many are willing to see nothing else. The fact that the average person can play around with ChatGPT may be part of that. YES, AI is a true game changer, BUT, on the other side of the ledger, anyone who lived through the dawning of the internet from an investing perspective knows full well that a potentially game-changing technology is like an addiction. Investors turn into addicts and they simply can’t get enough of this “drug”. They are consumed with irrational strategies and will pay any price to continue the euphoric high.

It’s when the intervention takes place and the counselor declares that they have already paid for multiple years of “potential” and un-quantified earnings, that they toss in the towel and go cold turkey. However, we have historical precedence that tells us that could take a while to get to that stage. It is why we MUST leave this alternative OPEN as a possibility that can drive the indices higher than we might imagine.

Therefore, it remains a sticky complex situation. It won’t be until the chains of higher inflation (and the higher interest rates that have accompanied it during the past year-plus), over-regulation, and restrictive business policies are removed from the equation, that I envision the economy lifting higher. That remains an OPEN item.

Therefore, on a MACRO level, I remain cautious about the longer-term outlooks for the economy, corporate earnings, and thus the stock market. In the near term though, real-world risk levels are in the background. The recent frothiness on Wall Street regarding all things related to artificial intelligence is about more than just investors and traders throwing money after the latest fad. We are still in the midst of a technological revolution and that process is going to continue to drive innovations in products and services. That is at the forefront of the investment world these days, and it’s driving near-term price action. However, other factors will influence investment decisions. YES, it’s all about quick oversized gains, BUT not everyone will go out on that elevated risk curve.

Bond Yields Can Challenge Equity Flows

Another issue that could keep funds on the sidelines. After the massive reset in interest rates last year, bonds look increasingly attractive versus equities. With the recent rally in the equity market, the S&P 500 earnings yield (the inverse of the price-earnings ratio) has fallen to 5.1% and hasn’t been this low in 15 months. Interestingly the S&P was trading at 4328 back then compared to Friday’s close at 4348. However, Bond yields were hovering around 2%.

Compare that to the 5.5% yield on the US corporate bond index or the 5.1% yield on cash instruments and suddenly stocks look a little less attractive on a relative basis. While equity flows have recently increased as investors chase the strong returns of the last few weeks, we suspect this dynamic could reverse, particularly if economic data continues to disappoint.

S&P Earnings yield (www.factset.com)

The data from Pantheon Macro shows cash on the sidelines remains mountainous at $5.5 trillion. Just how much will enter the equity market will depend on the outcome of my observation of the scene;

For now, this ‘change’ that has occurred will be led by GREED as the ‘chase’ for performance continues, while FEAR will keep others in risk-free instruments. We could easily see periods where GREED will take over the driving, followed by a time when FEAR takes over the controls. I can see that back-and-forth action continuing, in the end, it will come down to which emotion will maintain control in the intermediate (4-6 months) term.”

The FED

We now hear, YES it is going to be a soft landing for this economy BUT the recent rise in bond yields and more hawkish shift from Fed officials has deepened the US yield curve inversion. The 2-year Treasury yield (4.86%) exceeds the 10-year yield (3.81%) by ~100 bps, its widest level since before the March banking crisis and its deepest inversion since 1981, and it has been inverted for over a year.

This indicator has correctly predicted the last six recessions. Historically, a recession has occurred within eighteen months after the curve first inverts; this cycle’s inversion began in April 2022 which places a recession starting by this October. With the Fed maintaining a hawkish bias, the yield curve is likely to invert further. Similar to the US, yield curves are inverted in many countries, including Germany, the UK, Australia, Canada, and Sweden.

FOMC Meeting

The minutes of the June 13-14 FOMC meeting reflected considerable disagreement regarding the policy decision. The transcript showed;

“Some participants indicated that they favored raising the target range for the federal funds rate 25 basis points at this meeting or that they could have supported such a proposal.”

Almost all participants judged it appropriate or acceptable to keep the rate unchanged. Most of these participants thought this posture would allow for more time to assess conditions.”

Note the inclusion of “could have supported” and “acceptable” (in the above statements) in the discussion. These suggest a lot more disagreement than usual over the decision and the need for considerable compromise from the Hawks to reach a unanimous vote.

Finally;

Overall, inflation remains “unacceptably high” while the economy expanded at a moderate pace, with a robust labor market. Also of interest was the uncertainty with respect to the lags of the tightening impacts. It was also generally noted that banking stresses had receded and conditions in the banking sector were “much improved” since early March.

Analysts believe the Hawks will have the upper hand at the upcoming July 25-26 FOMC and will lead a vote to increase rates by 25 basis points as analysts cannot see how conditions will have changed significantly since June 14 to keep further tightening at bay.

The Week On Wall Street

Investors embarked on the first trading day of the second half, and as expected, it was a quiet start to July. Plenty of market participants took the long weekend for the July 4th holiday. Traders started to trickle back into their offices on Wednesday and they were met by a stock market that has returned to near-term overbought levels after four of the last five up-sessions in the S&P 500. As the first full day of trading opened, about 90% of NYSE operating companies were above their 10-day moving averages, which is higher than this reading ever got last month when stocks were going crazy on the upside.

Wednesday turned out to be a “yawner” unless you had a big position in the small caps. Except for the Russell 2000, which lost 1.2%, all of the other indices posted modest losses. Seven of the eleven sectors were lower on the day.

However, that wasn’t the case on Thursday as every sector and Index posted losses with the beleaguered small caps giving up another 1.6%. Friday’s price action demonstrated once again that the BULLS aren’t going to give up control without a fight. However, the late-day action was ugly, indicating the BEARS are ready. A choppy session ended up at the flatline for the major indices. The Russell 2000 did manage to claw its way back with a 1.2% gain on the day.

Friday’s gains weren’t enough to push the major averages into the green for the week as all closed with modest weekly losses.

The Economy

The U.S. ISM Manufacturing index dropped 0.9 ticks to 46.0 in June, weaker than projected, after dipping 0.2 ticks to 46.9 in May. It is the 8th consecutive month below 50 (contraction) and is the lowest since May 2020. Weakness in demand was the general headwind, according to the report.

Construction spending increased by 0.9% in May after gains of 0.4% in April. This is a fifth straight monthly gain after declines in seven of the prior eight months. Strength was in residential spending which bounced by 2.1%. Nonresidential spending dipped by 0.2%.

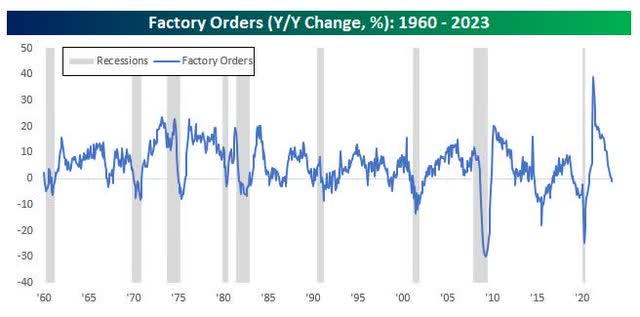

Factory Orders released during the week were a big miss. At the headline level, orders for May increased 0.3% which was a half percentage point below consensus expectations. Not only that but April’s reading was also revised down from a growth of 0.4% down to 0.3%. After stripping out Transportation, Factory Orders declined 0.5% while April’s reading was revised from a decline of 0.2% down to a drop of 0.6%.

Factory orders (www.bespokepremium.com)

Bespoke Investment Group: On a year/year basis, Factory Orders also dipped into negative territory for the first time since October 2020. The chart above shows the historical y/y change in Factory Orders since 1960. While readings were negative during every recession, there were plenty of other periods where they also declined on a y/y basis and the economy was nowhere near a recession.

Not only that but there were also many other periods during economic expansions where Factory Orders dropped by a much larger amount on a y/y basis. Bottom line; this data point may not be telling us much of anything.

“Services” continue to tell a stronger story.

At 54.4 in June, the final S&P Global US Services PMI Business Activity Index fell slightly from 54.9 in May. Nonetheless, the latest data indicated a substantial rise in business activity that was the second-fastest in just over a year. Companies noted that strong client demand and a sustained uptick in new business supported the latest expansion.

ISM-NMI services bounced to a 4-month high of 53.9 in June from the 50.3 reading in May. Anthony Nieves, Chair of the ISM Services Business Survey Committee;

“The majority of respondents indicate that business conditions remain stable; however, they are cautious relative to inflation and the future economic outlook.”

Employment

JOLTS: job openings fell 496k to 9.8 million in May after rising 575k to 10.3 million in April. There were about 1.6 jobs available for each unemployed seeker. Openings were at 11.4 million a year ago and were at a historic high of 12 million in March 2022.

Non-farm Payrolls report came in a little weaker than expected, increasing only 209k in June. That follows gains of 306k in May (it was 339k) and 217k (it was 294k) in April for a net -110k 2-month revision. Bottom line: the employment picture could be starting to show some cracks. The unemployment rate fell to 3.6% from 3.7% previously.

Average hourly earnings were 0.4% after the 0.4% May gain and tied for the strongest since 0.5% in July 2022. The labor force participation rate was unchanged at 62.6% for the fourth straight month and is the highest since February 2020. However, it remains lower than pre-pandemic levels

Manufacturing PMIs

With few exceptions, Global Manufacturing continues to be mired in contraction.

The J.P. Morgan Global Manufacturing PMI posted 48.8 in June, a six-month low and down from 49.6 in May. The PMI has signaled a worsening in operating conditions for ten consecutive months.

The U.K.

The UK Manufacturing Purchasing Managers’ Index fell to a six-month low of 46.5 in June, down from 47.1 in May. The PMI has signaled contraction in each of the past 11 months. All five of the subcomponent indices (output, new orders, stocks of purchases, employment, and suppliers’ delivery times) were at levels consistent with weaker operating conditions

Eurozone

The HCOB Eurozone Manufacturing PMI, compiled by S&P Global, fell to 43.4 in June, down from 44.8 in May and a twelfth successive month in sub-50.0 contraction territory. Overall, the headline figure signaled the sharpest deterioration in the health of the euro area goods-producing sector since May 2020.

China

The headline Caixin China General Manufacturing PMI remained above the neutral 50.0 level at 50.5 in June, signaling a back-to-back improvement in the health of the sector. That said, the reading was down from 50.9 in May and indicative of only a marginal improvement that was below the series trend.

India

As has been the case every month for two years, the India Manufacturing Purchasing Managers’ Index recorded above the neutral level of 50.0 in June. Despite falling from 58.7 in May to 57.8, the headline figure pointed to a considerable improvement in operating conditions.

ASEAN

The Global ASEAN Manufacturing Purchasing Managers’ Index (PMITM) posted 51.0 in June, down from 51.1 in May. The headline figure has now fallen for two consecutive months, with the latest reading signaling the least marked improvement in operating conditions since March.

Five of the seven ASEAN constituents monitored by the survey reported stronger business conditions in June.

Services PMIs

After a ramp upwards in Services gauges across developed and emerging economies alike early in 2023, headline PMIs for the non-manufacturing sector are broadly retreating across Asia and Europe with Eurozone members like France especially hard hit and reporting outright contraction.

The UK

At 53.7 in June, down from 55.2 in May, the headline UK Services PMI Business Activity Index signaled a slowdown in service sector output growth to its weakest since March. The latest index reading marked five months of continuous business expansion across the service economy.

Eurozone

Composite PMI Output Index at 49.9 – a 6-month low.

Services PMI Business Activity Index at 52.0 a 5-month low.

The HCOB Eurozone Composite PMI Output Index, signaled a stalling of the eurozone economy in June, registering just a fraction below the 50.0 no-change mark at 49.9. This was down from 52.8 in May and a considerable loss of momentum from April’s 11-month high of 54.1.

A disappointing end to the second quarter after robust growth in both April and May.

China

At 53.9 in June, the Caixin China General Services Business Activity Index slipped from 57.1 in May to signal a weaker upturn in service sector activity. Though solid, the rate of growth was the softest seen since the current period of expansion began in January. Despite the softer increase in activity, firms added to their staffing levels and at the quickest rate for three months. Recruitment in the sector was supported by a more positive outlook for the year ahead, with overall business confidence picking up for the first time in five months in June.

Japan

At 54.0 in June, the headline au Jibun Bank Japan Services Business Activity Index eased from a series record 55.9 in May to signal a softer, yet still solid expansion in activity and one that was considerably stronger than the long-run series trend.

India

As has been the case every month for just under two years, the Global India Services PMI Business Activity Index posted in expansion territory during June. Despite falling from 61.2 in May to 58.5, the latest figure was consistent with a sharp pace of growth as India bucks the slowing seen in the EU.

Food For Thought

The recent SUPREME Court ruling overruled the student loan forgiveness initiative, which was deemed unconstitutional. The notion was for loans to be paid back. A fairly simple concept that occurs every day in the US and across the globe. New efforts are underway to undermine the SUPREME court’s ruling, with the proposed “SAVE” plan.

I suspect the new “plan” will also likely be challenged as it once again has a “cost” associated with it. So that suggests there are economic impacts to consider. First, these “forgiveness” ideas are nothing more than more stimulus added to the economy. Another roadblock the Fed doesn’t need in their inflation fight.

Ironically, it may be seen as a positive by those who now believe these “consumers” won’t suffer a material hit to their lifestyle and therefore keep spending. In yet another ironic twist, other than the “moral ” issue which is hotly debated, none of this may matter as half of the students don’t open their checkbooks to repay the loans that helped them get employed. And that is the way it was BEFORE the pandemic excuse came along.

China announced curbs on exports related to metals used in the EV industry. The controls were placed on gallium, and germanium products as a move seen as a retaliatory measure in the US-China semiconductor chip disagreement. Firms are racing to apply for permits to stockpile, with new concerns that curbs on other rare earth exports could be next. Rare Earth producer – MP Materials (MP) is back on my radar screen.

As I have pointed out since the Global EV transition took root, CHINA is THE dominant player for ALL of the essential materials (these two metals are but one example) required to make the transition viable at a competitive cost.

If it escalates, this could turn out to be a concerning situation. China has set itself up to be a prime beneficiary as the world scrambles to electrify.

The Daily Chart of the S&P 500 (SPY)

The S&P has spent the last 5 weeks in “overbought” conditions and this week we witnessed the first step in correcting that situation

S&P 500 (WWW.tc2000.com)

So far it’s been a mild selloff with the S&P still able to close above the very short-term trendline. I wouldn’t be shocked to see the index weaken and revert to second support. Even if that were to occur, it wouldn’t jeopardize this near-term uptrend.

Investment Backdrop

The last time we discussed the market internals, I mentioned there were two possible paths that we could see this market take. Either the Big 7 and or the other momentum names would keep this a very narrow advance, OR would we see the market broaden out? The June results give us the first hint that the latter is developing and that is yet another positive that has to be acknowledged.

The S&P 500 has now confirmed May’s slight break above the long-term trend line. That joins the NASDAQ that broke out more decisively in May and also put in a second month in BULLish territory.

The negative divergences still exist but there is improvement. The DJIA has traded just above and below the longer-term trend line for the last 8 months offering no clear BULL/BEAR signal. The laggard is the Russell 2000 small caps (IWM) as it remains in a BEAR trend capped by its long-term trendline since January ’22.

If an investor is going to participate in the uptrend, that backdrop shouts “selectivity”. Staying diversified never hurts in ANY investment scene, so there is no need to have oversized positioning and get caught on one side of the boat.

The first four trading days of Q3 have been an example of stocks not picking up right where they left off in the second quarter. The first week of Q3 was a bit of a reality check as investors received a nudge that markets still move in both directions.

The increased selling pressure indicates that “overbought” finally did matter. For the S&P it was five weeks in that condition and eight for the NASDAQ. These types of pullbacks will tend to keep traders “honest” and take out some of the froth that has built up.

The 2023 Savvy Playbook is all About Stocks in BULL Uptrends

Given the across-the-board strength seen in June, that playbook has expanded. I’ve taken it one step further by dabbling in situations that are showing signs of reversal by demonstrating BEAR to BULL chart patterns.

In my view, there is also room to participate in what could be a strong “reversion to the mean”, or “catch-up trade” in Q3. The first shall be last and the last shall be first. That shouldn’t be taken that the leaders are about to completely fall apart, it’s doubtful they will. However, it is also doubtful they can put together another quarter of oversized gains, and perhaps other sectors can come back to life.

I’m also rounding out the portfolio with CEFs and BDCs that are attractively priced and offer HIGH income and stability.

The complete list of my recent additions can be found on the Savvy Investor Service Website.

Final Thoughts

After a 1st half that exceeded even the most BULLISH expectations, we’re all wondering what comes next for the equity market. I won’t use a crystal ball, instead, apply logic to the equation and come up with “probabilities” that can lead us in the right direction. One thing we have to acknowledge – “This is not a “one size fits all” equity market. Right now we have divergences in the indices and divergences under the surface in the various sectors. Therefore I doubt if we will see “This tide lifting all boats”.

From a seasonal perspective, July has historically been a strong month, especially over the last ten years. In years when the S&P 500 was up sharply (10%+) in the first half, median performance during July, all of Q3, and the entire second half have all been better than the historical norm.

If history repeats market participants have a decent tailwind to work with, but I can guarantee it won’t be without some bumps along the way. I suspect we will soon enter a day-to-day rotation underneath the grossly-extended averages making for a tougher environment in which to manage risk. That leads me to continue on the same path traveled during the initial phase of this “CHANGE”, adding some minor modifications to the strategy.

THANKS to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Best of Luck to Everyone!

Read the full article here