Introduction

As mentioned in some of my previous articles, I’m trying to add some duration to my fixed income portfolio. Preferred shares are an important part of my income-focused portfolio, but I am keeping close tabs on the financial performance of the issuers on a quarterly basis, just to make sure I can take action if/when there’s a need to fine-tune my positions. My objective is to review these investments on a quarterly basis, which is even more important for the non-cumulative preferred shares (where preferred dividends can be skipped). Although that’s not a major concern of mine, as the reputational damage of skipping a preferred dividend would be far worse than the few hundred million dollars it would save a company.

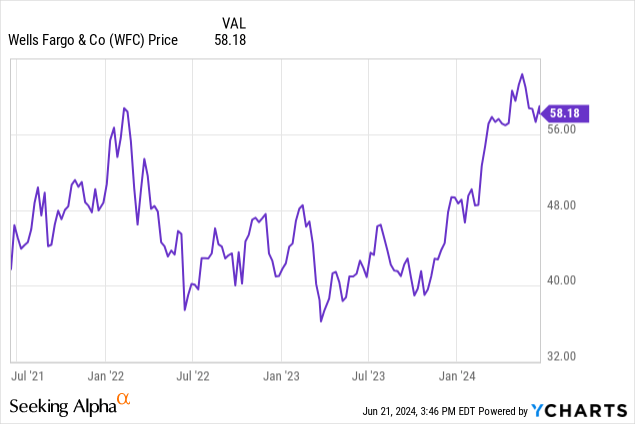

I like the so-called “busted” preferred shares, and Wells Fargo & Company’s (NYSE:WFC) Series L preferred shares (NYSE:WFC.PR.L) is one of those “busted” preferred shares where it isn’t realistic to expect the preferred shares to be called in the near-term or medium-term future.

The preferred dividends remain well-covered, despite almost $1B in loan loss provisions

Two elements matter to me: the preferred dividend coverage ratio as well as the asset coverage ratio.

Wells Fargo has obviously already published its Q1 2024 results, and that’s a good starting point to determine how well the bank is performing and what this means for the preferred dividend coverage ratio.

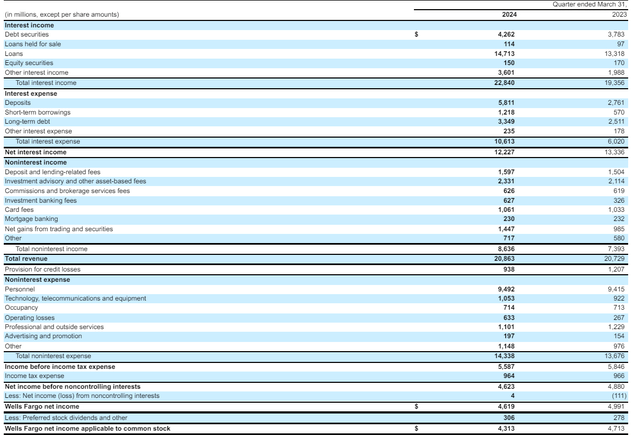

In the first quarter of the year, Wells Fargo reported a total interest income of $22.8B, which is an increase of exceeding 15% compared to the first quarter of last year. Unfortunately, the interest expenses also increased, by 75% to $10.6B, and the $4.6B interest expense increase (expressed in absolute numbers). This resulted in a net interest income of $12.2B, which is an 8.3% decrease compared to the $13.3B in the first quarter of last year.

WFC Investor Relations

The bank did see a substantial increase in its non-interest income thanks to a 50% increase in the gains from trading and securities, and this boosted the non-interest income by $1.25B while the non-interest expenses increased by ‘just’ $0.7M. This means the pre-provision and pre-tax income in the first quarter of the year was approximately $6.5B, compared to $7.05B in the first quarter of last year. That indeed is a $550M decrease despite recording a $270M decrease in loan loss provisions. Also keep in mind the new special assessment from the FDIC had a negative impact of almost $300M on the bottom line of the results.

This means the reported net income of $4.62B isn’t that bad compared to the $4.88B in the first quarter of last year and after deducting the $306M in preferred dividends, the net income attributable to the common shareholders of Wells Fargo was $4.3B which works out to $1.21 per share.

The income statement clearly shows that – despite some non-recurring items like the FDIC special assessment charge – the preferred dividends are very well covered. The bank needed just $306M of its $4.62B net income to cover these preferred dividends, which means the payout ratio was just 6.6% of the net income.

Meanwhile, there is plenty of margin of error in the income statement to put aside higher provisions in case Wells Fargo sees any additional signs of weakness in its loan portfolio. Even if the quarterly loan loss provisions would quadruple to $3.8B per quarter ($15B per year), the preferred dividends would still be fully covered by the bank’s profit.

The “busted” preferred share still is my preferred choice

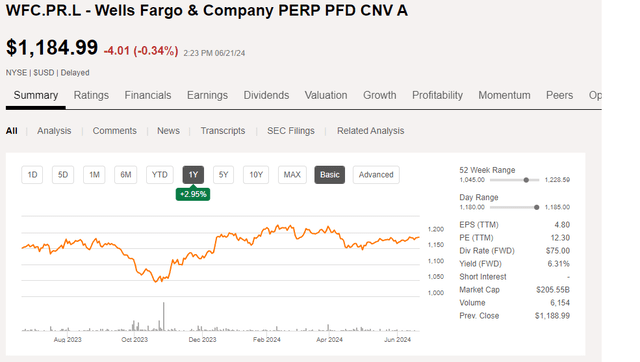

As explained in my previous article, there is one specific issue of preferred shares that I like best: The non-cumulative perpetual convertible, which is trading with (WFC.PR.L) as its ticker symbol.

That series of preferred stock was initially issued by Wachovia and cannot be called by Wells Fargo (which acquired Wachovia). There is a conversion feature with a conversion price of $156.7, but this only comes into play when Wells’ common shares are trading well north of $200, as per the terms of the preferred shares. To be precise, the Series L preferred shares can be converted into 6.3814 shares of Wells Fargo, and WFC can only force a conversion when the common share price exceeds $203.72 for a period of 20 trading days during a 30 consecutive trading day period. If and when that happens, you’ll receive at least $1300 in common shares (6.3814 * the minimum price of $203.72 – the market price could be higher), which would allow the preferred shareholder to realize a capital gain as well.

Seeking Alpha

Investors in Wells Fargo’s Series L should not anticipate a forced conversion in the near future, and should look at the Series L as the perpetual security it is.

At the current share price of $1185 per share, the $75 in annual dividends indicates the preferred dividend yield is currently just over 6.3%. Not the highest on the street, but an acceptable yield to lock in if you are looking for duration.

Investment thesis

I have a small long position in the Wells Fargo preferred Series L as I like the low probability of the security being subject to a forced conversion. As I wanted to add duration to my portfolio, I think I should add to my position in the Series L as any weakness in the share price is an opportunity to lock in a 6.3% yield.

Read the full article here