We’re more than halfway through the Q2 Earnings Season for the precious metals sector and the results have been mediocre on balance, with higher operating costs and lower than planned production partially offsetting the record gold price enjoyed in the period. Fortunately, the royalty/streaming companies have fared better, with Triple Flag Precious Metals (TFPM) enjoying a record quarter, but others haven’t been as fortunate, with Wheaton Precious Metals (NYSE:WPM) seeing declines in revenue, cash flow, and cash flow per share on a year-over-year basis. Increased uncertainty related to Penasquito, a key contributor to the company’s total sales and earnings, and its #1 contributor in its silver streaming portfolio. Please read my previous coverage on WPM here. Let’s inspect the results below:

Penasquito Operations (Newmont Presentation)

Q2 Attributable Production & Sales

Wheaton Precious Metals (“Wheaton”) released its Q2 results last week, reporting quarterly attributable production of ~85,100 ounces of gold and ~4.42 million ounces of silver, representing an increase of 28% in gold production, offset by a 32% decline in silver production. However, the sharp increase in gold production was mostly because of being up against easy year-over-year comparisons (attributable gold ounces fell 24% in the year-ago period), and silver production did not accurately reflect the current situation at Penasquito, with the strike announced in late Q2 (early June), which should lead to a much more drastic decline in production during the upcoming quarter for Wheaton’s stream on 25% of silver production from this asset mine in Zacatecas, Mexico.

On a gold-equivalent basis, production was down 5% year-over-year to ~147,700 GEOs, with ~97% of production from gold and silver.

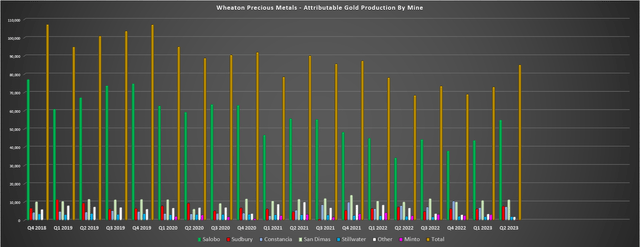

Wheaton – Attributable Gold Production by Mine (Company Filings, Author’s Chart)

Circling back to the company’s gold production statistics, attributable production was up sharply in the period, but Salobo largely saved the day (its largest gold producing contributor), with production of ~54,800 ounces, a 61% increase year-over-year which recovered from just ~34,100 ounces in Q2 2022. Salobo’s robust production results were attributed to the better than expected ramp-up of the Salobo III Expansion, offset by planned maintenance on crushers at Salobo I and II. With the full expansion (Salobo III) expected in 2024, the production from Salobo under Wheaton’s 75% gold stream will continue to trend higher, increasing Wheaton’s concentration to this massive Brazilian copper mine owned by Vale (VALE).

However, while Salobo picked up lots of the slack in Q2, we saw sharply lower production in its “other” gold category (made up of smaller assets), and Minto. In its other category, the 777 Mine closure (Q3 2022) affected attributable gold production, with this no longer contributing this year. Meanwhile, at the Minto Mine, operations were suspended, and the Yukon assumed care and control (subsequently giving control to JDS Mining) of the mine following the halting of operations by Minto Metals in May. These two assets contributed a combined ~6,000 GEOs in Q2 2022, so this will be a minor headwind from now on for Wheaton Precious Metals in its gold streaming segment.

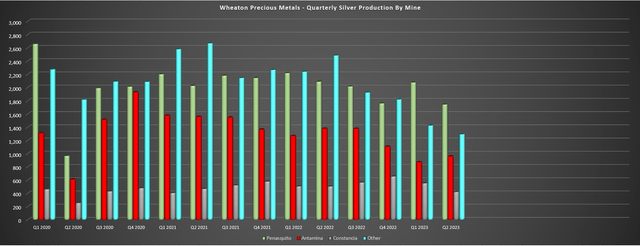

Wheaton – Attributable Silver Production (Company Filings, Author’s Chart)

Although the performance from the gold segment (production down 5% on a two-year basis) was a little disappointing, it was the silver segment that performed much worse in the period, with a foggy Q3 2023 outlook. As noted by Wheaton, production was down 28% year-over-year at Antamina (lower grades), 17% at Penasquito (lower throughput), 28% at Constancia (lower throughput and grades), its other silver segment was also down sharply related to the 777 Mine closure and the sale of the Keno Hill and Yauliyacu precious metals purchase agreements [PMPA]. The result was that silver production came in well below two-year ago levels, sliding from ~6.5 million ounces to just ~4.42 million ounces.

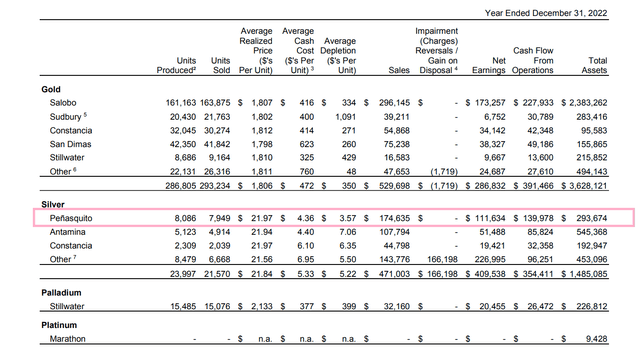

However, as noted previously, Penasquito’s production was only down slightly on a year-over-year basis as were sales (~1.74 million ounces produced and ~1.92 million ounces sold), which does not accurately reflect what the rest of year will look like. This is because over six weeks into Q3, we have seen no production at Penasquito because of the strike action announced on June 8th, 2023, with discussions ongoing but no major progress made to date between the National Union of Mine and Metal Workers of the Mexican Republic and Newmont (NEM). And for those unfamiliar, Penasquito made up ~33% of Wheaton’s attributable FY2022 silver production or ~$175 million in sales and ~$140 million in cash flow. These are massive figures if mine production and processing at Penasquito is not restarted in a timely manner.

Wheaton – Attributable Silver Production by Mine (2022) (Company Filings)

Overall, this is certainly a negative development, and while these ounces aren’t going anywhere, it could impact the company’s FY2023 guidance of 600,000 to 660,000 GEOs and its FY2024 attributable production and sales if the strike remains in place. Plus, if an agreement isn’t made in a timely manner, Newmont’s portfolio will get much larger by year-end with multiple low-cost assets (Havieron, Cadia, Brucejack, Red Chris Block Cave, Wafi-Golpu) set to come into its portfolio, meaning it may not see a need to stay in Mexico where it has a single operation. For now, I don’t see a divestment as likely, but the longer the strike goes on, the more Penasquito may be considered from a portfolio optimization standpoint post-Newcrest deal closing, which I don’t think was even considering pre-strike.

Obviously, this would be a negative development for Wheaton’s streaming agreement as it’s currently in the hands of the world’s largest gold producer (and a royalty/streamer ideally wants the largest and most well-financed operators as partners), so investors in Wheaton should root for a timely resolution to this issue. On a positive note, Constancia is expected to have a better H2 from a silver production standpoint with elevated stripping activities at the Pampacancha Pit completed in June, suggesting higher production for the asset to finish the year. That said, Constancia contributes barely one-fourth of Penasquito’s production, so it will only do much to offset the softer results from Penasquito.

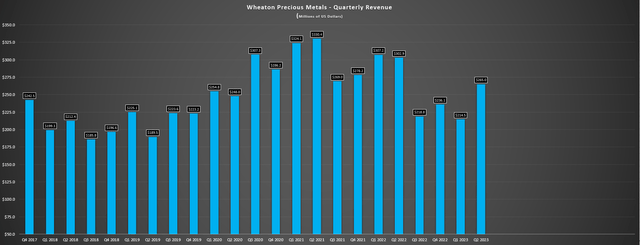

Wheaton – Quarterly Revenue (Company Filings, Author’s Chart)

Finally, looking at Wheaton’s financial results, they were solid in Q2 with revenue of $265.0 million, operating cash flow of $202.4 million despite fewer ounces because of ounces being produced but not yet delivered. This helped the company to finish Q2 with one of the sector’s strongest balance sheets ($800+ million in cash and ~$2.80 billion in liquidity), positioning it to continue to bring home major deals if attractive ones come across the plate, like its recent Cangrejos gold stream in southwest Ecuador. Still, these results don’t accurately reflect how the Q3 and Q4 results might look, with Penasquito being an ~8.0+ million ounce silver producer at sub $5.00/oz costs, so it’s tough to get overly excited about the strong financial results which is in the rear-view mirror until the Penasquito strike is resolved.

Recent Developments

As for recent developments, we’ve already covered Penasquito, which is a negative, but there was another negative to report in the period. Unfortunately, Adventus Zinc (OTCQX:ADVZF) reported that “the Constitutional Court admitted for processing an unconstitutionality claim filed by CONAIE and other complainants against the Presidential Decree 754 announced on May 31st, 2023”. The immediate effect of the provisional suspension of the Presidential Decree announced will mean that no medium or high impact projects (like Curipamba) will be able to obtain an environmental license until the issue is resolved by the Constitutional Court of Ecuador. This impacts Wheaton’s 50% gold stream + 75% silver stream (with step-downs) at the Ecuador Project as it no longer looks like this project will move into production by mid-2024 as previously highlighted by Adventus.

Overall, this is not a huge deal as this is one of many projects in the wings that will contribute to production growth for Wheaton. However, this is the second project that’s now been de-railed after the Fenix Project also got sidelined last year in Chile (EIA not approved). Assuming Penasquito comes back online by next year, these recent developments are not a big deal, but with two development projects seeing delays and a key producing asset temporarily in care and maintenance, these developments in combination are unfortunate for Wheaton. Fortunately, there was some surprise positive news out of Colombia, with the CARC (regional environmental authority) permitting the development of the Marmato Lower Mine, a 6.5% gold stream and 100% silver stream (with step downs) for Wheaton.

The final development worth noting is that B2Gold (BTG) and Artemis Gold (OTCPK:ARGTF) continue to make solid progress on the ground at Goose and Blackwater, respectively, with both assets set to be in commercial production by mid-2025 (Blackwater being the earlier of the two). These assets will be solid contributors even following the partial stream buyback by B2Gold ($46 million paid to retire 33% of gold stream). In addition, while this doesn’t directly benefit Wheaton unless it makes another key transaction, the environment for streaming/royalty companies continues to favor the larger names with lower costs of capital with share prices being weak and debt costs elevated, making streaming a more attractive choice that it would normally be in an environment with strong share prices (equity being an option) or lower rates. Let’s look at Wheaton’s valuation:

Summary

Wheaton Precious Metals had a mediocre quarter, with Salobo saving the day with higher production which offset significant declines in attributable production at Minto, Antamina, Constancia, and its smaller gold/silver streams (other category). Worse, Curipamba has been held up in Ecuador and doesn’t look like it will come anywhere near meeting its previous Q3 2024 commissioning goal following the provisional suspension of the Decree, making it a second project that was supposed to contribute by 2025 for Wheaton that will likely miss its deadline (Fenix, and now Curipamba). Fortunately, these ounces are deferred, not lost, and Wheaton is diversified, meaning that this is much worse for the operators’ share price than the company with a PMPA on the asset (Wheaton Precious Metals).

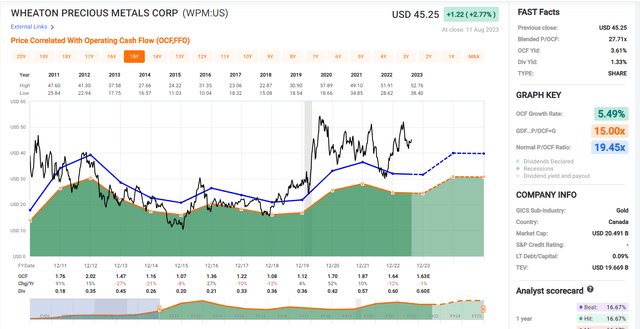

Wheaton – Historical Cash Flow Multiple (FASTGraphs.com)

Still, if we combine the delays on these projects with the recent Penasquito strike (Wheaton’s #1 silver contributor), there is certainly a lot more uncertainty here than there was heading into the year, yet Wheaton trades at a far higher cash flow multiple than where it entered the year and at a healthy premium to its 15-year average (21.7x FY2024 cash flow estimates vs. 19.5x cash flow). This doesn’t mean that the stock must go lower, but based on what I believe to be a fair multiple of 25.0x cash flow (industry-leading scale & diversification offset by recent uncertainty), I see a fair value for the stock of US$52.25, translating to a low-risk buy zone of US$39.20 or lower to ensure an adequate margin of safety (minimum 25% discount).

So, while I see WPM as one of the better names sector-wide, I continue to see far better relative value bets elsewhere in the sector, and I wouldn’t get interested in WPM unless it were to dip below US$39.20 where it would become more attractive from a valuation standpoint.

Read the full article here