By Scott Bauer

At A Glance

- The possibility of further interest rate hikes paired with banking sector turmoil has coincided with volatility spikes in the gold futures market

- Traders are increasingly using shorter-term gold options to manage the risk of sudden economic changes

The Gold market has been largely range-bound since the beginning of 2023. This may come as a surprise to investors associating rising inflation with rising gold prices. But due to a bevy of macroeconomic and geopolitical uncertainties, we have seen tremendous growth in gold options trading as volatility has risen.

In late May, Gold futures touched $2,000 per ounce for the first time since the immediate aftermath of Russia’s invasion of Ukraine, but prices slipped back after testing the level several times. The demand for exposure to the gold market has increased both volatility and volume in gold options.

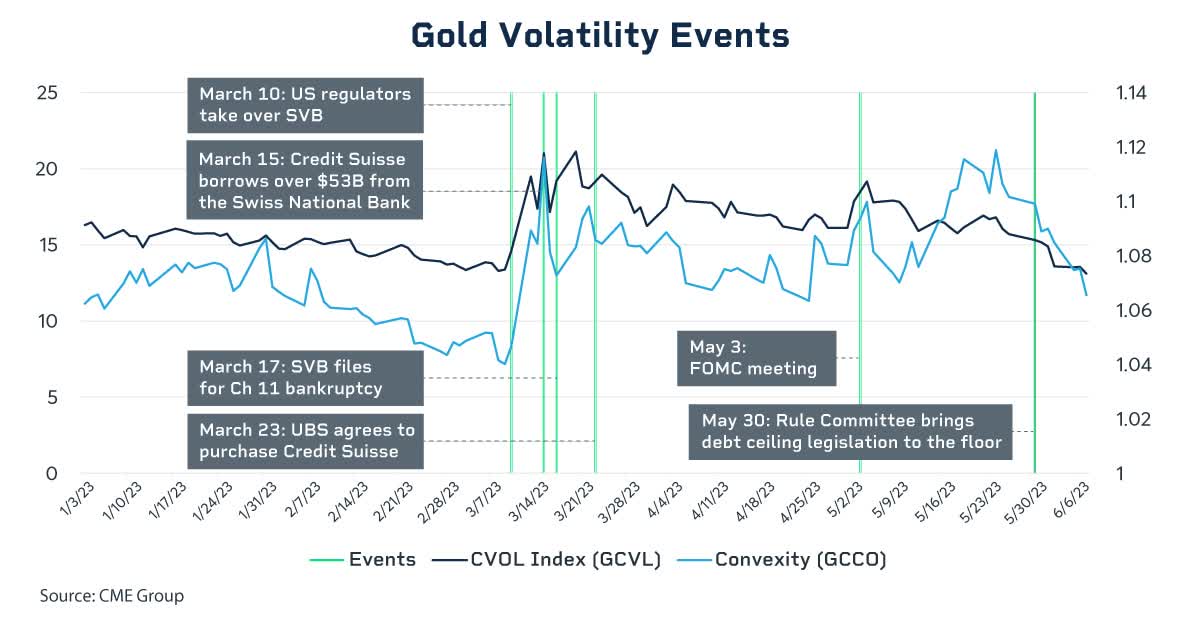

Following the Fed’s June meeting, the CME Group FedWatch tool was showing a higher probability that the Fed would raise interest rates at its July meeting. As the probability of further interest rate hikes remains, and the turmoil surrounding the banking sector has not disappeared, traders and investors are seeking safe havens. This is shown in the following data and the associated chart looking at volatility in the gold options market:

- March 10: US regulators take over SVB

- March 15: Credit Suisse borrows over $53B from the Swiss National Bank

- March 17: SVB files for Ch 11 bankruptcy

- March 18: UBS agrees to purchase Credit Suisse

- May 3: FOMC meeting

- May 30: Rule Committee brings debt ceiling legislation to the floor

An Extreme Move Ahead?

Using the CME Group CVOL measurement, we can see in the chart above that the convexity in gold options is at the upper end of the range. Convexity is a measure of the ratio of the volatility level of the out-of-the-money strikes to that of the at-the-money, meaning how expensive are the “extreme move” options. As levels are extremely elevated, traders may be looking for an extreme move.

In addition, physical demand for gold has soared to an 11-year high on the back of “colossal central bank purchases, aided by vigorous retail investor buying,” according to the World Gold Council (WGC). Annual gold demand jumped 18% to 4,741 tons (excluding over-the-counter or OTC trading) across the year, the largest annual figure since 2011. This was fueled by record fourth quarter demand of 1,337 tons. 2022 was the second highest level of annual demand on record going back to 1950, the WGC said.

March was the first month of net inflows into gold ETFs in nearly a year, while the volume of bullish options trades tied to the funds has approached record levels. There has also been a similar increase in interest in CME Group gold futures and options tied to them, including deep “out of the money” options, which would only pay out if the gold price hits new all-time highs.

Further, the trend for shorter-dated options, specifically weekly options, has soared. Year to date, weekly gold options account for 22% of total volume, the highest in history. Overall gold options average daily volume of 67,427 contracts is now the highest ever as well.

The price of gold is up by approximately 8% from June 2022. Given the economic uncertainty many investors are facing, coupled with gold’s reputation as a safe haven during periods of volatility, the market will continue to be one to watch closely. As the Fed faces another rate decision and the possibility of a recession draws closer, activity in the gold options market remains a useful measure to see how metals traders are reading the direction of the economy.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here