I wrote about Verano Holdings (OTCQX:VRNOF) in mid-March and explained that it is facing a challenge with its projected margins. I said then that I do like the company, but I wasn’t holding it in my model portfolios. I still don’t, though the stock has declined a bit since that piece. In this follow-up, I look at the chart and discuss its valuation again.

The Chart

Cannabis stocks, as measured by the New Cannabis Ventures Global Cannabis Stock Index, are having a tough time in 2023, down 16.5% year-to-date. Verano set an all-time low on an intraday and closing basis on Thursday of $2.61. At $2.78 after the rally on Friday, the stock is still down 12.5%. The chart of the action in 2023 shows sideways movement:

Charles Schwab StreetSmart edge

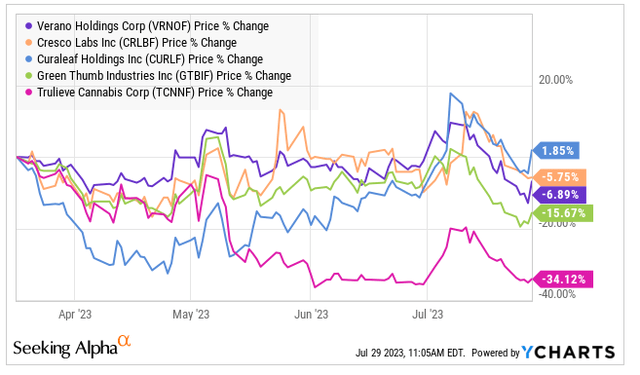

Since the article came out, the stock has dropped 6.9%, in the middle of its peers:

YCharts

When I wrote the piece in mid-March, it was the best performer year-to-date at the time. Updating the year-to-date chart, it still is:

- VRNOF: -12.5%

- CRLBF: -11.6%

- CURLF: -18.6%

- GTBIF: -20.3%

- TCNNF: -47.0%

In that last piece on VRNOF, I suggested that Trulieve (OTCQX:TCNNF) is a better stock, but it has declined a lot since then. I discussed it offered an excellent entry in June, and it has gone up and then back down, still a little higher than when I shared that piece. I haven’t written about Cresco Labs (OTCQX:CRLBF), but I much prefer its potential acquisition, Columbia Care (OTCQX:CCHWF), which I think would be a better buy even if the deal weren’t too ever close. Last week, I shared my concern with Green Thumb Industries (OTCQX:GTBIF), suggesting that it’s still not time to buy it, and, earlier this month, I called out Curaleaf (OTCPK:CURLF) when it was at $4, suggesting that investors should sell it.

These 5 stocks currently account for 79% of AdvisorShares Pure US Cannabis ETF (MSOS), which is up from the 77% almost six months ago when I last wrote about the ETF. At that time, the ETF was selling some holdings due to redemptions. While shares have actually increased a small amount since then, I continue to fear that MSOS could face redemptions and that the ETF is not properly investing in the market. Verano, just ahead of the Trulieve weight, is 11.7% of MSOS currently. GTI and Curaleaf total a stunning 47%.

The Outlook

In March, analysts were looking for Verano to generate $1.01 billion revenue in 2023 with adjusted EBITDA of $348 million. Now, analysts project that revenue will increase 8% to $947 million with adjusted EBITDA of $300 million down 7%, both sharply lower than when I wrote that last article on the company.

For 2024, the estimates have also declined. Revenue is expected to grow 12% to $1.06 billion, with adjusted EBITDA gaining 16% to $348 million. Revenue in March was projected at $1.11 billion, so the current expectation is slightly lower, while the outlook for adjusted EBITDA is 5% lower too.

I shared then that I thought the revenue forecast could drop to $998 million, and that adjusted EBITDA at 31% would be $309 million. I continue to view my outlook as correct. We will learn, perhaps as soon as they report on 8/8.

Valuation

I use the 2024 estimates to help set a year-end target. I used my outlook, shared above, in March to set a target based upon an enterprise value of 7X the projected adjusted EBITDA. This worked out then to $5.48, which then was 83% higher. Now, based on the 345.3 million fully-diluted shares that are outstanding and in-the-money and the $320 million net debt, this works out to a slightly lower target of $5.34, which is 92% above the current price.

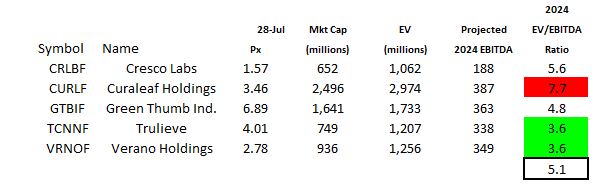

The stock trades currently at 4.1X my estimate for adjusted EBITDA, which still is cheaper than the average for its peers. Based on the consensus outlooks for Verano and its peers, it looks cheap:

Alan Brochstein, using Sentieo

I prefer Trulieve, which has less margin pressure, as well as three smaller MSOs.

Conclusion

As I said last time, I like Verano, but I don’t hold it in either of my model portfolios. The stock does appear cheap, but it doesn’t stand out relative to peers or other opportunities. The estimates have been falling for 2023 and 2024, but I think that they could fall more.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here