Introduction

A few fellow investors commented on my previous articles asking my thoughts on Main Street Capital (NYSE:MAIN) so I figured I’d share my thoughts on the stock. MAIN is one of the premier business development companies in the public BDC space. They’re often mentioned amongst investors when talking about monthly dividend paying companies, alongside the likes of Realty Income (O), Gladstone Capital (GLAD), etc. While I’ll admit I think MAIN is one of the best BDC’s out there, it normally trades at a high premium to its Net Asset Value. And rightfully so. Quality normally comes at a price. But it is now trading at a price I’m not willing to pay.

Valuation

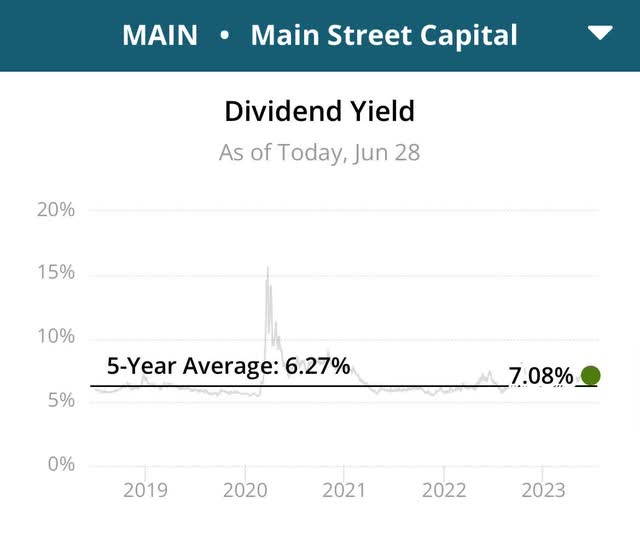

I’ve been keeping an eye on MAIN for the last few years and while it has seen a few nice dips here and there, it has typically traded in the $37-$45 range during my observations. But all things considered, I do not follow the stock very closely, but from a distance. Before the COVID-19 flash crash, MAIN traded at a high of almost $45. During the crash, the stock dipped below $18 which would have been a great price to pick the stock up at, giving investors a nice margin of safety. If the stock dips to this price again during one of the most predicted recessions in history, investors will have a great opportunity to buy again. At the time of this writing, MAIN has a current dividend yield of 7.08%, 12% above its 5-year average of 6.27%, indicating it may be undervalued. But in reference to its NAV, the stock is trading at a premium and I would wait for a potential pullback in price before starting a position. Me personally, I would consider starting a position if the stock dropped closer to its 52-week low of $31 or lower.

Simply Safe Dividends

Portfolio Strategy/Structure

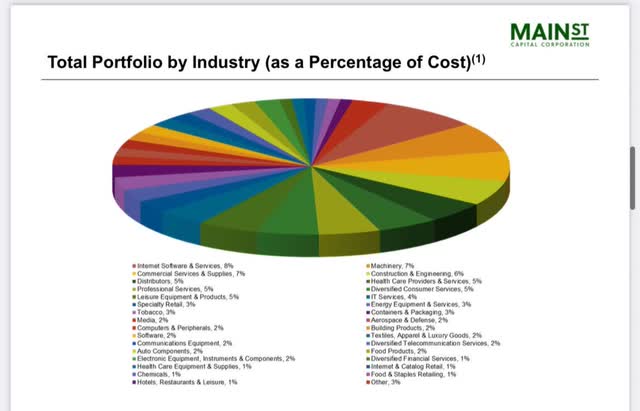

Besides being internally managed, something else I like about MAIN is their conservative capital structure, which provides long-term access to attractively priced and structured debt facilities. I also like that the BDC is well-diversified across 195 companies spanning across 50 industries, with the majority representing less than 1%. Their biggest percentages are in Commercial Services & Supplies and Internet Software & Services. In my opinion, the COVID impact has been positive for the latter, especially with companies moving to cloud-based working, and internet-based channels. The BDC also announced a new portfolio investment on June 28th in an industry-leading manufacturer and distributor of insignia and tactical products and accessories. The deal consisted of a combination of first lien, senior secured term debt and a direct equity investment which MAIN normally focuses on.

Main Street Capital Corporation

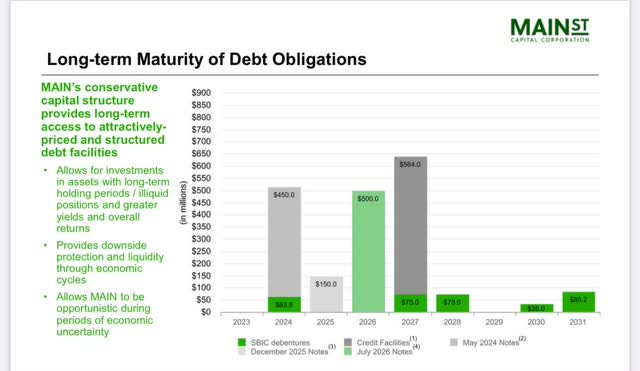

Another strength besides their first lien focuses and equity investments is their balance sheet. The company has no debt maturities in 2023 and only $63.8 million due in 2024. This is an important metric investors should look at when looking into invest into any stock. Their debt is well-laddered all the way through 2031. Furthermore, 72% of their outstanding debt obligations have fixed interest rates limiting the increase in interest expenses, while 73% of their debt investments are floating rate. This provides them the opportunity to grow their net investment income if rates continue to increase, while also providing downside protection if rates decrease.

Main Street Capital Corporation

Dividend Safety

Let me start off by saying, although I’m not overly fond of MAIN’s price, I am a fan of their monthly dividend and their occasional special dividends the BDC pays to its shareholders. During Q1 2023 earnings, MAIN reported Net Investment Income of $1.02, beating analysts’ estimates by $0.06 and distributable net investment income of $1.07. The BDC also beat on revenue by $6.63 million, coming in at $120.25 million for the quarter. MAIN’s DNII exceeded its monthly dividend of $0.23 by 59% and exceeded the total dividends paid by 26%. The company also managed to grow its NAV during the quarter. At the end of March, MAIN’s NAV stood at $27.23, an increase of $1.34 or 5.2% year-over-year.

Simply Safe Dividends

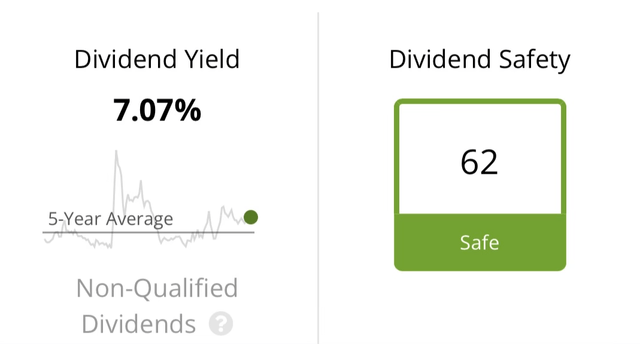

MAIN has a dividend safety score of 62, indicating a score of safe. Seeking Alpha gives the stock a dividend safety grade of C+. To put that in perspective, this is currently higher than both Ares Capital (ARCC) and Capital Southwest’s (CSWC) grade of C. I think this is a testament of MAIN’s portfolio strength and management. The company has also paid two special dividends this year, and management has stated that it plans to continue this in the near future. This mean shareholders could potentially see more specials in these next upcoming quarters. It is to be noted that MAIN has never decreased its monthly dividend rate.

Macroeconomic Factors

Many are suspecting another rate hike at the upcoming FED meeting in July. And while that may or may not be true, I do believe we are at the tail end of the FED fund rate hikes. I do believe they will maintain the higher for longer as promised going into 2024 which could potentially continue to benefit MAIN due to their floating rate investments. In addition, the bank failures we witnessed back in March could potentially be of benefit as well. Many companies will continue to need access to capital, and with banks potentially tightening on lending, I suspect these companies will look elsewhere such as BDC’s. The high interest rates could also continue to be a headwind for many stocks, but with MAIN’s well-laddered debt, I predict them to do well during our economic uncertainty.

As of March 31, 2023, MAIN had a total of 13 investment companies on non-accrual, representing 0.6% of its total investment portfolio at fair value. The company also added two middle market companies to non-accrual status during the quarter. If the Fed fund rates keep rising or stay too high for too long, this number could potentially see a sharp rise in the next quarter. But with MAIN’s management team experience and BBB- investment grade credit rating, I don’t see this being a huge problem shareholders should worry about.

Investor Takeaway

In my opinion, investors should wait for a pullback in share price before starting or adding to their current position. With talks of an upcoming recession, investors could possibly get a chance to get a premier monthly paying stock at a good price, giving themselves a nice margin of safety. Investing in MAIN, investors get a well-diversified, internally managed BDC with an investment-grade credit rating, and stellar balance sheet whose management team has over 200 years of experience making them well qualified for the current macroeconomic environment. With their dividend growth since IPO and occasional special dividends paid, there‘s a lot to like about this BDC except its premium.

Read the full article here