Shifting production to the US would therefore require years if not decades of coordinated investment in automation, tools, infrastructure and training. Incentivising foreign component manufacturers to build facilities in the US would also be a challenge.

“If you’re a Chinese supplier making a certain kind of component that can also be used in a Huawei or a Xiaomi phone, you’ve got leverage,” Mohan says. “The incentive to separate these factories is low, because you are getting scale and efficiency in China that you wouldn’t get if Apple was your sole supplier.”

Policy uncertainty is another problem, according to Tsay. “The American system as it stands, where everything can completely flip-flop every four years, is not conducive to business investment. When people and companies make investments, they need to have a longer horizon than that.”

Mark Randall was senior vice president at Motorola when it was owned by Google and looking to build its US smartphone factory. The idea was not impossible, he says, but “I just knew it was going to be incredibly hard.”

The US labour costs required to transform raw materials into finished goods are “significantly higher” than elsewhere, he says. The US, for example, has a shortage of mechanical tooling engineers. For a massive shift of electronics manufacturing to the US, “we are talking about needing tens of thousands of them.”

Tariffs create a “nightmare” when modelling the costs of a new plant, Randall adds. “This is why most companies don’t make short-term, knee-jerk reactions to the sort of changes that we are seeing today. You’ve got to be super strategic and know where you are going in the long term.”

Made in the USA?

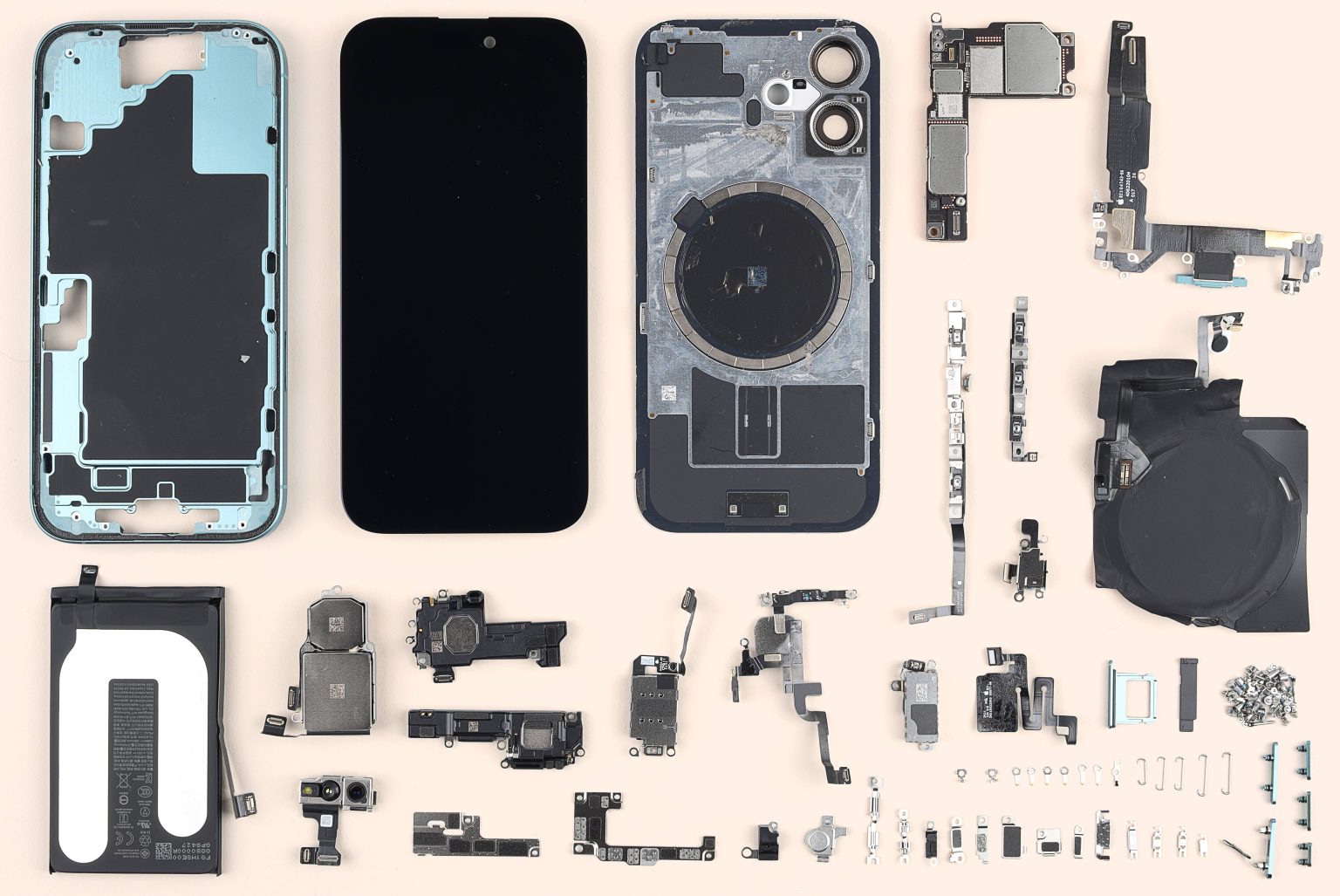

A deeper look at the supply chain for three parts in the latest iPhone models illustrates the complexities of moving manufacturing to the US, in an industry that requires years to make even incremental shifts.

The one component in the touchscreen currently made in America is the cover, produced by Apple’s long-standing glassmaker Corning in Kentucky, though the company also has facilities in China and India.

But the OLED display that helps preserve battery life and an integrated multi-touch layer that enables on-screen interaction are mostly produced by Samsung in South Korea.

The core electronic parts that make the screen functional are combined with the display unit at production facilities in China, before this component is transported to a Foxconn plant to be combined with the rest of the iPhone.

The metal frame neatly captures the challenge of removing China from Apple’s supply chain. For most models, the casing is cut and shaped from a block of aluminium using high-precision computer numerical control (CNC) machines.

Wayne Lam, an analyst at TechInsights, says the process relies on an “army” of these machines, which Apple’s vendors in China have spent years amassing and which cannot currently be reproduced elsewhere. “If Apple were to onshore iPhone production, there wouldn’t be enough CNC machines they can purchase to meet the scale of the China ecosystem,” he says.

Lam adds: “This is a specialised skill that is next to impossible to replicate outside of China.”

Even the iPhone’s simplest component — its miniature screws — are complex. They are made from different materials depending on their role, and have a number of heads: philips, flat, tri-tip and pentalobe, among others.

But it is the screwing in process that sums up the challenges the company would face if iPhone production was moved to the US. Apple’s design, different from many other smartphone brands, does not use glue to attach the frame, and analysts say that it is currently more cost-effective for Foxconn to hire people to do the screwing than to invest in robotic solutions.

Read the full article here