Introduction & investment thesis

Wix.com Ltd. (NASDAQ:WIX) is a cloud-based web development platform for users to create websites and mobile applications without existing coding skills. The stock has outperformed the S&P 500 (SP500) and Nasdaq 100 (NDX) YTD. I last covered the stock on March 29, where I rated it a “Buy” based on my thesis that the company will continue to see greater adoption of its Wix Studio given the growing momentum in its Partners Business, while it drives innovation in its AI product portfolio to improve the user experience, leading to a higher conversion rate and monetization on the platform. Since then, the stock is up 21%, outperforming the S&P 500.

Seeking Alpha: Wix’s price movement since last coverage

The company posted its Q1 FY24 earnings, where revenue and earnings grew 12% and 43% YoY, respectively. For the whole of FY24, the management has slightly raised its revenue guidance and expects to further streamline its operating expenses than its previous estimates. During this quarter, we saw that the management continued to execute brilliantly against its strategic priorities of gaining market share in its Partner business, which saw a growth of 33% YoY, with over 1M Studio accounts opened in Wix Studio, while innovating on its AI product portfolio, where it launched its AI Website Builder and AI Portfolio Creator to simplify website and portfolio creation to help users unlock productivity and efficiency gains. This led to strength in new and existing user cohorts with strong bookings growth and an improving return on marketing spend, allowing it to expand its profitability.

From a valuation perspective, although the valuation upside has now shrunk from 40% (as of my previous writing) to 20%, I believe that the stock is still attractive for long-term investors given the company’s strengthening fundamentals and product traction, making it a “buy.”

The good: Strength in new and existing cohort booking driven by its AI product portfolio; Growing market share in its Partners business; Return on marketing spend continues to improve.

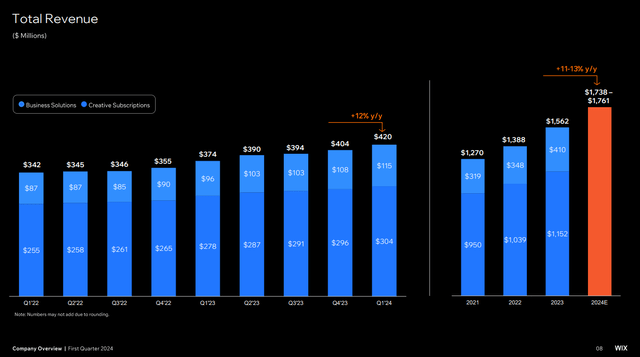

Wix reported its Q1 FY24 earnings, where it generated $419.8M in revenue, growing 12% YoY. Out of the $419.8M, Creative Subscriptions generated 72.4% of Total Revenue, growing 9% YoY to $304.3M, while the remaining 27.6% of revenue was driven by Business Solutions, which grew 20% YoY to $115.5M.

Q1 FY24 Earnings Slide: Growing Revenue across segments

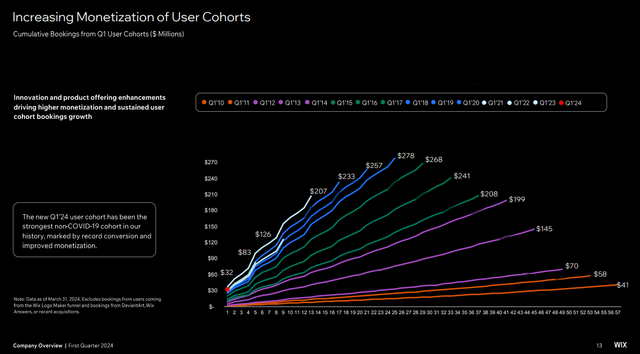

This was driven by the strength of both Self Creators and Partners, with robust innovation in AI products driving higher conversion and monetization among user cohorts. During the earnings call, Nir Zohar, President and COO of Wix, discussed that the Q1 FY24 user cohort of 4.9M new users has generated $32M in bookings, which is 6% higher than the Q1 FY23 user cohort. At the same time, the company continues to see strength from existing cohorts as well, which I believe demonstrates that the company’s strategic priorities in expanding its portfolio of AI products and driving adoption of Wix Studio in its growing Partners Business are working, as customers are purchasing higher priced packages, adopting more business applications, and generating more Gross Payment Volume (GPV), leading to higher Average Revenue Per Subscription (ARPS).

Q1 FY24 Earnings Slides: Growing user monetization by cohorts

In terms of its AI product portfolio, the company is firing on all cylinders, as it released its AI Website Builder, where Wix users can describe their intent and goals in a conversational AI chat experience to generate a ready to-publish website that is fully SEO optimized with a layout, theme, text, images, and business solutions, which, I believe, will boost the overall user experience through increased efficiencies. Since the launch of the AI Website Builder, the feedback has been terrific, with hundreds of thousands of sites already created using the tool by both Self Creators and Partners. At the same time, the company also launched its AI-powered image enhancement tools, where users can create professional images on their own, and its AI Portfolio Creator, which allows users to upload image collections, which are then transformed by its AI image clustering technology to generate online portfolios with clustered images, titles, descriptions, and layout options. In my opinion, this takes away the heavy lifting in portfolio creation, thus unlocking productivity for Wix users, who can now focus their activities on expanding their audience reach and opening new services and income streams.

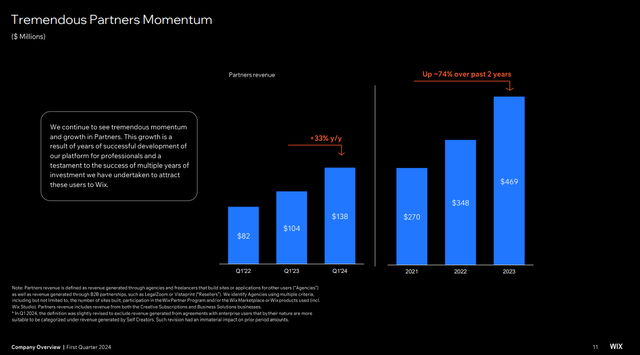

Turning our focus to its Partner Business, which Wix characterizes as

“revenue that is generated through agencies and freelancers that build sites or applications for other users, as well as revenue generated through B2B partnerships, such as LegalZoom or Vistaprint, and enterprise partners,”

it is showing tremendous momentum, growing 33% YoY to $138M and 6% sequentially, with over 1M Studio accounts created by agencies and designers, as it continues to gain market share. During the earnings call, Avishai Abrahami, CEO of Wix, sounded optimistic that the lifetime value of their Partners will continue to grow as more projects are built on Studio, given the superior design, creation, and workflow management capabilities. At the same time, the company is also adding new capabilities in its Wix Studio, where Partners can sell Studio templates directly within the Wix marketplace, which, I believe, will allow Partners to unlock new earnings potential and strengthen their presence within the Wix community.

Q1 FY24 Earnings Slides: The momentum in its Partners Business continues

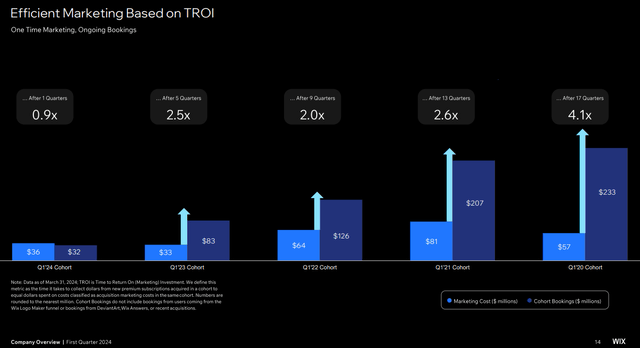

Shifting gears to profitability, the company generated $69.4M in non-GAAP operating income, which grew 43% YoY with a margin improvement of 400 basis points to 17%. I believe this is driven by a combination of the management’s efforts to streamline operating expenses and attract higher-quality users, which are driving higher conversion and monetization, leading to an improving ratio of Marketing Cost to Cohort Bookings, allowing the company to unlock its operating leverage.

Q1 FY24 Earnings Slides: Growing ROI on Marketing spend allowing Wix to expand profits

The bad: Macroeconomic uncertainty and declining small-business optimism may threaten Wix’s growth and margin prospects, especially with price hikes and ongoing spending on innovation

In the previous post, I discussed my concerns regarding the company’s new pricing model, which could lead to higher churn, especially as macroeconomic conditions remain uncertain within the high interest rate environment. Although the company is investing to differentiate itself with the launch of AI products and enhanced Wix Studio capabilities to improve overall user experience and efficiencies, resulting in a higher conversion rate and ARPS, I will be monitoring its Net Retention rate (NRR) carefully in the coming quarters as the probability of a macroeconomic slowdown remains, with the small-business optimism index at one of the lowest levels since the pandemic. Given the pace of rapid innovation, a macroeconomic slowdown will put margin pressures on Wix, which may temporarily dampen investor confidence.

Revisiting my valuation: Increasing my price target by 2.5% with an upside of 20%, making it a “Buy”

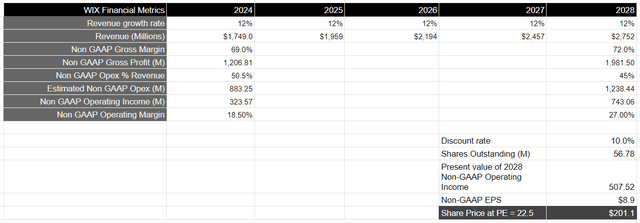

Looking forward, the management has raised its FY24 revenue outlook in the range of $1.73-$1.76B, from its previous guidance of $1.726-$1.757B, which represents a growth rate of 11-13%. Maintaining its guidance for non-GAAP gross margins at 68-69%, the management expects non-GAAP operating expenses at 50-51% of revenue, as opposed to its previous guidance of 51-52%, which would translate to a non-GAAP operating income of approximately $323M in FY24 with an estimated margin of 18.5%.

Over a 5-year investment horizon, my assumptions remain the same as before, where I expect the company to grow in the low teens region while improving its non-GAAP operating income to 45% by FY28, as per management’s long-term operating model that it laid out during its Investor Day. I believe that given Wix’s strategic initiatives to innovate its AI product portfolio to drive higher conversion and monetization of its user base by improving user experience and unlocking business efficiencies, while gaining market share in its Partners Business through increased adoption of Wix Studio, this will allow it to attract higher-quality users on the platform, which will lead to higher ARPS and return on marketing spend.

As a result, I believe that Wix should be able to generate $2.7B in revenue by FY28, and assuming non-GAAP gross margin improves from a projected 68.5% to 72% during this period of time, coupled with non-GAAP operating expenses at 45% of total revenue, it should generate $743M in non-GAAP operating income, which is equivalent to $507M in present value when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period with a price-to-earnings ratio of 15–18, I believe that Wix should trade at 1.5 times the multiple given the growth rate of its earnings during this period of time. This will translate to a P/E ratio of 22.5 or a price target of $201, which is 2.5% higher than my previous price target.

Author’s Valuation Model

Although the magnitude of my estimated upside has shrunk from 40% in my previous writing to 20%, I believe it still looks attractive for long-term investors, as the company continues to execute extremely well against its strategic priorities to gain market share in its Partners Business while rapidly building new capabilities and enhancements in its product portfolio to improve the lifetime value of its new and existing customer cohorts. I believe that as the company continues to attract higher-value customers, it will see improving conversion rates as they choose to increase their adoption of the platform, thus helping Wix unlock higher operating leverage.

Conclusion

Wix remains a “Buy,” as I believe the management is executing extremely well and positioning itself to drive higher conversion and monetization from its customer cohorts with its robust AI-led product innovation and enhancements to its Wix Studio. Although a possible macroeconomic slowdown may temporarily dampen Wix’s growth prospects in the short term, I believe that the company is poised to benefit long-term from the growing lifetime value of its customers and improving profitability.

Read the full article here