While our decisions for deploying cash into which treasury ETF may differ, it is clear that the treasury market provides safer opportunities for the road ahead and the inverted yield curve does provide a good return on excess cash. It is definitely extremely enticing on the ultrashort end of the yield curve.

In my one of my previous article, I have covered the ultrashort end of the yield curve primarily focusing on the 0-3 month treasuries as a safe haven and tactical cash holding in your portfolio; while in another explaining to reduce risk exposure by allocating into short term treasuries in the 1-3 year time frame. Nevertheless, there are multiple ways to earn a yield with reduced risk thanks to Federal Reserve.

The purpose of this short article is to compare both The US Treasury 6 Month Bill ETF (NASDAQ:XBIL) and BondBloxx Bloomberg Six Month Target Duration US Treasury ETF (NYSEARCA:XHLF) ETFs for investors which are both in the similar 6 month treasury time duration and to consider the merits of both.

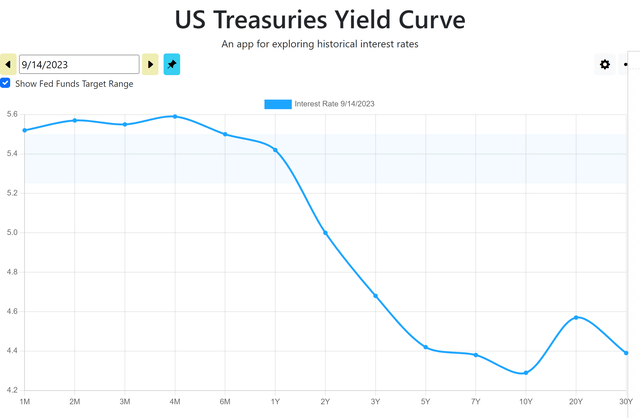

Yield Curve

US Yield Curve (US Treasury Yield Curve)

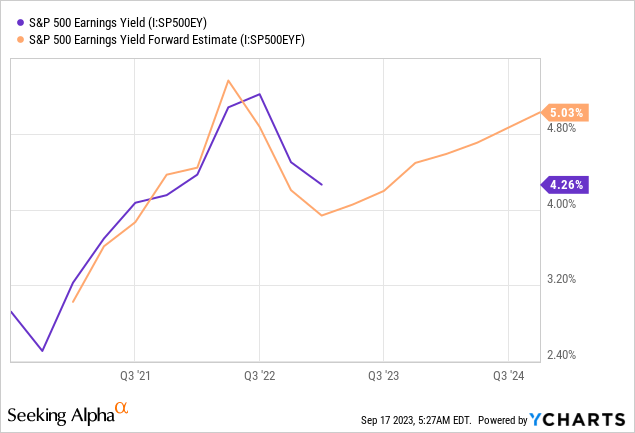

At the current moment, the current 6 month yield is at 5.5% and 1 year yield is at 5.4%. With the S&P 500 earnings yield and forward earnings yield both of which yielding lower that the 6 month and 1 year yield, it is clear than the short term treasury yield provides a safer place to put your money in.

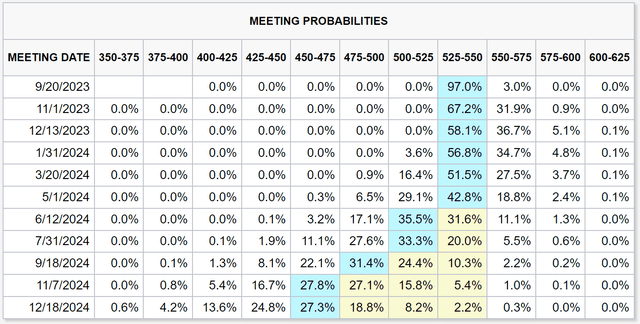

FedWatch Meeting Probabilities (CME FedWatch Tool)

From the CME FedWatch tool, it seems the peak in rates is in. But we shall see if inflation continues to tick upwards. But as of now, the meeting probabilities suggest the Federal Reserve is done hiking.

Therefore, enjoy the high yields while it lasts. Here are two ETFs that covers the 6-month end of the yield curve. As mentioned earlier, the purpose of this short article is to compare both The US Treasury 6 Month Bill ETF and BondBloxx Bloomberg Six Month Target Duration US Treasury ETF for investors to consider the merits of both.

XBIL

XBIL is a relatively new fund in the treasury ETF space and was only incepted on 7th March 2023. XBIL aims to provide exposure to the current US 6 Month US Treasury Bill, through an ETF and seek investment results that correspond (before fees and expenses) generally to the price and yield performance of the ICE BofA US 6-Month Treasury Bill Index.

The US Treasury auctions a new 6-month Treasury bill every week. Therefore what happens is that this auction will determine the coupon rate of each on-the-run note. Once it is time to settle, XBIL will sell the currently held 6-month US Treasury bills and roll into the newly-issued US Treasury.

In this way, XBIL does not keep the 6-month bill until maturity, but instead just rolls the 6-month bill every week, which technically should make it more sensitive to the current yield curve.

XHLF

BondBloxx Bloomberg Six Month Target Duration US Treasury ETF is an ETF that was incepted on 13 September 2022. Therefore, it is still relatively new considering it is just a year old.

The BondBloxx Bloomberg Six Month Target Duration US Treasury ETF seeks to track the investment results of an index which contains U.S. Treasury securities that have an average duration of approximately 6 months

Comparison Between XBIL and XHLF

| XBIL | XHLF | |

| Assets Under Management (AUM) | $378.46M | $925.88M |

| Average Daily Volume | $6.61M | $5.33M |

| Number of Holdings | 2 | 44 |

| Expense Ratio | 0.15% | 0.03% |

| Average Spread (%) | 0.02% | 0.02% |

Considering that XBIL is still a new fund, it is no surprise that XBIL has a smaller AUM than XHLF.

However, in the longer term, perhaps the most important factor is the expense ratio. If you choose a fund that charges 0.03% per year over a fund that charges 0.15%, you’re ahead by 0.12% annually. You cannot control what an ETF fund will return, but you can choose a better expense ratio. A lower expense ratio automatically means more money returned in the portfolio.

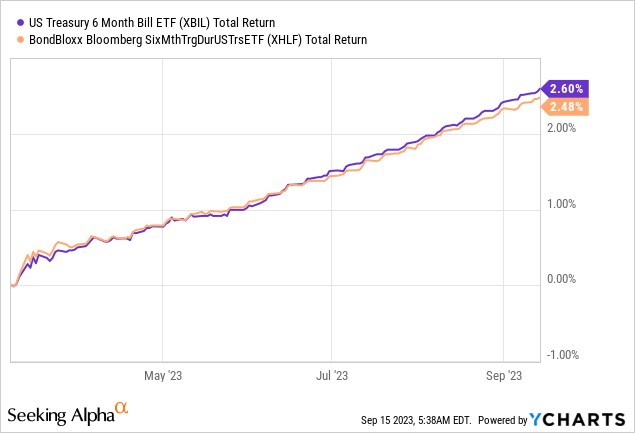

Total Returns Comparison

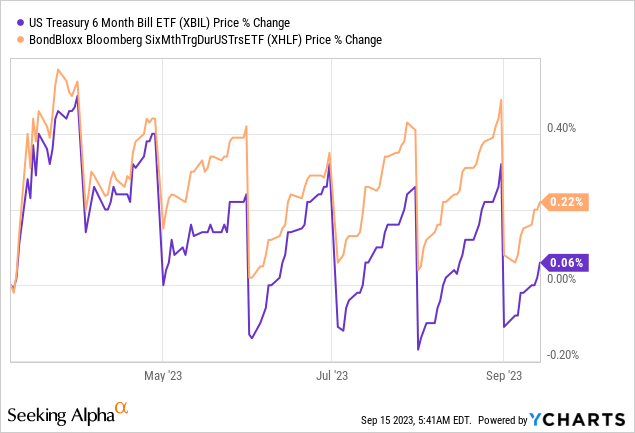

We can see from the charts above how the total return and the price percentage change for XBIL compares with XHLF.

If you are wondering why the prices of both ETFs move in that zigzag manner, it is due to the dividend paid out.

Conclusion

Considering that peak rates is here, these ETFs stands out if investors think we are going to see the Federal Reserve hold rates or lower rates in 2024. Holding a 6-month treasury ETF with a duration slightly higher than BIL and SGOV will keep a little longer higher front end yields.

Ultimately, both ETFs provide investors with a safe tool for short-term investing, capital preservation, and more importantly, liquidity. It offers the potential for generating income while minimizing the risks associated with other investments. However, as always, investors should carefully consider their financial goals and if needed, with their financial advisor before allocating funds.

Read the full article here