Formula for success: rise early, work hard, strike oil. – J. Paul Getty

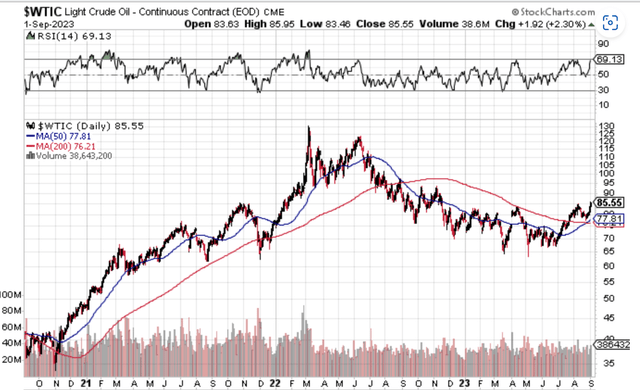

Oil has been surprisingly strong in the last couple of weeks and looks like it may stage a sizeable rally here. This is happening as unemployment is starting to pick up and as hope for easing inflation persists. I recognize this looks bullish for energy sector stocks, but if I’m right about the risks around a credit event, this could reverse quickly.

StockCharts.com

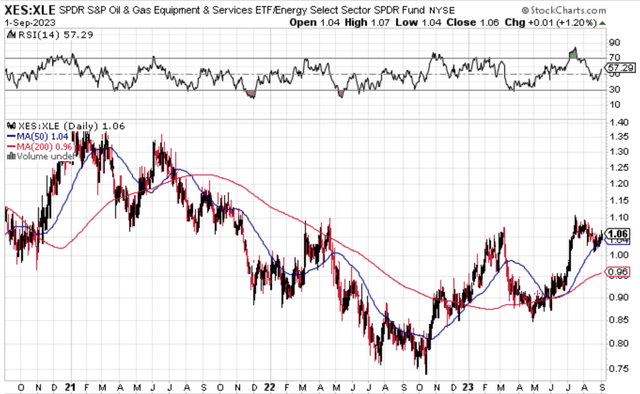

What if I’m wrong? Could energy stocks now get some real play? The SPDR S&P Oil & Gas Equipment & Services ETF (NYSEARCA:XES) is an exchange-traded fund (ETF) that provides a comprehensive way to gain exposure to the dynamic Oil & Gas Equipment & Services sector. The fund is managed by State Street Global Advisors and seeks to match the performance of the S&P Oil & Gas Equipment & Services Select Industry Index, before fees and expenses. This makes XES a compelling choice for investors who aim to outperform the market through strategic industry selection.

The fund has recently shown some good strength relative to the broad Energy ETF (XLE).

StockCharts.com

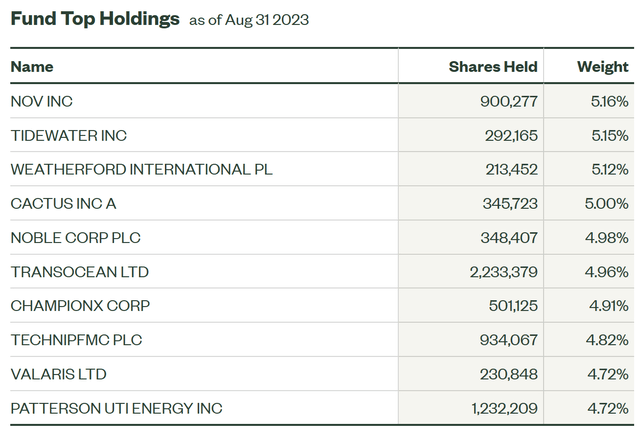

Diversified Exposure and Top Holdings

ETFs offer diversified exposure, minimizing single stock risk. However, it’s still important to delve into a fund’s holdings before investing. XES allocates its portfolio entirely to the Energy sector. It’s a fairly concentrated fund with just 31 holdings. Weightings aren’t overly concentrated overall though.

ssga.com

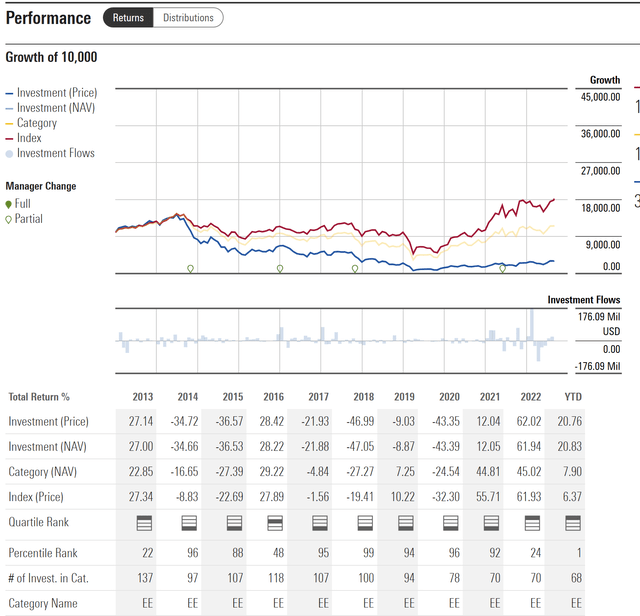

XES Performance and Risk Analysis

Against broader Energy exposure, the fund has mixed results historically. It did extremely well in 2022 as it surged over 62%, and has some strong performance here. Because this fund is so closely tied to the performance of Oil itself, this should make sense. If Oil does continue higher, this is the equity way of playing the commodity’s strength. I think this is important to emphasize as it really is highly dependent on Oil prices gaining ground.

Morningstar.com

Alternatives to Consider

While XES is a viable option for those seeking to outperform the Energy ETFs segment, there are other ETFs in the space worth considering. The iShares U.S. Oil Equipment & Services ETF (IEZ) tracks the Dow Jones U.S. Select Oil Equipment & Services Index, while the VanEck Oil Services ETF (OIH) follows the MVIS U.S. Listed Oil Services 25 Index. This is really a question more of preference as these funds still share the same factor sensitivity to Oil.

The Bottom Line

It’s important to remember that while XES provides a unique opportunity to invest in the Oil & Gas Equipment & Services sector, it also comes with its share of risks. These include factors like market volatility, sector concentration, and geopolitical events that can disrupt securities markets and adversely affect global economies.

Ultimately, I think this comes down to a question of whether Oil breaks, or if we are in a stagflationary environment whereby Oil is less sensitive to a global slowdown due to years of structural underinvestment. I’m not a believer in that thesis thus far for a host of reasons outlined in my prior writings. Regardless, I think it’s good to consider having a portion of a portfolio in a part of the market like this, with the caveat that it’s a play on Oil which could falter in a credit event.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here